Jason Pigott, president and CEO of Tulsa, Oklahoma-based Vital Energy (Source: Oil & Gas Investor)

Vital Energy sees major upside from its expanding acreage position in the Texas Delaware Basin.

Tulsa, Oklahoma-based Vital Energy—formerly Laredo Petroleum—is wading deeper into the Delaware Basin through an acquisition of private producer Point Energy Partners in a $1.1 billion all-cash deal with Northern Oil & Gas (NOG).

Vital agreed to acquire 80% of Point Energy’s assets for $880 million, with non-operated specialist NOG picking up the remaining 20% for $220 million, the companies announced on July 28.

It’s the second Delaware deal Vital and NOG have teamed up on after completing a $540 million joint acquisition of Forge Energy II last year.

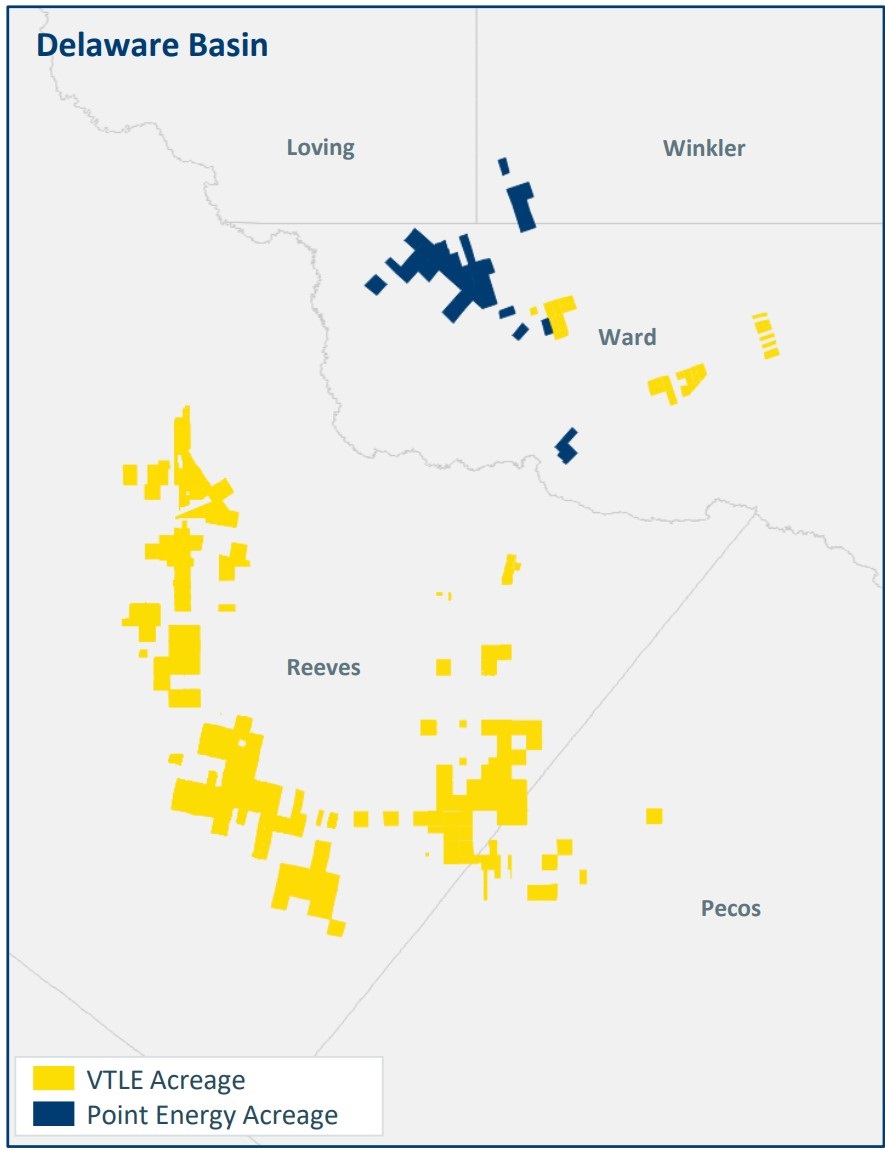

Point Energy’s assets will add around 16,300 net acres, primarily in Ward, Winkler and Loving counties, Texas, to Vital’s portfolio. The company’s Delaware footprint will grow by about 25% to 84,000 net acres after closing, and the Delaware will account for more than a third of Vital’s companywide oil production.

