Source: Hart Energy

Concho Resources Inc. (NYSE: CXO) said Jan. 24 it's swapping its stake in a Delaware Basin midstream joint venture (JV) for cash to fund drilling and future deals.

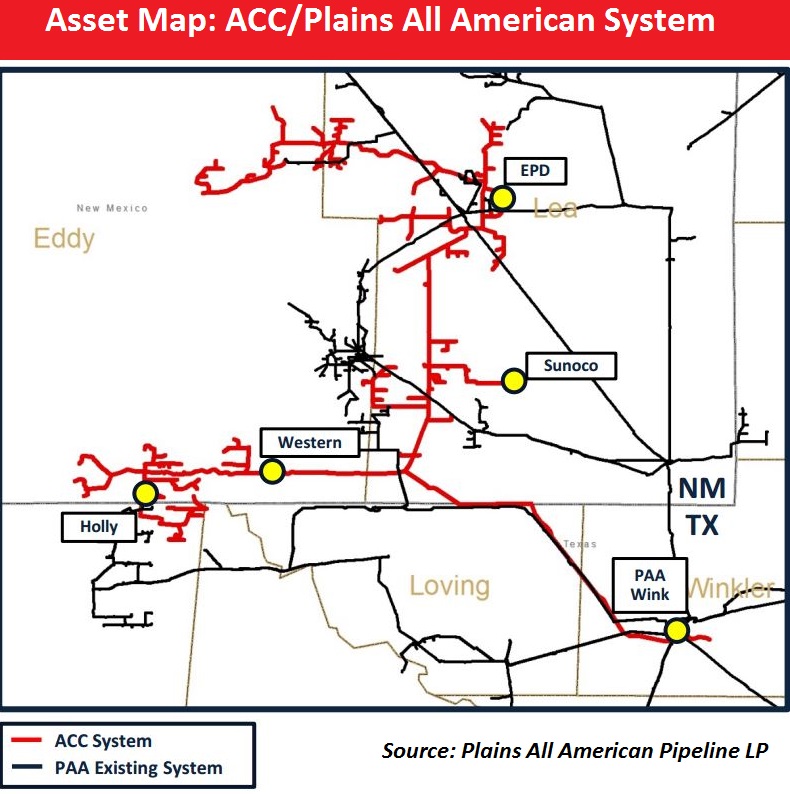

Plains All American Pipeline LP (NYSE: PAA) agreed to pay roughly $1.215 billion to acquire 100% ownership interests in Alpha Holding Co. LLC (ACC), a JV between Concho and Frontier Midstream Solutions LLC. Frontier is a portfolio company of Energy Spectrum Partners.

At year-end 2016, Concho’s net investment in ACC was about $130 million. The company expects net proceeds from its interest in the JV of about $800 million.

ACC owns a newly constructed crude oil gathering system in the Northern Delaware Basin. ACC assets include a 515-mile gathering system as well as crude oil storage facilities, truck terminals and multiple receipt points. The system is anchored by a long-term acreage dedication and area of mutual interest from Concho.

Concho has earmarked sale proceeds for drilling and future acquisitions as well as to reduce long-term debt, according to Tim Leach, Concho's chairman, CEO and president.

“This sale not only represents an exceptional return on investment for our shareholders, but also reflects the quality of the substantial resource potential across the northern Delaware Basin,” Leach said in a statement.

Concho owns 50% of the joint venture with an option to purchase Frontier’s ownership interest at a predetermined multiple of invested capital.

The ACC system was placed in initial service in late 2015 with multiple new well connections made throughout 2016. Fourth-quarter 2016 gathering volumes averaged about 70,000 barrels per day (bbl/d) and shipper nominations for January 2017 totaled about 85,000 bbl/d, Plains said.

Plains said it’s planning to make investments on new interconnects and other enhancements to support the ongoing development of the Delaware.

The transaction is expected to close first-half 2017 and subject to regulatory approvals.

Simmons & Co. International, energy specialists of Piper Jaffray, was Concho's exclusive financial adviser, and Vinson & Elkins was its legal adviser for the transaction. Jefferies LLC was Plain's financial adviser, and Norton Rose Fulbright was its legal adviser.

On Jan. 24, Plains also said it entered agreements with undisclosed companies to sell two noncore assets for about $310 million. The assets include the Bluewater gas storage facility in Michigan and a pipeline segment located in the Midwestern U.S.

Separately, Plains said it closed the sale of an undivided 40% interest in a segment of the Red River Pipeline to a subsidiary of Valero Energy Partners LP for about $70 million. The pipeline extends from Cushing, Okla., to Hewitt, Okla.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

Freshly Public New Era Touts Net-Zero NatGas Permian Data Centers

2024-12-11 - New Era Helium and Sharon AI have signed a letter of intent for a joint venture to develop and operate a 250-megawatt data center in the Permian Basin.

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.