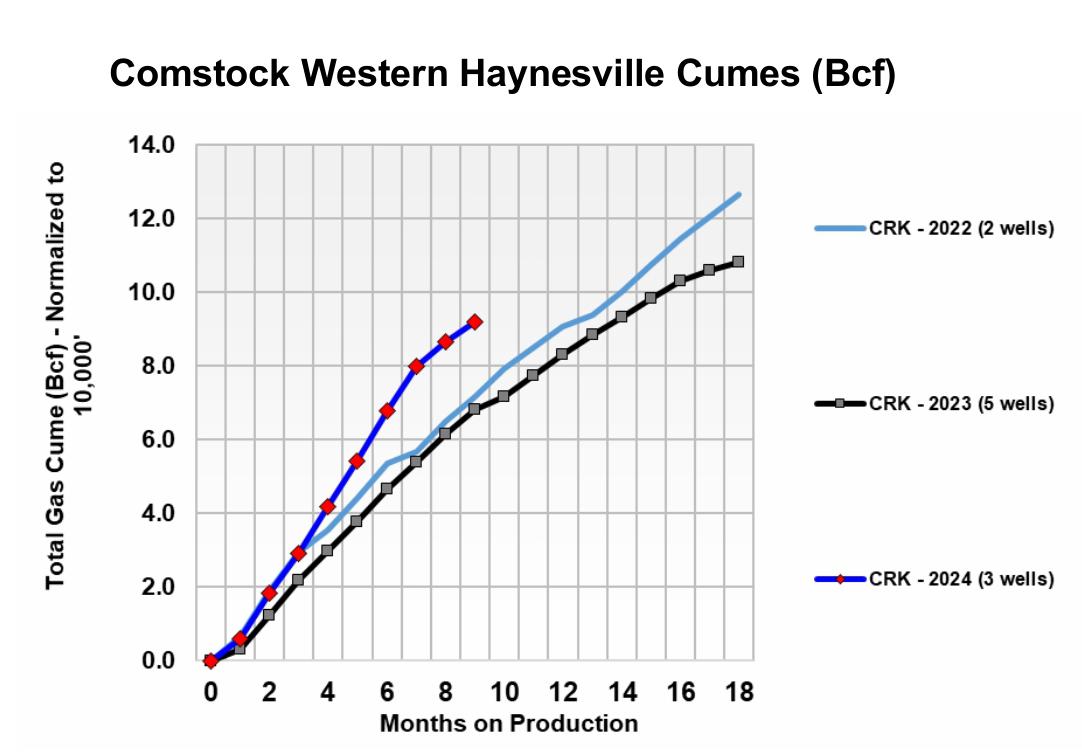

Comstock’s earliest well, Circle M #1H, has produced 18.4 Bcf in its first 33 months online, according to Texas Railroad Commission (RRC) data. (Source: Shutterstock/ Comstock Resources)

Comstock Resources is ramping to four rigs in its far western Haynesville leasehold, planning 20 new wells this year to join the 18 wells it made in its first three years wildcatting.

