BPX Energy CEO Kyle Koontz stands outside his office in the BPX headquarters on the outskirts of downtown Denver. (Source: Michael Ciaglo)

DENVER—A child of the oil industry, Kyle Koontz grew up in the boom-and-bust 1980s, deciding a career in energy wasn’t worth the cyclical risk.

But as an architectural engineer in Oklahoma City, the advent of the shale boom ultimately proved too tempting to resist.

He worked his way up with SandRidge Energy and joined BP not long before the British energy supermajor made its big shale splash by acquiring the onshore U.S. assets of BHP, eventually launching the BPX Energy brand.

Koontz recently took over as the CEO of BPX after his predecessor, Dave Lawler, who also held the title of BP America president, stepped down just days after BP CEO Bernard Looney was removed for personal relationships with employees.

Koontz, who was BPX’s COO of development, was quickly appointed to take over the onshore U.S. operations. In London, BP interim CEO Murray Auchincloss had the interim tag removed in January, bringing leadership stability back to the company.

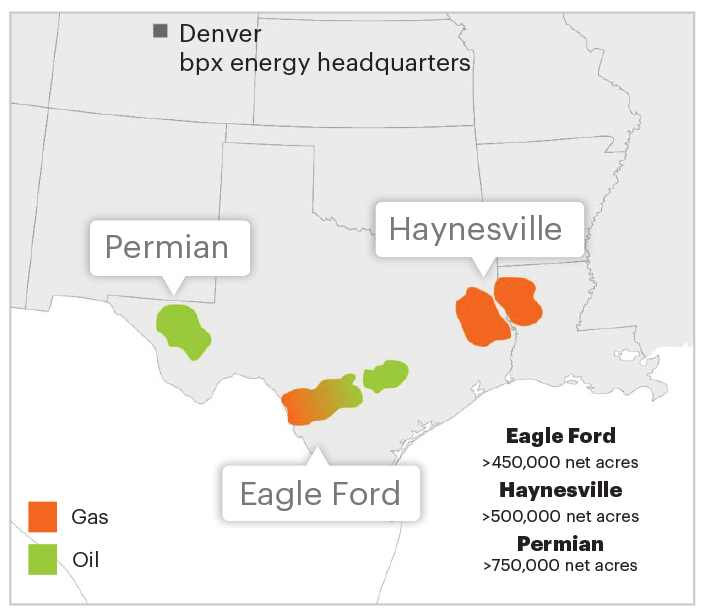

Now, Koontz is excited to be tasked with leading BPX’s rapid, planned growth in U.S. shale in the Permian’s Delaware Basin, the Eagle Ford and, eventually, in the Haynesville Shale, as natural gas prices recover.

Koontz sat down with Oil and Gas Investor in BPX’s Denver headquarters to discuss the past and future of the shale producer. In this month’s relaunch of E&P magazine, Koontz also discussed BPX’s field development plans in more technical detail.

This interview has been edited for clarity and length.

Jordan Blum, editorial director, Hart Energy: You took over as CEO in October. Obviously, you’re not new to BPX, but how has it been stepping into the new role, hitting the ground running and ramping up production with all the change in the BP corporate and BPX leadership?

Kyle Koontz, CEO, BPX: The role is different; it’s much wider. But it’s more than just business. Culture is a really big part of what we do. It’s something I’ve been passionate about. One of the things that’s new a little bit for me is that this is the farthest away I’ve been from the business—not being in the day-to-day—probably for the first time in my career. That’s been a bit of an adjustment. The way I’ve tried to adapt is empowering the right leaders that have the right attributes in terms of character and integrity. It was an adjustment to turn over the reins and let them go do their thing. But I committed that I wouldn’t be an over-the-shoulder type of leader, and so far, so good.

I think we had a bit of an adjustment period, both myself and the organization. My predecessor [Dave Lawler] was a big part of what we built here with a great legacy. And there were some structural changes we had started that we had to see through. A lot of the transition through the end of the year was just getting used to the new normal. The team came back strong in January. We had a town hall early in the year. The energy was strong. There were some quotes I got from people saying, “We haven’t heard this much buzz since 2017.” There’s renewed purpose, and it’s shown in the numbers in the business. We’re ahead of schedule in our production growth plans, and it’s showing up big for BP.

JB: You mentioned some structural changes, and that’s both in the U.S. and U.K. But how has BPX really been impacted?

