The oil and gas producer has been building on its commitment to environmental stewardship as it paves a path toward emissions management. (Source: Shutterstock/ California Resources Corp.)

California Resources Corp. (CRC) is taking a crack at the cement sector’s carbon emissions problem, having inked a carbon capture and storage (CCS) agreement with National Cement Co.

The agreement was announced March 3 as the company’s carbon management business Carbon TerraVault (CTV) gears up to break ground on its first CCS project at Elk Hills in second-quarter 2025. Ambitions are to reach first injection and flow cash by year-end.

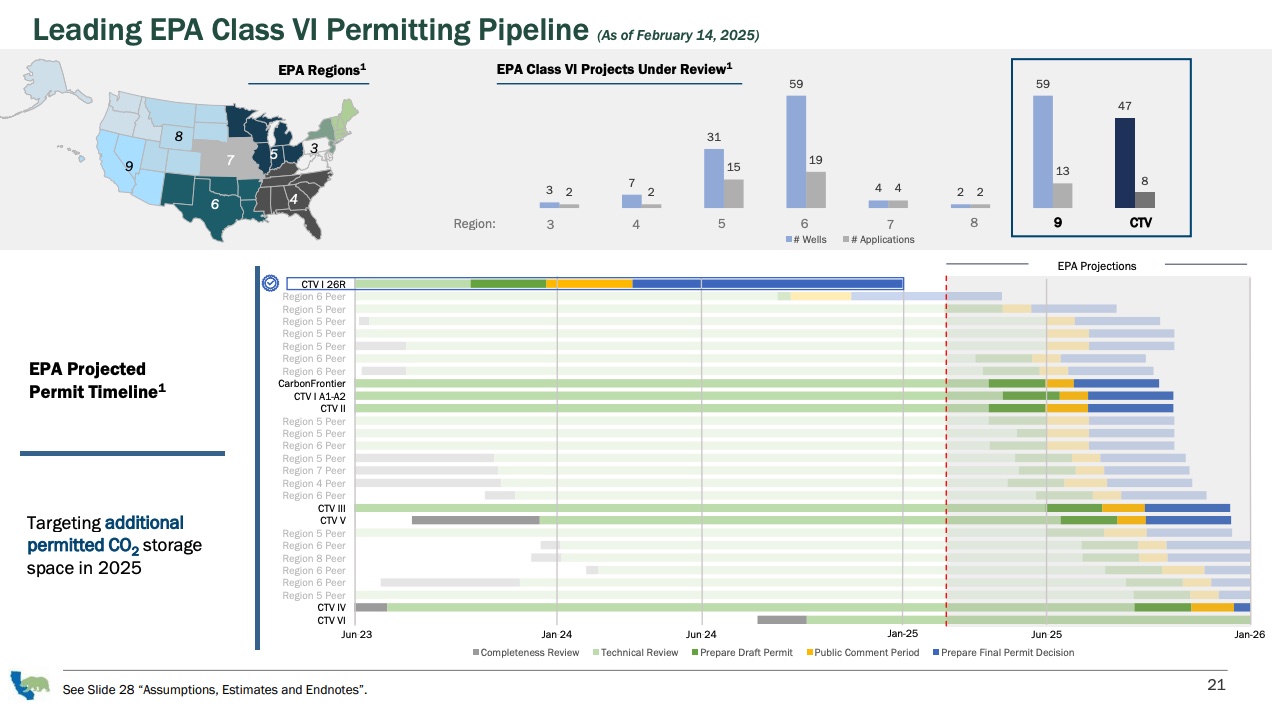

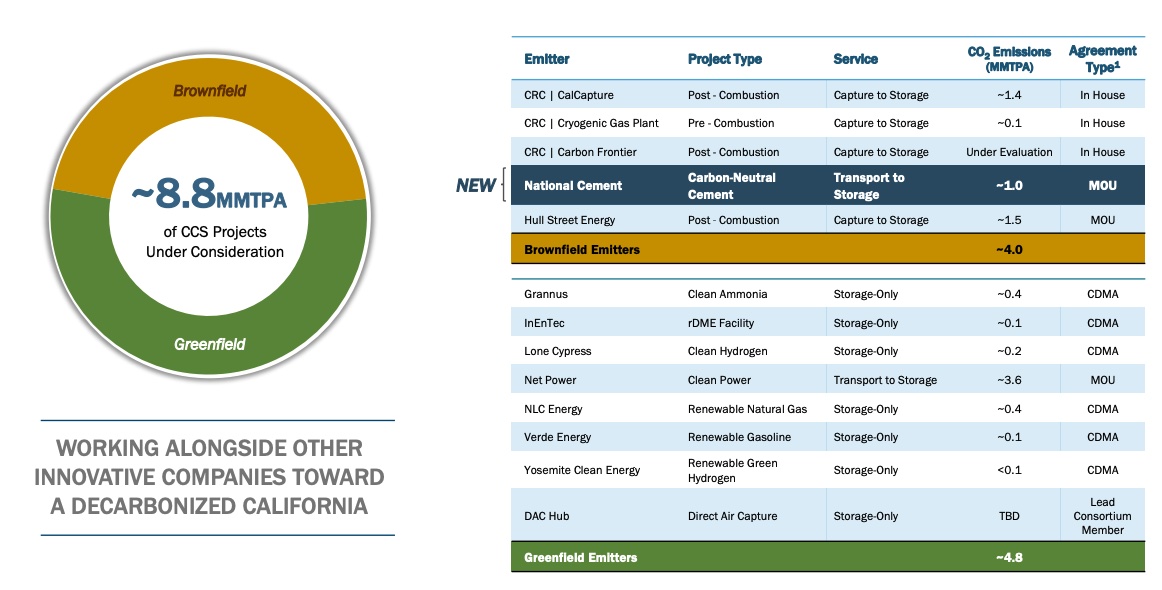

“We have nearly 9 million metric tons per annum of carbon management projects under consideration,” California Resources CEO Francisco Leon said during the company’s latest earnings call. “Our CTV business has seven additional Class VI permits in the queue, with an estimated total storage capacity of 287 million metric tons.”

The oil and gas producer has been building on its commitment to environmental stewardship as it paves a path toward emissions management. CCS, which involves capturing CO2 emissions from industrial processes or from the burning of fossil fuels in power generation and storing the greenhouse gas deep underground, is considered crucial to reducing emissions to slow global warming.

Data from the U.S. Department of Energy (DOE) show the cement industry alone emits about 70 million metric tons of CO2 per year in the U.S., or about 1% to 2% of the nation’s emissions. That’s roughly the CO2 equivalent emissions of more than 16 million gasoline-powered passenger vehicles, according to the Environmental Protection Agency’s (EPA) Greenhouse Gas Equivalencies Calculator.

