BP made a final investment decision to develop a new Gulf of Mexico platform in the Kaskida Field during the third quarter. (Source: Shutterstock.com)

BP Plc posted the lowest quarterly profit since the start of the pandemic as declining oil prices knocked its balance sheet off-kilter.

The U.K.-based supermajor also hinted that it could reduce the cadence of its share buybacks from $1.75 billion per quarter starting early next year.

BP’s U.S.-listed shares closed down 5% at $29.35 per share on Oct. 29.

BP approved another $1.75 billion share buyback program for the current quarter and reiterated its previous goal to repurchase at least $14 billion in shares through 2025.

However, the company plans “to review elements of our financial guidance, including our expectations for 2025 share buybacks” when BP considers medium-term plans in February 2025, CFO Kate Thomson said on an Oct. 29 conference call.

“Back in February this year, when we guided on $14 billion, we said that was around market conditions as they were in February,” Thomson said, “and we also said that it's at least 80% of surplus [free cash flow].”

European Brent crude prices fell by more than 11% to an average $74.02/bbl in September from $83.48/bbl in February, according to U.S. Energy Information Administration figures.

BP realized an average of $70.22/bbl of liquids production in the third quarter, down from $73.01 in the second quarter.

Analysts at Tudor, Pickering, Holt & Co. said the impending review of BP’s capital returns framework was “not surprising,” given weak crude oil fundamentals and a weakened downstream refining backdrop.

U.S. producers, by and large, have been able to continue returning capital to shareholders through dividends and share buybacks—even in this lower commodity price environment. But analysts and investors have questioned whether international majors will need to borrow money to keep their financial promises to shareholders.

Third-quarter profit attributable to BP shareholders was approximately $2.27 billion—beating estimates of around $2.05 billion, Stifel analysts said—but down 31% from $3.3 billion during the same quarter last year.

The decrease “mainly reflects lower refining margins and a weak oil trading contribution compared with a very strong result in the same period of 2023,” BP said in an earnings statement.

BP’s net debt also increased to $24.3 billion, compared to $22.6 billion in the previous quarter, due to lower cash flow, higher capex and lower proceeds from divestments.

RELATED

U.S. activities

Despite the decrease in earnings, BP reported strong results from its U.S. shale segment and momentum for new projects in the U.S. Gulf of Mexico.

BP’s upstream production averaged 2.4 MMboe/d during the third quarter. Oil and liquids production averaged about 1.49 MMboe/d.

Underlying oil production—output after adjusting for A&D, curtailments and production-sharing considerations—was 6.8% higher than the third quarter of 2023, partly due to the performance of BPX Energy.

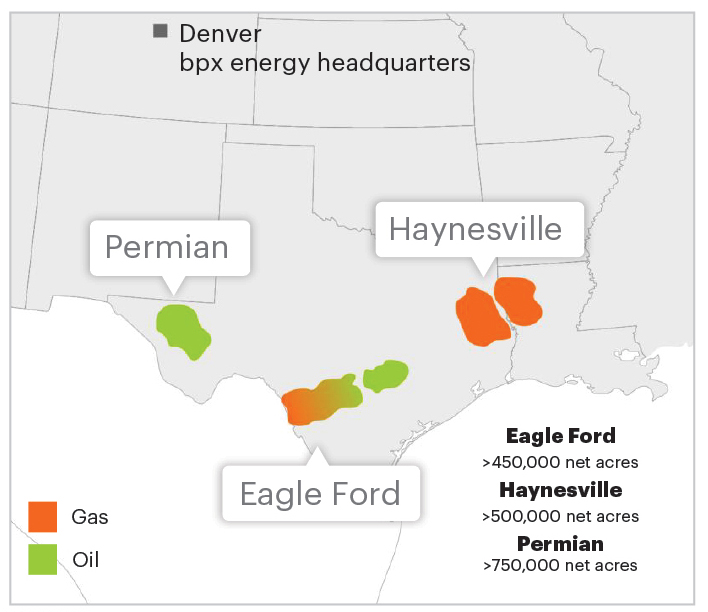

Denver-based BPX Energy manages assets in several key U.S. shale plays: the Permian Basin, the South Texas Eagle Ford Shale and the gas-rich Haynesville Shale.

Given low U.S. natural gas pricing, BP has “low levels of activity in the Haynesville and the Eagle Ford on the dry gas side” as the company waits for a spike in prices, said CEO Murray Auchincloss.

BP is optimistic about natural gas prices through the end of the decade, he said. Prices should begin to respond as additional LNG export capacity ticks online on the U.S. Gulf Coast and power demand grows for AI computing.

“We see very high demand for natural gas as we move through the decade, which makes us incredibly optimistic about our 22 Tcf of natural gas that just sits there waiting … for a price response,” Auchincloss said.

During the third quarter, BP made a final investment decision to develop the Kaskida project in the GoM.

Discovered in 2006, the Kaskida field is in the Keathley Canyon area about 250 miles southwest off the coast of New Orleans, Louisiana.

The new platform is expected to have a nameplate production capacity of 80,000 bbl/d. BP said the development could potentially unlock 10 Bbbl of discovered resource in place in the high-pressure reservoirs in the GoM’s Paleogene formation.

Following FID, BP entered into agreements with Enbridge Offshore Facilities LLC and Shell Pipeline Co. LP to transport oil and gas from the Kaskida platform to markets in Louisiana.

BP said that third-quarter GoM production was impacted by adverse weather conditions. Tropical storms and hurricanes, including Hurricane Helene, forced producers to shut in some GoM output during a particularly active storm season.

In addition to the Kaskida project, Auchincloss said other exploration projects offshore Namibia and Brazil “look pretty interesting” for BP in the future.

RELATED

Recommended Reading

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

US E&Ps Could Drop Up to 100 Rigs at New Low Oil Price

2025-04-17 - Private operators are likely to let rigs go first, beginning in the Midcontinent and Powder River Basin, then the Eagle Ford, Bakken and Permian, according to J.P. Morgan Securities.

Expand Lands 5.6-Miler in Appalachia in Five Days With One Bit Run

2025-03-11 - Expand Energy reported its Shannon Fields OHI #3H in northern West Virginia was drilled with just one bit run in some 30,000 ft.

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.