Civitas is adding Midland Basin production and drilling locations in a $300 million bolt-on. Civitas is targeting $300 million in upstream divestitures to offset the deal. (Source: Shutterstock.com/ Civitas)

Civitas Resources is buying Midland Basin locations in a $300 million bolt-on acquisition from an undisclosed seller, deepening its Permian inventory by about a year.

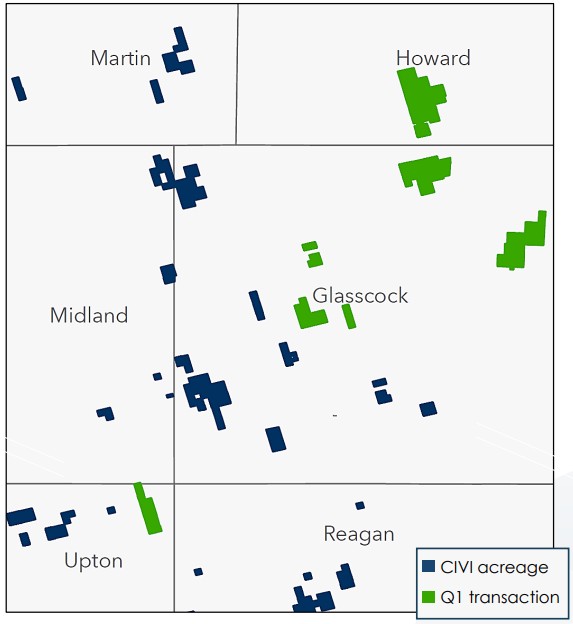

The transaction adds 19,000 net acres and approximately 130 future Midland Basin development locations, based on 2-mile average laterals, Denver-based Civitas announced in fourth-quarter earnings released Feb. 24.

Civitas said the deal adds future drilling locations in primary zones like the Wolfcamp A, B and D.

Civitas said it worked last year to delineate the Wolfcamp D bench on its Midland Basin asset “with higher-than-anticipated productivity and lower costs.”

The company sees additional upside from the acquisition in the Wolfcamp C and deeper Woodford and Barnett zones.

The acquired assets in Howard, Glasscock and Upton counties, Texas, will add 3,000 boe/d (50% oil) in 2025. The deal is expected to close by the end of February.

The bolt-on transaction adds Midland Basin inventory at a “reasonable” cost of around $2 million per location, said Siebert Williams Shank & Co. Managing Director Gabriele Sorbara.

To offset the Midland Basin deal, Civitas set a $300 million asset divestiture target for 2025.

The divestiture is “likely” to come from Civitas’ legacy acreage in Colorado’s Denver-Julesburg (D-J) Basin, Civitas President and CEO Chris Doyle said.

“Effectively, this is expected to accelerate value from the DJ in support of extending our runway in the Permian,” Doyle said on a Feb. 25 earnings call.

After closing the latest bolt-on, Civitas will have around 1,200 future locations across the Permian Basin, representing around a decade of drilling inventory.

Previously a Colorado pure-play producer, Civitas entered the Permian Basin with nearly $7 billion in M&A in 2023.

Civitas acquired private equity-backed producers Hibernia Energy III in the Midland Basin for $2.2 billion and Tap Rock Resources in the Delaware Basin for $2.5 billion.

In October 2023, Civitas followed on with a $2 billion acquisition of Vencer Energy, a Midland Basin E&P backed by international commodities trading house Vitol.

