In this photo, an offshore drilling rig can be seen in the Gulf of Suez, Egypt. Cheiron struck oil with the GNN-11 exploration well in the Gulf of Suez, the company announced Aug. 22. (Source: Shutterstock.com)

Cheiron struck oil with the GNN-11 exploration well in the Gulf of Suez, the company announced Aug. 22.

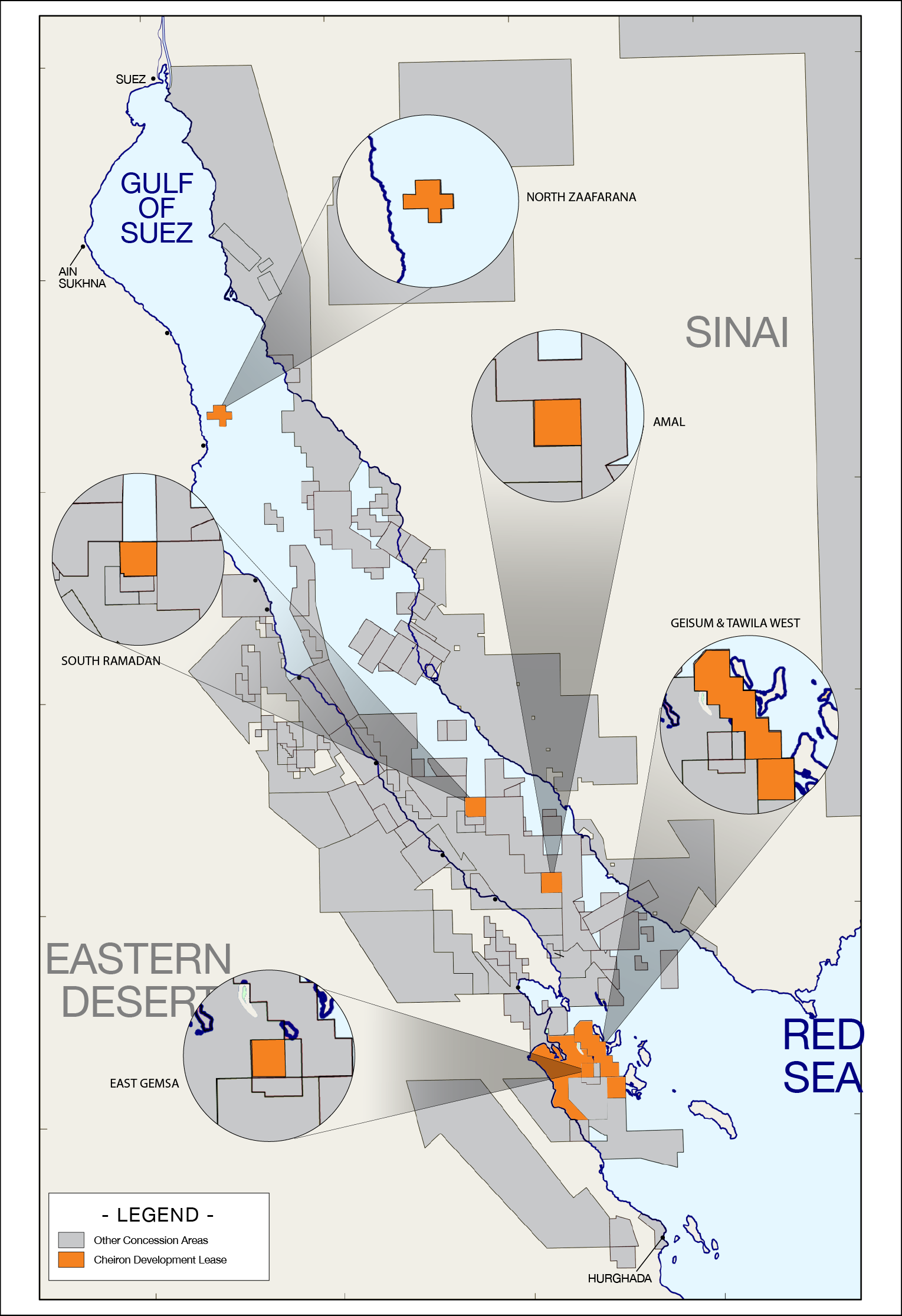

The exploration well was drilled into a fault block to the east of the GNN oil field development in Cheiron’s Geisum and Tawila West concession. The well encountered 165 ft of good quality vertical net pay in the Pre-Miocene Nubia formation and this is the first time the Nubia has been found to be oil bearing in the GNN area of the Concession. The producing reservoir in the main GNN field is in the Nukhul formation.

The GNN Early Production Facility (EPF), which started production in March, drilled the GNN-11 well and placed it on production at 2,500 bbl/d of oil.

GNN-11 is the fourth well to be completed from the EPF, which is located in the central area of the field and includes a conductor support platform, a mobile offshore production unit and a 10-inch oil export pipeline, tied back to the existing Geisum Star production complex. Three additional wells can be drilled from the EPF, and these will be used to complete the current phase of the GNN drilling program, Cheiron said.

According to Cheiron, with the addition of production from GNN-11, the concession’s gross oil production has grown to 23,000 bbl/d of oil from 4,000 bbl/d of oil before the GNN field was developed.

Cheiron and Kufpec plan to drill at least three additional exploration wells in the concession area.

Cheiron, through its PICO GOS affiliate, operates the concession with a 60% working interest, and partner Kufpec holds the remaining 40% interest. Feld operations are managed by the PetroGulf Misr Joint Operating Company on behalf of EGPC and the partners.

Recommended Reading

Energy Spectrum, UGI JV Buys Three Appalachia Gathering Systems

2025-01-28 - Pine Run Gathering LLC, a joint venture between Energy Spectrum Partners and UGI Corp., purchased three gathering systems in Pennsylvania from Superior Midstream Appalachian LLC.

Langford Enters Midland Basin with Murchison Oil and Gas Deal

2025-01-14 - Langford Energy Partners closed on an acquisition of 8,000 acres in the Midland Basin from Murchison Oil and Gas LLC.

Shale Outlook Uinta: Horizontal Boom to Continue in 2025

2025-01-11 - After two large-scale transactions by SM Energy and Ovintiv, the Uinta Basin is ready for development—and stacked pay exploration.

Matador Touts Cotton Valley ‘Gas Bank’ Reserves as Prices Increase

2025-02-21 - Matador Resources focuses most of its efforts on the Permian’s Delaware Basin today. But the company still has vast untapped natural gas resources in Louisiana’s prolific Cotton Valley play, where it could look to drill as commodity prices increase.

Ovintiv Closes $2B Uinta Sale to FourPoint Resources

2025-01-22 - Ovintiv is exiting Utah’s Uinta Basin in a $2 billion sale to FourPoint Resources, which will take over some of the play’s highest quality acreage.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.