CNX Resources CEO Nick Deluliis said the deal to buy Apex Energy underscores CNX’s confidence in the stacked pay development opportunities unlocked in the deep Utica. (Source: Shutterstock.com)

CNX Resources will buy the upstream and midstream Appalachian Basin assets of Carnelian Energy Capital Management-backed Apex Energy II for $505 million, the company said Dec. 5.

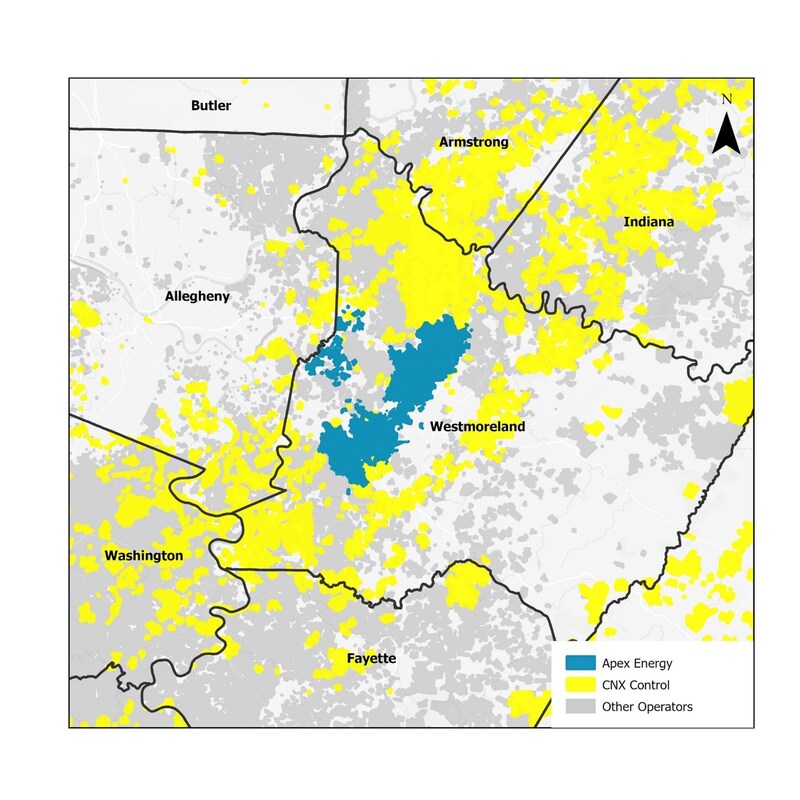

CNX entered into a definitive agreement to acquire Apex’s assets, including 36,000 total net acres (94% held) in Westmoreland County, Pennsylvania. The deal includes 21,000 undeveloped acres—8,600 acres in the Utica Shale and 12,600 in the Marcellus Shale.

CNX said the acquisition strategically expands its existing stacked Marcellus and Utica undeveloped leasehold in the region and provides an existing infrastructure footprint that can be leveraged for future development. The deal comes as natural gas prices continue to struggle but demand from LNG and data centers powergen is expected by analysts to recover in mid- to late-2025.

Operational and other development synergies are expected to add incremental value to the core business in the coming years, the company said.

"This transaction represents a rare opportunity to acquire a highly complementary asset adjacent to our existing operations,” CNX President and CEO Nick Deluliis said. “It underscores our confidence in the stacked pay development opportunities that have been unlocked from pioneering the deep Utica in this region."

CNX said the acquisition would be “immediately accretive” to its free cash flow per share.

“The attractive acquisition price and free cash flow profile of the assets allows the company to maintain its strong balance sheet and preserve significant capital allocation flexibility moving forward,” the company said.

The deal adds a fully integrated gathering midstream. CNX expects 2025 operating costs of approximately $0.16/Mcfe on the acquired assets. The existing infrastructure can be leveraged for future stacked pay development of the Marcellus and Utica, the company said.

For 2025, CNX said it expects daily 2025 production to average 180 MMcfe/d to 190 MMcfe/d. At recent strip prices, it projected 2025 EBITDA of $150 million to $160 million.

Apex is the second Carnelian Energy Capital Management-backed company to be sold this week following Crescent Energy’s agreement to acquire Eagle Ford assets from Carnelian-backed Ridgemar Energy for $905 million.

The Apex transaction will be funded through CNX’s secured credit facility. In May, CNX amended its secured credit facilities, extending the maturities to May 2029 and increasing the total elected commitment amounts to $2 billion. As of Sept. 30, CNX had approximately $1.8 billion of available borrowing capacity under the secured credit facilities.

The deal, subject to certain adjustments, has an effective date of Oct. 1, 2024.The deal is expected to close in first-quarter 2025.

BofA Securities is serving as exclusive financial adviser to CNX. Jones Day is serving as legal adviser to CNX.

Piper Sandler & Co is serving as exclusive financial adviser to Apex and Carnelian. Kirkland & Ellis LLP is serving as legal adviser to Apex and Carnelian.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.