BP also offers a net zero case in which energy addition gives way to energy substitution. (Source: Shutterstock)

Making any predictions a quarter century into the future, even based on hard science or mathematics, can produce some fuzzy results. Then there are energy predictions—a realm in which oil and natural gas supply, demand and prices are hard to pin down even a couple of months in advance.

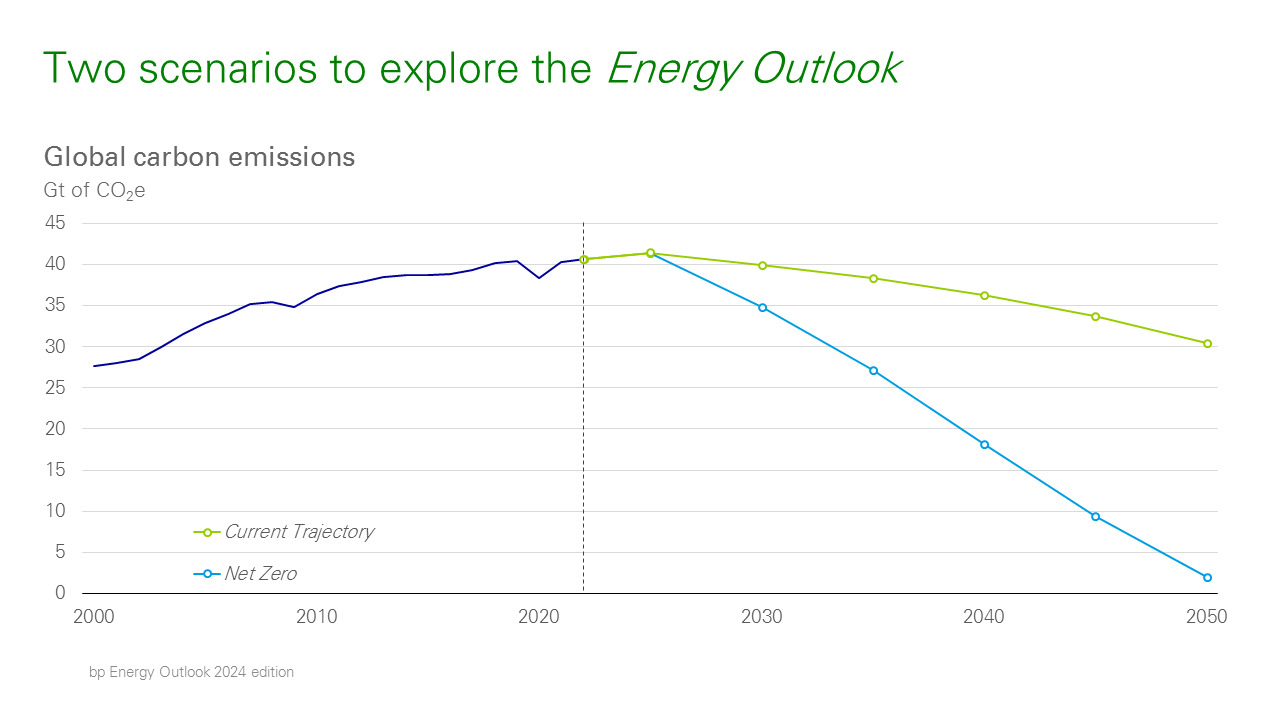

The 2024 BP Energy Outlook nevertheless gives it a try, presenting two macro paths—with caveats for the many possible side roads and detours between now and 2050—that have implications for both oil and gas.

Spencer Dale, BP’s chief economist, said the world faces two routes. In one, the “current trajectory,” energy use and the speed of adding more renewable power sources and decarburization efforts stays on track as-is from now through 2050.

BP also offers a net zero case in which energy addition gives way to energy substitution—a challenge Dale repeatedly highlighted as a history-defying shift throughout his July 10 presentation.

Both trajectories share common ground for oil use, Dale said. However, natural gas, and LNG in particular, follow radically different courses in the current trajectory versus the net zero case.

