EnLink Midstream Partners completed the second phase of its Cajun-Sibon NGL expansion project in late 2014. The $800 million project included a 100,000-barrel-per-day fractionator at its Plaquemine plant in South Louisiana. Source: EnLink Midstream Partners

Quarterly losses. Dividend cuts. Lay-offs. And less overall spending.

It’s a tough 2015 ahead in energy, especially for the folks drilling and producing hydrocarbons. But toward the middle of the oil and gas food chain—the midstream—the straits appear significantly less dire.

“I think 2014 and 2015 will kind of represent the peak spending period [for the midstream]. A lot of that is due to the fact the projects being constructed tend to be constructed over a multiyear time frame. They are oftentimes very large projects with multiyear spending,” Andrew Brooks, vice president and senior analyst for the corporate finance group at Moody’s Investors Service, told Midstream Business.

“We’ve been living in a very low natural gas price environment. That hasn’t stopped spending; it hasn’t reduced spending. And now we’re in a low crude oil price environment. Certain basins need infrastructure and certain basins don’t, but we’re still—in a number of situations—we’re still playing catch-up in terms of infrastructure and basic export capacity,” Brooks added.

Downstream’s midstream spending

In the Marcellus—sometimes called the poster child for infrastructure bottlenecks—and in the Bakken, a number of pipeline projects are in the works.

“Midstream connects the wellhead to the user. I think we’ve already seen weakness in the gathering and processing side, all field and basin related. You know, if we’re not drilling, if we’re not producing, then we’re not gathering and we’re not processing,” Brooks said.

Consequently, it’s those gathering and processing activities that actually touch the wellhead, where volume sensitivity and commodity prices can have an impact, depending on how contracts are constructed. Those that are contractbacked or can be supported with acreage commitments, can be supported with minimum buy-in commitments and that helps, he added.

“As you move further downstream, the interstate pipeline system that moves this stuff around that’s largely fixed-fee reservation based and not sensitive to utilization doesn’t take commodity price risks,” he said.

That’s largely what drove the $18 billion dynamic in early January for Energy Transfer Partners LP (ETP) to acquire Regency Energy Partners LP, largely considered a gathering and processing company that’s recently seen its unit price drop 25%.

“All of that impacts the cost of capital, and [Regency] has a big capital spending program going,” he explained. “ETP, on the other hand, is a much more diversified midstream company, both product wise and across basins, and its unit price has stayed pretty steady, notwithstanding the pressure on other, more specific midstream companies. If the economics favored a combination of the two, it gives Regency access to an investment-grade balance sheet, lower cost of capital and presumably they could continue to build out whatever they needed to build out.”

Midstream asset quality tends to be high and EBITDA tends to be generated by fixed fee or by contract-based structures, which has some resiliency.

Some of the larger players, such as Phillips 66, have even announced increases in their 2015 midstream spending plans. The company said in December it intends to spend almost $1 billion more in 2015 on projects earmarked to support midstream growth.

“I don’t mean to be sanguine on the midstream,” Brooks said. “Certainly on the G&P [gathering and processing] side, the market sees an issue and it’s possible if low oil prices stay around for a considerable period of time that there would be a lag effect in the midstream.”

Industry observers will see two things this year, Jason Stevens, director of energy equity and credit research at Morningstar Inc. in Chicago, told Midstream Business.

“You’re going to see folks work to execute existing backlog and looking for opportunities to add new projects, which may be challenging in this environment where producers will be hesitant to commit to capacity,” he said.

Demand pull

Kenny Feng, founder and CEO of The Alerian Index, told Midstream Business the closer midstream operators are to demand centers, the better off they are going to be.

“If you are in a demand-pull scenario vs. a supply-push, you are inherently going to be better positioned as far as the returns on that spending. I don’t think there are a lot of analysts making the case that demand-pull spending is going to see a hit because, for whatever reason, U.S. demand has taken a nosedive relative to expectations,” he said. “Most people would make the case, whether this is the predominant reason or other factors, I think many people will tell you it’s a supply-push problem.

“The fact that you have so much production come on board. The U.S. has represented the vast majority of U.S. oil production and growth over the last several years, and so as all of this oil is coming through, and we have these huge storage levels, it’s really a supplypush problem,” he added.

Reduced guidance

Indeed, some midstream companies are doing a bit of belt-tightening for the year. Plains All American’s management tempered its previously issued guidance based on slipping oil prices, adjusting for commodity price volatility. Instead of a capex total of $2 billion for 2015, management said it would be in the $1.75 billion to $1.95 billion range.

EQT Midstream Partners decreased its 2015 capex budget by 18%, a response to lower commodity prices, and includes 59 fewer Marcellus wells—down 33% to 122 wells—and 10 fewer wells in the Permian Basin, which is down 67% to five wells.

EQT’s production, however, will remain robust, according to a Global Hunter Securities report. The firm reiterated its guidance of 575 billion cubic feet equivalent (Bcfe) to 600 Bcfe—up year-over-year about 36%—and includes liquids. EQT’s 2014 production exceeded expected production, positioning the company above some analyst estimates for 2015 production.

Consequently, growth in the midstream will likely be less robust than in previous years, Morningstar’s Stevens said, but it’s important to remember that much of this year’s spending is already committed.

