The permit for CTV 1 26R will give the company permission to inject CO2 deep underground for geologic sequestration. It is a targeted milestone that CRC has been discussing for about three years as it works to decarbonize California’s hard-to-abate industrial sectors, including power. (Source: Shutterstock/ California Resources Corp.)

California Resources Corp.’s carbon management arm Carbon TerraVault (CTV) expects to receive its Class VI permit from federal regulators in December, moving closer to establishing the state’s first commercial-scale carbon capture and storage (CCS) facility.

“Shortly after receipt of the EPA permit, we expect to FID and break ground on our first carbon capture to storage project at our Elk Hills gas processing plant,” California Resources CEO Francisco Leon said Nov. 6 during the company’s third-quarter earnings call.

The permit for CTV 1 26R will give the company permission to inject CO2 deep underground for geologic sequestration. It is a targeted milestone that CRC has been discussing for about three years as it works to decarbonize California’s hard-to-abate industrial sectors, including power.

CCS is considered an essential tool for lowering greenhouse gas emissions. However, the process of capturing CO2 produced by emitters, transporting it and injecting it into rock formations such as saline aquifers or depleted oil and gas reservoirs has been slow to take off in the U.S. Reasons include high costs, technical complexity of some projects and regulatory hurdles, among other challenges.

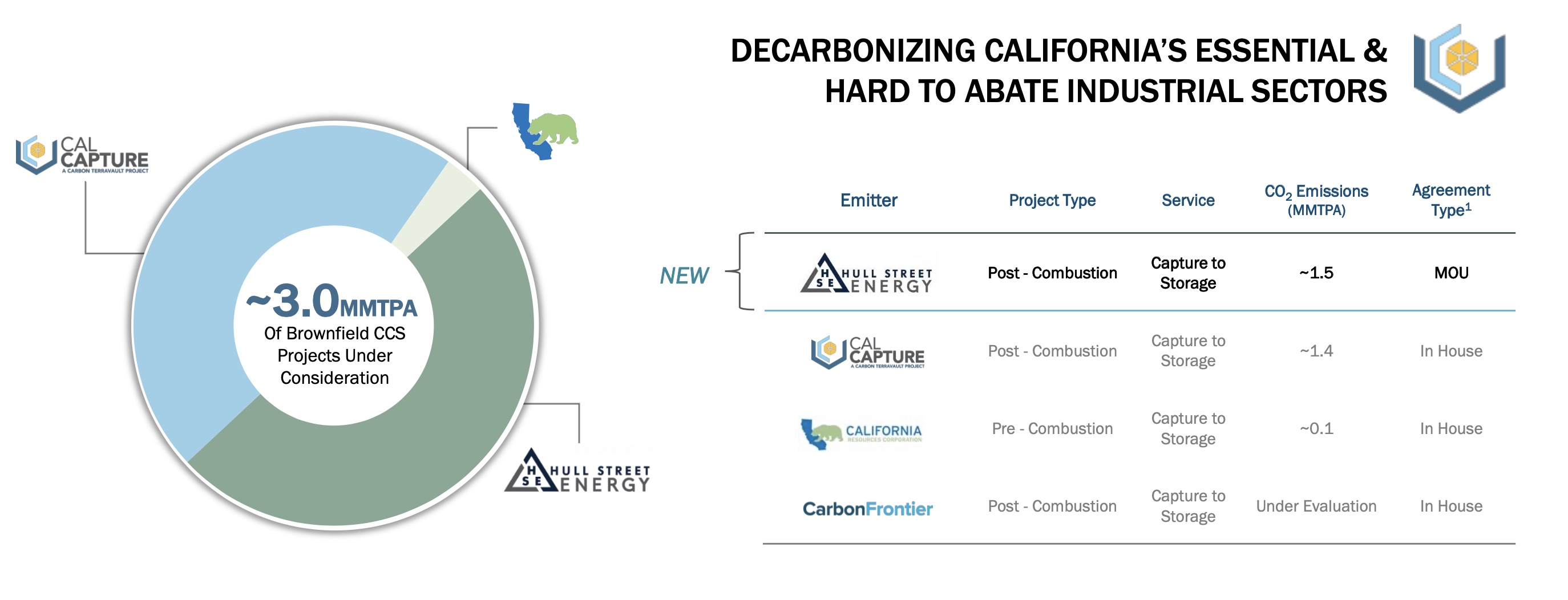

California Resources is among the companies making strides with more than 300 million metric tons of CO2 projects under federal permit review. It has about 3 million tonnes per annum (mtpa) of brownfield CCS projects under consideration along with about 1.2 mtpa of greenfield projects.

