CorEnergy plans to pursue an over-the-counter listing for the shares of common stock. (Source: Shutterstock/CorEnergy)

Pipeline operator CorEnergy Infrastructure Trust, which filed for Chapter 11 bankruptcy protection in February, is on the path to emerging from the process after a court has confirmed the company’s reorganization plan.

Chairman and CEO Dave Schulte said the company’s sale of its MoGas and Omega pipelines and full repayment of its secured debt had encouraged stakeholders to vote for recapitalizing the company’s balance sheet.

“These transactions were the result of a comprehensive strategic review process in which our board and advisors analyzed all reasonably available alternatives given the challenging market conditions we have faced since 2020,” Schulte said in a press release.

In May 2023, the company said it would sell MoGas and Omega for approximately $175 million.

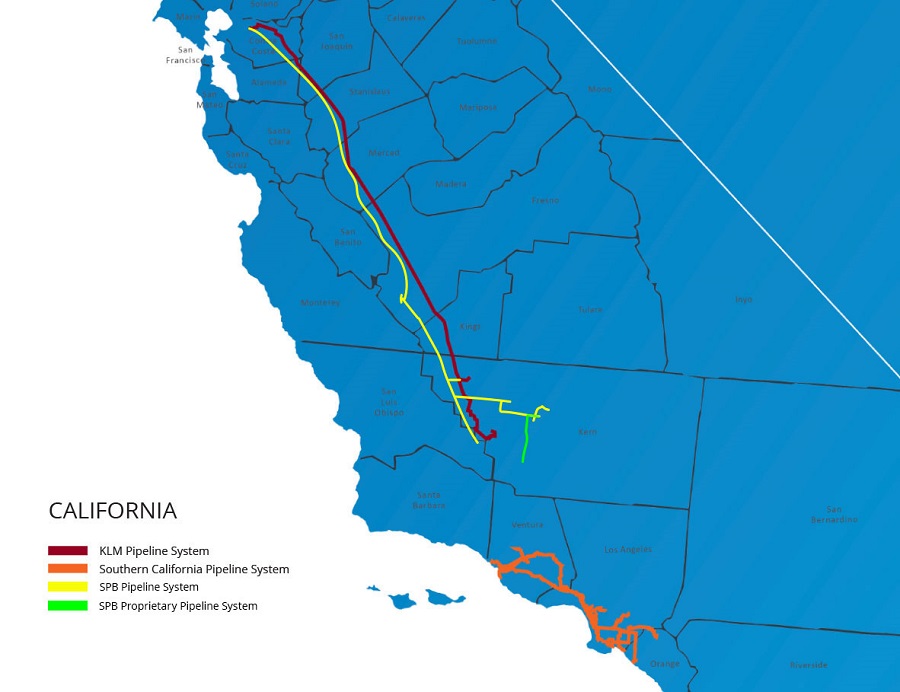

Throughout the bankruptcy, CorEnergy’s Crimson midstream assets, which span northern, central and southern California, have continued to operation without interruption.

“Crimson Pipeline has operated as usual throughout the company’s restructuring process and is expected to continue doing so,” said Robert Waldron, president of CorEnergy. “We await a decision on our requested San Pablo Bay rate relief before the California Public Utilities Commission to ensure the viability of the Crimson Pipeline assets, which we anticipate in late 2024. We also continue to evaluate potential opportunities to redeploy our assets into energy transition.”

Under the reorganization plan, confirmed on May 24, holders of CorEnergy’s 5.875% Unsecured Convertible Senior Notes and existing preferred equity would own the company’s common stock.

CorEnergy plans to pursue an over-the-counter listing for the shares of common stock, which will provide “liquidity for its equity owners while reducing overhead expenses to a level commensurate with its smaller size.”

The company expects to post an investor presentation about the plan before emergence, which the company expects on June 12.

Husch Blackwell LLP served as legal counsel to the company, Teneo Capital LLC as its financial adviser and Miller Buckfire as its investment banker. Faegre Drinker Biddle & Reath LLP served as legal counsel to an ad hoc group of noteholders and Perella Weinberg Partners and TPH&Co., the energy business of Perella Weinberg Partners, as its investment bankers.

Recommended Reading

Shale Outlook: E&Ps Making More U-Turn Laterals, Problem-Free

2025-01-09 - Of the more than 70 horseshoe wells drilled to date, half came in the first nine months of 2024 as operators found 2-mile, single-section laterals more economic than a pair of 1-mile straight holes.

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.