Chisholm Energy will purchase acreage from fellow independent E&P Resource Rock Exploration to expand its Delaware Basin position to 30,000 net acres. (Source: Hart Energy)

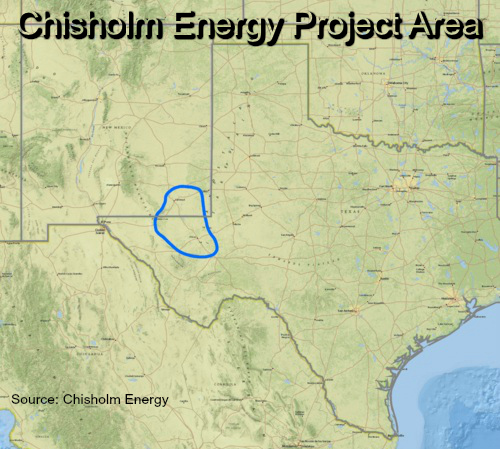

Private E&P Chisholm Energy Holdings LLC will expand it Delaware Basin position to more than 30,000 net acres through the acquisition of acreage from Resource Rock Exploration LLC, the company said Dec. 7.

Chisholm offered few details about the acreage and transaction terms weren’t disclosed. The Fort Worth, Texas-based E&P said the acreage contains horizontal reservoir targets in the Bone Spring and Wolfcamp formations in Eddy County, N.M.

Resource Rock holds about 16,500 net acres in the Delaware Basin, interests in more than 100 wells and 3-D seismic data covering about 300 square miles, according to the company’s website.

Resource Rock, based in Houston, was founded this year and is backed by private-equity firm Kayne Anderson. The company is led by president and CEO Charles Wampler.

Chisholm closed its first asset acquisition in Eddy and Lea counties, N.M. in May. The company, backed with a $500 million line-of-equity by Warburg Pincus, runs three drilling rigs and averages production of about 4,000 barrels of oil equivalent per day, Chisholm said.

Chisholm also picked up New Mexico acreage in September. Enduro Royalty Trust (NYSE: NDRO) divested 5,078 net undeveloped acres to multiple buyers, including Chisholm, for a total of about $49.1 million, according to regulatory filings.

Chisholm CEO Mark Whitley said the company’s acquisition from Resource Rock will add “scale and value to our growing platform in the region.”

“We look forward to applying our best-in-class operating capabilities to develop our position and will continue to pursue additional opportunities to deliver value,” he said.

Chisholm is also among several operators in Lea, including Cimarex Energy Co. (NYSE: XEC) and an affiliate of Devon Energy Corp. (NYSE: DVN), that have requested non-standard 160-acre spacing permits, according to New Mexico Energy, Minerals and Natural Resources Department documents.

The Resource Rock acquisition is expected to close in January, Chisholm said. Gibson, Dunn & Crutcher LLP represents Chisholm in the transaction and DLA Piper represented Resource Rock.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.