Vital intends to throttle down production on Point’s assets, then eventually scout out less-developed Southern Delaware Basin intervals—with the goal of adding more inventory than they underwrote when making the deal.

In recent months, activity on Point Energy’s Delaware asset has been quite high Vortus Investments- backed company prepared for a sale, Vital Energy President and CEO Jason Pigott said during a July 29 call with analysts.

Point Energy’s April production peaked at approximately 30,000 boe/d, a volume that reflected a 15-well package that Point had recently turned in line, Pigott said.

“We plan to moderate activity in the future and use free cash flow to reduce debt,” Pigott said.

From the deal’s effective date of April 1, 2024, through closing—expected to occur by the end of the third quarter— the assets “will be on a natural decline with no new wells being put online,” he said.

Production is expected to fall by 50% to average around 15,500 boe/d (~64 oil) by the fourth quarter, after the transaction closes. Vital anticipates operating a single drilling rig on the asset during the fourth quarter, while completing operations on approximately seven wells.

RELATED

Private E&P Point Energy Triples Delaware Basin Production to 15,000 bbl/d

Inventory story

The acquisition of Point Energy Partners adds 49 locations (68 gross) net to Vital’s portfolio. The company is paying approximately $1.4 million per undeveloped location. The acquired drilling locations are expected to break even with WTI oil prices at $47/bbl.

Production from the Point asset is about 64% oil—up from Vital’s companywide oil weighting of between 46% and 48%, Pigott said.

At a one-rig drilling cadence, Point’s asset represents more than five years of incremental drilling runway.

“Over the last several years, we have more than doubled our Permian Basin footprint,” Pigott said. “We’ll have approximately 280,000 net acres and a decade of quality drilling inventory.”

