Carrizo said the sale of Utica Shale assets will generate proceeds of $62 million with contingency payments that could boost the price to $77 million. (Source: Hart Energy)

Carrizo Oil & Gas Inc. (NASDAQ: CRZO) said Sept. 5 it will sell a portion of its Utica position, which includes 25,900 net acres, following the August purchase of ExL Petroleum Management LLC in the Delaware Basin.

Carrizo said on Aug. 31 it agreed to sell Utica acreage, primarily located in Guernsey County, Ohio, for up to $77 million. The price includes an initial $62 million cash as well as contingency payments of up to $15 million based on annual WTI price targets during a three-year period.

The gross price exceeded Capital One Securities estimates by about $45 million, said analyst Brian T. Velie. Other analysts expected the asset to sell for up to $95 million. Velie’s calculations were based on the sale of the entire Utica leasehold of about 26,000 net acres. Carrizo's remaining 7,000 acres in the Utica was nonproducing and the leases will likely be left to expire, a Carrizo official said.

The acreage produced roughly 740 barrels of oil equivalent per day (boe/d) in the second quarter for Carrizo.

“Our modeled estimate reflected just a PDP valuation for the asset, but after backing out that value, the implied acreage value in the deal is $1,633 per acre,” Velie said.

The Utica Shale assets include more than 130 net undrilled locations. However, Carrizo appears to have marketed only 18,745 net acres in the Utica, putting the value at $2,800 per acre, said Gabriele Sorbara, senior analyst at The Williams Capital Group.

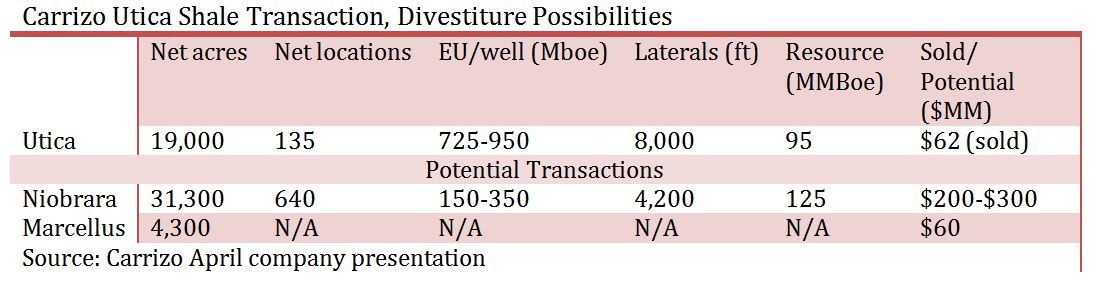

Carrizo has two more assets it could sell in the Marcellus Shale and the Niobrara. As of April, its Niobrara position consisted of 31,300 net acres and more than 640 net undrilled locations. Velie said the assets could command $197 million.

Carrizo’s Marcellus Shale assets include 4,300 net acres — about 95% HBP — and operate at 1,000-ft spacing. In April, the company drilled 32 net wells. The acreage also benefits from connectivity to the Williams, Millennium and Tennessee pipelines. Velie estimated that Marcellus Shale position could fetch about $62 million.

Carrizo’s goal is to raise about $300 million in proceeds for its acquisition of Quantum Energy Partners-backed ExL Petroleum, in which the company agreed to pay $648 million for 16,588 net acres in the Delaware Basin’s Reeves and Ward counties, Texas. The transaction included additional contingency payments of up to $125 million dependent upon the price of oil.

S.P. “Chip” Johnson IV, Carrizo's president and CEO, said that the company was able to complete arrangements for its Utica Shale divestiture following Hurricane Harvey “while also dealing with the personal aftermath of this historic storm.”

“While we cannot yet fully quantify the impact of Hurricane Harvey given potential damage to third-party midstream and refining assets along the Gulf Coast, we are pleased to report that our employees are safe and our assets were not damaged,” Johnson said. “I'd like to commend our staff for their effort and dedication leading up to the storm as well as in the days following it.”

Pro forma for recent transactions, Sorbara said Carrizo’s debt will total about $1.6 billion and the company will have about $654.9 million in liquidity.

The Utica Shale divestiture is set to close by Oct. 31, Carrizo said.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

Queen’s Chess: Changing the Rules

2025-02-28 - There’s a popular response to the inexplicable: “I don’t know. I don’t make the rules.” But what is known with certainty, as shown throughout history, is that we can change them.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.