When referring to the U.S. Lower 48 oil and gas sector, industry insiders will sometimes call it “the Lower 47.” They see no reason to include California in the mix.

Oil and gas producers have long lamented the Golden State’s stringent operating regime and focus on climate progress. For a fossil fuel producer, the Golden State may look more like gilded brass once you start peeling back the layers.

Despite the state’s bountiful onshore and offshore oil and gas reserves and relatively cheap conventional drilling costs, it’s become increasingly difficult to obtain permits for drilling and recompletion projects in California.

Most of the big oil majors with footprints in the state, including Exxon Mobil, Shell and Occidental, have limited their exposure to California over time. Just this summer, California supermajor Chevron solidified plans to move its corporate headquarters from San Ramon to Houston.

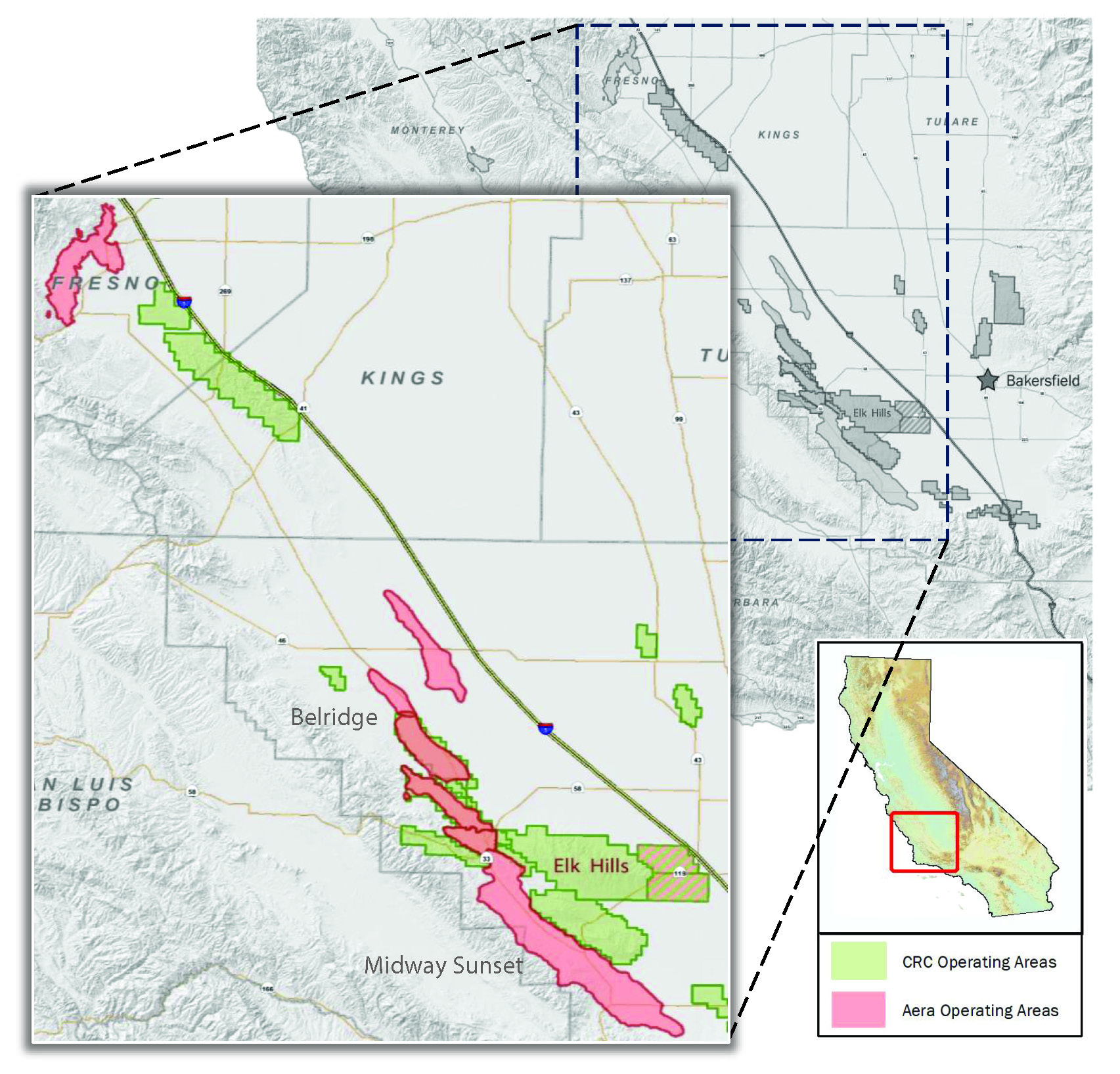

In the late 1990s, Exxon and Shell merged their California assets through a joint venture named Aera Energy. Occidental’s conventional and unconventional California assets were spun out into a separate publicly traded company, California Resources Corp. (CRC), in 2014.