KK: Very, very little. There’ll be some indirect impacts, obviously, but that’s one of the things that I wanted to get clear upon my appointment. “What is the expectation going forward? Is it similar to what I’ve come to expect?” And, yes, the response was, “We want you guys to continue to run the business headquartered in Denver. The growth strategy stays in place.” Really, there weren’t any material changes between us and BP. There’s a lot of change going on in BP but, I think, using Murray’s language, it’s a simpler, more focused company. And that’s what we’ve tried to do. There’s a lot more learning going from us back to BP than what was happening in the past. That’s something Murray asked me to do in the new role. We typically would take a lot of learning from BP, take their expertise. It’s one of the unique advantages we have of being a part of BP, they’re well capitalized.

It’s one stakeholder instead of many, which simplifies things a bit. It’s like being a very large private equity company, but your sponsor is one big energy company. And there’s no exit. We’re part of the long-term strategy.

JB: It seems like you see some advantages to being headquartered in Denver, even though all the assets are now in Texas and Louisiana.

KK: Especially in the post-COVID world, geographic location for some of what we do is not as key. The technology has been enabling.

When we first moved up here, proximity to assets was a driver. The asset base changed, but no regrets. Denver’s been a great fit. There are direct flights to London, so it’s easy to get in and out. Denver has a really cool pioneering spirit, which really fits our culture of innovation. It’s been a great recruiting tactic. A lot of companies have moved out of Denver, unfortunately. Through different consolidations and acquisitions, folks relocate to Houston. But we’ve been a big beneficiary of talent in that regard.

JB: There was the big acquisition with BHP, which has been more than five years now. Can I get your take on just how big a deal that was for BPX, and how things slowed not long after with the pandemic? How is it now finally being in ramp-up mode and really starting to take advantage of those assets more?

KK: It was a very significant asset purchased for BP and, in context, it’s the biggest one since ARCO [Amoco] over 20 years. There was a ton of capability we needed to gain, and we had to do it on the fly because we’d already made the deal. The good thing is, the assets had been a bit capital-starved, so there was a good opportunity to boost investment and get activity going, but we didn’t have the luxury of growing into it. We had to hit the ground running from day one. We took over operations, and we stood up additional rigs and frac crews to try to save leasehold that BHP had already given up on. And it was worth it. We saved a lot of acres and a lot of inventory from doing that, but it was a bit challenging and chaotic.

We had 13 rigs running, and then the pandemic happens. I remember March 9 [2020]. It’s when the world turned. We stood down all rigs but one in 45 days. We were one of the fastest responders of any of our counterparts. And then, nine months later, we were back to 11 rigs. So, that was kind of a vicious extreme case of what can happen in this business. But since we got back to work, we’ve been consistently building and growing the asset.

JB: You’re at about nine rigs now? Is that right? Of course, you can do more with each rig now than you could just a few years ago.

KK: Absolutely. Nine to 10 rigs for 2024 is the range. We planned on running five rigs in the Permian, but we dropped a rig this spring because we’re drilling so much faster. So, four rigs will get us the same footage now.

JB: How do you feel about just the portfolio right now? Do you feel comfortable, or do you see any changes on the horizon?

KK: We love the portfolio. We’re kind of hitting our stride, so to speak. We’ve been mostly doing lease-obligation drilling for the last couple years, but we’re now in growth mode in the Permian. We’re drilling way beyond lease obligations. We’ve got three central facilities built out as part of our multiyear strategy to build the field out. Now, we’re feeding volumes into that. We just brought on the third one [a few] weeks ago. That’s called Checkmate. We have one more compression project in the Permian that’s the last big project. Now, we’re looking at just optimizing each parameter, just trying to squeeze every dollar of investment we can.

The Eagle Ford is really exciting. There’s a ton of runway there. What we like about the Eagle Ford is it’s a much bigger acreage position. It’s about a half million acres compared to just under 80,000 in the Permian, but it’s got exposure to different commodity windows. We’ve got oil, gas, rich gas and condensate. You’ve got all these fluid windows, but the rock’s great, the deliverability is great, so they all produce really well. We shifted capital away from some of the gas assets to more oil-weighted assets, just seeing where the market was going with commodity prices.

In the Haynesville, we slowed our activity down, but it’s a premium gas asset. We’ve got some of the best acreage in the play. We started ramping down late last year. We’re down to one rig; it’s obligation drilling. Then we’ve deferred completions to late in the year or next year. We like the Texas side [of the Haynesville] as well, but the acreage quality is higher on the Louisiana side, so that’s been our focus. Our core strategy will be built around that, and we will work into the Texas side as we can.

We have high-quality inventory; we’re in the core of the core of all the basins we’re in. I like the focused concentrated position. I think it fits well with where we’re headed with BP focusing on just high-quality assets, and then delivering on those assets.

