The Archaea Modular Design allows plants to be built on skids with interchangeable components for faster builds. The plant is located in Shawnee, Kansas, just outside of Kansas City. (Source: BP)

There is treasure in trash, and the U.S. is sitting on more than 146 million tons of it.

That’s just at municipal landfills, according to the U.S. Environmental Protection Agency.

Add wastewater, livestock waste and other agricultural waste to the mix, and the potential to transform trash—specifically the methane emanating from it—to make renewable natural gas (RNG) grows.

Used in the same ways as conventional natural gas, RNG is formed when moisture and impurities—such as CO2 and hydrogen sulfide—are removed from methane to create pipeline-quality gas. The lower-carbon energy resource is capturing the attention of energy companies, including BP, as the world seeks ways to reduce emissions. The RNG sector expects to see more action in 2024 following a year filled with deal-making, project starts and regulatory moves—including the final renewable fuel standards rule through 2025, to further incentivize development.

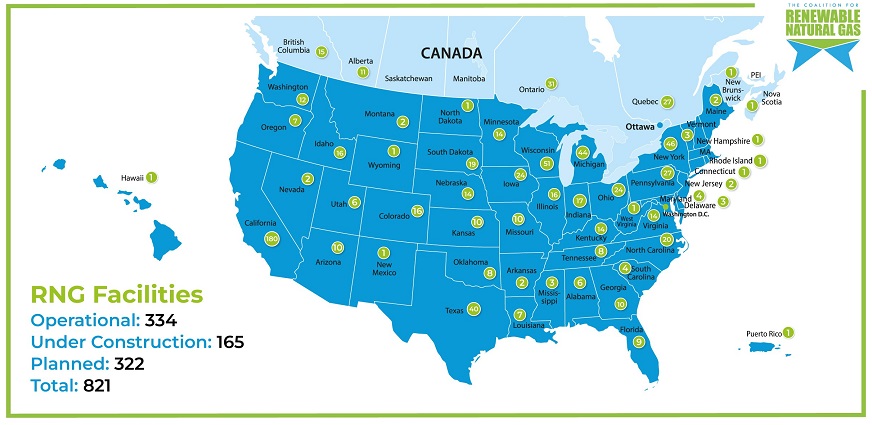

In the U.S. and Canada, more than 330 RNG production facilities are in operation, according to the Coalition for Renewable Natural Gas. Another 165 are under construction and more than 320 in development. Nearly three-quarters of the RNG volumes use municipal solid waste as feedstock.

It’s exciting to be a part of an industry that, while it’s been around for a long time, [has] gotten more attention in recent years and it’s really growing as an industry, but also from a demand perspective —Starlee Sykes, Archaea Energy

BP became the largest producer of RNG in the U.S. when it acquired Archaea Energy in 2022, a move that opened up another revenue stream for the company and another route toward reduced emissions. Archaea produced about 11 million MMBtus of RNG from its sites, which span more than 30 states. BP said it believes it can increase its biogas volumes this decade to about 70,000 boe/d by scaling Archaea.

The company has its sights set on building 15 RNG plants annually during the next couple of years with Starlee Sykes at the helm as Archaea Energy’s CEO. Sykes last served as senior vice president of BP’s Gulf of Mexico and Canadian operations.

She spoke to Hart Energy’s Velda Addison just after marking her one-year anniversary in the CEO role.

“When this opportunity came up, it was a chance to learn something new, to learn to do another new side of the energy industry in which I’m really passionate about,” Sykes said. “Honestly, it’s been fantastic.”

Velda Addison: What skills and expertise are you bringing to RNG from your experience in oil and gas?

