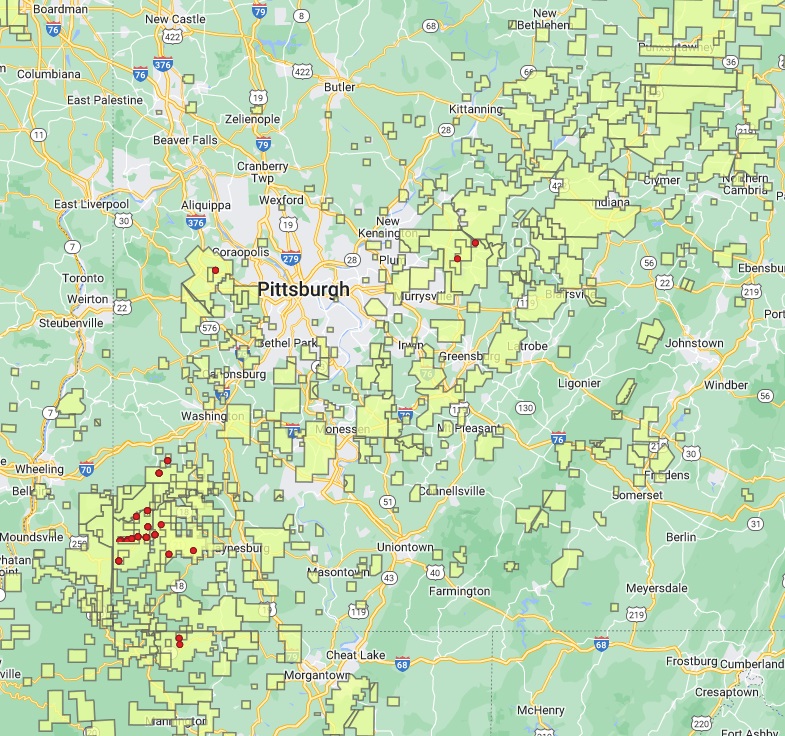

Appalachia gas producer CNX Resources owns leasehold in Somerset County, Pennsylvania (pictured). (Source: CNX, Shutterstock)

CNX Resources leaders are “pretty excited” about early results from two deep Utica gas wells brought online last quarter.

CNX turned in line two of three deep Utica Shale wells the company drilled in Westmoreland County, Pennsylvania, during the second quarter, the Canonsburg, Pennsylvania-based E&P reported July 25.

The two Utica wells were drilled with average lateral lengths of 13,800 ft (~2.6 miles), according to CNX regulatory filings.

Alan Shepard, CFO at CNX, said the two deep Utica gas wells are “absolutely meeting expectations” both on drilling costs and on well performance.

“We’re pretty excited about them,” Shepard said during CNX’s second-quarter earnings call on July 25.

CNX expects to bring the third deep Utica well in central Pennsylvania online during the third quarter.

The bulk of CNX’s core drilling program has focused on Marcellus Shale wells in southwestern Pennsylvania.

CNX reported drilling eight Marcellus wells with average lateral lengths of approximately 14,100 ft (~2.67 miles) during the second quarter; Two wells featured average lateral lengths of 19,800 ft (3.75 miles).

As of year-end 2023, CNX held the rights on 527,000 net Marcellus acres and 607,000 net Utica acres, per regulatory filings.

Overall, CNX’s quarterly production declined to 134 Bcf equivalent due to deferred completions in response to low natural gas prices.

U.S. natural gas prices have been historically low amid a run of overproduction, elevated storage inventories and weaker-than-expected demand during a mild winter season.

Henry Hub gas prices averaged $1.49/MMBtu in March, the lowest average monthly inflation-adjusted price since at least 1997, the U.S. Energy Information Administration (EIA) has reported.

And prices from February through April 2024 were the lowest ever recorded for those months, per EIA data.

CNX said it deferred 11 well completions in response to the challenging macro gas pricing environment. Several other large Appalachia gas producers also slashed drilling and completion activity, including EQT, Chesapeake Energy, Range Resources and Gulfport Energy.

However, CNX’s gas production is expected to climb as the company brings the remainder of its planned 2024 wells online during the back half of the year.

RELATED

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

New Technologies

CNX’s New Technologies segment helped contribute around $21 million in free cash flow during the second quarter.

The uplift came from the monetization of environmental attributes associated with 4.5 Bcf of coal mine methane (CMM), a residual waste released from coal mines for safety purposes.

CNX owns the rights to extract CMM from various active and abandoned mines in Virginia, West Virginia, Pennsylvania and other regions.

The company anticipates extracting between 15 Bcf and 18 Bcf of CMM this year, which is expected to generate approximately $75 million in incremental free cash flow at current market prices.

CNX also made headway with its proprietary CNG technology during the second quarter. In July, CNX used its CNG technology to deliver gas from its pads to the company’s electric frac operations.

CNX also delivered its proprietary CNG technology to its first third-party customer during the quarter. The company plans to give better clarity on the CNG technology’s impact to free cash flow moving into 2025.

RELATED

EQT: Non-op Marcellus Assets Pique International Buyers’ Interest

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

NOV Appoints Former Denbury CEO Chris Kendall to Board

2024-12-16 - NOV Inc. appointed former Denbury CEO Chris Kendall to its board, which has expanded to 11 directors.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.