I don’t see any big changes happening. I do think we are going to need to add inventory. Renewals of assets is always a strong part of the growth strategy, but one of the benefits of having the core position and the size of the BHP deal is we have the luxury of time. We’re not pressed to do anything, so we really want to make sure we buy right. It’s a big part of making value on acquisitions. We bought the BHP deal at $50/bbl oil. That was important, because we had to slow activity down in the pandemic that wasn’t planned. Price appreciation and some of the technology that we’ve infused have helped us make sure we did well in that investment.

JB: You said eventually you’ll need more inventory, but there’s no urgency. Do you think the growth would likely come in the Permian?

KK: I don’t know. I think we just don’t want to be so rigid that we’re not opportunistic. We want to still look at deals, screen deals, and then a lot of it is just what’s right for BP. What’s the timing? We always look at deals even though we haven’t bought anything major. Since the BHP deal, we’ve done a lot of smaller deals and cashless swaps and acreage trades. It’s pretty remarkable how much activity we’ve been able to do with very little capital outlay. This is all portfolio refinement, trading out with partners, blocking up units and getting our average lateral end up. But we estimate we’ve delivered over $1.5 billion of value just through those type of deals. Our deal teams are still very busy. Like I said, we have the luxury of time, and so we’re going to use it. If we find the right deal, then we’ll certainly bring it to BP and consider it.

JB: You have the goal of 650,000 boe/d by 2030. I think you’re over 400,000 boe/d now. So, you’re ramping up pretty quickly. The 2030 volumes would more than double the numbers from 2022. Can I get your take on how fast you’re moving up and just what the future holds?

KK: It equates to about a 10% annual growth rate, and so we will keep on that trajectory. The volumes get big towards the end of the decade as we increase investment in gas. If the market’s favorable, then we’ll be able to achieve those growth rates. I have very high confidence in that plan. But, also, if the market’s not favorable, then we’ll adjust. But we want to show visibility to be able to grow at that pace. Even with the mix of investment we’re doing right now, it’s highly profitable at these prices.

I think the Haynesville and the Hawkville [gassy southwestern Eagle Ford], as we get towards the end of the decade, are activated through reducing our spend on non-drilling and completion costs in the Permian. For the last couple of years, we’ve been spending quite a bit of money building out the [Permian] field gathering system. We decided to own and operate that ourselves to maximize flow assurance and speed of service, so we can connect and build right when we need it. It also allowed us the ability to electrify the field, which has given us reliability, uptime and a reduced emission profile. All of that took several years to build out. We’re kind of winding down that spend now, and we’ll be able to reallocate that capital to more gas growth.

JB: You mentioned targeting more of the liquids in the Eagle Ford. I assume that’s happening in the Permian, too. Can you say in terms of how weighted you are in the two basins right now versus what you were?

KK: The Permian has the biggest capital allocation. Eagle Ford is kind of a close second. But, purely upstream capital through the bit, they’re pretty comparable. We do have some continuous growing obligations on rich gas assets in the Eagle Ford. But any discretionary capital is going to the oil. The oil mix is comparable, but Permian could deliver more oil for just total volume. And we have a higher ownership percentage in Permian, so we get better net oil per dollar invested. That’s the plan going forward. I don’t see any major changes in capital.

So, we’ve shifted capital to the liquids. No change to Permian. We were already at development pace there. That was predicated a lot on building out the capacity.

JB: I’ll pivot a little bit. How’s the longer-term view of gas? Obviously, there’s a lot more bullishness beyond the present.

KK: We still love gas. It’s a great commodity, very clean burning, and I think it’s going to be really important for the future, including the transition. Some of our biggest operational gains were coming out of the Haynesville and, with some of them, we were able to leverage back into the Permian and the Eagle Ford. The Hawkville has a ton of running room as well. But, I think, just given the dynamics, gas is going to be more volatile and that’s what we’ve seen. It’s going to be important to maintain flexibility and try to be nimble to navigate that market.

JB: You’re lining up some DUCs in the Haynesville. Are you doing that in other basins, too, or is that really just a Haynesville specific thing right now?

KK: It’s just Haynesville specific. The maximum efficiency you get in frac operations is running a consistent frac crew. The guys get to know our guys, they develop a bit of synergy and that’s how you get the manufacturing mode going. The Haynesville work was already down to so little that we just deferred the rest of those completions into late next year, but it’s not a very high well count and we’re hoping it’s just a short-term duration.

JB: Going back to early days and the shale boom, all the majors really missed out on that first wave of the shale boom. Can I get your take on how BP, and maybe the rest of the industry as well, caught up and took more of a leadership role?