At the outset of BP’s outlook, Dale made it clear that energy addition has been the way of the world for much of history. Both old and new “unabated fossil fuels” are continuing to grow. Dale noted that in the mid-19th century, coal grew rapidly, supplanting wood and other biomass as the world’s primary energy source. Roughly a century later, oil was meant to overtake coal.

It didn’t.

“The world has never reduced any fuel on a sustained basis. It's just consumed more of everything and that's the historic challenge facing the global energy system,” Dale said.

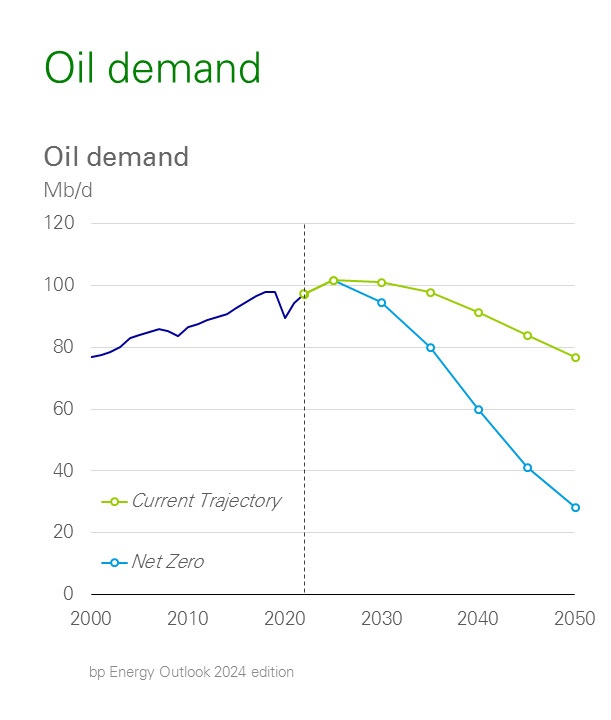

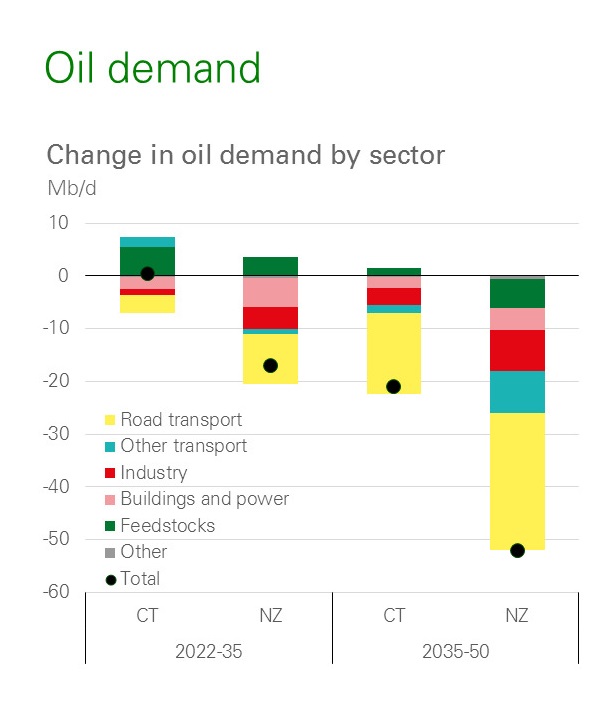

Dale highlighted what he called common trends for both current energy use and the path to net zero. At the forefront was oil demand.

In both of BP’s scenarios, oil demand declines by 2050, albeit at significantly different rates.

Oil continues to play a major role in the global energy system in the first half of BP’s outlook, with the world consuming somewhere between 80 MMbbl/d to 100 MMbbl/d through 2035.

