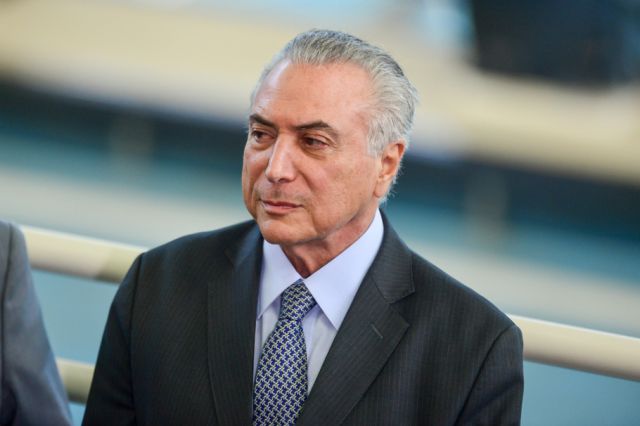

Brazil President Michel Temer visits Olympic Park in Rio de Janeiro in June 2016. (CP DC Press/Shutterstock.com)

RIO DE JANEIRO—Brazil has made progress in overcoming the toughest recession in its history, but another political scandal could put the country in a new crisis.

Brazilian newspaper O Globo reported May 17 that a recording existed of President Michel Temer approving a bribe intended to persuade jailed former House Speaker Eduardo Cunha to remain silent about Operation Car Wash. Temer denies the accusation. Both are members of Brazil’s Democratic Movement Party.

Despite the uncertainties stemming from the claim, oil and gas investors are interested in participating in two presalt auctions and one post-salt auction scheduled for this year, according to Decio Oddone, director general for ANP, Brazil’s oil and gas regulator.

“Brazil’s oil and gas industry is independent of the country’s economy from the point of view of demand, which depends on the global scenario,” he said in an emailed statement. “Oil companies that operate in the industry have a long-term focus.”

The ANP director is in New York promoting Brazil’s oil and gas opportunities to investors. ANP released on May 19 the pre-tender protocol for the 14th bidding round in which Brazil will auction 291 blocks across nine basins. The 14th licensing round is scheduled for Sept. 27.

Petrobras was at the center of Operation Car Wash, the country’s biggest corruption scandal that involved the oil major’s board of directors, Brazilian construction companies and politicians. The scandal involved kickbacks, bribery and bid-rigging.

The newspaper also reported that Joesley Batista, CEO of J&F Investments, which controls Brazilian meat processing company JBS, offered the bribe. Batista is also being investigated by Brazilian prosecutors for allegedly bribing politicians.

Now, Temer is facing threats of impeachment, and a resignation is a strong possibility as public and political pressures grow. In addition, he is under investigation by the Supreme Court.

The situation may affect the country’s energy sector. Although oil and gas regulatory changes made by Brazil’s energy ministry were received favorably by the industry, the future partly depends on how politicians manage this current crisis.

When President Temer took office, replacing Dilma Rousseff after her impeachment in May 2016, one of his promises was to give Brazil’s oil and gas industry a more business-friendly environment. This move contrasted the energy policices of the former administration in which state interventionism and protectionism had important roles.

The current administration is facing another dilemma. The Brazilian Socialist Party asked Brazil’s Energy Minister Fernando Coelho Filho, who is a member of the party, to resign. However, Coelho Fllho said he will stay in office to support Temer during his battle against the impeachment process.

Even if there are changes in the country’s leadership, the auctions will not be canceled, according to Rio de Janeiro Federal University Professor Edimar Almeida, who coordinates the Energy Group at the Federal University of Rio de Janeiro.

“This political crisis is very serious. The greatest concern of the industry is the auctions calendar, and the advances in the modernization of the regulatory framework will be kept. This is fundamental for companies to decide on investments,” Almeida said. “However, it seems to me that Congress will not reverse the progress achieved. So, I am optimistic that the auctions will not be canceled, regardless of the outcome of the crisis, which may even result in impeachment.”

If the president’s position becomes vacant, House Speaker Rodrigo Maia takes office. Afterward, Congress would have to call an indirect election within 30 days of the president’s removal, according to Brazil’s Constitution.

However, the opposition, led by the Workers Party, wants direct elections as soon as possible, proposing a constitutional amendment. Former President Luis Inácio Lula da Silva is leading the presidential election polls, but he is also facing corruption charges.

Recommended Reading

Woodside Reports Record Q3 Production, Narrows Guidance for 2024

2024-10-17 - Australia’s Woodside Energy reported record production of 577,000 boe/d in the third quarter of 2024, an 18% increase due to the start of the Sangomar project offshore Senegal. The Aussie company has narrowed its production guidance for 2024 as a result.

SLB Earnings Rise, But Weakened 4Q and 2025 Ahead Due to Oil Glut

2024-10-22 - SLB, like Liberty Energy, revised guidance lower for the coming months, analysts said, as oilfield service companies grapple with concerns over an oversupplied global oil market.

ConocoPhillips Hits Permian, Eagle Ford Records as Marathon Closing Nears

2024-11-01 - ConocoPhillips anticipates closing its $17.1 billion acquisition of Marathon Oil before year-end, adding assets in the Eagle Ford, the Bakken and the Permian Basin.

Empire Raises $10M in Equity Offering to Ease Doubts, Reports $3.6M Loss

2024-11-14 - Empire Petroleum received a waiver from its lender after falling out of compliance with a credit agreement.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.