KK: I’ll speak in the context of BP for that, but we were slow, and we were slow to make decisions, slow to act, slow to operate. When I got here in 2016, we were kind of in the middle of trying to change all that. We had to act more like an independent. But, along the way, we were able to learn quite a bit from the major side as well, particularly in safety leadership and systems and process. It’ll be interesting to see how that progresses forward because a lot of the smaller companies with the simpler structure can make decisions faster and they can iterate faster.

I think what’s shifting now is because the expectation of investors is a higher standard than what it used to be. Before, it was a very empirical model. You hear a lot of things like statistical play. Well, that means we can’t fundamentally describe or forecast the results, so we just run statistics and then we’ll extrapolate. I think the majors, though, were used to going much more beyond that in terms of science and predictability, more sophisticated models, more sophisticated subsurface understanding. What we’ve been able to do, and I’m really proud of, is kind of merge those capabilities. We had to have a little bit of an empirical nature to our business, fail small and fail fast so that we can continue to grow and learn. But we can’t afford to be catastrophically wrong either. I think merging that scientific approach from a major with the nimbleness of the independent mindset has been kind of the secret recipe for BPX.

JB: Going back to the Permian, can you give more of an overview of building out your electrical substation network and electrifying 95% of the well sites in the Permian?

KK: We wanted to power the field, but we couldn’t rely on a third party to build all that up for us. What we did is, we made a deal with our utility partner to buy directly off the transmission line, and then build out the system to step it down where we needed it, when we needed it. One of the unique advantages by doing that is we could customize the load design. We’re able to run Halliburton’s electric frac fleet off our grid, which is a big electrical load and most local grids aren’t designed for that. But we designed for that from the beginning. We had never done it before either, so that was a little bit of a learning curve, but we knew about what the load capacities would be and how fast we need to draw on it. That’s given us a unique advantage. Almost all of our sites now are fracked off the grid with e-frac, and all of our drilling rigs are outfitted with transformers with Nabors so that we can drill off the grid, as well. We use the electricity to our advantage. Once you have the power set, you can tap into it for multiple uses, such as saltwater transfer pumps. We can also do electrical submersible pumps that we run in some zones. Electrification has been a good bet.

One of the big benefits is, we had basically 99.9% plant availability for our first CDP [central delivery point] that we built right in the middle of COVID. It was the simplest of the three designs, but it’s performed at a very high level. The high reliability of electrical compression does really well at scale. It’s also been a huge benefit in reducing our overall CO₂-equivalent emissions. We’re down almost 40% from when we started back in 2019.

JB: And you’ve basically eliminated routine flaring, right?

KK: We’ve never flared just to sell the oil where we didn’t have a gas market. There was some flaring due to process subsets in the field, just the way the field was built out. As we started building the new infrastructure, we also started retrofitting the existing gathering lines, and the main advantage was getting low-pressure gas service and compression in the gathering lines. Then we started making some adjustments and modifications to the existing well facilities. It’s about 150 wells that we call legacy sites that we had to go do some retrofitting and modification. All the new sites don’t have tanks at the well site, so they have no flares at the well site. They just go through three-phase separation, and they’re piped to our CDP. The CDP has a flare, but it’s only there for safety and process subsets. So, we almost eliminated the flaring.

We had about 17% of our total gas stream that we were basically just burning. Part of the inspiration for how we built out the CDPs and deciding how many and where was, how do we sell all that gas? It was very cost prohibitive to put a vapor-recovery unit at every well site, but we could do it at scale at the CDPs. We captured 5%-6% more residue gas at our central facility, and that goes into the sales line. That’s the gas we used to be flaring, and now we’re down well below 1%.

JB: And the last facility under construction now is called Crossroads, right? Did it used to tentatively be called Royal Flush?

KK: Yes, Crossroads is the compression station for next year. There’s been some different iterations in the design. Originally it was five full CDPs. As we blocked up acreage, and we’ve fine-tuned the designs and the development schedule, we were able to whittle that down to three CDPs and one compression station. The compression station will help us for increasing the gas-to-oil ratio over time. The reservoir is built where more gas will come out—a solution as the pressure drops. That compression will give us the ability to service all of that gas to keep the oil utilization high.

JB: You’re a Texas native. I wanted to get your take on just how you got into the industry. You started out with architectural engineering right at Oklahoma State University and then switched to the archrival University of Oklahoma, eventually.