“The profile for all demand is pretty flat over the first half of the outlook, with a level of oil demand in 2035 pretty much exactly in line with the level of oil demand today,” Dale said. “Then we see gradual decline over the second half of the outlook, with the level of all demand reaching around 75 million barrels a day by 2050.”

The net zero scenario sees a quicker decline, with demand falling to between 25 MMbbl/d and 30 MMbbl/d in 2050—approximately 70% below the current demand levels.

Dale said the single biggest driver of the fall in demand is improving efficiency of the global vehicle fleet.

“Further out, there's a growing impact from increasing electrification of cars and trucks,” he said.

In both the current and net zero scenarios, by 2050 the number of electric vehicles (EVs) on the road increase to between 1.25 billion and 2 billion by 2050. The volume of oil used in road transportation, according to the outlook, falls from a little more than 40 MMbbl/d today to between 5 MMbbl/d and 25 MMbbl/d in the two scenarios, Dale said.

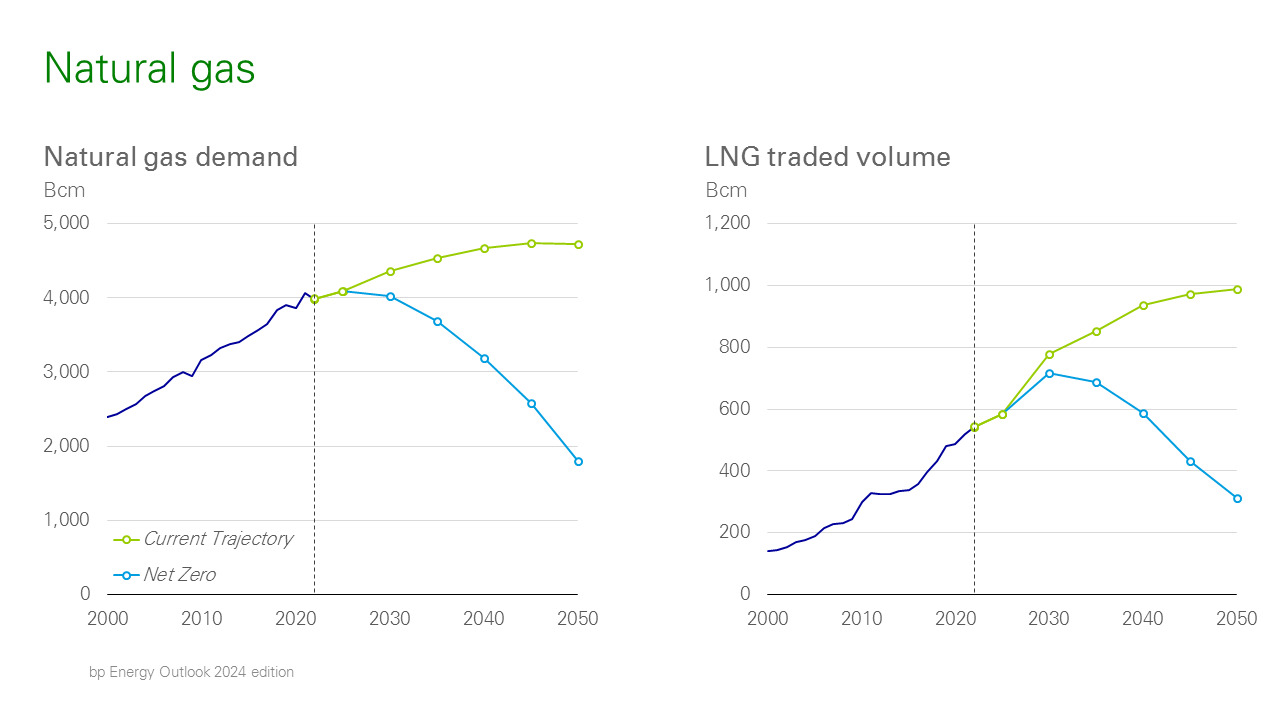

Natural gas uncertainty

Natural gas demand, unlike oil, could take wildly divergent paths between now and 2050, Dale said.

