Efuels can be used in place of fossil-based fuels to power planes and ships, for example, without changes to engines or infrastructure, according to Infinium. (Source: Shutterstock)

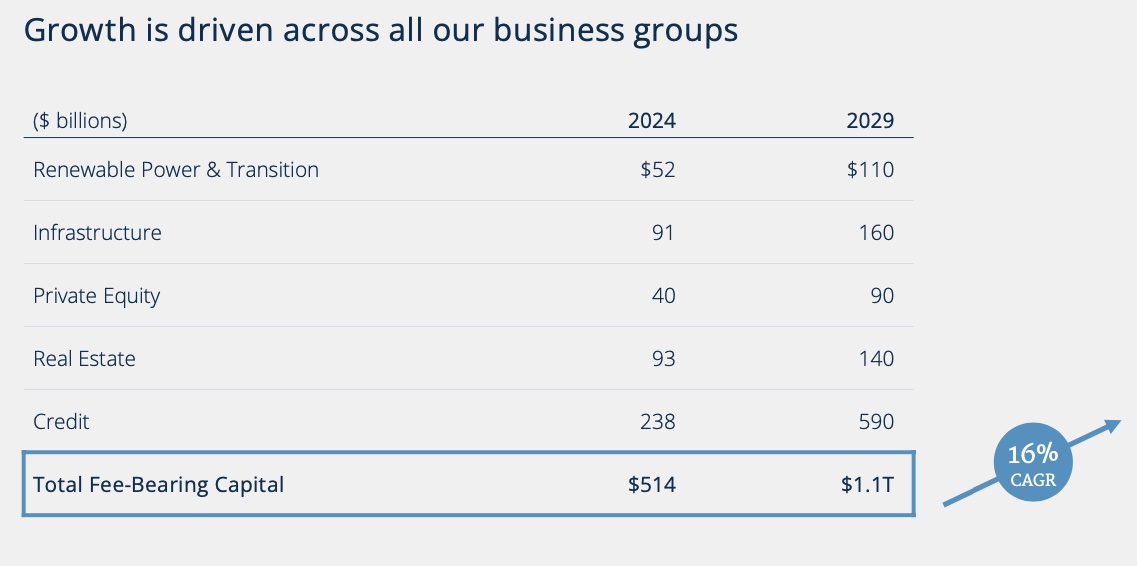

Brookfield Asset Management, the global private equity firm pouring massive amounts of capital into the energy transition space, looks to grow capital committed to its renewable power and transition business to $110 billion by 2029.

