Civitas Resources said it drilled 13 4-mile lateral wells in the D-J Basin—the longest wells ever drilled and completed in Colorado (pictured). (Source: Shutterstock.com/ Civitas Resources Inc.)

Civitas Resources is drilling its first Permian Basin wells designed in-house and going the extra mile on legacy Colorado assets.

Denver-based Civitas Resources was created in 2021 through the three-way merger of pure-play Colorado producers Bonanza Creek Energy, Extraction Oil & Gas and Crestone Peak.

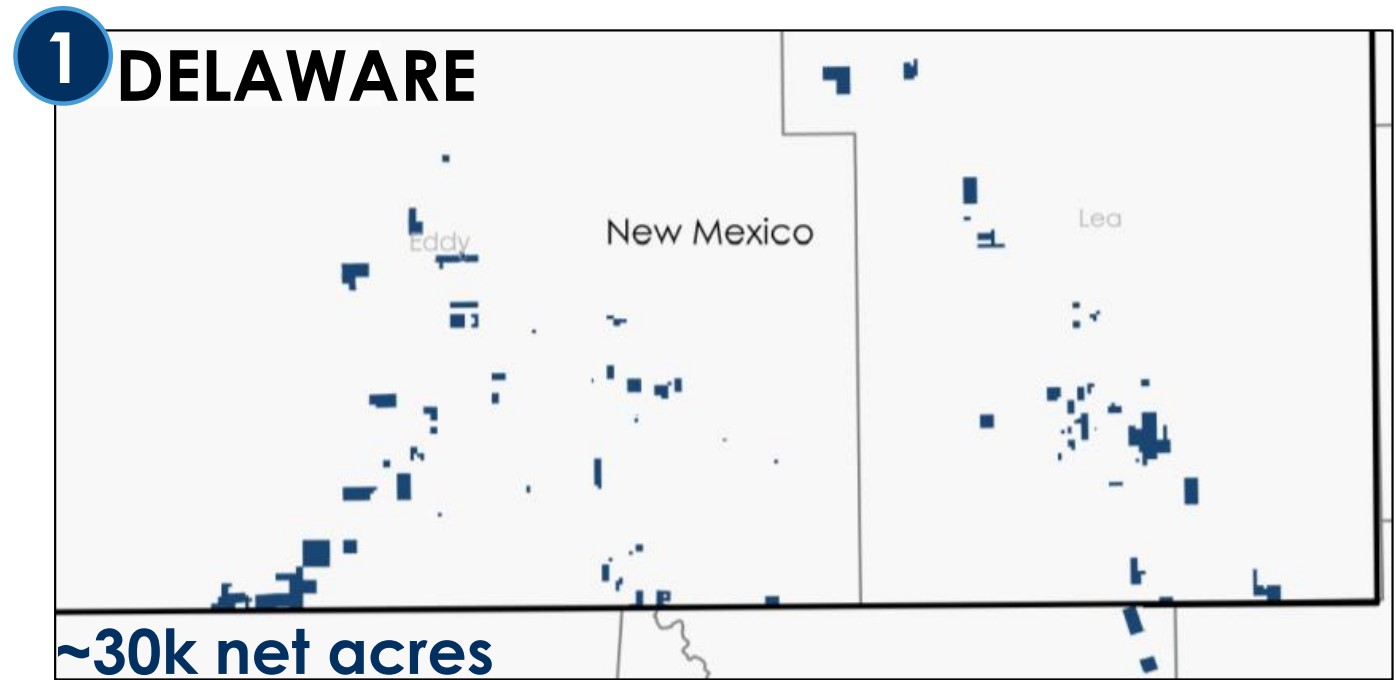

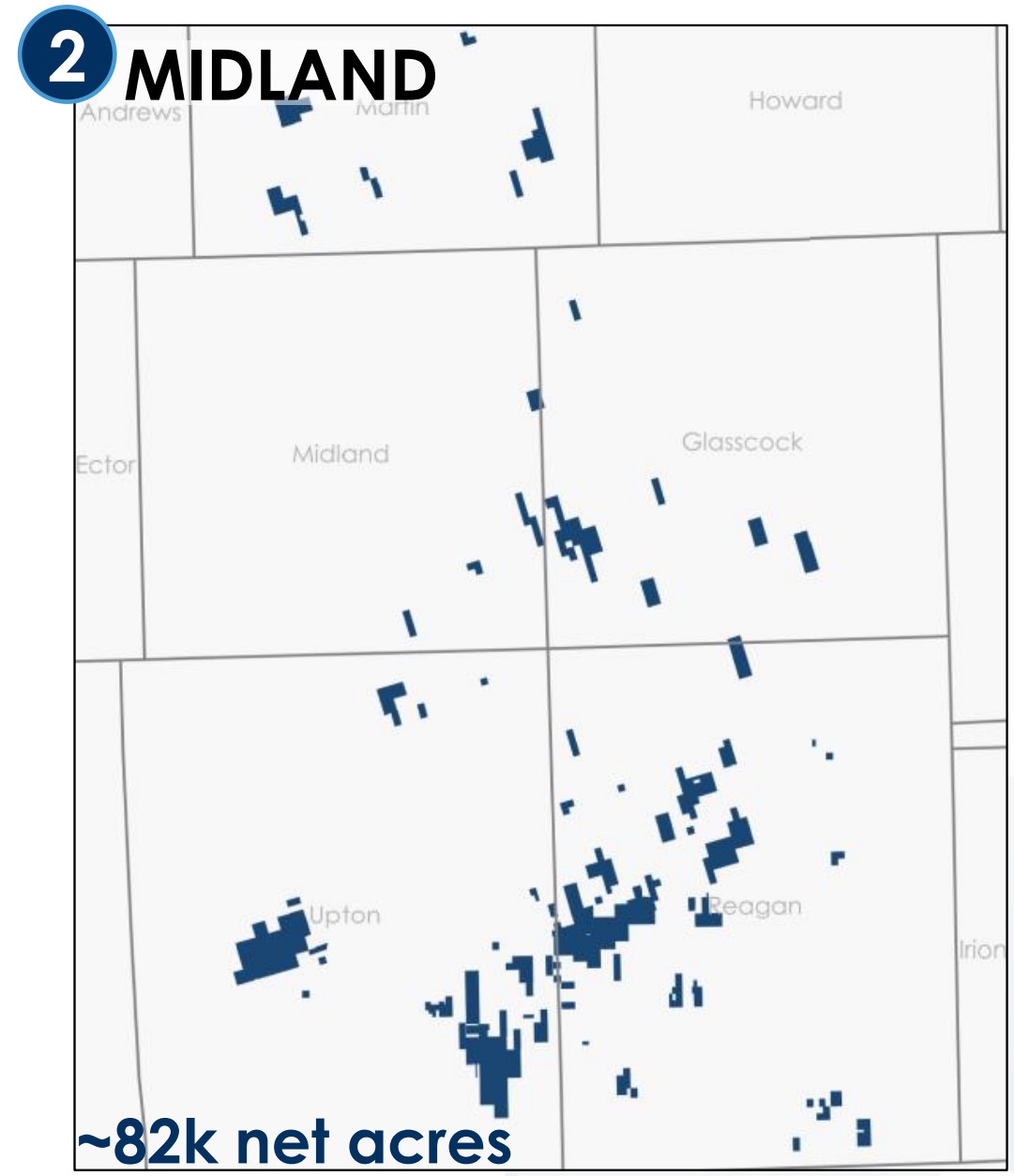

But the need for drilling inventory outside the highly consolidated Denver-Julesburg (D-J) Basin led Civitas to dive into the Permian Basin with nearly $7 billion in M&A in 2023.

At the start of the second quarter, Civitas had approximately 112,000 net Permian acres and 186,000 boe/d (47% oil) of Permian production within its portfolio.

Civitas’ Permian volumes increased nearly 12% quarter-over-quarter, driven by strong production from recent wells brought online in the Midland and Delaware basins, the company reported in second-quarter earnings after markets closed Aug. 1.

