Comstock Resources and Aethon Energy each added one well to Texas state production data on the new western Haynesville play, dubbed ‘The Waynesville.’ The oldest has surfaced 2.1 Bcf per 1,000 lateral ft to date. (Source: Comstock)

Comstock Resources’ newest far western Haynesville wildcat IP’ed up to 38 MMcf in a 24-hour test north of Houston, the company reported on July 31.

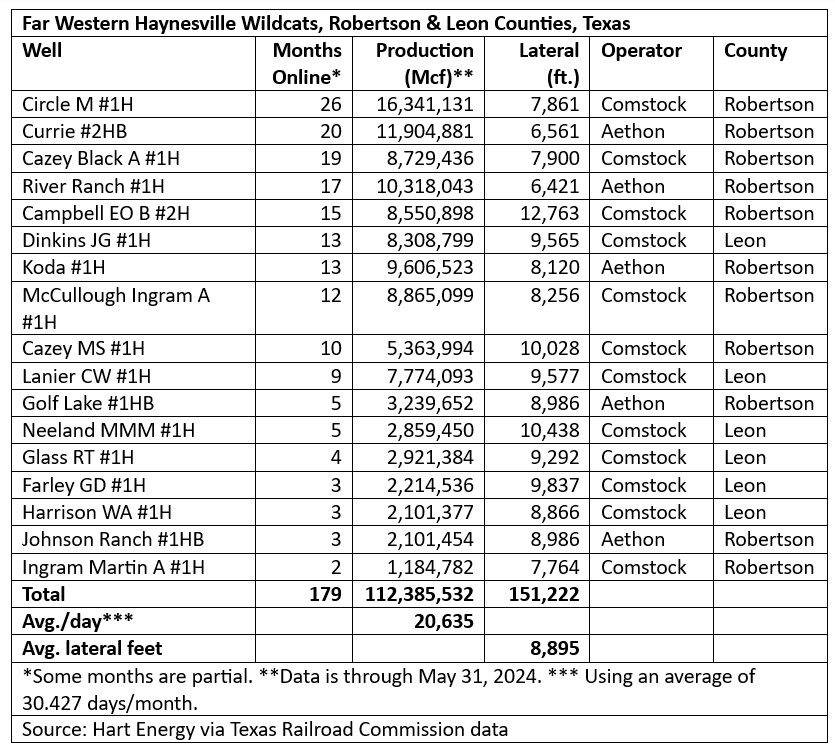

The well, Ingram Martin A #1H in Robertson County, Texas, averaged 27.6 MMcf/d in May, its first full month online, according to Texas Railroad Commission (RRC) data.

It has a 7,764-ft lateral.

Also testing the deep Bossier and deeper Haynesville formations, privately held Aethon Energy added one in March, Johnson Ranch #1HB, also in Robertson County. In its first three months, it’s made 2.1 Bcf from an 8,986 ft lateral, according to the RRC.

The wells bring the new play, which stretches from Robertson into Leon County, Texas, to a total of 17, making 112.4 Bcf to date and averaging 20.6 MMcf/d from wells ranging from 26 to two months old.

The Waynesville

Dubbed the Waynesville by industry members, Comstock’s share of that output is 75.2 Bcf from 12 wells. The company has four more drilled on two two-well pads and completion is expected in the coming months.

“Each one looks fantastic,” Jay Allison, chairman and CEO, told investors and analysts in an earnings call July 31.

Its four latest wells’ IPs were between 35 MMcf and 38 MMcf. In comparison, Comstock’s wells in the traditional Haynesville play in far eastern Texas and northwestern Louisiana had IPs of about 27 MMcf/d.

Comstock also pared drilling days to 54 in the wildcat stepout that is at up to 19,000 ft in vertical depth with laterals up to 12,000 ft.

“Our first wells were 80 days to drill,” Allison said. “Now, the last one has been 54, so these costs are coming down. I think we're getting better and better and better.”

All four of its newest wells that have been brought online are landed in the deeper Haynesville formation underlying the Bossier, which Comstock initially tested in its more than 450,000 newly leased, net acres.

‘Cowboy cash’

At Comstock, the publicly held Haynesville pureplay E&P is continuing to “batten down the hatches” now “during this weak period for natural gas,” Allison said.

The prompt-month natgas contract was trading at $2.04 during the call, according to CME Group data; the 12-month strip was below $3.

“We remain very focused on proving up our western Haynesville play,” Allison said.

To fund the Waynesville program as well as Comstock’s ongoing D&C in the traditional Haynesville play, it issued $400 million of bonds in April and received a $100 million equity injection from its 66.7% owner, Dallas Cowboys owner Jerry Jones.

The $100 million Jones investment was in part to fund the latest acreage adds to the new play. A securities analyst asked on the call, “Should we expect more ‘Cowboy cash’ in the future or is this a kind of one-time thing?”

The land grab is mostly over, Allison said. “We’re just cleaning up the infield.”

$40-million wells?

Industry sources have said the Waynesville wells cost between $20 million and $40 million.

A securities analyst asked, based on “the breadcrumbs provided” by Comstock, if this is the correct way to math the new play: The wells cost 2.0x more than those in the traditional Haynesville and have EURs of 3.5 Bcf to 4 Bcf per 1,000 lateral ft versus 2 Bcf.

“It would seem to us you’re about 50% more expensive but you recover 75% to 100% more gas. Is that [accurate]?” the analyst asked.

