The emerging E&P sold acreage in the Marcellus and Utica shales in Pennsylvania, West Virginia and Ohio as it attempts to reduce leverage prior to spinning off its coal business. (Source: Hart energy)

Consol Energy Inc. (NYSE: CNX) said Aug. 1 it closed or agreed to sell Marcellus and Utica shale assets for about $326 million during second-quarter 2017 as it deleverages in anticipation of spinning off its coal business.

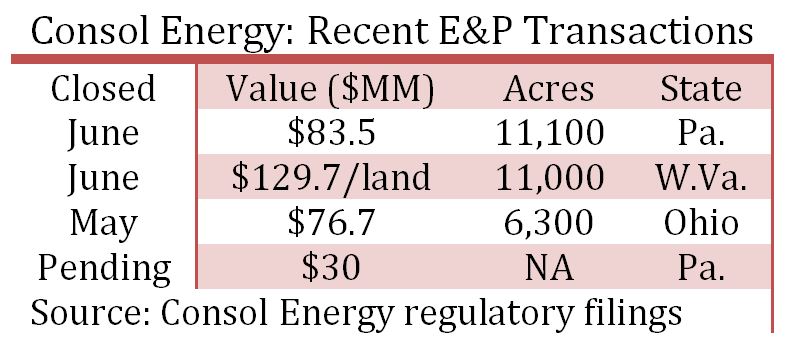

Consol said it recently closed on the sale of 28,400 net acres as well as producing and drilled but uncompleted (DUC) wells in deals in Pennsylvania, West Virginia and Ohio. For the year, the company has signed or closed about $345 million in shale-related deals.

Company leaders also definitively announced they are focused on separating their coal business “no later than year-end 2017.”

“We are at a pivotal point in our transformation as a company,” Nicholas J. DeIuliis, president and CEO, said. “The steady march of continuous improvement was sustained this past quarter in our E&P operations in all phases including drilling and completions.”

Consol said it recently closed four transactions for about $215 million, recording $127 million in gains on the sales.

In the largest of the four, Consol said it received nearly $130 million for assets in Pennsylvania and West Virginia from an undisclosed buyer. The assets included wells with average production of 20 million cubic feet equivalent of natural gas per day.

Consol said the sale comprised:

- 12 proved developed producing wells;

- 15 drilled but uncompleted wells; and

- About 11,000 undeveloped leasehold acres in Doddridge and Wetzel counties, W.Va.

In addition to cash proceeds, Consol received about 2,400 acres in the company’s Wadestown project area in Monongalia County, W.Va.

In the three other deals, the company sold non-producing and scattered Marcellus and associated Utica shale acres in Westmoreland, Washington and Allegheny counties, Pa., for a total of about $85 million.

Consol also expects to close another Marcellus transaction in Allegheny and Westmoreland during the third quarter for about $30 million.

All told, Consol’s recently closed deals included 22,500 Marcellus Shale acres, along with associated Utica Shale acreage in Pennsylvania.

“Closed asset sales did not disappoint and beat our prior stated goals, helping to drive our leverage ratio down to 3x at quarter-end, with an undrawn credit facility and $300 million of cash on hand,” Deluliss said. “To top things off, we are fully immersed in preparing to spin and separate the coal and E&P businesses.”

With no additional asset sales beyond those under contract or closed, Deluliis said Consol should finish the year at a leverage ratio in the mid-2x range.

“Additional asset sales that get us to the $600 million end of our asset sale guidance range would drive leverage ratio even lower,” he said.

However, the company missed consensus production estimates by about 9% due to delays at Utica pad drilling sites, said Zach Parham, a Jefferies analyst.

Parham noted the company also raised its 2017 capex by about 14% while “maintaining fiscal-year 2017 production guidance” and lowered its E&P guidance by $55 million.

Consol’s gas assets are primarily coalbed methane, Marcellus Shale and Utica Shale. The E&P division reported 5.73 Tcfe of proved reserves at the end of 2013, according to Jefferies.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

EQT’s Rice: ‘Wake Up’ to Anti-Energy Movement

2024-11-08 - In the face of growing opposition to fossil fuels and energy infrastructure, EQT CEO Toby Rice pulled out a rallying cry at Hart Energy’s DUG Appalachia conference: “Wake up!”

Pickering Prognosticates 2025 Political Winds and Shale M&A

2025-01-14 - For oil and gas, big M&A deals will probably encounter less resistance, tariffs could be a threat and the industry will likely shrug off “drill, baby, drill” entreaties.

Exclusive: Arbo Monitoring Courts, Congress Amid Energy Policy Shifts

2024-12-09 - Chip Moldenhauer, CEO and founder of energy analytics company Arbo, gives insight into regulatory impacts the energy sector should watch for entering 2025, in this Hart Energy Exclusive interview.

Belcher: Trump’s Policies Could Impact Global Energy Markets

2025-01-24 - At their worst, Trump’s new energy policies could restrict the movement of global commerce and at their best increase interest rates and costs.

Analysts: DOE’s LNG Study Will Result in Few Policy Changes

2024-12-18 - However, the Department of Energy’s most recent report will likely be used in lawsuits against ongoing and future LNG export facilities.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.