Coterra Energy is taking its promising dual-landing Harkey sandstone and Wolfcamp shale “row” development on the road, adding 49,000 net acres contiguous to its own blocked-up sections in the northern Delaware Basin.

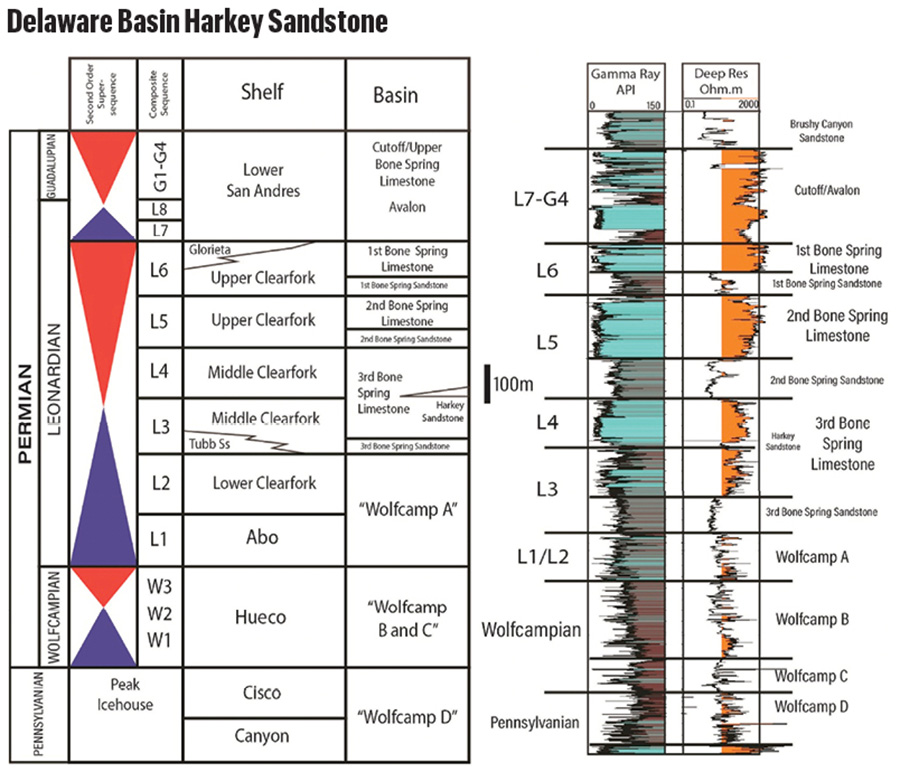

The E&P’s Culberson County, Texas, monster-sized multiple drilling-spacing-unit (DSU) row projects are landing laterals in the Harkey, which is at about 8,000 ft of the roughly 3,000-ft Bone Spring series of benches, overlying laterals in Wolfcamp at about 9,000 ft.

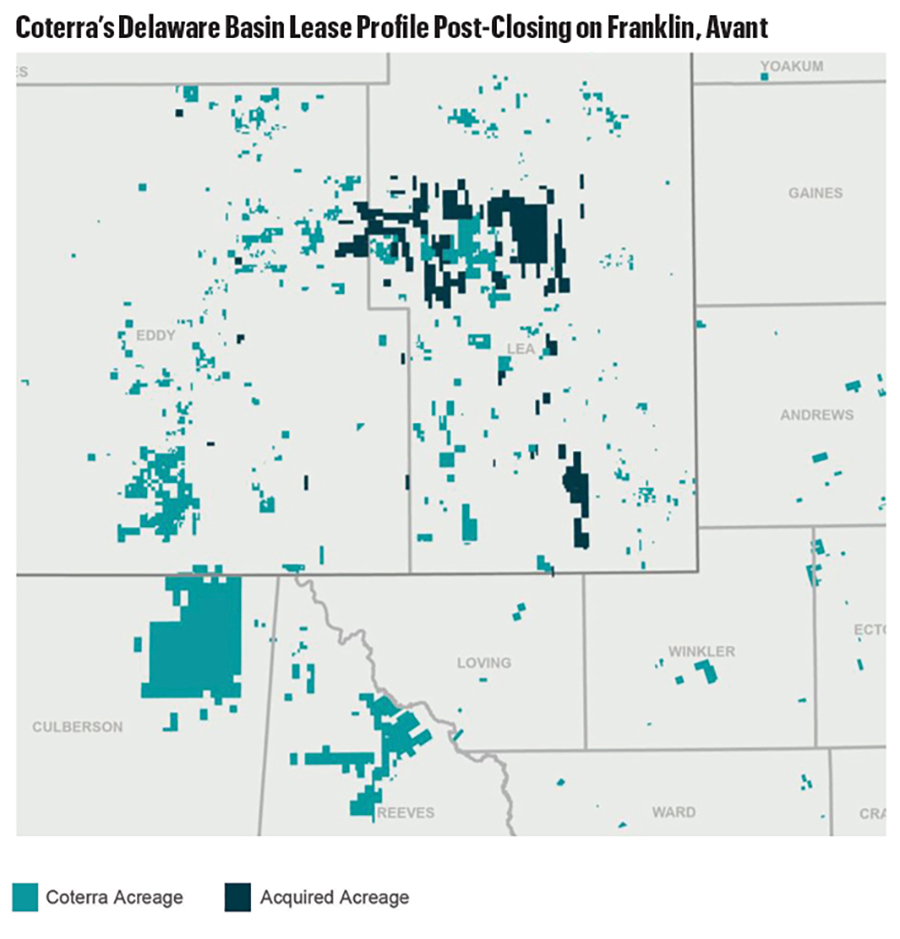

The additional Lea County, New Mexico, leasehold it is adding now will come from Franklin Mountain Energy and Avant Natural Resources for $4 billion of cash and stock.