Roland Burns, president and CFO, responded: “I don't think that's too unfair. I think the difference really is that [these are] larger reserves that we're finding in the western Haynesville, but it also takes longer to get them out.”

Netherland Sewell & Associates Inc. estimates the new play’s wells may have EURs of 3.5 Bcf per 1,000 ft of lateral. Comstock’s oldest well in the play, the 26-month-old Circle M Alloc #1H, has made 2.1 Bcf per 1,000 lateral ft to date, according to RRC data.

Landed in the Bossier in Robertson County, it came online in April 2022 and has made 16.3 Bcf through May. The lateral is 7,861 ft.

Held back

Wells in the new play are being held back, though, Burns added.

“We’re not flowing [them] at double the rates of the traditional Haynesville. It’s possible we could, but we’re choosing not to do that in this early stage, especially with the low-price environment.”

The returns appear similar right now, “but it’s longer term. It’s an investment in the future.”

Allison added that the 2 Bcf-per-1,000-ft figure for a traditional Haynesville would be “a blue-ribbon well.”

Instead, EURs for wells there range “anywhere from 1.2 [Bcf per 1,000 lateral ft] to maybe 2.2 [Bcf per 1,000 lateral ft]. I mean you may see 2.3.”

He added that, like the original Haynesville play that kicked off in 2008, “the more wells you drill, the lower the costs are.”

The Circle M’s, side-by-side

The Circle M Alloc #1H was drilled from the same pad and landed alongside a horizontal Encana Corp. (now Ovintiv Inc.) tried in 2012 when taking its early 2000s vertical Bossier development in the Amoruso Field lateral, according to the RRC.

The well, Circle M. Ranch-Hoyt Gas Unit #1H, had a 24-hour IP of 22 MMcf on a 20-inch choke from a 4,868-ft lateral, according to the well file.

Casing pressure was 938 psi absolute (psia); shut-in wellhead pressure-tubing, 9,700 psia; and flowing tubing pressure, 12,152 psia.

The bottomhole temperature was 380 F at 16,491 ft. The average shut-in temperature was 227.5 F.

Through this past May, it made 7.9 Bcf since it was turned into sales in November of 2012.

Production peaked at 603 MMcf in March 2013.

That dwindled to 4.1 MMcf in January 2022. Then it was shut in while Comstock was making the Circle M Alloc #1H alongside it in early 2022.

Its first full month back online—July 2022—brought 32.5 MMcf, indicating it underwent a frac hit, but its most recent production was 23.1 Mcf/d or a May 2024 total of 717 Mcf.

Meanwhile, Comstock’s Circle M #1H had a 24-hour IP of 36.7 MMcf from a 7,861-ft lateral on a 28-inch choke. Shut-in wellhead pressure-tubing was 11,900 psia; flowing tubing pressure, 9,488 psia.

Bottomhole temperature was 320 F at 15,980 ft; average shut-in temperature, 100 F.

‘Wrong direction’

KeyBanc Capital Markets analyst Tim Rezvan reported disappointment in Comstock’s D&C costs in a note July 30.

“The heavy drilling activity in the western Haynesville is dragging corporate D&C costs per foot in the wrong direction,” he wrote.

D&C per lateral foot for wells of more than 8,500 lateral ft was $1,730, up from $1,501 in the first quarter, Comstock reported July 30. The difference primarily came from drilling costs: $936/lateral ft, up from $714/ lateral ft in the first quarter and a 2023 average of $660/ lateral ft.

Completion costs were mostly the same in the second quarter as in the first—about $790/ lateral ft—and down from the $883/lateral ft averaged in 2023.

Portfolio-wide, Comstock’s second-quarter production was 1.44 Bcfe/d. Operating costs were $0.84/Mcfe, up from $0.76/ Mcfe in the first quarter but similar to the 2023 average.

After the July 31 call, Rezvan wrote, “We see a tough near-term road ahead for Comstock shares. With leverage over 3.0x and an underhedged—in our view—production stream, we see minimal free cash flow through 2025.”

Cash flow may total $66 million in this and each of the next five quarters.

“We believe management needs to show a much more granular path for meaningful well-cost reductions [in the western Haynesville], while validating informal comments that EURs are roughly twice that of legacy inventory,” Rezvan wrote.

“We believe a positive update on this exploratory area in the next six to nine months is possible, but we are uncertain it is likely.”

Recommended Reading

Apollo Funds Acquires NatGas Treatment Provider Bold Production Services

2025-02-12 - Funds managed by Apollo Global Management Inc. have acquired a majority interest in Bold Production Services LLC, a provider of natural gas treatment solutions.

Nabors Closes $370MM Parker Wellbore Acquisition

2025-03-12 - The acquisition of Parker Wellbore adds a large-scale, high performance tubular rental and repairs services operation in the Lower 48 and offshore U.S. to the Nabors portfolio.

VAALCO Acquires 70% Interest in Offshore Côte D’Ivoire Block

2025-03-03 - Vaalco Energy announced a farm-in of CI-705 Block offshore West Africa, which it will operate under the terms of an acquisition agreement.

Enverus Acquires Pearl Street Technologies to Help Bolster Grid

2025-03-13 - The acquisition of the spinout from Carnegie Mellon University strengthens Enverus’ suite of offerings as it expands deeper into power and energy transition solutions, the company says.

ConocoPhillips to Sell Interests in GoM Assets to Shell for $735MM

2025-02-21 - ConocoPhillips is selling to Shell its interests in the offshore Ursa and Europa fields in the Gulf of Mexico for $735 million.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.