Starlee Sykes: I’ve been really surprised and excited about how much is transferable. There’s the obvious stuff like being a leader. So, leadership and caring for people and supporting people and building a team and a culture—all of that is 100% transferable. But it’s also understanding the value drivers. What drives revenue and earnings has been transferable. Safety is a big part of who I am. And understanding how to lead a safe organization from a personal and process safety perspective is definitely transferable because even though it’s renewable natural gas, it’s still natural gas, which for all scientific purposes is the same composition as the gas that I was used to dealing with in oil and gas. It is just that it comes from landfills and dairy rather than from fossil fuels.

That’s all transferable as well as technical knowledge and problem solving. Understanding how to build and operate plants is something that I’ve done a lot of my career and it’s still applicable here. I guess the last thing would be relations with the government, stakeholders and suppliers. How do you build those relationships and maintain them in a healthy way that supports the business?

VA: How would you characterize the state of the RNG sector today in the U.S.?

SS: It’s exciting. Renewable natural gas, as you know, comes from the gas produced from waste as it decomposes. It’s considered renewable because it is, and it’s helping to have beneficial use from gas that otherwise would just be released into the environment. So, that’s a positive thing for our customers, for the environment and for people. And there’s an increasing market for that as corporates, governments and people put more emphasis on renewables and more emphasis on doing the right thing for the climate.

The demand for renewable natural gas is growing. It’s exciting to be a part of an industry that, while it’s been around for a long time, [has] gotten more attention in recent years and it’s really growing as an industry, but also from a demand perspective. I’ve loved learning about the fundamentals of the business and understanding how BP can uniquely add value and be a part of it at scale.

VA: Where do you see the greatest opportunities for RNG both in terms of supply and demand or offtake?

SS: When I think about RNG, there are two primary markets for demand. One would be into the voluntary market, which is people, whether it’s corporates or university systems or others that have made voluntary commitments to their customers, stakeholders [or] investors that they’re going to use a certain percentage of renewables or shift their profiles in a way that supports better environmental goals by using RNG. That market is growing, again, as there’s more pressure from investors and from people in general to do the right thing for the environment. The demand for that on the voluntary side is growing.

Then, the other side of the demand would be the compliance market, which is support from government programs and legislation such as the Renewable Fuel Standard or the Low Carbon Fuel Standard in California and from the IRA [Inflation Reduction Act] that was put in place where you’ve got investment tax credits and production tax credits that are driving increased demand and production of renewable natural gas.

VA: Where do you see some of the challenges that are ahead for the sector? Is permitting still a problem like it seems to be for most other energy industry projects?

SS: Yes, it absolutely is. It’s the time it takes to get permits. For this industry to thrive, it needs regulatory certainty and support is very helpful. We’ll continue to have good implementation of the Renewable Fuel Standard and the Low Carbon Fuel Standard markets, and hopefully that will grow, spreading to places beyond California, and then also looking at investment tax credits and the guidance for that to make sure that it is fully supportive of incorporating the language that will help support renewable natural gas production.

Those support the industry, but the challenges you see are [not only] permitting, but also inflationary pressures and supply chain delays. That’s not unique to the RNG industry, but it’s an issue. And then, also, some markets of labor can be expensive. Focus on getting the right people and the right skill sets is important, too. The last thing I’d say is utility interconnects. So, how do you get the power to run the plants and interconnect to the pipelines to sell the gas?

VA: When it comes to securing customers and offtake agreements, is it a tough sell to customers who can opt for lower cost natural gas for the same uses?

SS: No, I think it depends on the customer, and that’s one of the things that’s really exciting about BP buying Archaea. When Archaea was a standalone company, it was looking very much towards the voluntary markets because it needed the stable revenues and flows in order to justify getting capital from the markets. But what’s exciting about BP is we have a very mature and advanced trading organization. While I’m focused, as the leader of Archaea, on operating our plants well, building new plants and building out our very large development pipeline, I’ve got a whole trading organization that helps with managing the offtake. That is an advantage BP has in the way that we are able to take that gas to market.

VA: Let’s talk a little bit more about BP’s plans. Can you tell me about some of your targets in terms of production, pipeline of projects and the amount of capex being allocated for RNG?

