Trans Mountain Pipeline traffic is moving a lot of crude out of Alberta, as signals indicate from both ends of the line.

At the Canadian line’s terminus in Vancouver, British Columbia, tanker traffic has jumped from barely noticeable to constant, according to a professor emeritus from the local university.

David Huntley from Simon Fraser University monitors traffic in Vancouver’s Burrard Inlet, according to the Canadian Broadcasting Co.

“It’s a very sudden change, which, of course, is to be expected because there’s an awful lot more oil (that) can be sent down the pipe,” Huntley said.

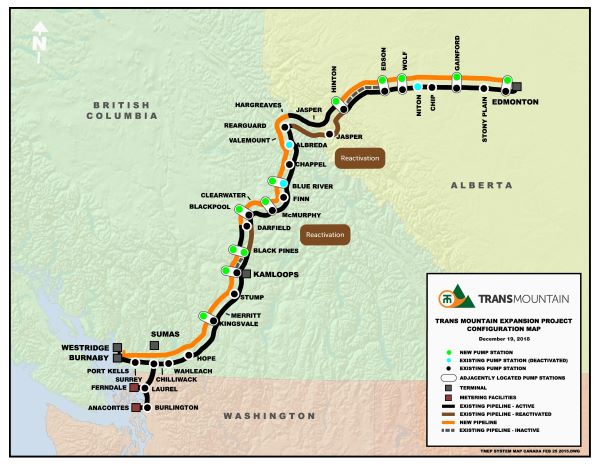

Trans Mountain completed work on the company’s namesake pipeline expansion on May 1. It was the end of a difficult and controversial pipeline project that started development in the 2010s under Kinder Morgan.

The Canadian government eventually bought the project and established Trans Mountain as a Crown corporation, meaning that it was owned by the government but acted as an independent business, and would eventually be sold by the government.

The project almost tripled the pipeline’s capacity from 300,000 bbl/d to 890,000 bbl/d, greatly expanding crude egress out of Alberta.

Delays and cost overruns plagued the project, eventually costing CA$34 billion (US$25 billion). However, the pipeline has been full since ramping up to capacity, according to Trans Mountain.

The first tanker loaded the first cargo from the completed pipeline on May 21. By the end of August, TMX reported that more than 65 oil tankers had taken a load from the expanded pipeline. Ship traffic in Vancouver’s Burrard Inlet has risen from two a month to more than 20 during the same time span, Huntley said.

The Canadian government is still determining how and when to sell the pipeline. Trans Mountain is already planning to give First Nations along the pipeline’s path a 30% stake in the pipeline, the company announced in May. At the end of July, Bloomberg reported that, as the pipeline is still a political issue, the sale of TMX will most likely not occur until after the next Canadian national election in 2025.

North/south traffic

In Alberta, the line rapidly affected toll rates after operations began.

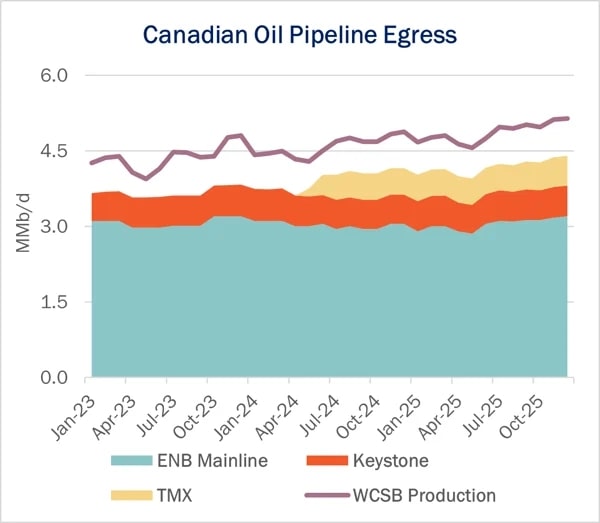

Enbridge’s Mainline, the largest crude oil egress out of Canada into the U.S., began lowering spot rates in joint tariffs on Sept. 1, East Daley Analytics reported, an acknowledgment that the TMX is providing more competition for Mainline’s customers.