To date, Coterra’s dual-zone, row developments have focused exclusively on Culberson County.

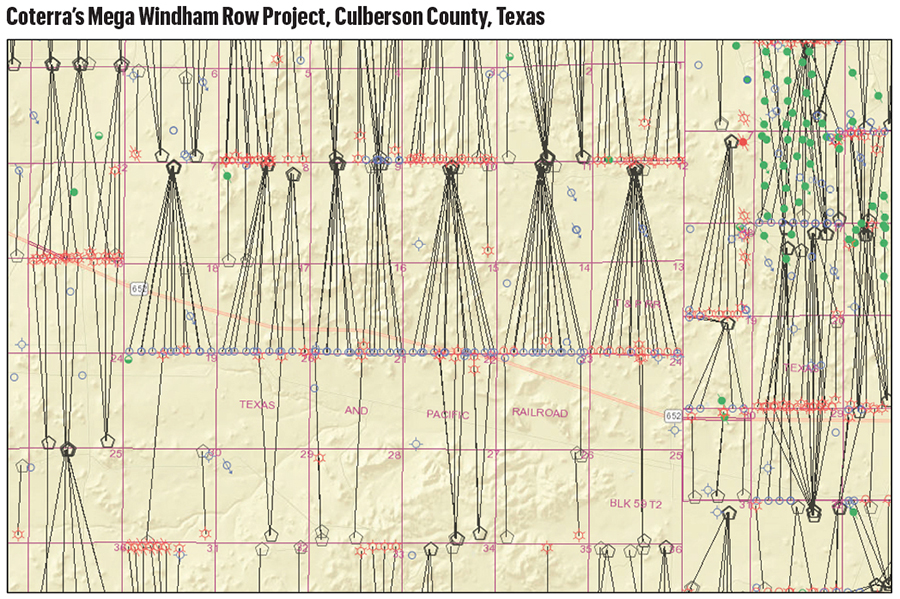

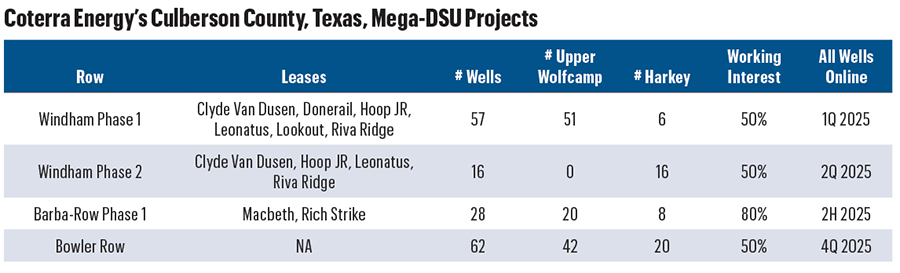

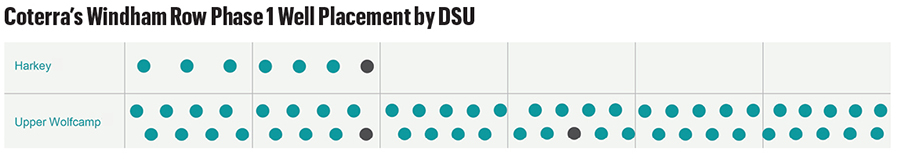

And the latest—73 2-mile wells across 12 sections in six DSUs—is underway with 51 wells in Wolfcamp and 22 in Harkey.

Coterra reported in November that 36 wells of the first 57 wells are online now and 10 more will be turned in line (TIL) by year-end with the last 11 going into sales in the first quarter.

The company expects to follow this with 16 more wells—all in Harkey—in 2025.

Prewit-Barbaro 23 Row

While results are not yet available from that project, known as “Windham Row,” first-10-month production data from an initial Harkey-Wolfcamp dual-development row test, Prewit-Barbaro 23, suggest success.

The 13-well project in Culberson County put four 2-mile laterals in Harkey and the other nine in Wolfcamp, according to Texas Railroad Commission (RRC) files.

In the four Harkey wells’ first 10 months through August—the latest month for which the RRC reported data by mid-November—they produced a total of 885,357 bbl of condensate or about 726 bbl/d each.

The nine in Wolfcamp produced 2.15 MMbbl of condensate combined in their first 10 months online for an average of 784 bbl/d each.

What differentiates the two zones is the associated gas. From the Wolfcamp, gas averaged 3.7 MMcf/d per well, while the Harkey wells made 3 MMcf/d each or about 19% less.