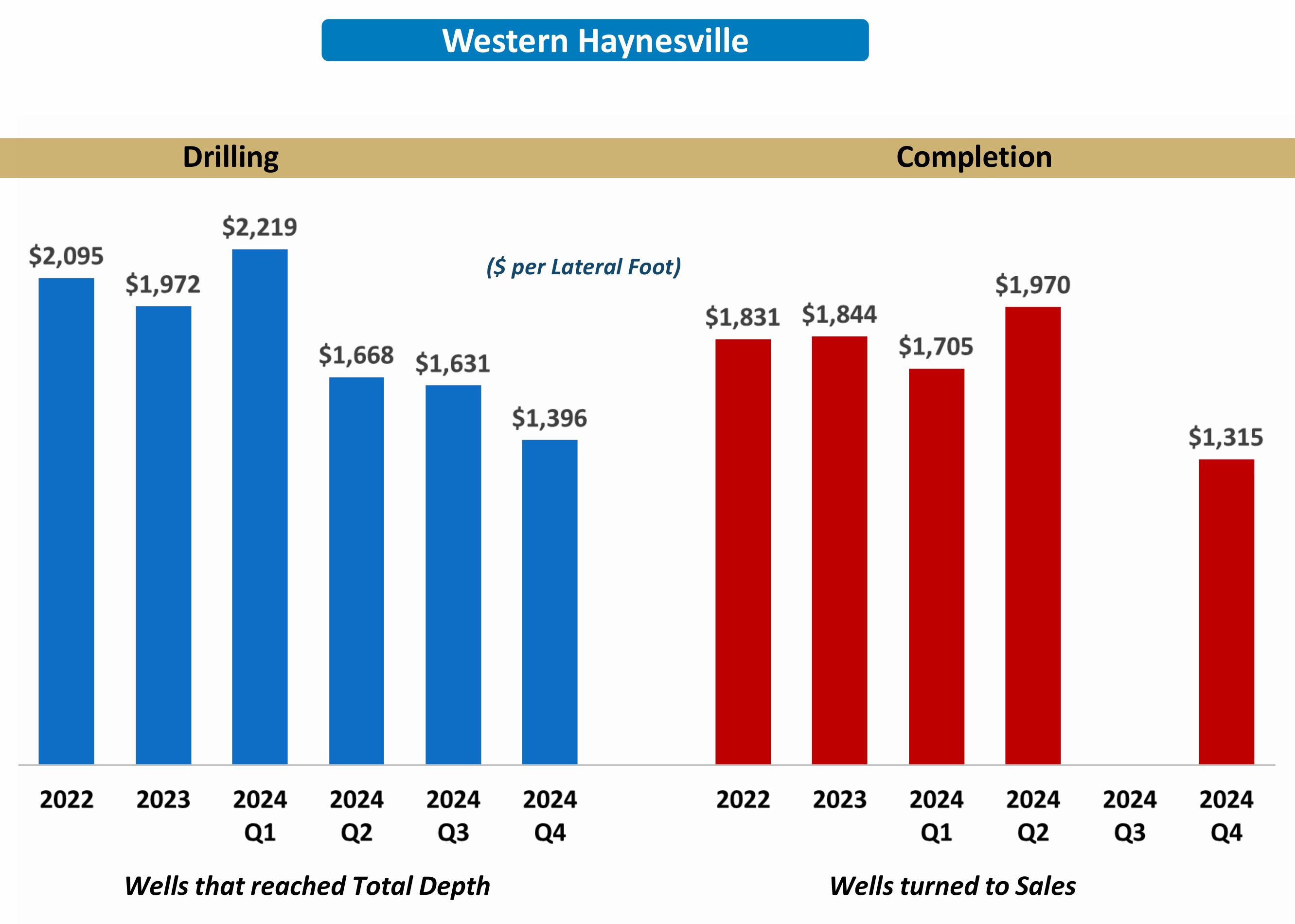

The mega-wells’ D&C cost has declined to $27 million per 10,000 lateral ft for the latest holes, down from $39.3 million in 2022 for the first well, it added.

The latest drilling cost per lateral foot was $1,396, down from $2,095 in 2022; completion cost per foot was $1,315, down from $1,831.

With 18 wells in the play so far, “it was a big enough data set so that we could actually come out and talk about the cost,” Jay Allison, CEO, told investors in an earnings call Feb. 19.

“And in all major Tier One plays, the more you drill the wells and complete them, typically the cost structure comes down.”

Dan Harrison, COO, added that the outsized well costs reflect the play’s outsized D&C task and the volume of gas-in-place it targets.

Comstock’s earliest well, Circle M #1H, has produced 18.4 Bcf in its first 33 months online, according to Texas Railroad Commission (RRC) data.

Based on its 7,861-ft lateral length, cumulative output through December is 2.34 MMcf per foot.

“We are drilling the deepest, hottest stuff,” Harrison said, where the gas in place is well cooked but pressure and temperatures are well cooked as well.

Depth to Haynesville is some 19,000 ft. The temperature is up to 450 F.

“We didn't start out with the easy depths,” Allison said. “The challenge in the western Haynesville was not geological, as we are confident the shale is there.