Dale said it’s unclear how the energy system might evolve in the future, but “for most fuels and energy vectors, we at least have a pretty good idea about how the level of demand in 2050 will be relative to today.”

The use of oil and coal will be lower, he said. Wind, solar, electricity, biofuels and low carbon hydrogen will be higher.

“But that's not the case for natural gas,” he said. In the current trajectory, natural gas demand increases over the whole of the outlook. Demand increases 20% by 2050 compared to today. In the net zero scenario, natural gas increases in the near term before beginning to fall away to about half of its current level by 2050.

“These contrasting outlooks reflects the impact to two competing forces. The dominant factor in [the] current trajectory is increasing use of gas in emerging economies as they grow and industrialize,” Dale said.

In contrast, in the net zero case, natural gas demand is crowded out as energy systems around the world increasingly electrify and the share of wind and solar in power generation increases.

“These two opposing forces are operating in both scenarios,” Dale said. In the current trajectory, increasing demand in emerging markets dominates. In contrast, in net zero that's swamped by the growing electrification and increasing role of wind and solar.”

Emerging economies, with natural gas demand met by LNG, are a major factor for achieving, or missing, net zero goals.

“Given that much of the growth in natural gas in emerging economies is met by liquefied natural gas, LNG, it follows this uncertainty concerning the future level of natural gas demand is also reflected in uncertainty about the level of LNG trade,” he said.

As things stand, LNG increased by about 80%. In the net zero case, it falls by about 40%.

“That range of possible outcomes for LNG, both up and down, adds to the uncertainty associated with investments in LNG facilities which have long economic lives,” Dale said.

Climate discussions’ ‘cousin’