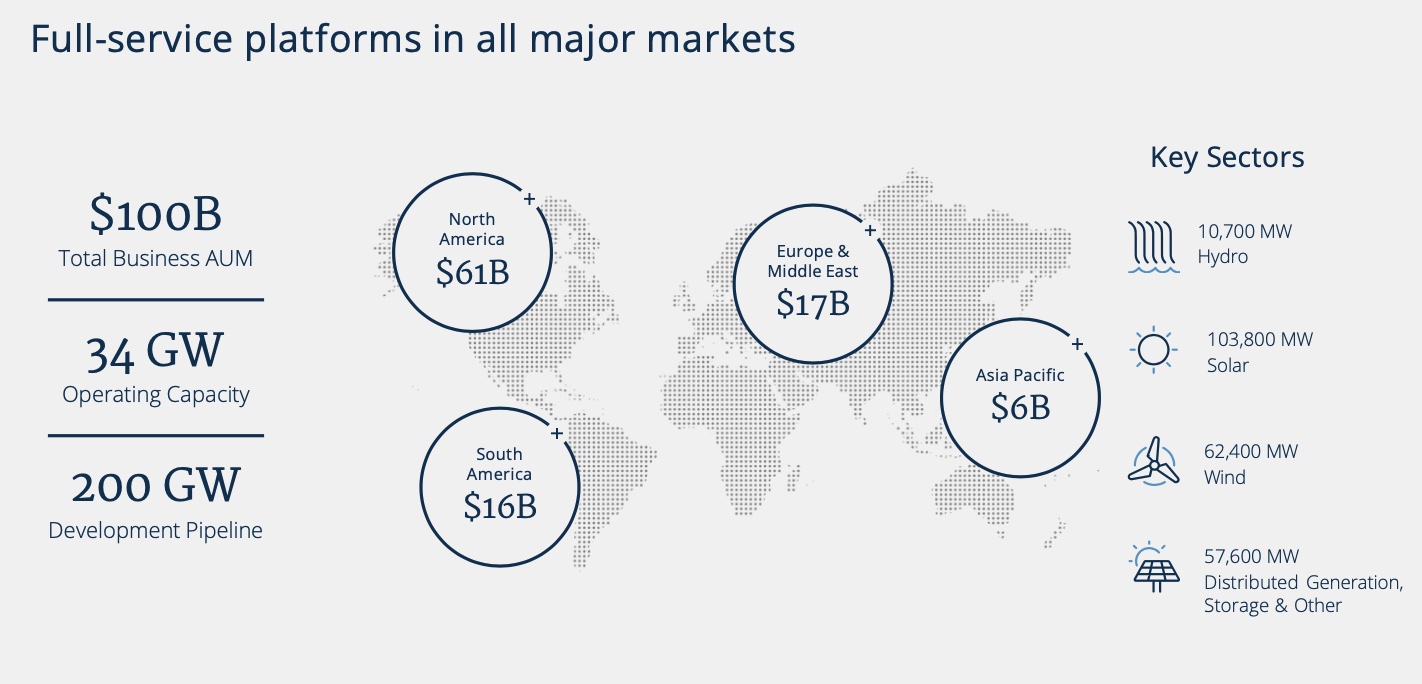

The firm, which has about 34 gigawatts (GW) of operational capacity and a 200-GW pipeline, sees key investment opportunities in corporate-backed renewables, batteries and sustainable solutions such as sustainable aviation fuel (SAF).

Speaking during the firm’s investor day on Sept. 10, Natalie Adomait, managing partner of renewable power and transition for Brookfield, said last year was a record year for the transition sector with $1.8 trillion of capital flow into the space.

“It’s a space that’s seen strong historic growth over the last decade of roughly 25% year over year. But despite that strong historic growth, more capital is still needed to be invested,” Adomait said. Estimates are “about $5 trillion of capital … needs to flow into renewables and transition every single year from now until 2030. And that number actually goes up in the years after that. That means by the time we reach 2050, renewables in transition will be well over $100 trillion investment opportunity.”

Continued growth is expected as the world shifts to lower-carbon energy sources. Though fossil fuels will still be needed to meet the world’s growing needs for reliable and affordable energy, efforts are underway to lower emissions of greenhouse gases. Private equity firms and their billion-dollar funds have been leading the charge, investing in new and emerging technologies, accelerating renewable energy companies’ plans to increase energy capacity and acquiring developers with large development pipelines.

Billion for eSAF

Brookfield’s latest move came Sept. 10 when the firm announced it will invest up to $1.1 billion in e-fuels producer Infinium. The company commercially produces ultra-low carbon efuels, including SAF. Under the agreement’s terms, Brookfield agreed to invest more than $200 million in Infinium and Infinium’s Project Roadrunner that is being developed in West Texas. It also agreed to invest up to $850 million more to deploy Infinium deploy some of its other eFuels projects.

Efuels can be used in place of fossil-based fuels to power planes and ships, for example, without changes to engines or infrastructure, according to Infinium. The company’s eSAF is made is through a proprietary process that combines water, waste CO2 and renewable energy to produce ultra-low carbon fuels. The investment, made by Brookfield Global Transition Fund, marks Brookfield’s first direct investment in SAF. Brookfield will also serve as lead in Infinium’s Series C Preferred Stock offering, the company said in a news release.

“Our first operational facility will be in Texas and once complete will sell its output to American Airlines and another airline that we’ll announce soon,” Adomait said. “We’re very excited about this space. We think SAF alone could represent a $50 billion market opportunity through 2030.”

In addition to SAF, Brookfield is also targeting investments in hydrogen, carbon capture and recycling solutions among others.

