As California Resources Corp.’s carbon management arm, Carbon Terravault, pursues carbon capture and storage projects, it also is keeping tabs on data center power opportunities. (Source: Shutterstock)

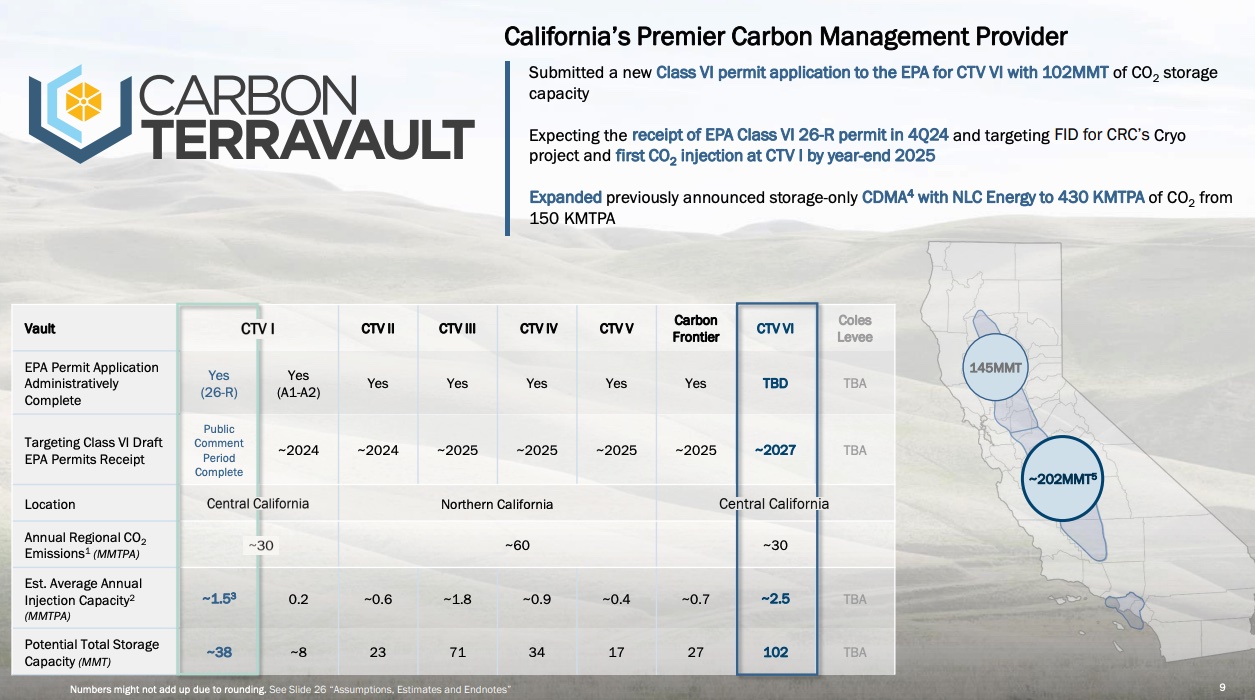

Carbon Terravault (CTV), the carbon management arm of California Resources Corp., now has more than 300 million metric tons (mt) of CO2 projects under federal permit review as it aims to capture and store greenhouse gases (GHG) more than a mile underground in rock formations.

Its latest Class VI well permit filed with the U.S. Environmental Protection Agency (EPA) is for a vault with a CO2 storage capacity of 102 MMmt, California Resources CEO Francisco Leon said during the company’s second-quarter 2024 earnings call this week.

“Like the other reservoirs, CTV VI is centrally located near major emission regions in California,” Leon said. “In terms of execution, we’re targeting the receipt of California[’s] first Class VI EPA permit and the FID [final investment decision] of our cryogenic gas plant CCS [carbon capture and storage] project by year-end. Our goal is to inject CO2 into CTV I before the end of 2025.”

The projects are advancing amid continued efforts to lower emissions to slow global warming. CCS is seen as a viable route to mitigate climate change. The process involves capturing CO2 from large emitters such as power plants and industrial facilities and compressing it for transport and permanent underground storage.

