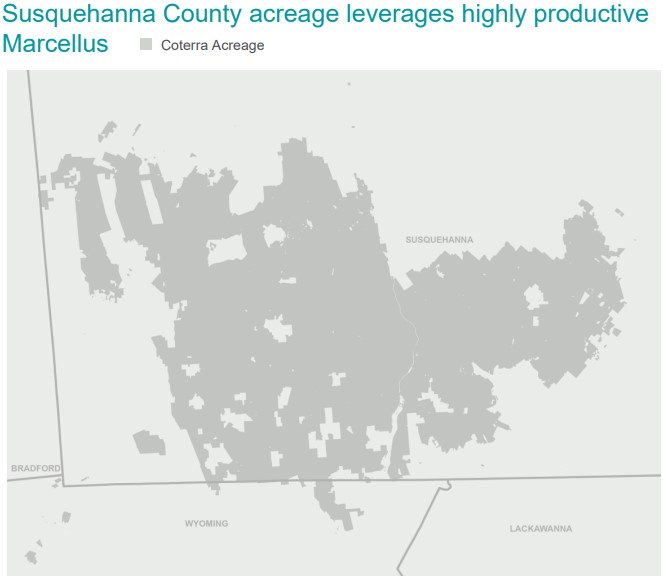

Coterra held approximately 186,000 net acres in the Marcellus dry gas window at year-end 2023, mostly within Susquehanna County, Pennsylvania (pictured). (Source: Shutterstock.com)

Coterra Energy released its last Marcellus Shale rig and may halt well completions as the multi-basin operator shifts capital into liquids-rich areas.

“As we sit here today, we have no rigs running in the Marcellus,” Coterra CEO Tom Jorden said during the Barclays 38th Annual CEO Energy-Power Conference this month. “We've released our last rig in the Marcellus, where we still have a frac crew working.”

When that frac crew finishes, Coterra “may go to no completions.”

Coterra has the “luxury,” Jorden called it, of being able to pivot capital into oily and liquids-rich areas, like the Permian and the Anadarko basins.

RELATED

The OGInterview: CEO Tom Jorden on Coterra’s ‘Meritocracy of Ideas’

But halting drilling activity in the Marcellus comes as low prices take a toll on gassy E&Ps, including Coterra, which merged Cimarex Energy’s portfolio with Cabot Oil & Gas’ legacy position in Appalachia.

Cabot Oil & Gas was a fast-follower in developing the horizontal Marcellus play behind pioneering Appalachia gas producer Range Resources. Range is credited for discovering the Marcellus play in 2007.

Coterra held approximately 186,000 net acres in the Marcellus dry gas window at year-end 2023, mostly within Susquehanna County, Pennsylvania, according to regulatory filings.

The Marcellus remains a large part of Coterra’s portfolio, accounting for nearly 53%, or 352,400 boe/d, of total companywide production (669,200 boe/d) during the second quarter.

Coterra isn’t alone in shifting capital out of the gassy Marcellus and Utica shale plays. Several Appalachia producers—Range, EQT Corp., Chesapeake Energy, CNX Resources, Gulfport Energy and others—have pulled back on drilling activity during a prolonged period of weak natural gas prices.

Shutting in production is an appropriate response by operators, Jorden said; Coterra currently has “a little under 300 MMcf/d shut in” as the company waits for gas prices to improve.

The company is continuing to complete and turn certain wells to sales but may choose to delay TILs in the future, he said.

“Turning TILs on and putting capital back are two different things,” Jorden said.

RELATED

CNX Touts Deep Utica Wells Results as Deferrals Hit Production

Liquids-focused drilling

Coterra is opting to deploy significant capital into the Permian Basin, the nation’s top crude producing region.

The company holds approximately 296,000 net acres in the Permian’s Delaware Basin, where Coterra is experimenting with the timing of landing wells in the Harkey Mills sandstone to reduce interference between zones.

Coterra is planning a 54-well project across a 12-section drilling spacing unit (DSU) in Culberson County, Texas, including 51 wells landed in the Upper Wolfcamp bench and three in the Harkey interval.

“We have pivoted a little bit on how we think about the Wolfcamp-Harkey interaction and whether they should be co-developed or if you can do one and come back later,” Jorden said. “We don’t know that we have the final answer yet.”

Coterra had 21 of those Wolfcamp wells online at the end of the second quarter.

The company observed “a little better performance” from a test co-developing the Wolfcamp and Harkey intervals, he said—compared to a test where the Wolfcamp was developed first and Coterra came back later to layer in the Harkey section.

Coterra produced 258,400 boe/d from the Permian in the second quarter, representing about 39% of its companywide production.

The company also retains a portfolio in the Midcontinent’s Anadarko Basin. Anadarko output averaged 58,000 boe/d in the second quarter, about 8% of companywide production.

Although the Anadarko generates significant natural gas volumes, it also produces a lot of NGL, Jorden said.

“For a typical Anadarko well, the dominant revenue phase is a combination of oil and [NGL],” he said.

Anadarko drilling activity has majorly declined since peaking in 2019, but the basin is highly competitive within Coterra’s portfolio.

“Under current conditions, it's slightly behind the Permian—but only slightly,” Jorden said.

Some operators have soured on the Midcontinent after a string of high-profile bankruptcies plagued Oklahoma over the past decade. But as E&Ps search for future drilling locations, they’re taking a harder look at what’s left to buy in the Anadarko Basin, experts say.

“I'll just say this, you asked me about value: There's a lot of value in the Anadarko Basin,” Jorden said.

RELATED

Recommended Reading

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

Expand Lands 5.6-Miler in Appalachia in Five Days With One Bit Run

2025-03-11 - Expand Energy reported its Shannon Fields OHI #3H in northern West Virginia was drilled with just one bit run in some 30,000 ft.

Trump Says He Will Double Tariffs on Canadian Metals to 50%

2025-03-11 - President Trump said he would double his tariffs on Canadian steel and aluminum products in response to Ontario placing a 25% tariff on electricity supplied to the U.S.

E&P Highlights: March 10, 2025

2025-03-10 - Here’s a roundup of the latest E&P headlines, from a new discovery by Equinor to several new technology announcements.

Diversified, Partners to Supply Electricity to Data Centers

2025-03-10 - Diversified Energy Co., FuelCell Energy Inc. and TESIAC will create an acquisition and development company focused on delivering reliable, cost efficient net-zero power from natural gas and captured coal mine methane.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.