Cement is considered a hard-to-abate sector due to the chemical reactions involved with making the product. Besides using alternative production methods that use different feedstock, CCS is one way for the sector to reduce emissions.

Wrangling emissions

As part of the agreement, CTV will provide carbon management services for the first-of-its-kind initiative—called Lebec Net Zero—to produce carbon-neutral cement at National Cement’s California facility. CTV will develop transportation and sequestration solutions for up to 1 million metric tons per annum of CO2 emissions captured from National Cement’s Lebec plant in Kern County, California, CRC said. Plans are to transport the captured CO2 and store it in CTV’s underground storage reservoirs. Operations are expected to begin in 2031, pending customary approvals.

“When operational, the plant will mark the first step in establishing a decarbonized cement market. It will be California’s first net zero cement facility, backed by up to $500 million in DOE funding,” Leon said. “California Senate Bill 596 requires 40% of all cement used in the state to be net zero by 2035, and 100% by 2045. This project is crucial to meeting these mandates, and National Cement selected CTV as its partner. This vote of confidence validates our CCS strategy and our expertise in carbon management and transportation.”

In addition to the CCS component, the project includes the production of blended cement, which substitutes clinker with a less carbon intensive calcined clay alternative. The project will also utiliize locally sourced biomass from agricultural byproducts such as pistachio shells as an alternative to fossils fuels, according to National Cement.

“This is an exciting and transformative project for the cement industry,” National Cement CEO Eric Holard said in a news release. “We are making a significant investment because we believe in creating a cleaner future and bringing innovation to domestic manufacturing.”

