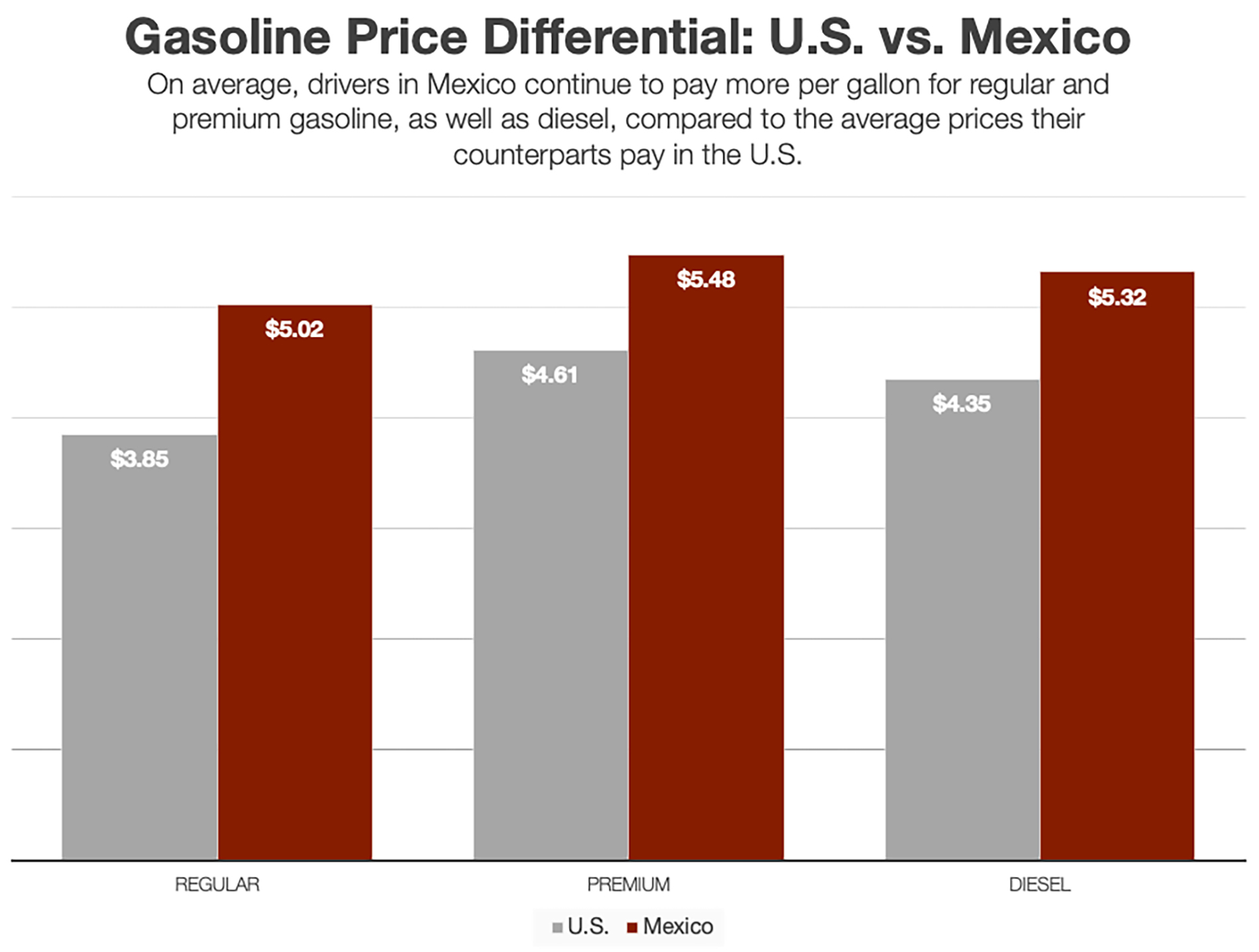

Drivers in Mexico are paying a hefty 125% premium for gasoline and an average 122% more for diesel compared to their U.S. counterparts, according to Hart Energy analysis. (Source: Shutterstock.com)

MEXICO CITY, Mexico—Some things are cheaper in Mexico compared to the U.S. but gasoline and diesel are clearly the exception.

Mexican drivers are paying an average premium of about 125% for regular and premium gasoline and an average premium of 122% for diesel compared to their American counterparts.

Mexican prices are steeper for a couple of reasons: higher import and logistic costs related to a deficit of domestically-produced gasoline as well as illicit fuel trade, according to state-owned Petróleos Mexicanos (Pemex).

RELATED: Mexican Drivers Pay More for Gasoline than Americans

Mexico’s average price of regular gas runs $5.02/gallon and for premium $5.48/gallon, according to data released Aug. 21 by Mexico’s consumer protection agency PROFECO. The average diesel price was $5.32/gallon.

Mexican states with the highest regular gasoline prices include Nuevo León ($5.67/gallon), Durango, Baja California Sur and Guerrero, according to PROFECO.

RELATED: Mexico Embracing E-mobility, but Headwinds Persist

In the U.S., the average price of a gallon of regular was $3.85 and for premium $4.61/gallon as of Aug. 22, according to the American Automobile Association Inc., or AAA, a federation of affiliated automobile clubs. The average U.S. diesel price was $4.35/gallon.

The U.S. states with the highest regular gasoline price are California ($5.26/gallon), Washington, Hawaii, Oregon and Alaska, according to AAA. That compares to an average price of $3.47/gallon in Texas and $3.41/gallon in Louisiana, where a number of U.S. refineries are located.

Recommended Reading

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Trump Says He Will Double Tariffs on Canadian Metals to 50%

2025-03-11 - President Trump said he would double his tariffs on Canadian steel and aluminum products in response to Ontario placing a 25% tariff on electricity supplied to the U.S.

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.