Around 58% of Civitas’ second-quarter Permian sales volumes were from the Midland Basin and 42% were from the Delaware.

Civitas, now squarely in the operator’s seat on the assets it acquired around the Permian last year, is highlighting decreasing well costs in the basin.

Midland Basin well costs are down 10% for Civitas since year-end 2023; Delaware well costs are down around 3%.

Chris Doyle, president and CEO of Civitas, said cost reductions are stemming from several areas of the business, including optimizing drilling and completion designs, high-grading service providers and capturing benefits of scale in the Permian.

“Across the Permian, these achievements are increasing the number of low breakeven locations by 20% to 30% and extending high-quality inventory life,” Doyle said during Civitas’ Aug. 2 earnings call with analysts.

At the end of 2023, the all-in cost to design, drill and complete a 2-mile Midland Basin well was approximately $850/ft.

After looping in savings from using higher-spec drilling rigs, optimizing completion designs, boosting horsepower and pump rates, using in-basin sand and other cost-reduction efforts, drilling the same 2-mile Midland Basin well today costs Civitas $765/ft.

Civitas aims to bring its Midland Basin well costs down an additional 5% over time. In the deeper, more geologically complex Delaware Basin, Civitas is targeting a 5% overall well cost reduction.

Doyle said Civitas is “particularly excited” to see well results from its first fully designed, drilled and completed wells in the Permian during the third quarter.

“The second-half 2024 [turn-in-lines] will target core zone development and slightly wider lateral spacing than previous operators,” Doyle said.

Doyle said the previous operator on the asset probably over-drilled one of the pads with tighter spacing. While the wells are performing as expected, the company believes it wasn’t the best spacing design from a cash-return development perspective.

Civitas closed its first two Permian acquisitions in August 2023, scooping up Hibernia Energy III in the Midland Basin for $2.2 billion and Tap Rock Resources in the Delaware Basin for $2.5 billion.

In early January, Civitas closed a $2 billion acquisition of Vencer Energy, a Midland Basin E&P backed by international commodities trading house Vitol.

