The Fort Wayne plant can process 6,400 cf of landfill gas per minute into RNG. (Source: BP Archaea Energy/Republic Services)

Companies are cashing in on trash and other waste by transforming it into renewable natural gas (RNG)—with the help of supportive regulatory frameworks—as more projects come online.

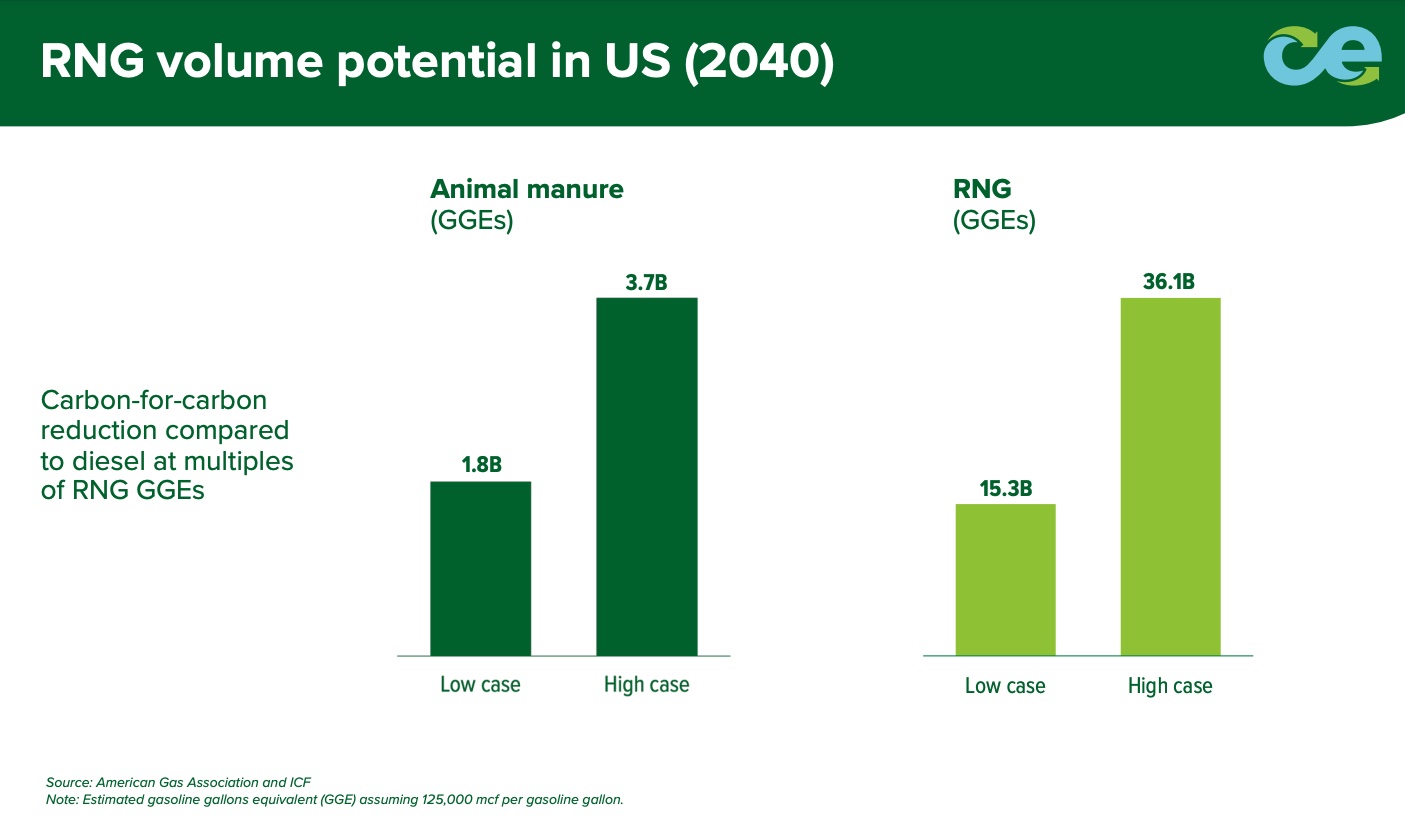

Though the RNG market is still considered niche in the U.S. with less than 1% of the natural gas market, it is growing. The growth is taking place amid continued efforts to seek out fuels with lower emissions profiles.

