Falling crude oil and product prices have driven higher U.S. oil demand in recent years. Through the first five months of 2015, the price of crude averaged $52/bbl, compared to $100/bbl over the same time in 2014.

Many diverse factors combine to determine prices in a globally integrated oil market. About 60% of the world’s oil supply is traded internationally, and particular sources of oil can be interchangeable within the limits set by the oil’s quality. Consequently, the price of oil is global.

No matter where it is produced or consumed, the price tends to move in the same direction at a similar rate. New supplies or disruptions to existing supplies will impact prices around the world, no matter where those events occur. Similarly, a change in demand in any particular country is likely to affect prices globally.

With energy consumption growing, pressures are tightening on the oil and gas industry as the demand for hydrocarbon fuels continually rises despite extraction becoming more challenging. While the high cost of energy has enabled the commercial exploitation of shale gas, traditional oil and gas companies need to go farther and deeper to locate new fields.

However, operational realities require this to be done with more transparency, greater investment in safety and with larger consideration for the environment and the bottom line.

As of now, the oil and gas industry remains confident in its ability to grow and meet demand. But there are areas where the industry is exercising great caution as it is seeing higher costs as a barrier to growth.

How does this industry, historically behind the curve in technology due to manual processes, meet the demand in a time- and cost-effective way that will not negatively impact the consumer?

The answer is the digital oil field.

What is the digital oil field?

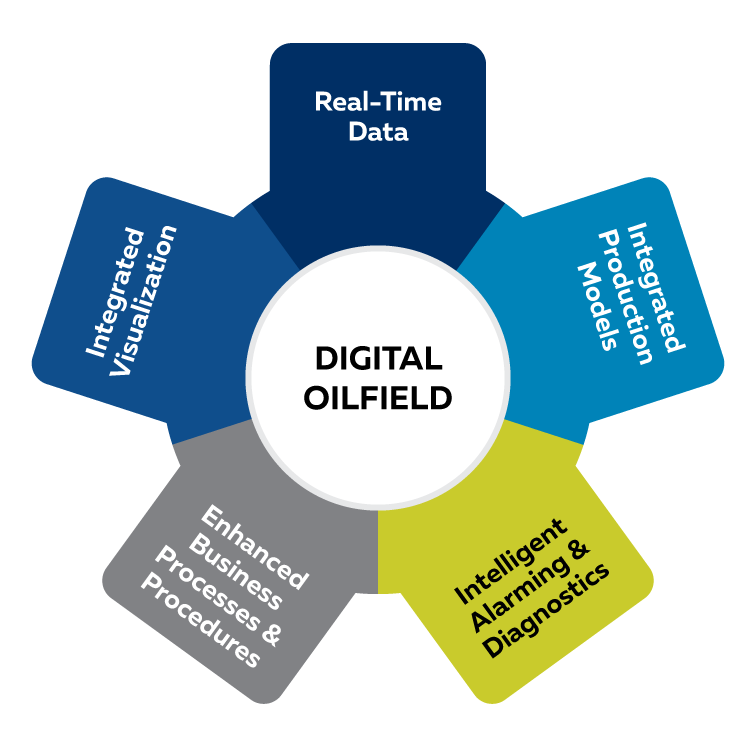

The digital oil field maximizes oilfield recovery, eliminates nonproductive time and increases profitability through the design and deployment of integrated workflows. The digital oil field combines business process management with advanced IT and engineering expertise to streamline and, in many cases, automate the execution of tasks performed by cross-functional teams.

The term “digital oil field” has been used to describe a variety of things, and its definition has encompassed an equally wide variety of tools, tasks and disciplines. All of them attempt to describe various uses of advanced software and data analysis techniques to improve the profitability of oil and gas production. Common recurring themes of the digital oil field include:

- Operational efficiency;

- Production optimization;

- Collaboration;

- Decision support;

- Data integration; and

- Workflow automation.

Cost reduction is a major growth driver for the digital oilfield market, according to a research report on the global digital oil field that states that the entire oil and gas industry needs to optimize operations, increase efficiency and reduce operational costs. Research suggests that digital oilfield technology will gain prominence during the forecast period of 2015-2019 as it offers a high return on investment by increasing production efficiency. Integrating high-tech systems in oilfield production provides concise real-time accurate information and allows better control and continuous monitoring of subsea infrastructure.

A research report on the digital oilfield market indicates the global market for the digital oil field is expected to rise at a healthy compound annual growth rate of 7.9% through 2019 and 5.6% for projections up to 2024. The Middle East and Asia-Pacific regions are expected to show the highest growth rate period under consideration in this report. The report indicates that this astounding growth is dependent on the implementation of digital oilfield technology.

Data in the digital oil field

Oil and gas companies must capture and manage more data than ever before—and that information is being churned out at an ever-increasing velocity. According to industry analyst firm IDC, the digital universe now includes 2.7 zettabytes of data (that’s almost 1.1 trillion gigabytes). Companies are struggling to store, analyze and gain useful information from these huge volumes of data.

Advances in instrumentation, process automation and collaboration are increasing data volumes even faster.

For oil and gas firms, advances in instrumentation, process automation and collaboration are increasing data volumes even faster. Experts believe these volumes are growing by a factor of five each year.

There are hundreds of technologies being developed to improve efficiency, assist deepwater drilling and provide better information for improved safety and disaster response as well as improve knowledge- sharing and remote operations insight. However, for many companies, challenges still remain in rolling out the digital oilfield concept to all its operations as well as effectively managing the increased amount of data being recorded.

Many of the industry leaders already are crafting new visions with the digital oil field in mind. Shell sees the digital oil field of the future as encompassing increased fiber-optic wells and advanced reservoir monitoring as well as ensuring that all assets have the “appropriate level of smartness” applied to them. BP has similar goals to roll out its Field of the Future Technologies across its assets. If the oil price remains low, optimizing all of this technology and the wealth of data it provides for EOR, increased safety and efficiency will remain paramount.

As digital oil fields and analytics expand horizontally to encompass every aspect of operations and engineering, they also will expand vertically within the organization to touch every functional discipline, from accounting and finance to executive management.

Digital oil fields will become digital companies, with all information pertaining to the acquisition, development, production and disposition of oil and gas assets being managed in a centrally administered system with business process management processes, orchestrated workflows and notifications.

Changes to a production plan in one asset will, through the design of increasingly more sophisticated workflows that include economic analysis, roll up to a revised portfolio optimization plan maintained by the finance department, with changes in expected net present value being made immediately available to executive decision makers.

Acknowledgement

The preceding information is an excerpt from “Bridging the Gap: The Digital Oilfield & Its Data,” a white paper written by Digital Intelligence Systems LLC (DISYS). The full white paper can be downloaded at disys.com/wp-content/uploads/2016/02/ Whitepaper-The-Digital-Oilfield-and-its-data.pdf.

References available.

For more information, contact Rhonda Duey at rduey@hartenergy.com.

Recommended Reading

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

M&A Competition Off to the Races as Mesa Minerals Kicks Off Fourth Iteration

2025-04-16 - The Mesa Minerals IV launch comes as M&A competition grapples for mineral and royalty interests, no matter the basin, says Mesa Minerals CEO Darin Zanovich.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.