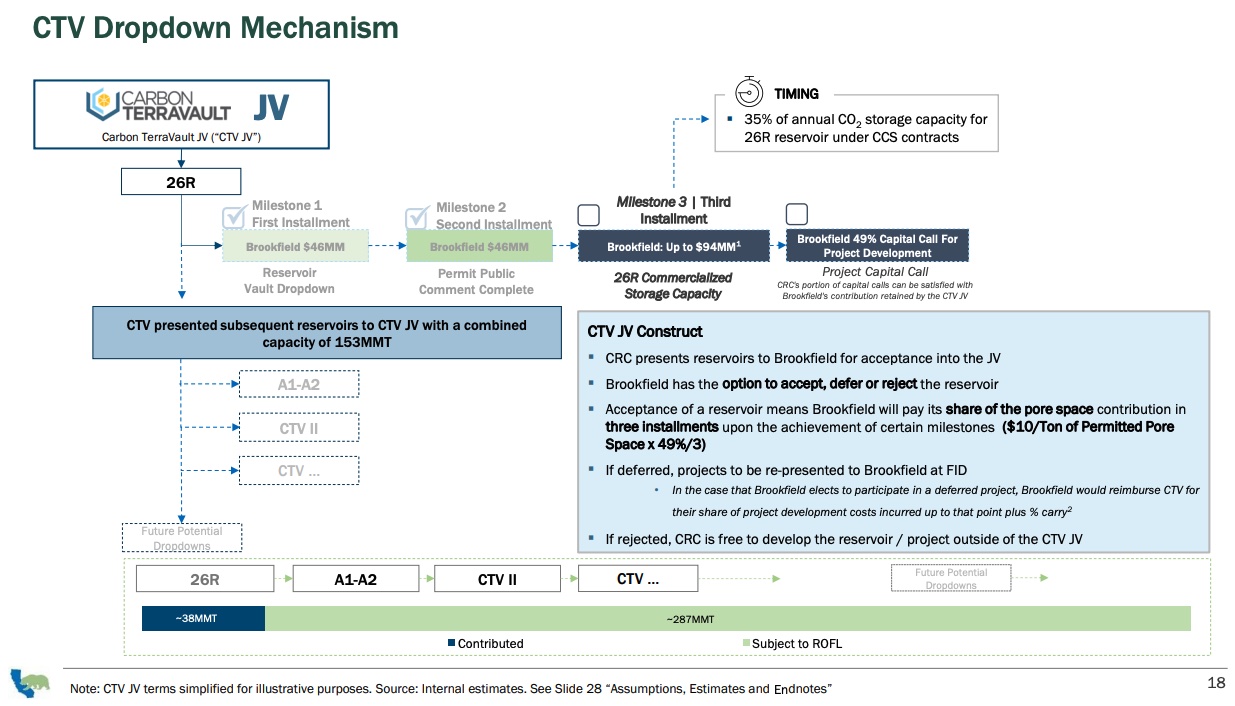

The CCS project is one of several CTV is pursuing following its receipt of Class VI well permits in December from the EPA. The permits are for CTV’s first CCS project at its Elk Hills cryogenic gas plant. Working with joint venture (JV) partner Brookfield, CTV aims to store up to 100,000 metric tons of CO2 per annum from the plant in Kern County into the 26R Reservoir. The reservoir, one of two depleted oil and natural gas reservoirs that make up the CTV I storage site, has an estimated capacity of up to 38 million metric tons of CO2.

CRC has said it plans to invest between $14 million and $18 million to capture CO2. The internal rate of return for the project is expected to be at the high-end of its previously disclosed range of 10% to 30%.

“The goal is to get to first injection and first cash flow by the end of the year and be off to the races on the first project,” Leon said. “If you look at the EPA tracker, there’s four to five incremental permits that should be approved this year or beginning of next, and those are in different parts of the state.”

Leon said the expectation is to convert memoranda of understanding signed so far for CCS projects into formal agreements. But the company is being highly selective with the partnerships it forms, he said, adding projects must make economic sense.

“We’re also looking for partners that bring their own money to be able to build the capture systems,” he said.

Project pathways

In addition to the National Cement memorandum of understanding (MOU), CTV also has MOUs in place with Net Power and Hull Street Energy. Currently, CRC has two in-house capture-to-storage projects—CalCapture and the cryogenic gas plant. A third, called Carbon Frontier, is under evaluation.

“I also see a path to incremental brownfield and greenfield projects coming down the pike. As we move up north, you open up a different universe of emitters. That’s where the data centers are. There’s a lot of power generation, a lot of a lot of potential customers are in those northern reservoirs,” Leon said. “And as we’ve proven by being the first in California with a permit, we know what we’re doing, and we’re going to march on and bring that pore space that we’ve accumulated into execution form into fully permitted, and that’s going to turn into cash flow.”

CRC is pursuing agreements with “multiple well-known and capitalized parties” to advance AI data centers in California, he said, telling analysts to stay tuned.

Data centers, which require ample amounts of electricity to process data and cool equipment, are among the main drivers for the anticipated surge in power demand in the U.S.

“What we’re trying to solve for is a high value, long term PPA [power purchase agreement] and we’re looking at about 150 to 200MW, but then also unlocking the low carbon emissions solution with CCS,” Leon said. “Finding the right partner, locking arms with that partner is critical, as we expect this to be a decade-plus type of contract. So, the goal here is to deliver power today; make the electrons low emissions and the data carbon free.”

Analysts with TD Cowen said investors are eager to see the sum of the parts of CRC across E&P, power and CCS. In a note March 4, analysts pointed out partner Brookfield deferred its third JV installment of about $94 million until CRC secured 35% of 26R capacity, which they said ultimately requires a final investment decision.

“Effectively, we read this as NPV management from Brookfield, but expect large projects such as CalCapture would easily meet this threshold and are logically included in a holistic solution for power to provide net-zero energy to datacenter customers, a target that remains for FY25,” analysts said in the note.

CRC is also taking steps to get CO2 pipelines in place to connect emission sources to reservoirs by working with regulators. The state, which aims to achieve carbon neutrality by 2045, has a moratorium on new CO2 pipelines in place until federal regulations are updated.

“There’s growing recognition that in order for California to be successful with climate goals, with all the ambitious targets that we have here in the state, we’re not going to be able to do those without CO2 pipelines,” Leon said. “We see momentum building with legislators in the administration to lift that moratorium in the 2025 legislative session.”

Recommended Reading

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Burleson: Rockcliff Energy III Builds on Past Successes

2025-04-09 - Rockcliff Energy III is building on past experiences as it explores deeper in the Haynesville, CEO Sheldon Burleson told Hart Energy at DUG Gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.