Used in the same ways as conventional natural gas, RNG is formed when moisture and impurities—such as CO2 and hydrogen sulfide—are removed from methane to create pipeline-quality gas. While it can be produced from a variety of sources, including livestock, landfill and other waste operations, RNG produced from methane-emitting landfills dominate in the U.S.

Analysts from Wood Mackenzie this week said capacity from landfill gas-to-RNG alone has nearly doubled in the past five years with only 10% of the resource potential being utilized. Success is driven by factors such as economies of scale, location, upgrader technology and operational efficiency, the firm said.

“Landfills are one of the largest sources of methane, and increased scrutiny by governments on methane regulation will likely boost more LFG-to-RNG conversions. Not to mention, policy incentives have targeted the RNG industry as demand for it rises—especially in the transport sector,” said Dulles Wang, director of research at Wood Mackenzie. “The relatively lower carbon intensity (CI) of the LFG-to-RNG process on a life-cycle basis compared to conventionally produced natural gas provides the economic justification for the subsidies. We expect more LFG-to-RNG projects to take off due to attractive economics.”

Still, some RNG producers face some challenges as they work to start up RNG facilities. Here is what some companies, including one focused on dairy waste, have been up to lately—as shared in second-quarter 2024 earnings calls.

Archaea: The largest RNG producer in the U.S., BP-owned Archaea is targeting the startup of four RNG plants in the third quarter, having brought three RNG landfill plants with a combined capacity of more than 2 MMBtu per annum online in the second quarter.

Carol Howle, executive vice president of trading and shipping for BP, highlighted what she called a “positive pricing market” with D3 renewable identification numbers (RIN) averaging about $3.19/RIN in the second quarter. Through participation in the Federal Renewable Fuel Standard program, producers can generate a cellulosic biofuel renewable identification number (D3 RIN), which adds to the molecule’s value, when it’s used as a transportation fuel.

Rising demand in the transportation market is giving BP confidence in Archaea, Howle said during a Q&A session following BP’s second-quarter 2024 earnings webcast. Demand was up 14% in the first half of 2024 compared to the first half of last year, she said.

“And just as a reminder, if Henry Hub was $3/MMBtu—which I know is probably a little bit optimistic at the moment—but if it were and we were looking at placing our RNG into the transport market with RINs at $3,” Howle said, “we can actually sell that RNG for ten times more [than] the value of Henry Hub. So that just gives you a sense still of the value in that portfolio.”

Despite the positive economics, RNG is not without headwinds.

“We have seen that across the market—permitting, interconnect delays—but we are confident about that delivery, and we are still focused on delivering $800 million to $1 billion by 2030,” Howle said.

Clean Energy Fuels: The California-based company, which announced on Aug. 5 the completion of its latest RNG production facility at Ash Grove Dairy in Minnesota, reported generating $98 million in revenue from RNG during second-quarter 2024. That was up from $90 million a year earlier, according to Clean Energy Fuels CEO Andrew Littlefair.

The company produces RNG at dairy farms across the U.S. and distributes it through its network of more than 600 fueling stations serving heavy-duty trucks, buses and other large vehicles. Most of the company’s stations are private; however, it is growing the number of publicly accessible RNG stations. That includes 19 built with Amazon as its anchor customer.

Clean Energy Fuels has formed partnerships with other RNG producers and produces its own RNG to keep its stations filled.

“We’ve approved a cluster of dairies in Georgia and Florida and other single-dairy projects in New Mexico, Nebraska and South Dakota,” Littlefair said during an Aug. 7 earnings call. “Engineering has begun on these projects with completion scheduled in 2025 and 2026. We also recently broke ground for an RNG digester at South Fork Dairy in Texas.”