“Most projects with capital being spent on them have contract commitments, and they’re supported by solid contracts. The typical contracts are capacity-based, long-term so there shouldn’t be a lot of risk of cancellation or deferrals,” he said.

But while widespread downward revision isn’t expected in midstream capex, companies will probably be more prudent with their capital, said Feng.

“One would hope that at least for the management teams that went through the 2008 commodity bust that they have not built their distribution growth in expectation of a commodity deck that has oil at $100 in perpetuity,” Feng said.

“The whole point of having a coverage ratio, or for traditional c-corps, an inverse of the payout ratio, is to say in different environments, our business is not always going to generate X, Y or Z. We need to have some cushion in reserve for changes in the business cycle. Anybody who’s followed the energy business for more than a day knows that there are energy cycles, or business cycles that are going to impact cash flows, regardless of where you are in the value chain,” he added.

Management on the prowl

Smaller and midsize companies that find they can’t meet distributions and capital spending amid current commodity prices will find themselves creating a target-rich environment for larger companies, several analysts said.

“Some of the smaller players that are geography-specific are going to have a little bit less diversity. They may have some private equity backing, and they may have more of a challenged time going forward because they don’t have scale, they don’t have access to capital, and in an environment like this where people are worried about lending more to energy companies because of things like volumetric risk, you could see some of those names become opportunities for the large-cap, diversified companies,” Feng said. “It’s not necessarily the capex question, but you can certainly see the M&A activity creep up in the second half of this year if you continue to see oil prices where they are.”

Capital pays for pipe. A portion of the Cajun-Sibon NGL system goes in the ground in Louisiana. Source: EnLink Midstream Partners

In fact, Stevens said, the downturn presents a good opportunity for some companies to move capital spending to consolidation.

“It’s not going to happen overnight. The assets that folks are sharpening their pencils on are midstream-appropriate assets that are sitting at E&Ps,” he noted. “The E&Ps are under a bit of stress. They can place their midstream assets with an MLP and realize cash immediately when they had been holding out for a while, hoping to IPO their own captive MLPs, but it may be more attractive to them at this juncture to just monetize and sell it to get the cash immediately.”

Feng added that from a spending standpoint, it will become clear where companies have placed their priorities once the first-quarter earnings reports come out in April and May. Backlog, or what most companies refer to as committed projects, may become more interesting to both analysts and investors, he said.

“A lot of these projects on the midstream side—it’s pretty rare to take a midstream project from regulatory approval, whether it’s intrastate or interstate—where you’re going to see those things take less than 12 months. So a lot of what’s happened in 2015 has already been contracted for and works through binding commitments,” he explained. “It’s more interesting, I think, as these announcements come out over the next couple of quarters to say, ‘What’s happening to your backlog?’ and some of that backlog number coming off as you complete your spend.”

Still, Feng pointed to the recession in 2008 when backlogs grew less impressive and distributions shrank. The sector still survived.

“It is absolutely true that MLPs did not grow their distributions or midstream companies didn’t grow their dividends overall at the same rate that they had in 2005, 2006 and 2007, but it is important to say that they actually did grow their distributions during those times,” he said. “It is important to keep in mind they still did grow their distributions through that and obviously, it’s rebounded since then as there’s been need for additional infrastructure. The sky is not falling; it’s not all coming to an end."

Deon Daugherty can be reached at ddaugherty@hartenergy.com or 713-260-1065.

Recommended Reading

Surge Energy Balancing M&A Hunt with Testing Midland’s Shallow Zones

2024-12-05 - Surge Energy’s Travis Guidry discusses the potential for $1.3 billion in Permian Basin M&A and the company’s quest to grow inventory organically.

Hollub: Oxy Low Carbon Ventures Bolsters US Energy Independence

2024-11-18 - Occidental Petroleum is making a number of low-carbon moves in the Permian—a maneuver that will bolster the U.S.' energy independence, CEO Vicki Hollub told Hart Energy in an exclusive interview.

Post Oak Capital Backs Permian Team, Invests in Haynesville

2024-10-11 - Frost Cochran, managing partner at Post Oak Energy Capital, said the private equity firm will continue to focus on the Permian Basin while making opportunistic deals as it recently did in the Haynesville Shale.

Quantum Teams Looking for Acquisitions ‘Off the Beaten Path’

2024-10-14 - Blake Webster, partner at Quantum Capital Group, said the private-equity firm’s portfolio teams are looking to buy from sellers looking for cash buyouts, though not necessarily in the usual places.

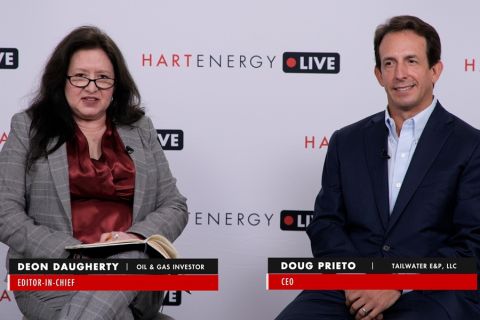

Tailwater E&P CEO Details Recent Core Permian Acquisition

2024-10-08 - Tailwater E&P CEO Doug Prieto said the firm put together funding for the deal from institutions, investors and family offices looking for “high quality assets that have durable cash flow.”

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.