But California Resources and the company’s president and CEO, Francisco Leon, are still committed to making it work in the Golden State.

CRC closed a $1.1 billion combination with Aera Energy in July, cementing itself as California’s top oil and gas producer.

The combined CRC still plans to run a one-rig program with the permits it already has in hand. But Leon envisions an eight-rig program operating across CRC’s massive land position, spanning from northern California to the San Joaquin Basin in the Central Valley.

Environmentally conscious residents might think differently, but California still needs domestic oil and gas producers like CRC, Leon argues.

California was the largest jet fuel consumer and second-largest motor gasoline consumer in the nation during 2023, according to U.S. Energy Information Administration data. It ranked third in crude oil refining capacity last year.

But California relies heavily on foreign oil imports to meet its needs. Over 60% of the crude oil supplied to California refineries in 2023 came from foreign sources.

California’s top foreign suppliers in 2023 were Iraq (21.7%), Saudi Arabia (15.7%), Brazil (15%), Ecuador (14.6%) and Guyana (9.73%).

Just around 24% of crude oil supplies to California refineries last year were produced in the state. The remaining 16% came from Alaska.

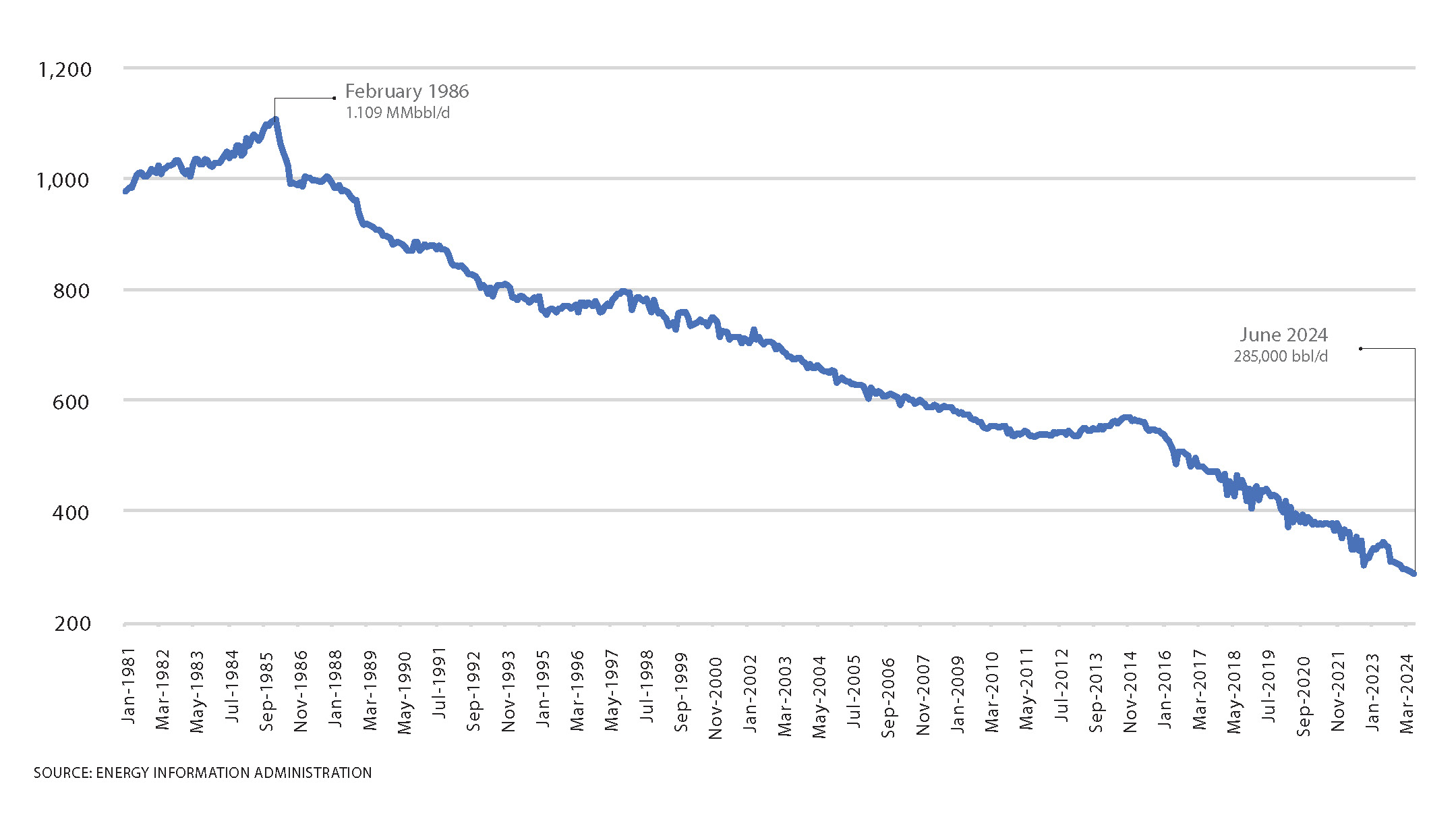

California crude production averaged 285,000 bbl/d this June, according to the EIA. It’s a far cry from the late 1980s, when California oil output averaged about 1 MMbbl/d.

California residents and businesses also pay more for power than anywhere else in the Lower 48, according to EIA figures.

The nation’s third-largest electricity consumer, California imports more electricity than any other state.