KK: The short answer is: I was born into it. I was born in 1979. The oil price went over $140/bbl, which was a record at the time. My dad and mom were both in the business. They worked for an operator out of Midland. By ’86, oil was under $30/bbl. My dad had several businesses that he ultimately wasn’t able to keep, and that left a deep impression on me. One, that the energy business was very dynamic, very volatile. It was a really exciting business to be in; it was also a bit painful. It changed the course of my life. We moved several times in several years. My dad changed jobs. I ended up in the Dallas-Fort Worth area growing up in Grapevine. But that kind of left a bad taste in my mouth, so I didn’t really want to pursue energy.

So, I went into architectural engineering. I was a structural project manager for two years for a great firm out of Tulsa. I moved to Oklahoma City with that firm to get married. I had met my wife in college. At that time, it was 2006, with the full-on shale boom going, led by Chesapeake primarily, but also Devon Energy. There was a new company that Tom Ward was putting together after leaving Chesapeake called SandRidge Energy. There was a big run on petroleum engineers. When I heard what petroleum engineers were making as starting salary versus what I was making as a project manager, I thought, “Man, I’m in the wrong business.”

It was a calculated risk. My parents thought I was crazy, but I went back to the oil patch. I went back to OU. I was able to get on with SandRidge and intern during the summers while I was finishing up school. It was a really unique experience just because there was so much activity, so much growth. It was an empirical model; there was a lot of trial and error. It was just a great training ground for an eager young professional. I got to spend a lot of time with senior leadership, see how decisions were made, how capital was allocated, just learn the business top-to-bottom, and I got to prospect over 1,000 wells in the first three years. It was just a tremendous volume of experience and work, which I’m super grateful for. And it’s been a big part of why I’ve been able to keep accepting bigger roles and responsibilities for a relatively short career. I just realized what a dynamic business this is. It’s so much different than designing buildings not to move. So, I just leaned in and went for it. And now here I am in Denver.

JB: I take it your parents don’t think you’re crazy anymore.

KK (laughing): They’ve gotten over it.

JB: How was it going from SandRidge to private equity-backed Templar Energy and then, eventually, to BP in 2016?

KK: It was a bit crazy, frankly, but I’m really grateful for all those experiences. One of the things I was very interested in early on was reading about guys like (Continental Resources founder) Harold Hamm and (Devon Energy co-founder) Larry Nichols and a lot of those great leaders in energy, and how they were well-rounded businessmen and oilmen. The more you can learn about the business, the better you can make decisions. A lot of the leaders that I worked with at SandRidge had gone out and joined Dave Le Norman, who’s a veteran in the private equity world. I had an opportunity to go over and join that team, and that was a fantastic experience.

That was also a very active time, a lot of deal flow, made a lot of great friends, a lot of great mentors and just great experiences. One thing that drew me to join BP was leadership, and it was at the individual level through Dave Lawler, who recruited me over, but also the dynamic of an integrated international oil company. You can make decisions to lead big bodies of peoples. That was a different skillset that I didn’t have. I figured I’d try it out, see how it went, and it’s been a good fit.

JB: Of late, BP is still very much embracing the energy transition. However, and you may not want to use this word, there’s a pivot back to oil and gas.

KK: Oil and gas have always been cornerstones of the strategy. I think we’ve learned some lessons, and we are now going to move at the pace of societies, and we’re going to be pragmatic about it. BPX fits within that. It’s the resilient hydrocarbon strategy. Not only do we need to be profitable, but we need to be environmentally sensitive and conscious about how we impact the Earth and the communities around us.

We also need to be very cost-conscious because pricing, as you know, is pretty volatile in this business. We can’t rely on high pricing like we maybe have in the past as an industry. We’ve got to be competitive, and we’ve got to go after those margins just like manufacturing companies do, just like digital companies do. And try to learn from those industries as much as we can. The better we do that, the more we can learn, because we can learn in a much faster cycle time than BP. Then it can help BP, as well. I don’t think the focus has shifted as much as maybe what we’ve chosen to highlight. And I think the way we talk about it is a little bit different now. But it’s always been core to the strategy.

Recommended Reading

MOGAS Wins Multimillion Contract for Aramco-backed S-Oil

2024-07-02 - MOGAS said the contract is part of S-Oil backer Aramco's largest investment in South Korea.

Oceaneering Awarded Multiple GoM Vessel Services Contracts

2024-07-02 - Oceaneering also secured two separate pricing agreements that include the use of new technologies from its integrated, customizable IMR service.

E&P Highlights: July 1, 2024

2024-07-01 - Here’s a roundup of the latest E&P headlines, including the Israeli government approving increased gas export at the Leviathan Field and Equinor winning a FEED contract for the all-electric Fram Sør Field.

Laredo Oil Subsidiary Hell Creek Begins Drilling in Montana’s Midfork

2024-06-28 - Laredo Oil expects the well to be production-ready by late July.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.