Bullish on batteries

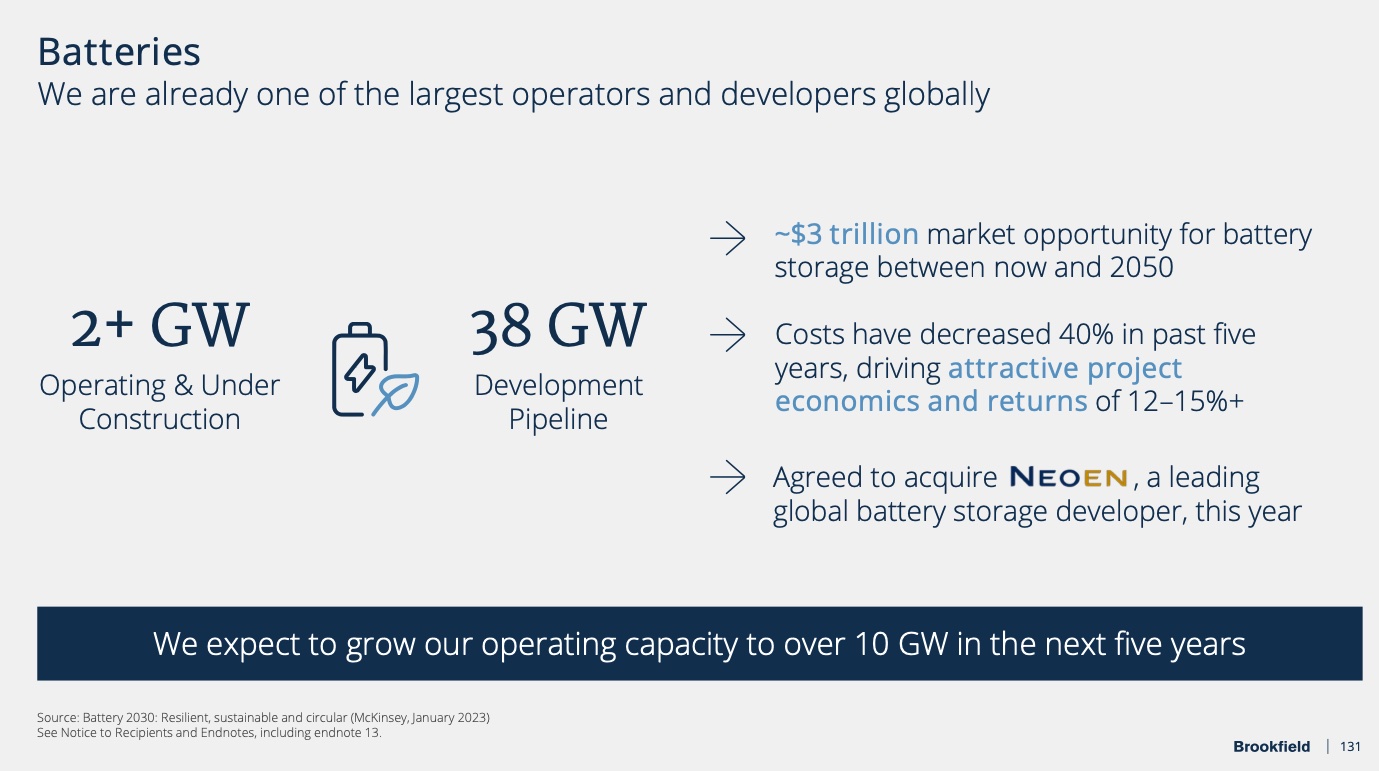

Brookfield is also eyeing opportunities in batteries. The firm believes batteries represent a $3 trillion investment opportunity, Adomait said.

“A commercial case for this technology is quite simple. As cost of the technology have come down, the revenue arbitrage opportunity in the commercial need for these assets has really been increasing,” she said. “That’s ultimately being driven by the increasing proliferation of renewables on the grid.”

Battery energy storage, which is paired with intermittent renewables such as solar and wind, has been booming in the U.S. and abroad. In the U.S., the Energy Information Administration (EIA) forecasts battery storage capacity could increase by 89% by the end of 2024 if all planned projects come online. Utility-scale battery capacity was about 16 GW at the end of 2023. The EIA said developers planned to add another 15 GW this year and 9 GW in 2025.

