Since late 2003, investors have become increasingly sanguine about the fundamentals of the oil and gas industry. But the recent move by OPEC to curb its oil output has emboldened even frothier expectations for future commodity prices and energy-stock performance. Caution: this market mindset could prove as perilous as the industry's own misplaced sense of reality during the short-lived boom cycles of the past 50 years. "We've seldom been more enthusiastic about the longer-term future of the energy business, but recent commodity and stock prices appear somewhat disconnected from current industry fundamentals or even the forecast of those fundamentals," says William H. Walker, president of Howard Weil, the energy-focused investment-banking firm in New Orleans. "The stock market seems to be saying-as suggested by the 25% run-up in the OSX (Oil Service Index) during the past three months-that with commodity prices as high as they are, producers have absolutely no choice but to drill frantically in the near future to replace reserves. "We're not certain this is the case because producers have learned the importance of capital discipline and return on capital employed, and they're likely-for the most part-to continue that discipline." This doesn't mean oil-service activity won't pick up during the next few quarters. It will, but not to the level that warrants the extended period of good news now being discounted in that sector's stock prices, says Walker. The banker also believes that hedge funds-which have become far more active traders in the energy sector than ever before-have triggered higher commodity- and stock prices than are justified by political uncertainties in the Middle East, supply and demand fundamentals, cold weather and storage levels. For the balance of 2004, he sees commodity prices moderating, to the mid-$20s for oil and $5 for gas. "This might have the effect of bringing energy-stock prices down a bit, but the upside of that would be another buying opportunity for investors." Among the service-stock stories that will be presented at Howard Weil's annual energy-investment conference this month, Schlumberger's is likely to capture a great deal of attention because it's so well capitalized and because its new leader, Andrew Gould, has refocused the company's business solely on the oil patch, says Walker. Also, he expects U.S. gas-levered independents with good balance sheets and prospective acreage-the likes of Apache, Burlington Resources, Anadarko Petroleum, Chesapeake Energy and Devon Energy-to draw major investor interest. "Until LNG (liquefied natural gas) becomes part of this country's energy solution, natural gas is the most attractive part of the U.S. energy story." The conference will also include presentations by ConocoPhillips and BP, major oils that have increasing exposure to large LNG and gas-to-liquids (GTL) projects as well as the ability to grow production and reserves, pay a dividend and buy back stock. Presenting, too, will be such coal companies as Peabody Energy and Arch Coal, as well as KFX Inc., a clean-coal technology company. This is in addition to merchant-energy companies like Dominion Resources, The Williams Cos. and El Paso Energy. "We're convinced that coal will ultimately become a big part of the future energy solution for this country because there's not enough natural gas," says Walker. "Also, many merchant-energy companies that suffered from the fallout of the Enron debacle are in various stages of turnaround and a few offer real investment potential." The banker's advice to energy presenters: don't bore the audience with a lot of history. "Tell investors what distinguishes you from the rest of the herd, how your story is different from this time last year and why they should own your stock." Skip the maps, he stresses. Buysiders aren't interested in them. "Instead, show where your company is going during the next year and what your financial picture will look like. "In short, tell investors how you're going to make them money-and how you're going to do it better than most other energy companies."

Recommended Reading

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

Investor Returns Keep Aethon IPO-ready

2024-10-08 - Haynesville producer Aethon Energy is focused on investor returns, additional bolt-on acquisitions and mainly staying “IPO ready,” the company’s Senior Vice President of Finance said Oct. 3 at Hart Energy’s Energy Capital Conference (ECC) in Dallas.

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

Aethon, Murphy Refinance Debt as Fed Slashes Interest Rates

2024-09-20 - The E&Ps expect to issue new notes toward redeeming a combined $1.6 billion of existing debt, while the debt-pricing guide—the Fed funds rate—was cut on Sept. 18 from 5.5% to 5%.

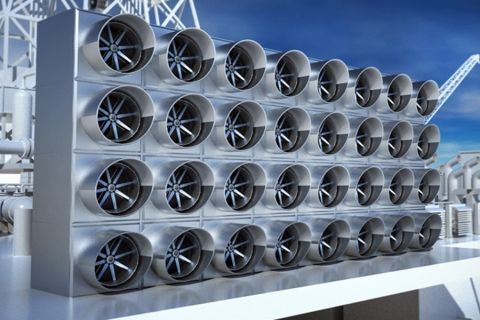

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.