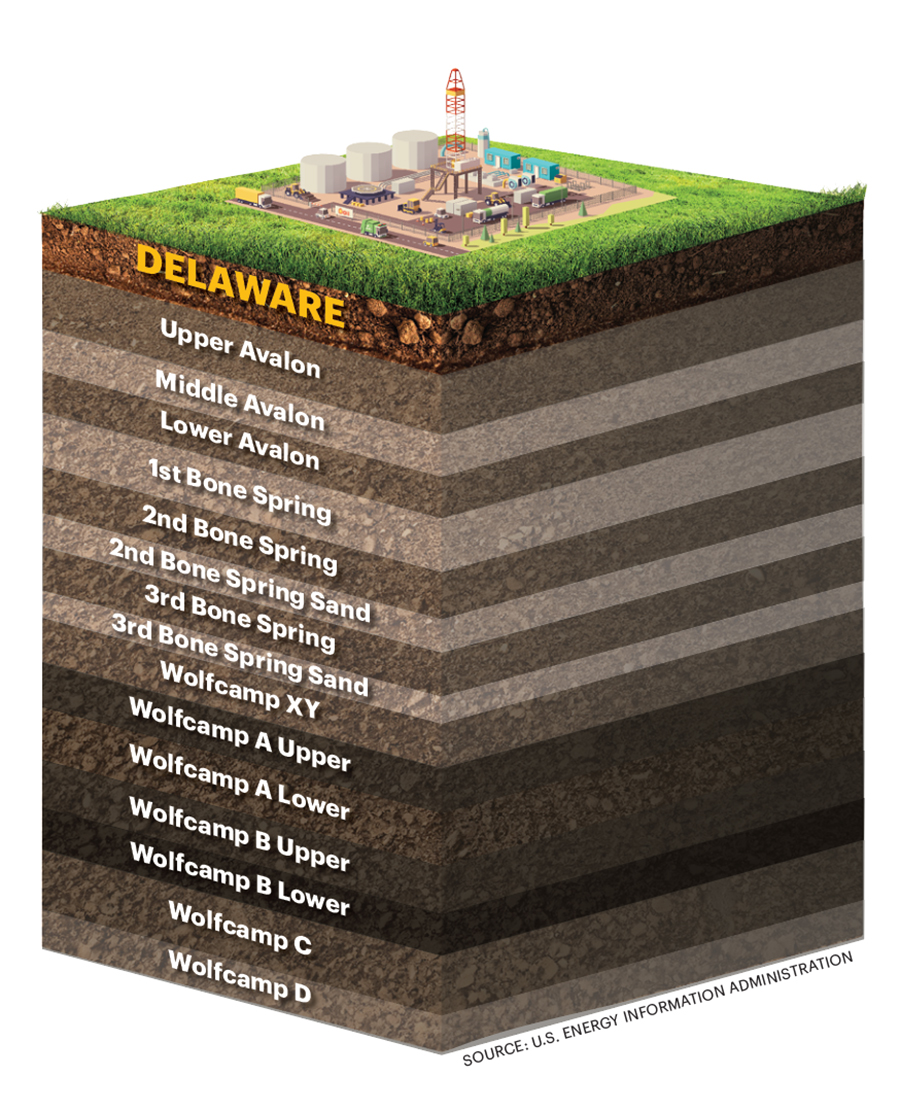

The 49 incremental locations picked up through the Point acquisition were underwritten across the Third Bone Spring shale, the Wolfcamp A and the Wolfcamp B formations.

Vital has been working to optimize its drilling and spacing techniques in the Southern Delaware Basin since the company has grown a larger and larger footprint in the region.

Vital underwrote the Point Energy transaction at $10.7 million per well featuring 10,000-ft laterals, which aligns with the company’s 2024 Delaware capital spending plans, Pigott said.

The company has also seen a major benefit from employing wider spacing in the Southern Delaware.

The Point Energy team developed its acreage with six wells per drilling spacing unit (DSU); Vital has underwritten the Point asset at four wells per DSU.

“As we’ve highlighted on prior calls, on our Southern Delaware area that’s been a real driver of outperformance there,” Pigott said, “and we hope to see these same things on these new assets.”

The underwritten total includes 16 gross “horseshoe” wells—double-long wells with U-shaped laterals, several of which Vital has already drilled successfully in the Permian.

Vital also sees additional upside from delineating and testing less-developed Delaware intervals, including the First Bone Spring, Second Bone Spring and Wolfcamp C zones.

“We’ve proven with all of our acquisitions we have the ability to bring in more inventory than we’ve underwrote,” Pigott said. “More importantly, we applied no value to these upside locations; We only underwrote the core development zones.”

A growing number of operators—Continental Resources, Marathon Oil, Occidental Petroleum, Diamondback Energy and more—have tested less popular Delaware intervals, such as the deeper Wolfcamp D and Woodford zones.

RELATED

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

Integration station

Vital gobbled up Permian acreage through M&A last year, taking part in the historic deluge of dealmaking sweeping across the prolific oil basin.

In February 2023, Vital paid $214 million to acquire oilier Midland Basin acreage from Driftwood Energy. The Driftwood deal, which closed in April 2023, included 11,200 net acres that average 5,400 boe/d (63% oil).

Then in June, Vital and NOG teamed up to acquire Forge Energy II, backed by private equity firm EnCap Investments LP. NOG covered 30% of the $540 million purchase price.

In September, Vital was on the move again, spending $1.165 billion across three Permian transactions with Henry Energy LP, Tall City Exploration III and Maple Energy Holdings—deals that all came together within roughly week of each other, Pigott told Oil & Gas Investor last year.

Now, Vital is getting even deeper in the Texas Delaware through the Point Energy acquisition. But look to see Vital more focused on integration and delineation going forward, and less on M&A.

“I can tell you that the good deals are getting harder to find and we have a high bar,” Pigott said on the call.

Over the next year, Vital will probably focus on integrating the assets it has already acquired, generating free cash flow and reducing debt.

The company’s leverage is expected to be approximately 1.5x at closing. At current strip commodity prices, Vital expects to reduce its leverage to 1.3x within 12 months.

RELATED

Recommended Reading

What's Affecting Oil Prices This Week? (March 31, 2025)

2025-03-31 - For the upcoming week, Stratas Advisors predict that the price of Brent crude will move sideways and struggle amid concerns and uncertainties about the impact of the tariffs imposed by the Trump Administration.

What's Affecting Oil Prices This Week? (March 3, 2025)

2025-03-03 - For the upcoming week, Stratas Advisors expects oil prices to continue bouncing around but overall trend upward.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

What's Affecting Oil Prices This Week? (April 21, 2025)

2025-04-21 - Stratas Advisors predict that the growth in non-OPEC supply will be muted by the uncertainty of low oil prices, including supply associated with U.S. shale producers, which are facing financial and operational pressures because of lower oil prices.

What's Affecting Oil Prices This Week? (Feb. 24, 2025)

2025-02-24 - Net long positions of WTI have decreased by 59% since Jan. 21 and are 61% below the level seen on July 16, 2024, when the price of WTI was $80.76.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.