SS: We currently have 50 plants in operation and we’ve got a development pipeline of over 80 more projects. So, we’re currently the largest renewable natural gas supplier in the U.S. We currently have the largest RNG plant in the U.S., and we’re building out a really impressive development pipeline. It’s our intent to continue to be a leader in the renewable natural gas industry in the U.S. for a long, long time to come. And we’re growing at a rate that’s pretty impressive.… We’re building 15 plants [per year in 2024 and 2025] … and really looking to grow this business beyond what it is today in a very material way.

VA: What’s being done to bring costs down to make it more cost-competitive and what role do you see government incentives playing in further bringing down costs?

SS: Cost competitive[ness] obviously is very important, and we feel like we have a unique solution to that in that we have what we call our Archaea modular design. This is a standardized design that has several different sizes of plants. As I’ve learned in my previous roles building projects around the world, the more often you do the same thing the more cost-effective it is and the more you can learn from it. So, by deploying this standard design at all of our locations, the cost of those developments should come down over time. It will also help you get more effective at operating and maintaining those plants, because you’ve got standardization across all of our locations, which is, I believe, a big advantage for us.

You mentioned government incentives. To elaborate on that a little bit, I think there are three big things we’re focused on when it comes to government incentives. One is maintaining the Renewable Fuel Standard and the Low Carbon Fuel Standard, expanding the Low Carbon Fuel Standard markets where it makes sense. I mentioned the IRA earlier—in particular, the ITC. We’re working with Treasury on making sure the guidance is supportive of being able to get investment tax credits for the equipment associated with producing renewable natural gas. Then, the last thing is a focus on ERINs (electric renewable identification numbers) as an additional pathway for RNG offtake.

VA: Is there anything in the [ITC] that you would like to see changed or added?

SS: It’s a technical correction. In February, the IRS issued a technical correction to the language. The original guidance that was put out was very helpful, but it didn’t properly incorporate the typical structure of landfill-to-biogas projects. The correction classifies upgrading equipment as integral and not functionally interdependent, when it really is functionally interdependent. The language as it reads right now could disqualify ITC for taxpayers like Archaea from being able to claim the cleaning and conditioning equipment for ITC, we would have to also own a fractional interest in the gas collection system, which is historically owned separately by the landfill owners. So, we are asking and working with others in advocating for a correction in that language to make it more inclusive, which we believe was the intent of the legislation.

VA: If you don’t mind pulling out your crystal ball, a year from now, how do you think the RNG sector will look?

SS: I’m always careful on forward-looking statements, as you can imagine. But, I think a year from now it’s going to look like progress is being made and growth is happening. I think, in particular, Archaea will have a bit more of a track record, being a leader in the RNG space. And, I think it’ll still be a very exciting place to invest and be in. I think our employees will be excited to be a part of it, and I’m optimistic that I’ll be very happy with our progress.

Recommended Reading

Targa Pipeline Helps Spark US NGL Production High in 2024

2025-01-23 - Analysts said Targa Resources’ Daytona line released a Permian Basin bottleneck as NGLs continued to grow.

Phillips 66 Makes EPIC Move to Strengthen South Texas Position

2025-01-09 - Phillips 66’s $2.2 billion deal with EPIC allows for further integration of its South Texas NGL network.

EQT: Gas Demand Likely to Outpace Midstream Sector’s Ability to Supply

2025-02-19 - Most infrastructure projects being built will not come online for another year—too late for the quickening pace of gas demand.

EIA: NatGas Storage Plunges, Prices Soar

2025-01-16 - Frigid weather and jumping LNG demand have pushed natural gas above $4/MMBtu.

Charif Souki Plans Third US NatGas Venture, Including E&P Team

2025-03-25 - Charif Souki, co-founder of the Lower 48’s first and largest LNG exporter, has his sights set on a third natural gas venture after his exit from Tellurian Inc.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.