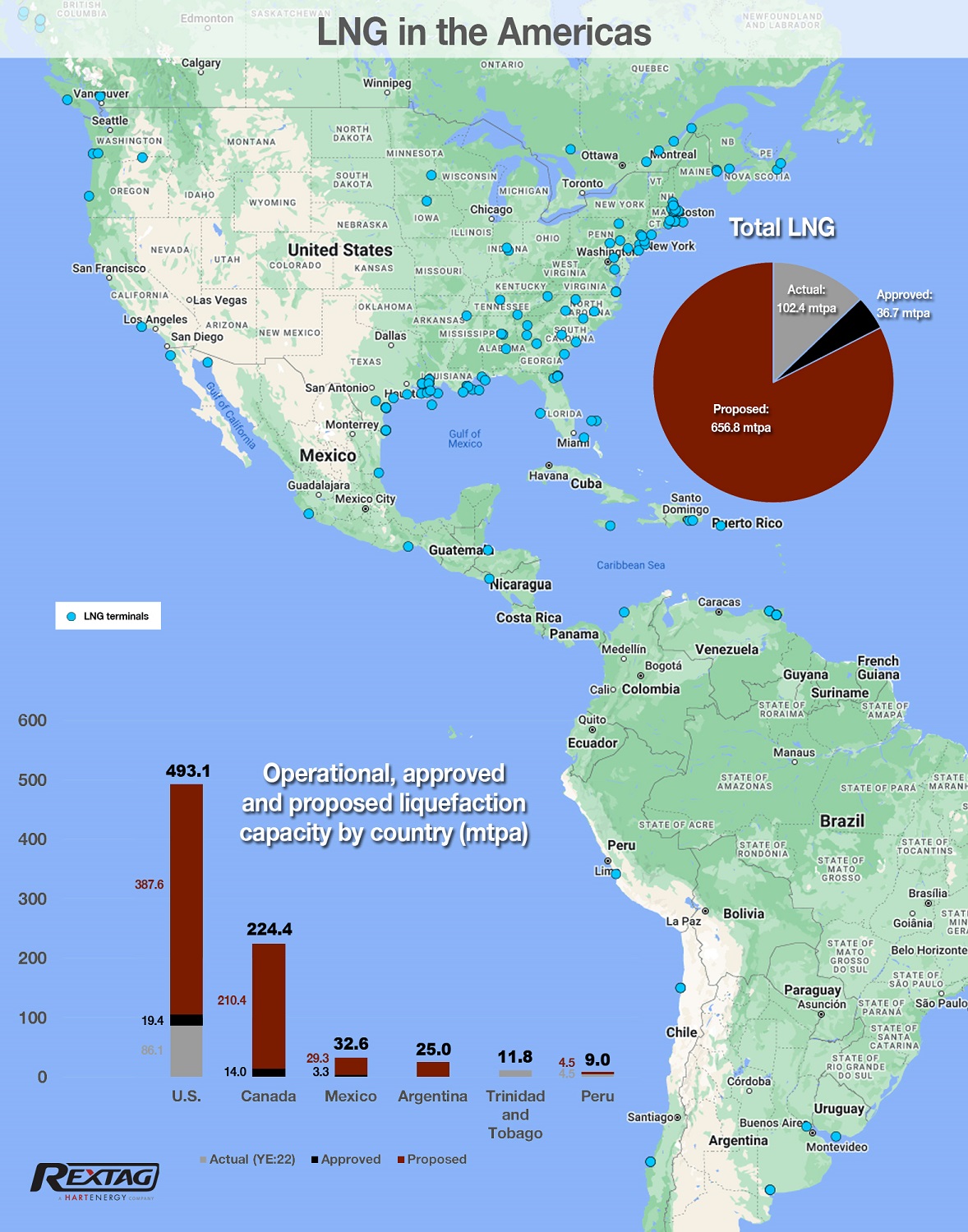

Staked by the Permian and the Vaca Muerta, Mexico and Argentina have the potential to bring to market 32.6 mtpa and 25 mtpa respectively over the near-to-mid-term, according to data from Rystad Energy and Argentina’s YPF SA. (Source: Hart Energy)

Mexico and Argentina are placing their bets on LNG exports. Mexico has access to the Permian Basin while Argentina boasts its own massive Vaca Muerta shale formation.

The stakes: the countries could swiftly rise to hold the third and fourth largest liquefaction capacity in the Americas.

For Mexico and Argentina, much of the success will rely on attracting the necessary capital, despite the political and economic headwinds specific to each country.

If actual, approved and planned liquefaction plants are fully executed, Mexico could bring to market around 32 million tonnes per annum (mtpa) over the near-to-medium term, according to Rystad Energy data compiled by Hart Energy. Other estimates put Mexico’s ultimate liquefaction capacity at around 45 mtpa.

For Mexico, its LNG success is mainly related to tapping shale gas from the Permian, which will require infrastructure to transport the U.S. gas to liquefaction plants in Mexico. While the political environment is challenging, private investors such as Sempra continue to move related projects forward.

RELATED: Permian Producers Fancy Larger Piped-gas Exports to Mexico

In Argentina’s case, that figure could reach 25 mtpa, based on details revealed by state-owned YPF SA.

For Argentina, the continued development of the Vaca Muerta, which is arguably on par with the Permian in many aspects, could anchor a massive buildup of liquefaction capacity.

Unlike Mexico, private investors in Argentina confront stronger headwinds politically, economically and financially.

The first major headwind: a need for capital to expand gas pipeline infrastructure to transport Neuquén gas to the Argentine coast to export as LNG.

The second: getting the capital necessary to finance Argentina’s first liquefaction train from Malaysia’s Petronas and YPF.

Will Mexico and Argentina succeed? Only time and capital will tell.

RELATED: Argentina Goes for LNG Exporting Glory

Senior Managing Editor Joseph Markman contributed to this story.

Recommended Reading

US Crude Oil Stocks, Excluding SPR, Fall to 2-Year Low, EIA Says

2025-01-15 - Crude inventories fell by 2 MMbbl to 412.7 MMbbl in the week ending Jan. 10, the EIA said, compared with analysts' expectations in a Reuters poll for a 992,000-bbl draw.

What's Affecting Oil Prices This Week? (March 31, 2025)

2025-03-31 - For the upcoming week, Stratas Advisors predict that the price of Brent crude will move sideways and struggle amid concerns and uncertainties about the impact of the tariffs imposed by the Trump Administration.

What's Affecting Oil Prices This Week? (March 17, 2025)

2025-03-17 - The price of Brent crude could get a boost from Trump’s threats of sanctions on Russia, Iran and Venezuela, but it is doubtful it will break $72/bbl, Stratas Advisors says.

What's Affecting Oil Prices This Week? (Jan. 27, 2025)

2025-01-27 - For the upcoming week, Stratas Advisors predict that the price of Brent crude will threaten $75.

What's Affecting Oil Prices This Week? (March 3, 2025)

2025-03-03 - For the upcoming week, Stratas Advisors expects oil prices to continue bouncing around but overall trend upward.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.