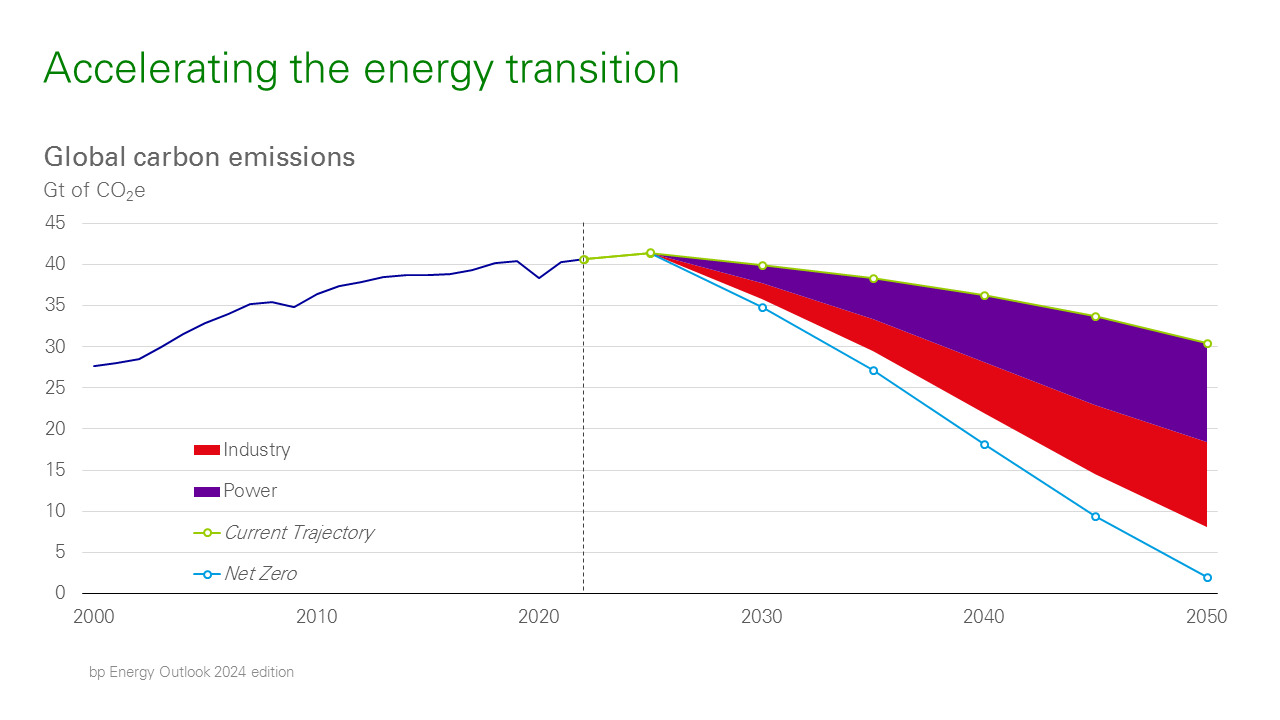

The single biggest difference between the two outlooks is whether efforts are made to quicken the pace of decarbonizing global power systems.

Global power generation in the net zero scenario is entirely decarbonized by 2050; in the current trajectory, decarbonization lags behind by another 15 years.

“So why are power markets in net zero able to decarbonize more quickly relative to the other one?” Dale said.

The main difference is the pace at which emerging economies decarbonize their power systems. In the current trajectory, power generation in the developed world largely decarbonizes by 2050, Dale said.

“But the rapid growth of electricity demand in many emerging economies means it's far harder to grow low carbon energy sufficiently, quickly to both meet the growth in power demand and displace existing fossil fuel generation.”

Again, Dale emphasized, history shows that societies add energy sources, not substitute them.

Only some progress is made in the current trajectory, Dale said. In the net zero case, low carbon energy, especially wind and solar, helps to “crowd out coal in particular.”

Power generations’ end users—industry, transport and buildings—are also a vital part of solving for the net zero equation.

“The most important sector accounting for the faster decarbonization in net zero relative to current trajectory is the industrial sector,” he said. “The industrial sector accounts for more carbon emissions than the other two sectors combined. It's where most of the action is.”

In net zero, decarbonization of the industrial sector is achieved by increased efficiency in industrial processes and wider energy conservation measures that help reduce demand for manufactured goods and materials.

Dale said that energy efficiency measures are often overlooked in policy discussions and debates.

“It sometimes feels like the poor cousin of climate discussions,” he said, but the world’s ability to move from energy addition to substitution depends on such efficiencies rapidly accelerating.

“Other than energy efficiency, there's no single silver bullet accounting for the faster decarbonization of industry net zero,” Dale said. “It's more to do with policy incentives and support driving faster and more widespread adoption of different low carbon technologies in different sectors.”

He cited other gains achievable by increased electrification in light industry; greater deployment of carbon capture, utilization and sequestration in the cement sector; and low carbon hydrogen use in steelmaking.

“All these technologies exist today,” Dale said. “The challenge is to apply them at speed and scale.

Recommended Reading

EQT: Gas Demand Likely to Outpace Midstream Sector’s Ability to Supply

2025-02-19 - Most infrastructure projects being built will not come online for another year—too late for the quickening pace of gas demand.

AI Deals Line Up for Energy Transfer’s Gas Supply

2025-02-13 - Midstream company Energy Transfer’s executives say they’re working on more than 100 deals for gas-powered generation projects.

Renegade Waiting for ‘Catalyst’ as it Mulls Building, Buying Midstream

2025-02-06 - Renegade Infrastructure CEO Drew Ward says the company is currently “basin agnostic” and is considering greenfield projects and M&A after winning a capital commitment from PE firm Energy Spectrum Partners.

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

2025-02-14 - About three-quarters of future U.S. gas demand growth will be fueled by LNG exports, while data centers’ needs will be more muted, according to Expand Energy CFO Mohit Singh.

EnCap Portfolio Company to Develop NatGas Hub with DRW Energy

2025-01-21 - EnCap Flatrock Midstream portfolio company Vecino Energy Partners LLC and DRW Energy Trading LLC will be developing an intrastate natural gas storage hub together.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.