“The Mainline has been running effectively full, and the lower uncommitted joint rates will help keep throughput high,” wrote analyst Gage Dwan. Enbridge’s Mainline can carry 3.2 MMbbl/d from Canada to the U.S. Midwest.

Spot rates are market prices as determined between suppliers and midstream companies to ship a load of oil in bulk. The new rates only apply to joint services with downstream pipes and do not affect Mainline tolls from Alberta to Chicago.

According to East Daley’s pipeline traffic monitors, uncommitted heavy crude tolls decreased for joint tariffs with the Flanagan South and Seaway pipelines, and Enbridge has cut heavy crude spot rates in the joint tariffs from Edmonton, Alberta, to Houston by more than a $1/bbl, from $10.9319/bbl to $9.8380/bbl.

“East Daley Analytics anticipates softer earnings ahead for ENB’s largest asset,” Dwan said.

TC Energy’s Keystone Pipeline is another competitor to Trans Mountain. However, the line currently is fully utilized and 94% contracted. The line moved an average of 637,000 bbl/d in the first quarter. The company offers a market-low committed heavy crude rate of $2.508/bbl.

“Keystone throughput is likely to see little impact from TMX and the lower Mainline joint rates,” Dwan said.

Further downstream, pipes like MPLX’s Capline, a major carrier for Canadian heavy crude, will transport more light crude from the Bakken Shale in North Dakota to offset the loss of Canadian heavy grades, analysts said.

For now, the government-owned TMX and other midstream companies will continue to fight over heavy Canadian barrels.

TMX, with minimum volume commitments totaling 525,000 bbl/d, is handling primarily heavy sour crude with some batching of synethic crude, according to EDA.

Tolls for TMX have not been finalized. The Canadian Energy Regulator is responsible for approving tolls. The current benchmark toll for shippers with a 15-year contract transporting less than 75,000 bbl/d from Edmonton to Burnaby is $11.46/bbl. The fixed rate is lower than the uncommitted joint tariff on Mainline to the Gulf Coast, making it a more attractive egress route for Canadian producers.

Looking east

The low rates also make the TMX attractive to the customers at the other end of the line, especially in Asia.

It was a “game changer” when Canada opened its export terminal on its West Coast, said Wu Qiunan, chief economist of PetroChina International at the S&P Global Commodity Insights’ APPEC event in September. The transport from Vancouver to Asia is 19 days, as opposed to the more than 45 days it can take for crude loaded from the Gulf to arrive in China.

More Canadian crude could make its way to Asia, Wu said. The voyage from Canada is also competitive to the Middle East, taking about the same amount of time.

Crude exports from Canada to Asia rose by 240,000 bbl/d in July. China took 75% of the volume, while the remainder went to India, according to S&P. The previous high of 57,000 bbl/d was in June 2020.

“It is a very good option for Asia to receive more from Canada,” Wu said.

Reality sets in

The cheaper toll rates on the TMX are not likely to last.

The lengthy delays and cost overruns during construction are expected to eventually increase tolls, several analysts said.

According to the CBC, each individual Canadian subsidized the project at a rate of CA$850 (US$625). Eventually the debt will need to be repaid.

