Targa Resources Corp. has entered into agreements on Nov. 1 to source renewable electricity from Concho Valley Solar LLC to provide power to Targa’s natural gas processing infrastructure in the Permian Basin in West Texas. Concho Valley Solar is a joint development between Merit SI and Komipo America, Inc.

Concho Valley Solar initiated construction of the 160 MWac project near San Angelo in Tom Green County, Texas in the fourth quarter of 2021 and is expected to begin delivery of clean, renewable energy during the fourth quarter of 2022. Concho Valley Solar will deliver low-cost, renewable electricity to Targa under a long term power purchase agreement (PPA). This PPA continues to advance Targa’s long term sustainability strategy to reduce its emissions intensity.

As joint owner in much of Targa’s Midland Basin gas processing infrastructure, Pioneer Natural Resources will participate in the renewable electricity sourced from the Concho Valley Solar project, enhancing its emissions reduction initiatives through renewable electricity purchases and related renewable energy credits. The combined support by Targa and Pioneer for this project and potential future joint opportunities exemplifies the commitment of the two companies to be industry leaders in reducing emissions throughout the Midland Basin.

Approximately 150 jobs are expected to be created during the construction phase and increased revenues will be generated over the operating life for Tom Green County taxing entities.

Concho Valley Solar is specially designed to generate clean energy while minimizing impacts to wildlife, habitat, and other environmental resources. The project will utilize high efficiency bifacial solar photovoltaic (PV) modules.

Recommended Reading

Private Equity Gears Up for Big Opportunities

2024-10-04 - The private equity sector is having a moment in the upstream space.

Quantum’s VanLoh: New ‘Wave’ of Private Equity Investment Unlikely

2024-10-10 - Private equity titan Wil VanLoh, founder of Quantum Capital Group, shares his perspective on the dearth of oil and gas exploration, family office and private equity funding limitations and where M&A is headed next.

Companies Take Advantage of ABSs to Finance Acquisitions

2024-10-17 - Some companies have taken advantage of asset-backed securitizations to monetize some of their cash flows and better position themselves for a sale.

Investment Firm Elliot Calls for Honeywell Restructuring in Letter to Board

2024-11-13 - As Honeywell’s largest active investor, Elliott Investment Management’s letter to Honeywell International argued that Honeywell should split into two entities—Honeywell Aerospace and Honeywell Automation.

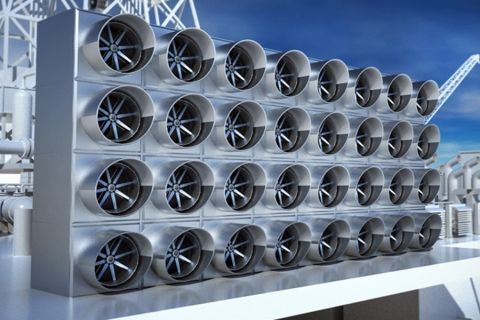

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.