RELATED

Regulators Greenlight CRC’s Carbon TerraVault I CCS Project

CTV’s first capture-to-storage project at California Resources’ Elk Hills cryogenic gas plant is part of the CalCapture project, which aims to capture and permanently store 1.5 mtpa of CO2. The storage reservoir has a total estimated capacity of up to 46 million metric tons of CO2 storage, the company has said. It expects first CO2 injection by year-end 2025.

California Resources also said this week it signed a memorandum of understanding (MOU) with Hull Street Energy for a CCS project, targeting about 1.5 mtpa of CO2 emissions. Analysts pointed out the agreement is significant because it involves post-combustion capture, considered more difficult because the concentration of CO2 in flue gas is low, which means more energy is needed to separate it. This, in turn, makes the process more expensive than pre-combustion capture.

The agreement with Hull Street Energy shows there is market appetite for such projects, Leon said. The MOU is CTV’s first third-party brownfield emissions project.

“Our new MOU with Hull Street Energy, a leading power provider in a state that desperately needs more clean power today, is aligned with ours and the state’s climate objectives,” he said. “Natural gas is necessary to powering California today, and combining it with CCS will deliver net-zero power, which is needed to achieve the state’s climate goals.”

While the company is making progress on its CCS ambitions, executives say more is needed from regulators, especially regarding CO2 pipelines.

“We need regulators to do their part and take fast action on CO2 pipeline regulations to enable the installation of new pipes,” Leon said. “This will allow carbon to be safely captured, transported and stored. Our CTV subsidiary is rapidly scaling today with nearly 4.2 million metric tons per annum of CCS projects under consideration and other substantial agreements in discussion.”

California Resources reported third-quarter 2024 adjusted EBITDA of about $402 million, up from $187 million a year earlier. Other quarterly highlights included the closure of its $1.13 billion merger with Aera Energy. The company said it is on track to deliver about $235 million in synergies related to the merger by third-quarter 2025. So far, $135 million of synergies have been realized.

“The Aera transaction brings more stability, bigger scale and more cash flow to the business,” Leon said. “As we closed the Aera transaction, we took our cash levels down to zero and then we rebuilt it in one quarter to over $200 million. …It showcases the capacity, the cash flow capacity, of the business.”

Recommended Reading

Eversource Energy Agrees to Sell Aquarion Water Co. in $2.4MM Deal

2025-01-28 - Eversource Energy plans to use the proceeds to pay down debt and reinvest into its core electric and natural gas businesses.

Tidewater Midstream Closes CA$24MM Alberta Roadway Sale

2025-03-25 - Tidewater Midstream and Infrastructure agreed to sell the roadway network, located around the Brazeau River Complex, to Canadian Resource Roadways for CA$24 million (US$16.8 million).

Golden Gate Capital Completes Stonehill Environmental Sale

2025-03-12 - Private equity firm Golden Gate Capital has completed the sale of energy infrastructure company Stonehill Environmental Partners for an undisclosed amount.

Woodside Divests Greater Angostura Assets to Perenco for $206MM

2025-03-28 - The Greater Angostura field produces approximately 12% of Trinidad and Tobago’s gas supply, said Woodside CEO Meg O’Neill in a press release.

Obsidian to Sell Cardium Assets to InPlay Oil for US$225MM

2025-02-19 - Calgary, Alberta-based Obsidian Energy is divesting operated assets in the Cardium to InPlay Oil for CA$320 million in cash, equity and asset interests. The company will retain its non-operated holdings in the Pembina Cardium Unit #11.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.