Constellation will pay Calpine $4.5 billion cash and 50 million shares of Constellation stock. (Source: Shutterstock)

Constellation Energy (CEG) will acquire Calpine Corp., a natural gas power generation company, in a cash-and-stock deal valued at $16.4 billion, the companies said Jan. 10. Constellation will also assume Calpine’s net debt of $12.7 billion.

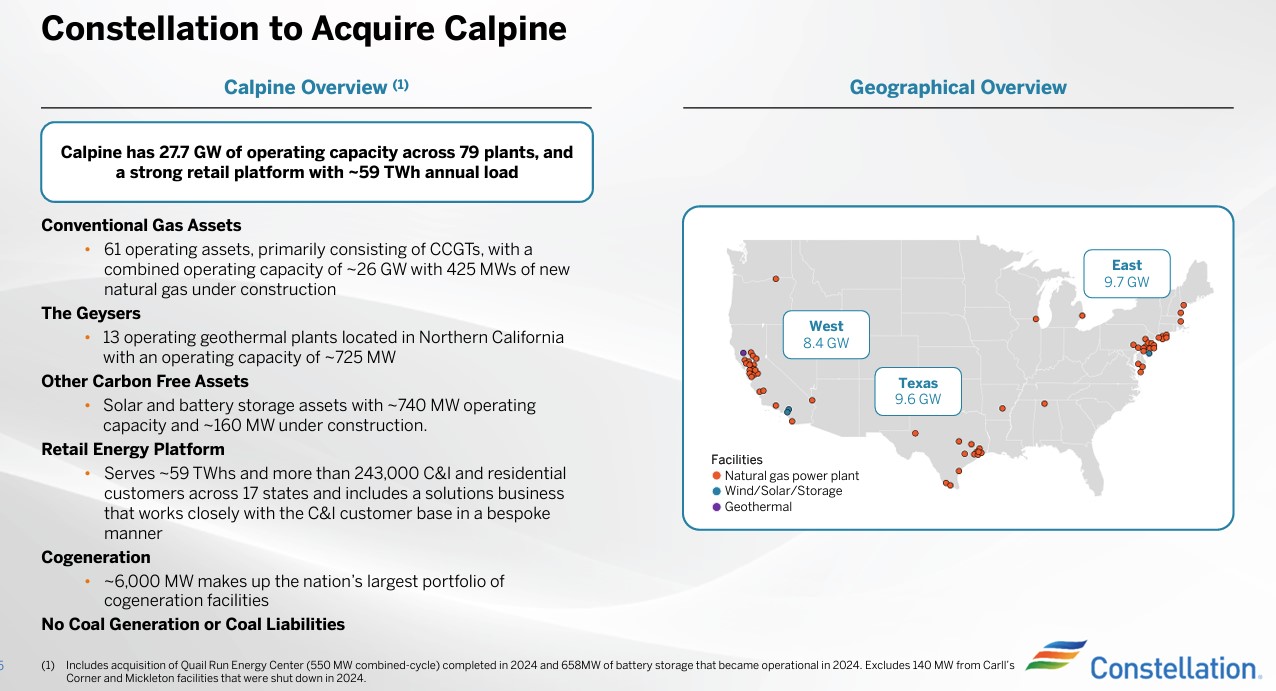

Constellation, a nuclear power generation company, said Calpine will add “low-emission natural gas generation and an expanded renewable energy portfolio, including the largest geothermal generation operation in the U.S.”