But Leon is hopeful that CRC and other California producers will be able to keep drilling to sustain—and ideally grow—output inside the state. CRC and other operators in Kern County are hopeful for a resolution in a years-long permitting battle with county and state regulators. Once that’s resolved, he thinks CRC can get back to drilling and growing production. In California, that might be easier said than done.

Leon spoke with Chris Mathews, Oil and Gas Investor’s senior editor for shale/A&D.

Chris Mathews: CRC recently closed a merger with fellow California producer Aera Energy. What do you see as some of the biggest needs for the deal, or the strategic rationale for coming together?

— Francisco Leon, president and CEO, California Resources Corp.

Francisco Leon: We see this as a transaction that’s good for shareholders certainly, but also for California, and I’ll explain. We’re now the largest E&P company in the state by far. The state is a big energy consumer, but has chosen to satisfy the demand through imports, which is not good for environment consumers and even the state itself—they earn less taxes. So, we do feel this transaction is a win for everybody, and the assets are a very good fit.

California is mostly conventional—sandstones, big benches of very productive, very prolific rock. We haven’t really had to go into shales, just because how the rock is so prolific. You have very few operators, and most of them are private. Aera has been privately run for 25 years through a combination of Exxon and Shell’s portfolio. They formed a private company, put in a CEO that was a Shell representative and a CFO that was an Exxon representative, and they have had this very profitable partnership for many years. These are very well-run assets that you would expect coming from the legacy of two supermajors.