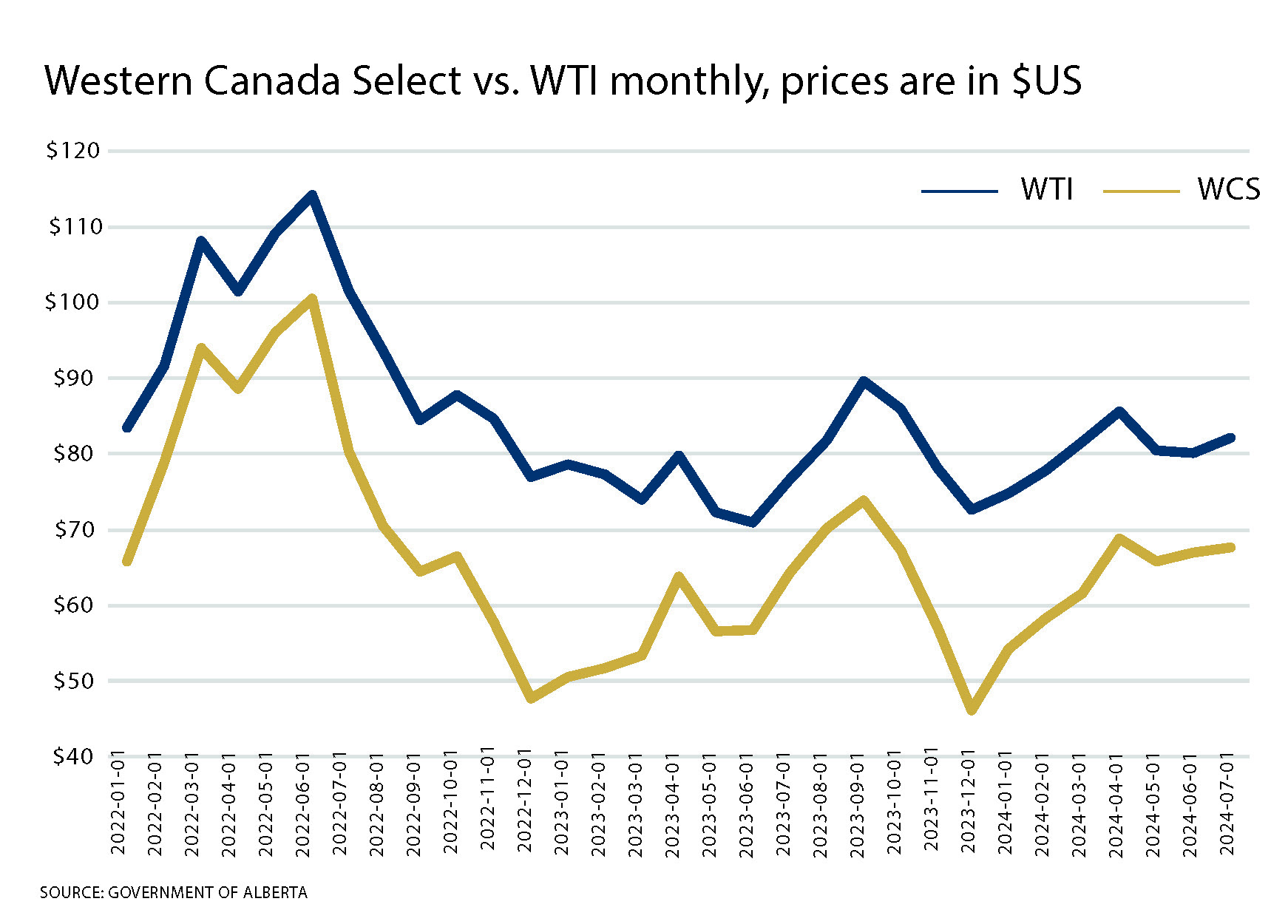

One disappointment for Canadian analysts has been the price of crude.

The expansion was meant to shrink the discount on Canadian oil versus U.S. crude. As of August, the differential had widened since start-up in May, Reuters reported.

Many analysts had forecast the differential on Western Canada Select (WCS) versus U.S. crude would gradually narrow to single digits thanks to the extra 590,000 bbl/d of export capacity offered by TMX.

But in August, WCS for delivery in Hardisty, Alberta, was $15/bbl below WTI. In May, the differential was $11.75/bbl below WTI. The primary long-term advantage of the expansion will be the ability of Canadian producers to worry less about “blow-outs,” times when the egress out of Alberta is so full that the prices to a major discount against WTI, according to analysts.

Growth overcomes

Analysts predict that TMX’s pull from other pipelines would be a short-term situation. Volumes on rival pipelines are likely to pick up as Canadian oil output is expected to grow rapidly.

Output will rise about 500,000 bbl/d in 2025 from 2023, offsetting the additional capacity added by TMX, said Kristy Oleszek, director of energy analytics at East Daley.

Excess pipeline space will be filled relatively soon, Oleszek said.

Recommended Reading

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

EON Deal Adds Permian Interests, Restructures Balance Sheet

2025-02-11 - EON Resources Inc. will acquire Permian overriding royalty interests in a cash-and-equity deal with Pogo Royalty LLC, which has agreed to reduce certain liabilities and obligations owed to it by EON.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.