“The challenge was drilling 10,000-foot horizontal wells at vertical depths of 19,000 feet in temperatures that can exceed 400 degrees.”

Contributing to higher well costs are the treating pressures, which “are definitely much higher down here [versus the legacy Haynesville play northeast] just based on the depth and the frack gradients,” Harrison added.

But “the beauty is the western Haynesville fracks very consistently, so it's been really kind of trouble-free, but it's a lot more horsepower.”

Also, Comstock has been pumping bigger jobs in the western Hayesville: on average, 4,000 lb of proppant per foot versus an average of 3,500 lb in the legacy Haynesville.

“So that’s also part of it,” Harrison said.

Completion costs in the second quarter were $1,970/ft. Harrison said Comstock pumped a bigger frac on the one well that quarter.

“We pumped 6,000 pounds per foot on that well for a data point just to monitor how that well produces in the future compared with all our others.”

Overall, results from all 18 of Comstock’s wells are conservative, he added.

“I'd say we definitely have been conservative on how we're drawing the wells down … and making adjustments on how we do that, manage the draw down, how hard we pull the wells, when we flow them back and clean them up, turn them to sales and then where we set the rate after that,” Harrisons said.

Allison added, “Some of these wells, we tube up; some we don't. It's a big cost variance too. So we figure out what we need to do or not do as we drill more of these wells.”

$4 an acre

The two-rig add to the two-rig play will be purpose-built for the depth, temperature and pressure.

To date, “we’ve de-risked maybe 26 miles of this play,” Allison said.