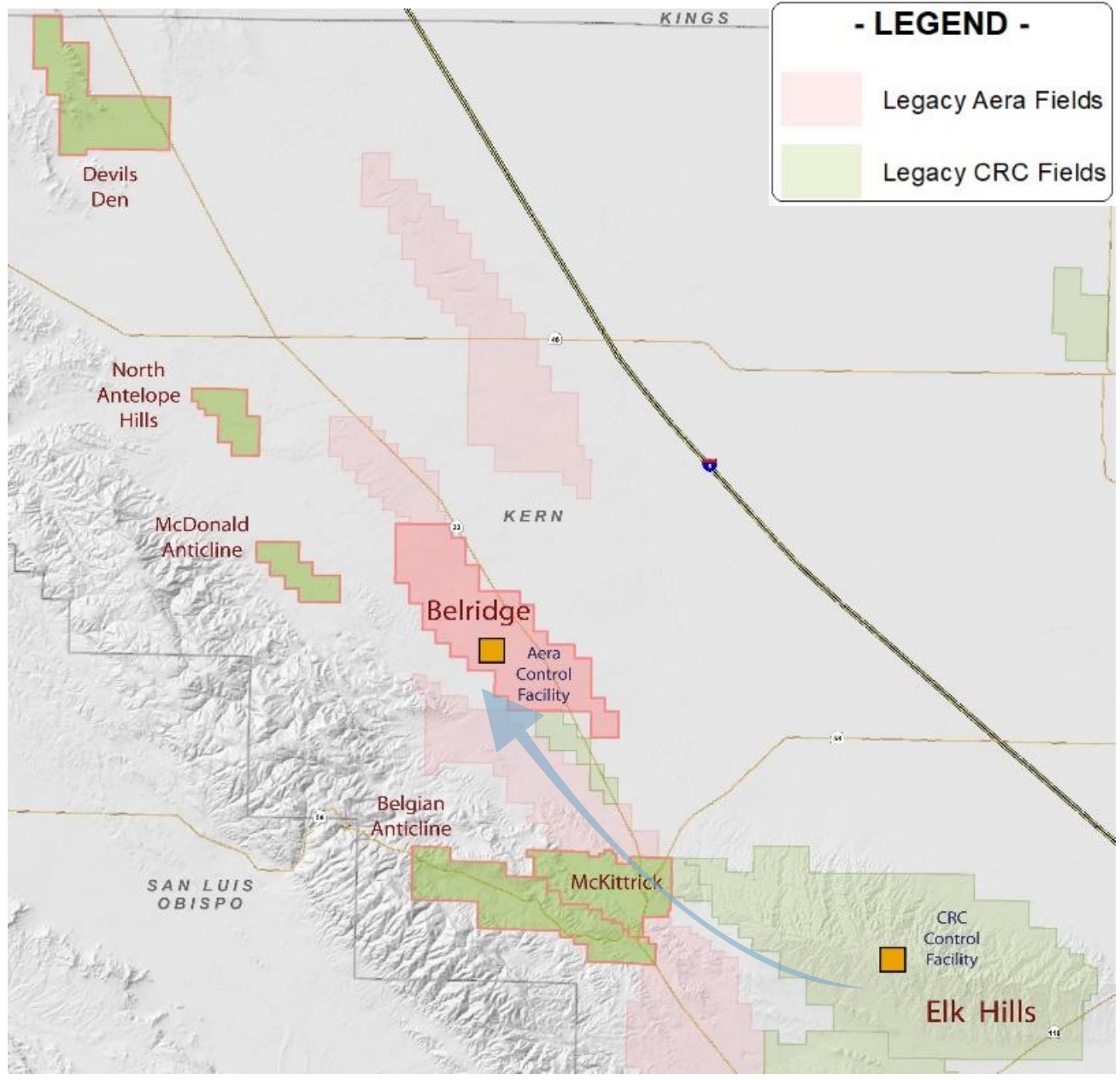

But the nice thing that was probably attractive to us and why I felt like this deal was always meant to happen is a lot of Aera’s assets are adjacent and right next to our fields. The synergy potential from our operational sense is tremendous.

So, why did we do it now? Because we found a willing seller that we thought was reasonable in their price expectations. We did an all-stock deal at an attractive valuation to CRC shareholders. It’s a unique deal in that it was accretive day one.

Ultimately, we’re trying to build scale. I think we all recognize that bigger companies have a better trading multiple. You can attract more investors, and you have the benefits of cost of capital.

CM: Talk to me about drilling new wells, workover activities and managing your existing base in California. What do you find yourself doing day-to-day to maintain, or grow, production?

FL: Because we are conventional assets, we’re not as drilling intensive. You have the benefit of very shallow declines. [For] Aera and CRC, on an average basis, the corporate decline of production is about 12.5%. That’s your starting point, so you don’t have to offset a lot of production. You’re able to hang onto it.

The reason for that, again, is that these are very good rocks. Good permeability, good porosity, and you’re able protect a lot of that production through injection—water injection, steam-flooding, sort of regular base-decline management. That’s the nuts and bolts of the business.

We do need new drilling—we cannot offset everything through the management of that. But, the first most cost-effective, highest-return activities are through capital workovers and sidetracks.

We have a lot of wellbores in the combined portfolio. We see wellbores as big assets that have multiple opportunities, multiple bites at the apple. Historically, California has been a lot of shallow drilling and a lot of vertical drilling. Oxy had been the company that really tested the deeper horizons, and what we inherited at CRC was a bit more focus on deeper drilling than peers.

That means our wellbores are going through multiple productive zones. For many reasons, the history has been to complete each zone at a time and to be somewhat conservative in the productivity of that wellbore.

As opposed to shale, which is about initial production and then you move on, the wells here are managed much more methodically over time. We have the opportunity to go uphole, downhole, sidetrack existing wellbores. That second bite at the apple, if you will, is a very profitable next step forward.

We have a one-rig program. Basically, you can go from about 12.5% corporate decline to about roughly a 7% to 8% decline with workovers and sidetracks. So really, you’re trying to offset the rest with new wells. That’s where we see some of the headwinds in California.

CM: What are some of the permitting headwinds that CRC and other producers face in Kern County?