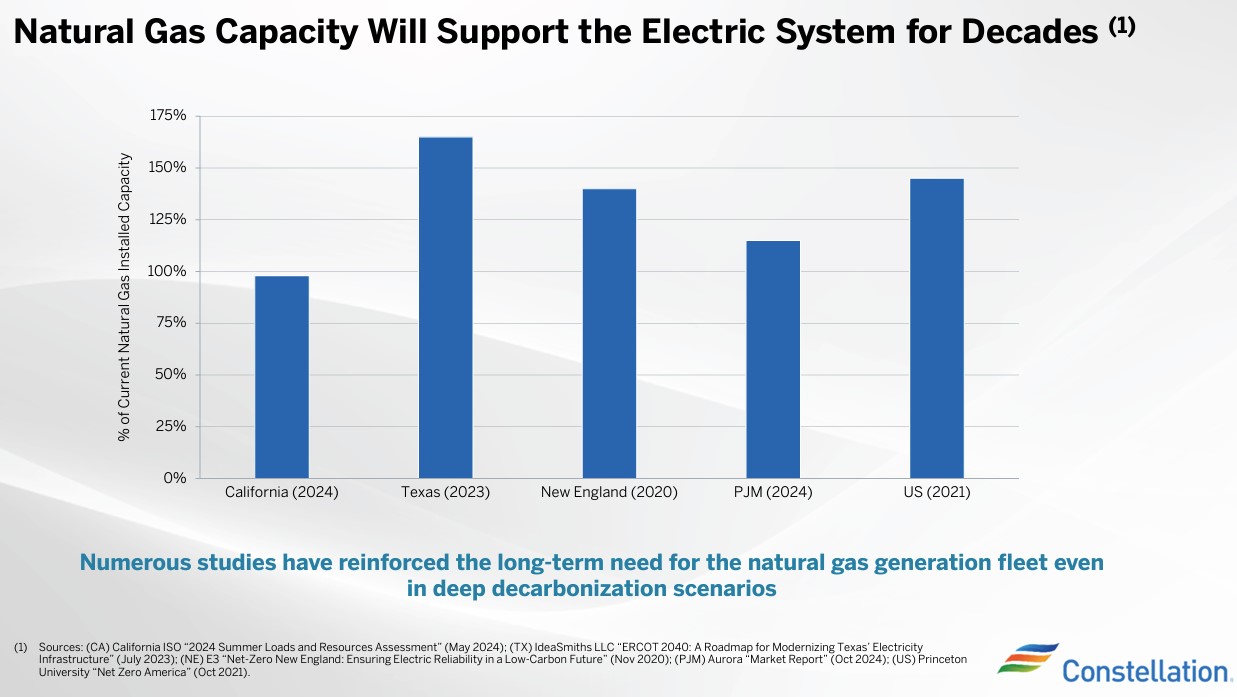

The megadeal centers on natural gas for power generation, which Constellation said will be needed for decades “even in deep decarbonization scenarios.”

The acquisition comes as Constellation and other power generation companies are scrambling to meet power demand needs for data centers. Microsoft and Constellation struck a deal in September to restart the Three Mile Island nuclear plant’s Unit 1 reactor in Pennsylvania to power new data centers.

However, Constellation faces major tests from multiple state and federal regulators as it seeks to become what S&P Global described as the “largest coast-to-coast power generator.”

If successful, the deal would transition Constellation from pure-play nuclear to a more diversified, gas-heavy player similar to Vistra Corp., according to Enverus Intelligence Research (EIR).

“CEG is highly regarded by investors for its heavy tilt toward stable, lower-risk nuclear power generation, which accounts for nearly 90% of its output,” said Scott Wilmot, an EIR analyst. “The Calpine portfolio, which is predominantly gas, carries significantly higher commodity risk. While the acquisition price appears fair, the shift in CEG’s risk profile could lead to a higher risk premium being priced in, potentially putting downward pressure on its stock.”

RELATED

BYOP (Bring Your Own Power): The Great AI Race for Electrons

Largest natgas fleet

Constellation and Calpine’s combined generation capacity will be nearly 60 gigawatts (GW). Pro forma, the company’s footprint will span the Lower 48 and include a significantly expanded presence in Texas, the fastest growing market for power demand, as well as other key strategic states, including California, Delaware, New York, Pennsylvania and Virginia, the companies said.

Calpine owns about 27.7 GW of generation concentrated in Texas (~10 GW), PJM/New England (~10 GW) and California/West (~8 GW), Jefferies analyst Paul Zimbardo wrote in a Jan. 10 research note.

“This includes 26 GW gas, 725 MW high value California Geysers, ~740 MW batteries…,” Zimbardo said. As of Dec. 31, 2023, Calpine “had 17.5 GW combined cycle, 6.0 GW combined cycle co-generation, 2.4 GW simple cycle and 809 MW renewables. Purely on generation basis, this implies ~$1,050/kW across technologies.”