CRC has applied for several federal Class VI permits for underground storage vaults across California’s San Joaquin and Sacramento basins. The first, CTV I, is located at Elk Hills in Kern County with an estimated capacity of up to 46 MMmt.

Getting bigger

The company’s recent $1.13 billion merger with Aera Energy, a joint venture created by Shell and Exxon Mobil and later acquired by international asset manager IKAV, enabled the expansion of premium pore space in the Bakersfield, California, area, Leon said.

Additions to the portfolio include Aera’s CarbonFrontier, which will capture up to 1.6 MMmt of CO2 per year for permanent storage at the Belridge oil field in Kern County, and another property called Coles Levee marked for CCS and adjacent to Elk Hills.

A Class VI permit application was submitted in early 2023 for the CarbonFrontier and a final permit decision by the EPA is expected in March 2025, according to the EPA’s Underground Injection Control Class VI permit tracker. Carbon Terravault intends to submit a 27 MMmt Class VI permit application to the EPA for Coles Levee by the end of 2024.

Having ample assets along with surface and subsurface rights gives the company a strong land position for CCS projects, according to Leon, adding the Aera acquisition introduced more. “We feel those projects are in really good shape with strong permits submitted, and we look forward to taking it over and accelerating some of the emission capture in the Central Valley.”

Targeting tech

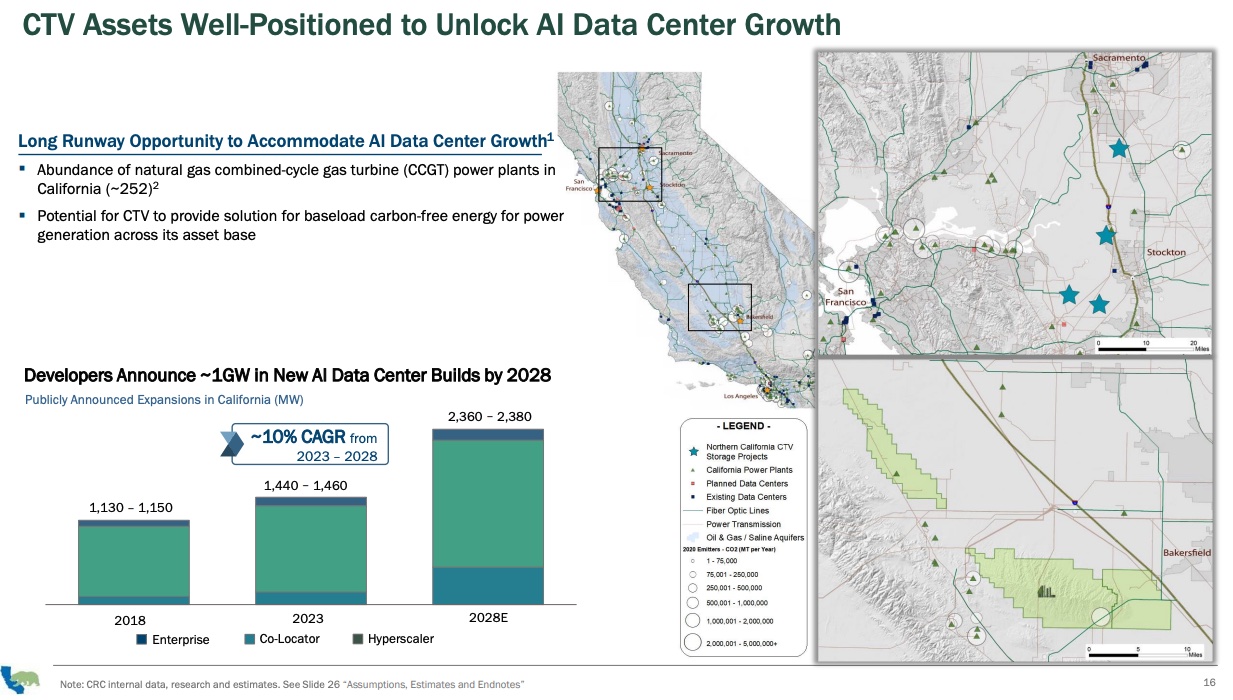

CRC, which is now California’s largest oil and gas producer, also sees opportunity for Carbon Terravault in meeting the needs of data centers—especially given the state is home to top data center markets in Silicon Valley and Los Angeles.