RELATED

Civitas Resources Closes $2.1 Billion Vencer Energy Deal

Going long in the D-J

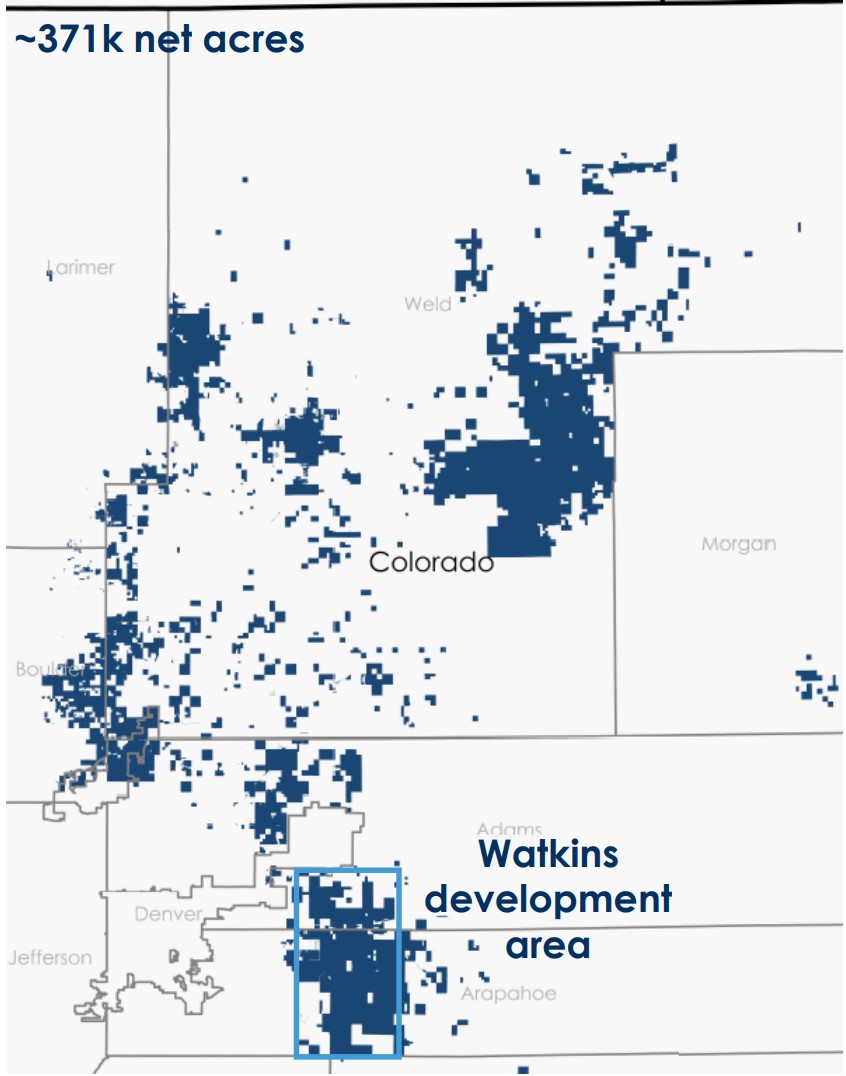

Civitas might be prioritizing investment in the Permian Basin, but it still maintains a large legacy footprint in Colorado.

Civitas ended the second quarter with approximately 371,000 net acres and 157,000 boe/d (43% oil) in the D-J Basin.

The company’s second-quarter D-J volumes were down around 5,000 boe/d (~35% oil) compared to the first after closing two non-core asset divestments in March and May.

In late June, Civitas started production on 13 D-J Basin wells with 4-mile laterals from the Watkins development area—the longest laterals ever drilled and completed in Colorado, the company said.

Doyle said Civitas grew more comfortable drilling longer and longer wells after seeing how several 3-mile wells performed compared to its 2-mile wells.

“Now, it’s replaying itself on the 4-milers—very strong type curve expectations,” Doyle said. “But we are risking that fourth mile, still being very conservative as we are.”

The returns from the 4-mile D-J wells have been “quite compelling” so far, Doyle said. Civitas’ 4-mile D-J wells cost around 5% less to drill and complete per foot compared to 3-mile wells.

“We're focused on upsizing infrastructure in the area to unleash these wells,” Doyle said. “We're super excited, not just from an operational execution perspective, but seeing contribution throughout the lateral.”

Civitas turned in line 41 net Permian wells and 31 net D-J Basin wells during the second quarter. The company’s average lateral length completed during the quarter was 2.3 miles in the Permian and 2.2 miles in the D-J.

RELATED

Civitas, Prioritizing Permian, Jettisons Non-core Colorado Assets

Recommended Reading

Elliott Demands Phillips 66 Sell or Spin Off Midstream Biz for $40B+

2025-02-12 - Activist investor Elliott Capital Management disclosed Feb. 11 it has built a $2.5 billion position in Phillips 66 and issued a series of initiatives, including the sale or spinning off of the company’s midstream assets.

Energy Trader Vitol Eyes $3B Sale of US Shale Producer, Sources Say

2025-03-27 - Global commodities trader Vitol is exploring a sale of its VTX Energy Partners business, in a deal that could value the U.S. shale oil and gas producer at as much as $3 billion, including debt, people familiar with the matter said.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

Amplify Updates $142MM Juniper Deal, Divests in East Texas Haynesville

2025-03-06 - Amplify Energy Corp. is moving forward on a deal to buy Juniper Capital portfolio companies North Peak Oil & Gas Holdings LLC and Century Oil and Gas Holdings LLC in the Denver-Julesburg and Powder River basins for $275.7 million, including debt.

Whitecap, Veren Enter $10.4B Merger of Western Canadian Basin E&Ps

2025-03-10 - Whitecap Resources and Veren Inc. will create the largest light oil and condensate producer in the Alberta Montney and Kaybob Duvernay in an all-share combination valued at CA$15 billion (US$10.43 billion).

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.