The key question will be whether the deal can secure regulatory approval, Zimbardo said. Constellation disclosed that it will propose “limited” PJM asset sales to address concentration as part of its Federal Energy Regulatory Commission (FERC) mitigation plan.

“Approvals include FERC, US Department of Justice and New York Commission. CEG discloses ‘other filings’ including Public Utilities Commission of Texas and twenty states. Management expects significant interest in the proposed divestitures packages and its accretion includes ‘aggressive elements,’” Zimbardo said. “Given the increased political and overall attention on power demand, we would expect a protracted process and likely opposition from stakeholders, including regulated utilities.”

The deal also broadens Constellation’s renewable portfolio, including the Geysers facility in Northern California, the largest geothermal generator in the U.S, the company said. Following the merger, Constellation will serve 2.5 million customers.

“This acquisition will help us better serve our customers across America, from families to businesses and utilities,” said Joe Dominguez, Constellation’s president and CEO. “By combining Constellation’s unmatched expertise in zero-emission nuclear energy with Calpine’s industry-leading, best-in-class, low-carbon natural gas and geothermal generation fleets, we will be able to offer the broadest array of energy products and services available in the industry.”

Aneesh Prabhu, Power & LNG Infrastructure managing director for S&P Global Ratings, said the firm sees “the generation fleets as complementary and owning generation as credit favorable in the short-to-medium term.”

The combined company will be the largest independent power producer in North America, Prabhu said.

S&P affirmed Constellation’s BBB+ credit rating and noted the company is poised to be the largest operator of clean and firm nuclear generation at scale; the largest natural gas generation fleet; and the largest geothermal operation.

Deal metrics

Constellation will pay Calpine $4.5 billion cash and 50 million shares of Constellation stock. After accounting for the cash expected to be generated by Calpine between signing and the expected closing date, as well as the value of tax attributes at Calpine, the net purchase price is $26.6 billion, “reflecting an attractive acquisition multiple of 7.9x 2026 EV/EBITDA,” the company said.

EIR’s Wilmot said that at a 7% weighted average cost of capital, EIR’s “bottom-up valuation of Calpine’s generation fleet is an estimated ~$29.5 billion, or 10.6x 2026 EBITDA.”

Constellation said the transaction is expected to deliver immediate adjusted operating earnings per share (EPS) accretion of more than 20% in 2026 and at least $2 per share of EPS accretion in future years. The deal is projected to add more than $2 billion in annual free cash flow.

“Constellation’s base earnings outlook is expected to continue growing at a double-digit rate through the decade,” the company said.

Based on Calpine’s performance through Sept. 30, fiscal year 2024 suggests $2.8 billion in adjusted EBITDA and ~$1.8 billion in free cash flow, Zimbardo said.

“Considering the $11.9 [billion] equity and $4.5 [billion] cash payment for $16.4 [billion] equity value and $2 [billion]+ additional FCF, this represents an attractive 12%+ free cash flow yield,” he said.

Constellation said Calpine’s owners, led by Energy Capital Partners (ECP), Canada Pension Plan Investments and Access Industries, have agreed to an 18-month lock-up of stock they receive as consideration for the deal, subject to a schedule of potential sales.

The transaction is expected to close within 12 months of signing, subject to the satisfaction of customary closing conditions, antitrust clearance and other U.S. federal and state and Canadian regulatory approvals, the company said.

Constellation will continue to be headquartered in Baltimore and maintain a significant presence in Houston where Calpine is currently headquartered.

Lazard is serving as financial adviser to Constellation. J.P. Morgan Securities LLC is also serving as financial adviser to Constellation. Kirkland & Ellis is serving as legal counsel.

Evercore served as lead financial adviser to Calpine. Morgan Stanley & Co. LLC, Goldman Sachs & Co. LLC and Barclays US are serving as additional financial advisers to Calpine and ECP. Latham & Watkins and White & Case are serving as legal counsel.

Recommended Reading

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Riverstone’s Leuschen Plans to IPO Methane-Mitigation-Focused SPAC

2025-01-21 - The SPAC will be Riverstone Holdings co-founder David Leuschen’s eighth, following the Permian Basin’s Centennial Resources, the Anadarko’s Alta Mesa Holdings and the Montney’s Hammerhead Resources.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.