FL: It gets into very technical regulatory aspects of environmental impact reviews (EIRs). That’s what’s being challenged in court. At the end of the day, we see them as regulatory challenges that will be overcome.

This is not a political stance or anything, other than California has a lot of rules under something called the California Environmental Quality Act (CEQA). No matter what you’re doing—real estate or drilling wells—you have to do EIRs on everything. That’s where we’re getting some headwinds to run through.

Right now, we are declining about 6% per year by not having the ability to drill new wells. That’s also one of the reasons that prompted us to acquire Aera and grow more inorganically on a consolidated basis.

I don’t think permitting is a long-term issue. I think it gets resolved this year. So, we’ll go back to drilling. We want to get to about eight rigs combined to offset the combined company decline. It’s very capital efficient and low-cost drilling. But, if there’s an opportunity to acquire assets at the right price that are bolt-ons, we would also do that.

The headwinds on permits are in Kern County and it’s across the board to every operator. Aera has a tremendous inventory of new wells, but they don’t have the permits on hand to execute it. It’s a potential down the road, but again, these assets are not declining very much. The focus in the near term is on synergy capture, which we think is going to be significant.

We don’t see a line of sight this year to get back to permitting and then getting to the eight rigs that we want to do. But, what we have is an ability to grow cash flow per share. If you look back at the last three years from 2021 to 2023, even though we didn’t have the full slate of permits and we declined production, we grew cash flow per share about 13% to 14% over that period.

With the Aera transaction, on a per share basis, now we more than double that amount. So, our focus is on cash flow. Production is critical—we do want to have production. We think it’s the right thing for the state to have barrels that are operated by CRC and are going to be better than any alternative.

CM: Why is Kern County so important to California producers? Why not drill someplace else?

FL: Kern County is like the Permian for us. It’s the heartbeat of the industry. It’s where the most prolific fields are. It’s where you have the right conditions away from any population centers.

Truly, some of the best fields in the U.S. are in Kern County. Elk Hills is 47,000 acres. If you think about the size of that, it’s like Washington, D.C. And it’s a field that’s owned 100% by CRC. It’s fee simple—that means we own the surface and we own all the mineral rights of the entire field.

Aera owns the Belridge Field. That’s actually bigger than Elk Hills and it’s almost entirely held in fee simple, as well. These are billions of barrels of oil in place and these fields have been operated very safely for over 100 years.

If you think about California, it’s Hollywood perhaps, or Silicon Valley. Well, the Central Valley is oil and gas and farming. A lot of the almonds, pistachios, carrots and strawberries that we consume nationally come from the Central Valley.

CM: Where does CRC-produced crude end up going?

FL: It’s entirely for local consumption. I think California consumes 1.5 MMbbl/d. The local production is about 350,000 bbl/d of that, and all consumed within the state. Once upon a time, we had 1 MMbbl/d produced in California, and it’s shrinking.

That’s the problem. Some people feel like [production] needs to be coming down. Demand’s not coming down. What’s coming down is the local supply and then the backfill is imports. There’s no change in the consumption of the product, but there is a change in how it’s supplied.

So, we’re going to foreign countries that don’t have the world-leading safety, labor, human rights and environmental standards of California. You’re bringing it from places where you have no control over.

What’s shrinking is the one industry where you reap all the benefits. It’s backwards. That’s not the way it should be. We can decline production if it’s a product that the world no longer needs. But we shouldn’t be prioritizing imports versus local production. That makes no sense.

Recommended Reading

LNG, Data Centers, Winter Freeze Offer Promise for NatGas in ‘25

2025-02-06 - New LNG export capacity and new gas-fired power demand have prices for 2025 gas and beyond much higher than the early 2024 outlook expected. And kicking the year off: a 21-day freeze across the U.S.

LNG Leads the Way of ‘Energy Pragmatism’ as Gas Demand Rises

2025-03-20 - Coastal natural gas storage is likely to become a high-valued asset, said analyst Amol Wayangankar at Hart Energy’s DUG Gas Conference.

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

US NatGas in Storage Grows for Second Week

2025-03-27 - The extra warm spring weather has allowed stocks to rise, but analysts expect high demand in the summer to keep pressure on U.S. storage levels.

US NatGas Prices Jump 9% to 26-Month High on Record LNG Flows, Canada Tariff Worries

2025-03-04 - U.S. natural gas futures jumped about 9% to a 26-month high on record flows to LNG export plants and forecasts for higher demand.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.