Centennial Resource Development agreed to sell nonoperated Delaware acreage in Reeves County, Texas, while closing a deal to buy 4,000 net acres in Lea County, N.M. (Image: Hart Energy)

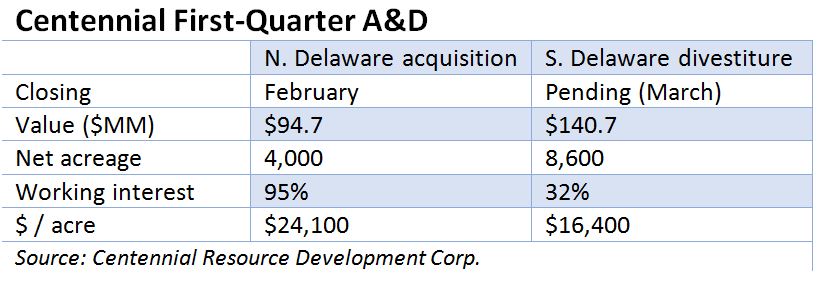

Centennial Resource Development Corp. (NASDAQ: CDEV) ran up $235.4 million in A&D in an attempt to get longer in the Delaware Basin while clearing out nonoperated acreage in Reeves County, Texas.

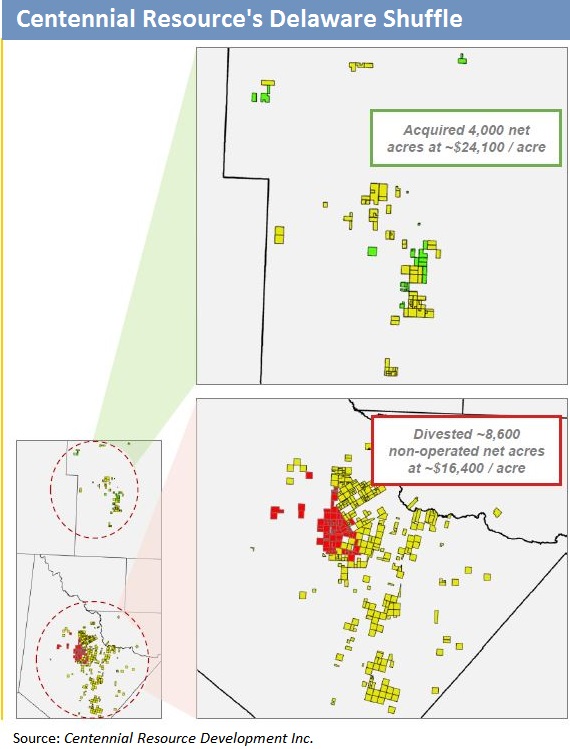

In its fourth-quarter 2017 earnings release, Centennial said it closed a bolt-on acquisition of 4,000 net acres in Lea County, N.M., in February with OneEnergy Partners Operating LLC for $95 million. The deal works out to about $24,100 per acre, the company said.

Centennial said it also agreed to sell 8,600 net acres in Reeves for $141 million. The deal, which is expected to close at the beginning of March, is largely nonoperated with a 32% working interest.

The company regards the transactions as a high-grading of it acreage position while also generating net cash, which will be used for drilling or other bolt-on acquisition opportunities. In the Lea bolt-on, Centennial increased its northern Delaware position by roughly 30% to more than 16,000 net acres, Sean Smith, Centennial COO, said during an earnings call in late February.

“The acquisition represents an operating position with a high working interest of 95%,” Smith said.

For OneEnergy, it’s the company’s second deal of the year following a $70 million sale to Lilis Energy Inc. (NYSE: LLEX). In that transaction, OneEnergy sold Lea leasehold for about $18,940 per acre.

Centennial’s acquisition also adds another 100 gross locations to its inventory. Because the acreage is contiguous with the company’s position it will also allow 20 shorter horizontal wells to convert to extended laterals, “significantly increasing the potential wellhead IRRs (internal rate of returns),” Smith said.

On the divested Reeves acreage, 2017 average net production was less than 250 barrels of oil equivalent per day, or less than 1% of total company production.

“The divestiture is largely nonoperated and had a minimal current production, hence the reason we were willing to part ways with it,” Smith said, adding the sale would not affect Centennial’s 2018 production targets or inventory.

Analysts reacted favorably to the deals.

Tudor, Pickering, Holt & Co. said March 1 that the company’s high capex in the fourth-quarter—about 33% higher than expectations at $246 million—may overshadow the company’s efforts to swap out low working interest acreage for a contiguous Lea position along with “promising initial Third Bone Springs sand and carbonate well results” in its retained Reeves acreage.

Seaport Global Securities also liked the deals. The firm noted in late February that Centennial’s “evolving completion designs continue to push well productivity higher. To this point, despite well costs that look to increase about 10% year-over-year in 2018, project returns on its long-laterals are pegged at 98% IRRs assuming $60 oil.”

At the end of 2017, Centennial leased or acquired about 84,718 net acres and operated about 91% of the acreage.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.