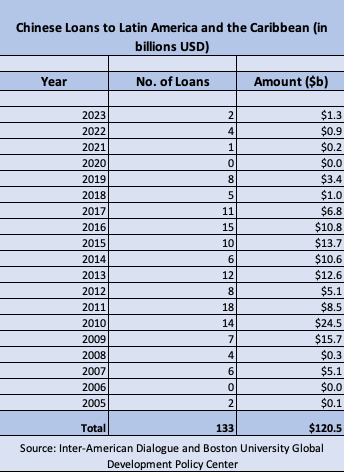

Between 2005-2023, China Development Bank and Export-Import Bank of China provided $120 billion via 133 loan commitments to countries across Latin American and the Caribbean (LAC) and state-owned enterprises. (Source: Shutterstock)

China will not be resuming the mega oil-backed leaning of yesteryear as its focus turns to debt negotiations, according to the Inter-American Dialogue (IAD) and the Boston University (BU) Global Development Policy Center.

A decade ago, Chinese lending to the Latin American-Caribbean region surpassed lending from the World Bank and the Inter-American Development Bank (IDB).

Between 2005-2023, China Development Bank (CDB) and Export-Import Bank of China (Ex-Im Bank) provided $120 billion via 133 loan commitments to countries across Latin American and the Caribbean (LAC) and state-owned enterprises, IAD and BU said June 18 in a joint press release announcing the results of a recent study.

Of the $120 billion, energy projects investments were $94.1 billion or 78% of the total followed by other ($12.1 billion), infrastructure ($12.1 billion) and mining ($2.1 billion). By region, the distributions were destined to four countries with received 92% of the financing: Venezuela ($59.2 billion, 49%), Brazil ($32.4 billion, 27%), Ecuador ($11.8 billion, 10%) and Argentina ($7.7 billion, 6%).

But now, lending from the World Bank and IDB to the Latin America-Caribbean region has surpassed lending from Chinese financing institutions, the IAD and BU said in the release.

“As in previous years, there is little to indicate a resurrection of the multibillion-dollar, oil-backed lending that once characterized the bulk of China’s financial engagement with the region,” the IAD and BU said in the release.

However, the CDB and Ex-Im Bank will remain committed to issuing smaller loans more closely linked to Chinese and host country development objectives. Such loans could be for transport infrastructure development or generating investment and trade in priority-emerging industries, the release said.

“The next few years will be marked by debt negotiations between China and its debtors in the region, but also by continued recalibration as China adjusts its domestic economic policy and as the Belt and Road Initiative (BRI) and related finance and investment follow suit,” IAD and BU said in the release.

In the Latin America-Caribbean region, only Suriname reported debt levels to Chinese creditors of over 5% of GDP or projected debt service payments amounting to over 2% of projected exports over the next 5 years.

Chinese companies—now well established in much of the area—are no longer dependent on development finance institutions loans to generate opportunities for their involvement in infrastructure projects. With CDB and Ex-Im Bank focused on debt reduction, China’s smaller commercial banks have increasingly stepped into the fold through syndicated loans to Chinese or LAC companies.

Recommended Reading

US Drillers Add Oil, Gas Rigs for Second Week in a Row, Baker Hughes Says

2025-02-07 - Despite this week's rig increase, Baker Hughes said the total count 6% below this time last year.

PotlatchDeltic Enters Lithium, Bromine Lease Agreement in Arkansas

2025-02-06 - PotlatchDeltic’s agreement with gives Tetra Brine Leaseco covers about 900 surface acres in Lafayette County, PotlatchDeltic says.

McDermott Completes Project Offshore East Malaysia Ahead of Schedule

2025-02-05 - McDermott International replaced a gas lift riser and installed new equipment in water depth of 1,400 m for Thailand national oil company PTTEP.

SLB: OneSubsea to Provide Equipment for Vår Energi Offshore Norway

2025-02-04 - The OneSubsea joint venture among SLB, Aker Solutions and Subsea7 will support multiple oil and gas projects on the Norwegian Continental Shelf for Vår Energi.

Resurrected Enron Hijinks Gets Serious with New Electric Business

2025-02-03 - After Enron returned as a seemingly elaborate hoax, Enron Energy Texas’ vice president told Hart Energy the company aims to deliver real electricity to consumers.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.