RELATED

Civitas: 4-mile Colorado Laterals A ‘Competitive Edge’ in D-J Basin

Analysts suspect Oxy

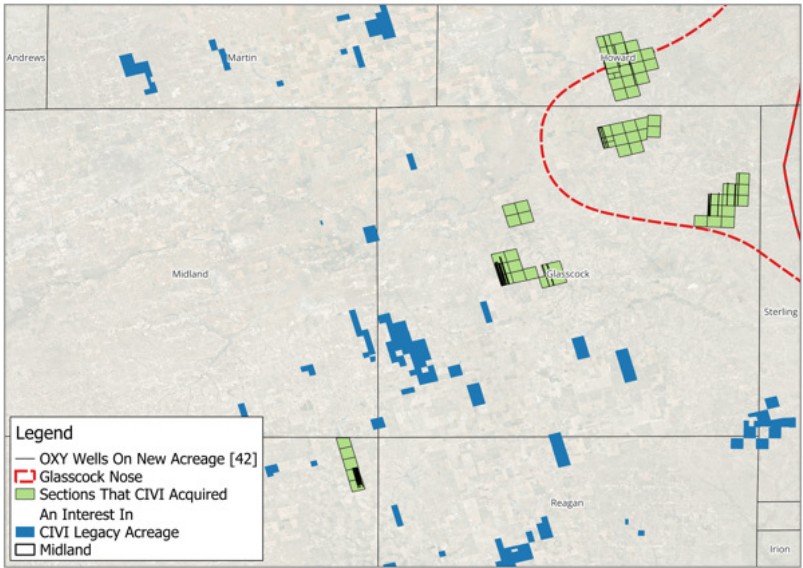

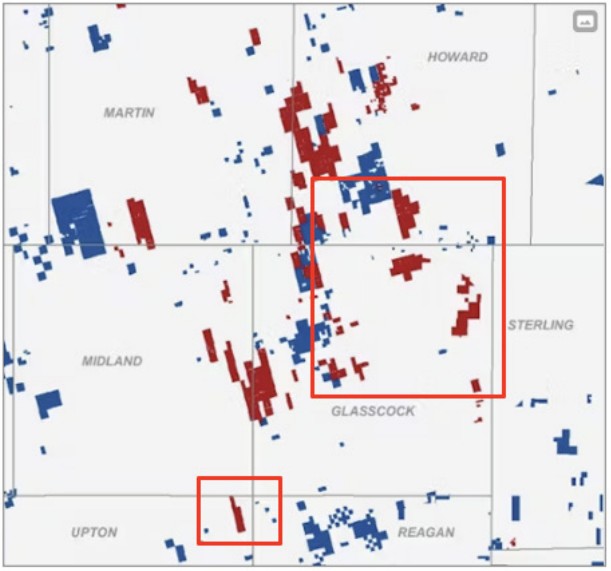

Based on the Midland sections Civitas picked up and existing wells on the assets, analysts at research intelligence firm Novi Labs estimate the sale came from Occidental Petroleum.

Occidental has been divesting assets to reduce debt after a $12 billion acquisition of Midland E&P CrownRock LP last year.

Occidental signed two upstream divestitures totaling $1.2 billion during the first quarter, including non-operated assets in the Rockies and Permian Basin assets “not included in Occidental’s near-term development plan,” the company announced earlier this month.

Oxy declined to comment on its divestiture plans. Hart Energy has reached out to Civitas for more information on the Midland Basin bolt-on.

Novi Labs noted that Civitas’ new Permian assets have exposure to a subsurface feature known as the “Glasscock Nose.”

From the western-to-eastern edge of Glasscock County, the Wolfcamp loses around 2,000 ft of depth; The associated turn-in comes with a loss of pressure and a structural feature that effectively defines the carbonate shelf edge.

Novi estimates that around 65% of the acquired acreage is on or around the flanks of the Glasscock Nose—which currently falls outside the firm’s modeled inventory fairway for the Midland Basin.

“[Civitas’] new acreage will have less depth, more geologic heterogeneity but potentially greater reservoir thickness in some areas,” Novi researchers wrote in a fourth-quarter earnings recap.

RELATED

Occidental to Up Drilling in Permian Secondary Benches in ‘25

Divestiture plans

As Civitas looks to divest $300 million in assets from its portfolio, all options are on the table, Doyle told analysts.

“We’re looking at all types of assets,” Doyle said on Civitas’ earnings call.

Rotating out D-J Basin assets to fund the Midland Basin bolt-on is the top option, Doyle said.

But Civitas is also considering selling assets without associated production, like midstream assets or water infrastructure assets in the Permian Basin.

Civitas also remains open to a larger-scale divestiture to “accelerate value” from its portfolio, Doyle said.

Reports have suggested the company has considered a full exit of its legacy D-J assets in Colorado in a sale valued around $4 billion. Civitas closed on $215 million of smaller non-core D-J divestitures last year.

Civitas held 356,800 net acres in the D-J Basin and 120,400 net Permian acres as of year-end 2024, according to regulatory filings.

Last year, Civitas brought online 13 4-mile D-J Basin wells, “the longest laterals ever drilled and completed in Colorado” and “the highest 180-day cumulative oil-producing wells in the state,” the company said.

Civitas also brought online its first “U-turn” wells in its northeast D-J extension area, which are outperforming expected costs, cycle times and production.

D-J Basin sales volumes averaged 165,400 boe/d during 2024. Permian volumes averaged 179,300 boe/d.

Full-year 2024 production averaged 345,000 boe/d. Oil production averaged 159,000 bbl/d.

Civitas expects 2025 production to average between 325,000 boe/d and 335,000 boe/d. Oil production is forecasted at between 150,000 bbl/d and 155,000 bbl/d.

RELATED

Prairie Operating to Buy Bayswater D-J Basin Assets for $600MM

Recommended Reading

Burgum: US Electrons are ‘Mission Critical’ in Cyber War with China

2025-03-28 - Natural gas will play a key role in feeding energy to tech providers like Microsoft Corp. as China innovates in the AI arms race at breakneck speed, Interior Secretary Doug Burgum said at CERAWeek by S&P Global.

E&P Execs Level Scathing Criticism at Trump's Drill Baby Drill 'Myth'

2025-03-26 - E&P executives pushed back at the Trump administration’s “drill, baby, drill” mantra in a new Dallas Fed survey: “’Drill, baby, drill,’ does not work with [$50/bbl] oil,” one executive said.

14 Energy Execs Send Open Letter to Canadian Government

2025-03-26 - The leaders requested the government to ease environmental regulations and encourage investments to expand the country’s energy industry.

Venture Global Asks FERC to Approve Calcasieu Pass Opening

2025-03-25 - Shell’s CEO says he expects an update to the company’s ongoing arbitration with Venture Global.

In Colorado, the Regulatory Noose Tightens for E&Ps

2025-03-25 - More stringent rules on everything from drilling and orphan wells to emissions is raising the cost of fossil fuel production in the state.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.