Like other RNG producers, Clean Energy Fuels is starting to realize the benefits of investment tax credits (ITC). Littlefair said the company successfully monetized the ITC generated by the company’s first dairy RNG project in Del Rio, Texas. The “credit sale generated approximately $9 million of net proceeds to the project. [The] plan is to monetize the investment tax credits on our other five currently operational projects over the next 12 months.”

Republic Services, Waste Connections: Waste management companies Republic Services, Waste Connections and WM also continue to advance projects turning landfill gas into RNG. However, some projects are facing delays.

Speaking on the company’s earnings call July 24, Republic Services President Jon Vander Ark said the company brought one RNG project online during the second quarter and completed the RNG project in Fort Wayne, Indiana, with partner BP.

“This will be the first project to come online in our joint venture with BP. We expect five additional projects to be completed in the second half of this year,” he said.

The higher value of RINS, which averaged above $3, mitigated the impact of additional costs and delays in the commissioning and startup of three RNG projects that had been expected to begin operating in the second quarter, Waste Connections CEO Ron Mittelstaedt said. “These benefits are now expected to begin during Q3.”

Driving the delays is the “last mile” interconnect with electric utilities, according to Waste Connections CFO Mary Anne Whitney. The projects are still expected to come online, contributing about $200 million in EBITDA, she said on the company’s earning call. Mittelstaedt added that though the projects are a bit more expensive, analysis does not include the ITC credits.

WM: Like Waste Connections, WM also reported delays with a couple of its RNG plants.

WM is still moving forward with plans to bring five RNG projects online in 2024. The company has another nine projects in the active construction phase and is targeting more.

“We’re driving strong returns with expected payback periods of three years to four years at better multiples than traditional M&A, plus we're expanding environmental benefits by collecting and beneficially using more landfill gas,” WM CEO James Fisher Jr. said July 25 on the company’s earnings call. “And we’re strengthening our core business by positioning our landfill assets as community energy partners.”

Fisher later appeared to take umbrage at a media report indicating the company was exploring a $3 billion sale of its RNG unit.

“We’ve said kind of all along everything is for sale at a price,” Fish said. “But I would tell you $3 billion is not that price. In fact, it’s a long way from that price. … If somebody threw a gigantic number at us, we would look it.”

BP acquired Archaea for about $4.1 billion in 2022. The acquisition remains the largest deal to date in the RNG sector.

Recommended Reading

Improving Gas Macro Heightens M&A Interest in Haynesville, Midcon

2025-03-24 - Buyer interest for Haynesville gas inventory is strong, according to Jefferies and Stephens M&A experts. But with little running room left in the Haynesville, buyers are searching other gassy basins.

Matador Touts Cotton Valley ‘Gas Bank’ Reserves as Prices Increase

2025-02-21 - Matador Resources focuses most of its efforts on the Permian’s Delaware Basin today. But the company still has vast untapped natural gas resources in Louisiana’s prolific Cotton Valley play, where it could look to drill as commodity prices increase.

‘Golden Age’ of NatGas Comes into Focus as Energy Market Landscape Shifts

2025-03-31 - As prices rise, M&A interest shifts to the Haynesville Shale and other gassy basins.

Exxon’s Dan Ammann: Bullish on LNG as Permian Drilling Enters ‘New Phase’

2025-03-18 - Dan Ammann, Exxon Mobil’s new upstream president, is bullish on the long-term role of LNG in meeting global energy demand. He also sees advantages of scale in the Permian Basin.

Aethon: Haynesville E&Ps Hesitate to Drill Without Sustained $5 NatGas Prices

2025-03-12 - Operators are looking to the Haynesville to fill rising natural gas demand for U.S. LNG exports. Haynesville E&P Aethon Energy says producers need sustained higher prices to step up drilling.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.