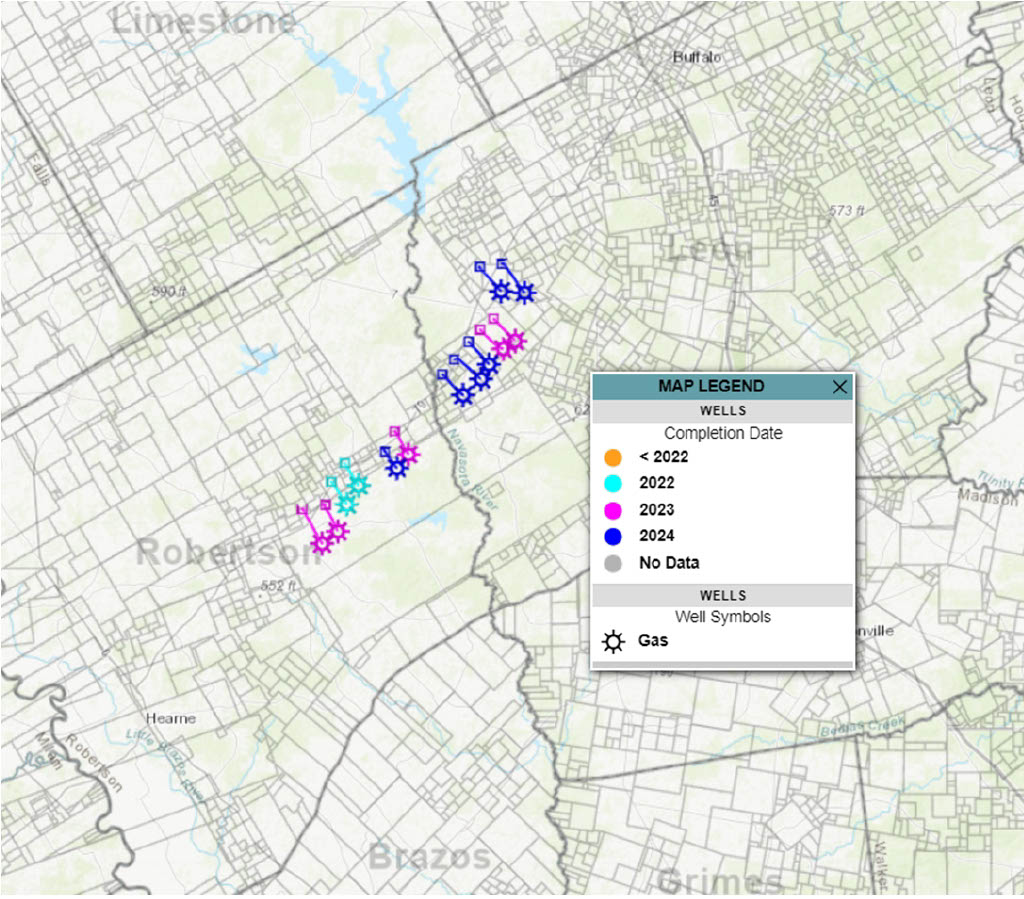

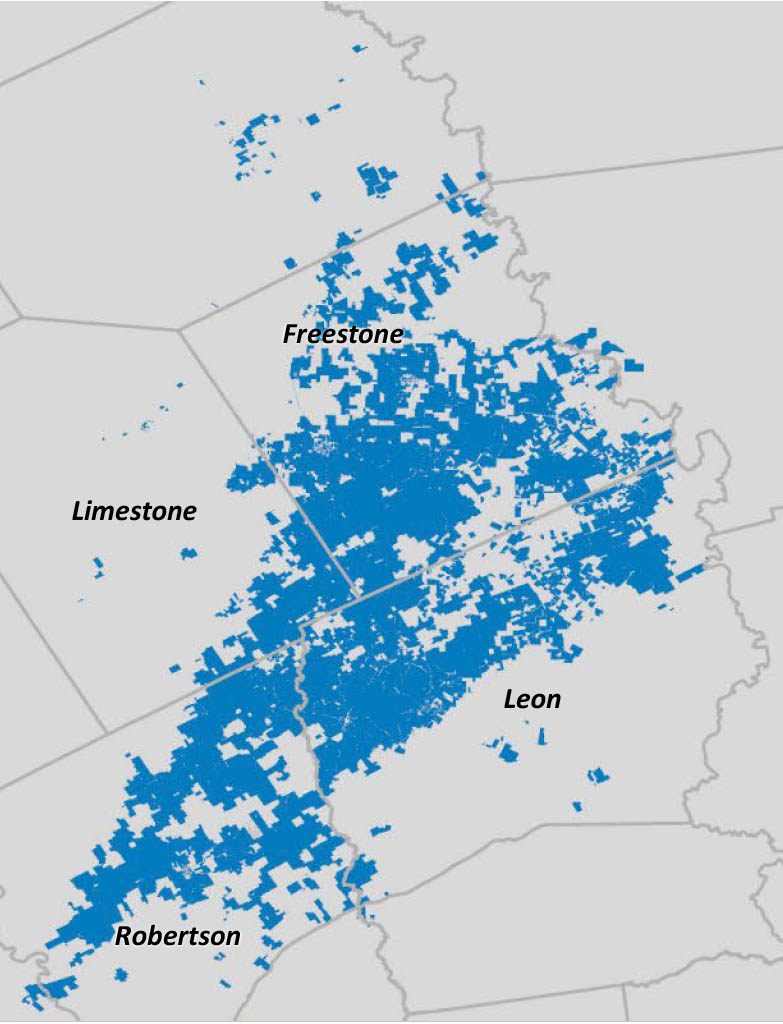

Comstock has leased rights for the Haynesville and the overlying Bossier in a four-county trend in Robertson, Leon, Limestone and Freestone counties, Texas, totaling 697,639 gross acres and 517,624 net acres, mostly contiguous. Half of it was leased for $4 an acre, Allison said.

Revealing a detailed map of its leasehold for the first time, Allison said, “the land grab is over.”

North of the acreage that’s in eastern Robertson and western Leon, the targets are “shallower and a little bit cooler,” Harrison said.

Comstock hasn’t drilled there yet; the leasehold is already HBP, so “it just remains to be seen what the EURs are going to look like,” he said.

“But I would certainly think maybe a hair less, if you just correlate it to depth. But we also expect our D&C costs are going to be a lot lower when we drill up there in the future.”

IPs for the 11 western Haynesville wells Comstock brought online in 2024 ranged from 31 MMcf/d to 44 MMcf/d, averaging 38 MMcf/d from laterals averaging 10,032 ft from a range of 7,764 ft to 12,055 ft.

