The 50-50 joint venture with JERA takes shape as BP takes pulls back from renewables to focus on higher returns and cash flow generation. (Source: Shutterstock.com)

BP and Japan’s largest power generator JERA are combining their offshore wind businesses to become one of the world’s biggest offshore wind developers, the companies said Dec. 9.

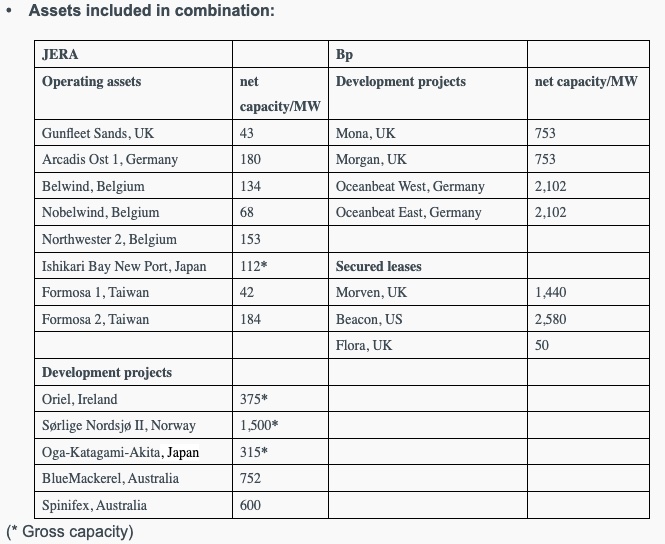

With capital commitments of up to $5.8 billion through the end of 2030, the 50-50 joint venture will create JERA Nex bp. The companies will have a total potential net generating capacity of 13 gigawatts (GW) comprised of operating assets and development projects, according to a news release.

“This will be a very strong vehicle to grow into an electrifying world, while maintaining a capital-light model for our shareholders,” BP CEO Murray Auchincloss said.

The alliance takes shape as BP pulls back from renewables to focus on higher returns and cash flow generation. It also takes place as offshore wind developers push forward with projects having faced high interest rates, supply chain issues and inflation that slowed or stopped some developments in recent years.

“Offshore wind has significant potential and is a critical component of the energy transition,” said JERA CEO Yukio Kani. “The sector is at an inflection point, and we believe the transformative partnership launched today between our two companies combines the resources, capabilities, and network necessary to be a world-class offshore wind company, and in doing so, realize the potential of offshore wind globally, while positioning this business for long term success.”

The companies will contribute operating assets with about 1 GW net generating capacity, a pipeline of development projects with about 7.5 GW capacity and secured leases with about 4.5 GW of potential capacity, according to a news release. The JV will initially focus on advancing existing projects in Australia, Europe and Japan, and plans are to pursue competitive projects that add value and optimize the combined portfolio.

JERA, which is owned by Tokyo Electric Power Company (TEPCO) and Chubu Electric Power, said it entered the offshore wind market in 2019 with investments in projects in the U.K. and Taiwan. In 2023, JERA acquired Belgium offshore wind company Parkwind. The largest development project JERA is bringing to the JV is the 1.5 GW Sørlige Nordsjø II offshore Norway.

BP brings to the table more than 4.5 GW of secured leases, including Beacon Wind in the U.S., along with about 5.7 GW of projects under development. These include the 2.1-GW Oceanbeat West and 2.1-GW Oceanbeat East offshore Germany.

Analysts at TPH & Co. said the announcement drove outperformance in London trading.

“In addition to the complementary nature of the two portfolios, the pro-forma scale with both combined, and the background of collaboration between both companies (existing long-term LNG agreements), the funding plan will significantly reduce the ~$10B in renewables capital BP had previously envisioned out to 2030,” TPH & Co. said in a note Dec. 9.

Analysts pointed out that BP’s maximum commitment of $3.25 billion through the end of 2030 could be significantly lower, depending on project decisions and venture financing and proceeds from potential asset sales and farm-downs. Another plus for BP, according to TPH, is the company “will retain access to its equity share of power offtake, enabling continued value for its trading business.”

The alliance, however, excludes BP’s existing interests in offshore wind partnerships in South Korea.

The formation of the JERA Nex bp is expected to be complete by the end of third-quarter 2025, if required regulatory and other approvals are met. The company will be based in London.

JERA will nominate the company’s CEO and the CFO nomination will be made by BP, according to the news release. Reuters reported Dec. 9 that Matthias Bausenwein, head of offshore wind for BP, said he was leaving the company after the company announced the offshore wind JV.

Recommended Reading

National Grid Agrees to Sell $1.7B Onshore US Renewables Business

2025-02-24 - The sale of National Grid Renewables to Brookfield comes as the utility continues efforts to streamline its business and focus on networks.

SLB Capturi Completes Its First Modular Carbon Capture Plant

2025-01-23 - The Netherlands facility will capture up to 100,000 metric tons of CO2 annually, SLB said in a news release.

Copenhagen Infrastructure Partners Selects Canadian Solar for Energy Storage Systems

2025-02-10 - Construction on the 240-megawatt battery energy storage system in South Australia is expected to start in 2025, Canadian Solar says.

Smackover Lithium Derisks Direct Lithium Extraction Technology

2025-03-11 - With the completion of a final field test, the Smackover Lithium joint venture's direct lithium extraction technology moves toward commercialization, Standard Lithium says.

USA BioEnergy Secures Texas Land for $2.8B Biorefinery

2025-01-13 - USA BioEnergy subsidiary Texas Renewable Fuels plans to annually convert 1 million tons of forest thinnings into 65 million gallons of net-zero transportation fuel, including SAF and renewable naphtha.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.