Data from the International Energy Agency also shows global growth as average battery costs fall due to advances in battery chemistry and manufacturing.

More than 40 GW of battery storage capacity was added in 2023 in the power sector, according to the IEA. That was double the previous year’s increase.

Earlier this year, Brookfield agreed to acquire Neoen, a France-headquartered independent power producer known for its pioneering battery storage technologies, for €6.1 billion (US$6.7 billion). Neoen installed the world’s first “big battery,” which initially packed 100 megawatts of installed capacity, at Hornsdale Power Reserve in South Australia in 2017 working with Tesla.

“With that acquisition, we took our already very significant portfolio in batteries to 2 gigawatts of operating and under-construction capacity,” Adomait said. “And with that business and our broader pipelines, we see line of sight to add over eight gigawatts of capacity over the next five years.”

Backing renewables

Another growth opportunity on Brookfield’s radar is corporate-backed renewables.

While governments are incentivizing investment in renewables and lower-carbon technologies with policy such as the U.S. Inflation Reduction and Green Deal UK, “we are seeing corporates invest in decarbonization because their end customers demand lower carbon and greener products,” Adomait said. “So, moving into this space presents an opportunity to gain market share if they move faster.”

About 90% of the contracts Brookfield executed in 2023 were with corporates. And, conversations are being had not just on renewables but also carbon capture and biofuels.

Adomait used Brookfield’s recent agreement with Microsoft as an example of the firm’s platform in action. Brookfield in June signed an agreement to provide Microsoft with 10.5 GW of renewable energy capacity through 2030.

Tech giants including Microsoft have been increasingly turning to renewables to help meet net-zero targets while lining up energy to power large-scale data centers.

Data centers are one of the main drivers of infrastructure investment growth and capital needs, according to Sikander Rashid, managing partner for Brookfield’s Infrastructure Group.

“AI [artificial intelligence is primed to be the most impactful general-purpose technology in modern history,” Rashid said, adding trillions of dollars will be required.

But “there’s a lot more to the AI value chain than just datacenters and power. There’s graphic processing units, which are four times more expensive than CPUs, central processing units,” he added. “These graphics processing units are much needed for AI. Artificial intelligence chips are much needed. 95% of these chips are produced in Taiwan today, and that production needs to be extrapolated across the world.”

Growing capital

Brookfield estimates the world will need $94 trillion of capital in the need 15 years alone for infrastructure, according to Rashid.

“On one hand, we need capital to maintain and upgrade legacy infrastructure, including water pipes that bring water to your homes, gas pipelines, electricity wires that move electrons around the world, airports, toll roads,” he said. “But on the other hand, there’s a need for greenfield or new fresh infrastructure projects, including data centers and a few other areas.”

Historically, governments and publicly-listed entities provided most of the capital; however, market volatility and stretched balance sheets impeding their abilities to fund buildups. “And that creates a unique opportunity for large scale private capital providers such as Brookfield.”

In all, Brookfield has set out to reach $1.1 trillion in fee-bearing capital by 2029, up from $514 billion in 2024, executives said. The firm describes fee-bearing capital as capital committed, pledged or invested in perpetual affiliates, private funds and liquid strategies managed that entitles the firm to earn fee revenues.

Recommended Reading

Pair of Large Quakes Rattle Texas Oil Patch, Putting Spotlight on Water Disposal

2025-02-19 - Two large earthquakes that hit the Permian Basin, the top U.S. oilfield, this week have rattled the Texas oil industry and put a fresh spotlight on the water disposal practices that can lead to increases in seismic activity, industry consultants said on Feb. 18.

Novel EOR Process Could Save Shale from a Dry Future

2024-12-17 - Shale Ingenuity’s SuperEOR, which has been field tested with positive results, looks to remedy the problem of production declines.

Microseismic Tech Breaks New Ground in CO2 Storage

2025-01-02 - Microseismic technology has proved its value in unconventional wells, and new applications could enable monitoring of sequestered CO2 and facilitate geothermal energy extraction.

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

Understanding the Impact of AI and Machine Learning on Operations

2024-12-24 - Advanced digital technologies are irrevocably changing the oil and gas industry.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.