Energy providers across the U.S. have been salivating at potential business opportunities that could come their way from Big Tech. Tech companies are commanding more electricity to power and cool equipment storing massive amounts of data to power artificial intelligence (AI) and other applications.

“First, we can provide data centers with the key ingredients they need to operate: large plots of land, access to fiber networks, water, power infrastructure, natural gas and related interconnections,” Leon said. “Our Elk Hills complex, for example, is in the sweet spot and can meet the data center needs and provide accelerated time to market benefits that other potential competitors simply cannot match. Our second advantage is that we can utilize our resources and energy expertise to support the development of carbon-free baseload power before the end of the decade.”

CRC, which produces about 80% of California’s natural gas, has strategically positioned itself around large emitters for the last couple of years. Its CCS projects are in northern and central California, where industries with hard-to-abate emissions are operating in the San Francisco Bay Area and Sacramento.

Utilizing natgas

Leon sees answers to data centers’ growing power needs in combined-cycle natural gas retrofitted with CCS. As CRC tracks data center growth, Leon said older power plants are critical to attracting and retaining data centers in California.

The company’s movement to the north for CCS projects adds more pore space, strengthening its ability to sequester emissions there.

“It’s a race to get the market first. Time to market is critical. So, having existing infrastructure is absolutely going to be key,” he added. “The nice thing is with CTV, we offer not only the time-to-market opportunity, but we have an ability to bring a decarbonized power generation into the fold that also meets the other criteria.”

Data centers will not rely on renewables and intermittent power, Leon said. When it comes to baseload power, California’s options are limited.

“We’re down to one nuclear plant. Hydro tends to be variable depending on the rain. So, you look at this infrastructure that’s already in place,” Leon said, referring to independent power producers and underutilized natural gas power generation. “The plan should be in California to maximize that utilization. And if you can put the decarbonization plans that we have in place, then you can really solve for multiple variables. And that’s what has us really excited.”

The company plans to seek partnerships around existing power plants while also remaining open to opportunities for technologies such as fuel cells and geothermal. Those, Leon added, will be important depending on what data centers ultimately want to power their AI.

Recommended Reading

Aethon Dishes on Western Haynesville Costs as Gas Output Roars On

2025-01-22 - Aethon Energy’s western Haynesville gas wells produced nearly 34 Bcf in the first 11 months of 2024, according to the latest Texas Railroad Commission data.

Comstock Doubling Rigs as Western Haynesville Mega-Wells’ Cost Falls to $27MM

2025-02-19 - Operator Comstock Resources is ramping to four rigs in its half-million-net-acre, deep-gas play north of Houston where its wells IP as much as 40 MMcf/d. The oldest one has produced 18.4 Bcf in its first 33 months.

Birch Resources Mows Dean Sandstone for 6.5 MMbbl in 15 Months

2025-01-06 - Birch Resources has averaged 7 MMboe, 92% oil, from just 16 wells in the northern Midland Basin’s Dean Formation in an average of 15 months each, according to new Texas Railroad Commission data.

BP’s Eagle Ford Refracs Delivering EUR Uplift, ‘Triple-Digit’ Returns

2025-02-14 - BP’s shale segment, BPX Energy, is seeing EUR uplifts from Eagle Ford refracs “we didn’t really predict in shale,” CEO Murray Auchincloss told investors in fourth-quarter earnings.

Matador Touts Cotton Valley ‘Gas Bank’ Reserves as Prices Increase

2025-02-21 - Matador Resources focuses most of its efforts on the Permian’s Delaware Basin today. But the company still has vast untapped natural gas resources in Louisiana’s prolific Cotton Valley play, where it could look to drill as commodity prices increase.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.