The first three western Haynesville wells were drilled in 95 days each; in 2024, 57 days each. One was drilled in 41 days in the fourth quarter.

Reducing the drill days in the western Haynesville has come from improved casing-point selections, streamlined casing designs and improved bit selection in the vertical section, Harrison said.

“In the laterals, we're utilizing thermal drill pipe and continue to see more consistent downhill motor performance,” he added.

While costly, “we've accumulated a wealth of knowledge during those early wells that is now paying big dividends for us.”

The results “allowed us to hone in on the good designs for future wells and, as a result, we've been able to reduce our latest D&C capital to a point lower than our original estimates of roughly double what our legacy Haynesville wells cost,” he said.

‘Saw the vision’

Aethon Energy, which has tucked six wells in the play in eastern Robertson in a pocket Comstock doesn’t own, reported well costs of some $23.5 million in a recent interview with Hart Energy.

Comstock began reviewing logs and leasing five years ago. It also bought a midstream plant and gathering infrastructure over the acreage.

Allison said, “The creation of the western Haynesville opportunity is quite a feat for a company of our size.”

He noted the support of Jerry Jones, the Dallas Cowboys owner and holder of 71% of Comstock shares, and the Jones family.

“They saw the vision. They got in the weeds with us as we kept our focus to capture the prize, proving a vast natural gas reserves beneath our 518,000 net acre footprint,” Allison said.

With new demand coming from LNG exporters and from powering AI data centers, “the Golden Age of natural gas is here and we're on the leading edge of technology to unlock the value of the western Haynesville.”

Comstock shares were about $20 during the earnings call, up from about $7 a year earlier. Strip on Feb. 19 was more than $4.

‘Not going to overproduce’

Comstock’s fourth-quarter production was 1.35 Bcf/d, down 12% from a year before as it took a “frac holiday” in the third quarter and dropped two rigs earlier in the year.

Operating costs companywide in the fourth quarter were $0.72/Mcf.

It added 113 new two-mile well locations to inventory in a one-mile stranded, legacy leasehold where it plans horseshoe wells rather than one-mile straight laterals.

Of its six rigs, four are drilling the western Haynesville. Comstock may add a third rig to its legacy leasehold later this year if gas futures remain strong.

New wells in its legacy Haynesville leasehold average 26 days to drill.

Roland Burns, president and CFO, said of gas producers holding the choke on their overall U.S. output, “I think everybody's been very cautious to say, ‘We're not going to oversupply this market and maybe we undersupply it because we're so cautious.’”

Allison added, “We're not going to overproduce.”

The company is adding two rigs to the western Haynesville, but the point there isn’t to increase production.

“We're adding those rigs because that's the best place for us to drill because we need to drill more wells to HBP more of the footprint.”

Meanwhile, he added, “We don't see any E&P company out there out of control on their production rates. None of them.”

Recommended Reading

Trump to Host Top US Oil Chief Executives as Trade Wars Loom

2025-03-19 - U.S. President Donald Trump will host top oil executives at the White House on March 19 as he charts plans to boost domestic energy production in the midst of falling crude prices and looming trade wars.

US Tariffs on Canada, Mexico Hit an Interconnected Crude System

2025-03-04 - Canadian producers and U.S. refiners are likely to continue at current business levels despite a brewing trade war, analysts say.

Pickering Prognosticates 2025 Political Winds and Shale M&A

2025-01-14 - For oil and gas, big M&A deals will probably encounter less resistance, tariffs could be a threat and the industry will likely shrug off “drill, baby, drill” entreaties.

Impacts of Trump’s Tariffs on North American Energy Markets

2025-03-06 - On March 6, President Trump granted exemptions on tariffs for numerous goods imported from Mexico and Canada until April 2, when Trump intends to impose another set of retaliatory tariffs on various countries. What are their immediate and long-term impacts and how can companies mitigate their effects?

Paisie: Impact of Tariffs, Sanctions and ‘Drill, Baby, Drill’

2025-03-07 - The U.S. has the advantage with tariffs on Canada, but sanctions and pleas for increased oil supply are unlikely to be effective.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.