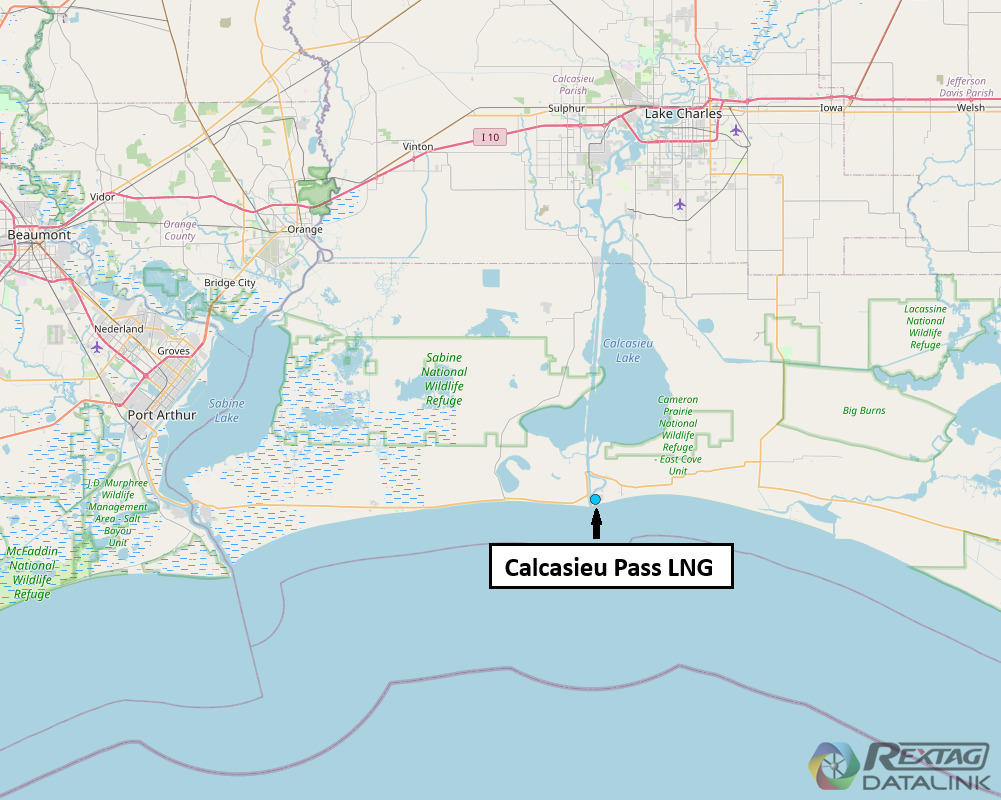

Venture Global (VG) notified its long-term customers that it will start fulfilling its supply contracts for Calcasieu Pass LNG on April 15. (Source: Shutterstock, Venture Global)

Venture Global (VG) notified its long-term customers that it will start fulfilling its supply contracts for Calcasieu Pass LNG on April 15, after months of back-and-forth over the facility’s commissioning status.

Venture Global released a two-paragraph press release on Feb. 17 to make the announcement. The company thanked the construction teams, contractors and the government regulators who had worked with them on the project.

“These efforts now allow us to supply our long-term customers with the full 20-year contract term of the lowest-cost, clean LNG as promised under our contracts, and, with our COD, makes Calcasieu Pass among the fastest greenfield LNG projects completed,” the statement said.

The facility received a final investment decision in 2019 and will commence commercial operations in under 68 months.

Calcasieu Pass began delivering LNG cargoes in early 2022 and has continued since, angering many of its long-term customers, such as Shell (SHEL), Edison (ED) and BP, who filed for arbitration at the end of 2024.

At issue is Venture Global’s categorization that the functioning plant had not been fully commissioned. The long-term contracts were only due to be honored by a commissioned and commercially operational plant, the company argued. Instead, Venture Global sold the LNG cargoes on the spot marked for higher prices.

The long-term customers disagreed and entered arbitration with claims of about $5.4 billion in December. Neither side has given an update on the arbitration’s status.

According to a Feb. 17 report from Bloomberg, Shell released a statement that Venture Global has “proven to be an unreliable supplier and, until we receive our contracted cargoes, we will continue to view them that way.”

While the Calcasieu Pass facility has developed, Venture Global has continued to make moves in the market. Its second facility, Plaquemines LNG, delivered its first cargo in November and is ramping up operations. The company went forward with its IPO on Jan. 24 and was trading at $15.96 per share as markets opened on Feb. 18.

Recommended Reading

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.