Also different is the gas and condensate Mcf-to-bbl ratio in the wells’ 10th month online. The four Harkey wells’ ratios in August ranged from 3:1 to 8:1, while the Wolfcamp wells averaged 7:1 to 10:1.

In November 2023, the 13 wells’ first full month online, each began with a ratio of between 3:1 and 4:1, according to RRC data.

Meanwhile, the full first-10-month average for the Harkey wells was between 3:1 and 5:1, while the Wolfcamp wells averaged between 4:1 and 5:1.

Staged TILs

Based on the Prewit-Barbaro 23 project and Coterra’s early findings from Windham Row’s first 36 wells, “in a nutshell, our results have been outstanding and we expect similar projects to be a part of our program for many years to come,” Coterra Chairman, President and CEO Tom Jorden told investors in early November.

“Our Windham Row has confirmed what we have stated all along: These projects are well calibrated and highly predictable.”

When plans for Windham were announced in 2023, he said “this is exactly what our shale era is needing.

“We can take advantage of infrastructure. We can take advantage of operational efficiencies, … our electrification and … minimizing any kind of parent-child interference.”

With Windham, Coterra is bringing wells online in time rather than all at once, he added in an investor call this spring.

“Doing them in stages allows us to … not have to build facilities for absolute peak production—because these wells do decline.”

If tank batteries are built for peak production, “you find that very early in their life they’re underutilized.”

‘All A-grade’

Coterra hasn’t made data public yet on returns from the Harkey interval versus the Upper Wolfcamp and the first and second Bone Spring.

Jordan said in early November, “Averaging is always difficult. Basin-wide, we would say the Harkey is outstanding but slightly less than the Upper Wolfcamp. It depends on where you are.”

But they’re all good wells, he added. “We’re also seeing some … really nice results from that section above the Harkey—the Second Bone Spring and First Bone Spring—in particular areas of the basin,” Jorden said.

“So, look: It is just a question of A++, A+ or A. These are all A-grade returns and we’re delighted to have them.”

Blake Sirgo, Coterra senior vice president, operations, said data would be shared when all 57 wells in Windham’s first phase are online. Meanwhile, the project is “ahead of schedule, below cost and initial production results look strong.”

Row Science-ing

As for completing in the Harkey, “we’ve learned to do a little different completion, whether we’re in a sand or shale,” Jorden said in a 2023 call.

As for losing some well-by-well subsurface learnings as a large row project is being made, “that is a two-edge sword,” he added.

On the one hand, Coterra can make it a science project since 73 wells in a row creates a rare opportunity for a control-and-variable test.

“One of the things that is vexing in our space is, if you have an individual small project and you march off and change some parameters, you don’t always have that control experiment to compare it to,” Jorden said.

But a 73-well project “will have the opportunity to have several subtests within that and have good offset control [to] really normalize out some of the geologic and other attributes that can cloud your conclusions.”

Row-ing North

Sirgo wished in the Nov. 1 call that Coterra could take the row projects on the road. It’s been unique for Coterra in Culberson County where it and Chevron control four contiguous townships in a joint development area.

Coterra is the county’s No. 1 producer with 14.2 MMbbl of condensate this year through August, with Chevron following at No. 2 with 9.2 MMbbl, according to RRC data.

The pair have the county mostly locked up as the No. 3 producer made 1 MMbbl through August.

Sirgo’s wish was granted Nov. 13 as Franklin and Avant signed to sell, creating a large, blocked-up Coterra leasehold in Lea County where Coterra has made laterals since 2010, operating as Cimarex Energy.

The Franklin and Avant purchases are Coterra’s first M&A deals since it emerged from the merger of Cimarex and Cabot Oil & Gas in October 2021.

The November deal comes with 49,000 net acres, 85% operated, and between 400 and 550 future well locations. The acres are adjacent to existing Coterra leasehold.

Targets are Bone Spring, Harkey and Avalon, as well as the underlying Lower Wolfcamp and potential for Pennsylvanian shale development.

The future-well count assumes between four and eight wells per section and an average lateral of 9,500 feet.

Sirgo said in the Nov. 13 call that reduced drilling and completion (D&C) costs from applying row development to the combined Coterra, Franklin and Avant property is “the reason we put this asset together.”

Coterra’s Culberson County D&C costs average $730 per lateral foot. Adding facility and post-completion expenses, all-in cost is $850 per lateral foot.

“I mean, we have a playbook for this,” Sirgo said.

Efficiency gains come from shared infrastructure and marketing, simul-fracs and making multi-DSU row developments.

“It’s a lot of work to do before we can start quoting cost savings on the [acquisitions], but we have a playbook for this,” Sirgo said.

In Culberson County, “which is kind of the epitome of getting to take advantage of every single one of these efficiencies, we ultimately drove 15% of cost out of it. I don’t know if we’ll get that far here, but we’re sure going to try.”

Harkey Vertical Control

The Harkey—a “low-stand submarine fan deposit” that is also known as the Harkey Mills—has seen laterals dating back more than a decade in Lea and Eddy counties, according to Marshall D. Davis, whose master’s thesis in 2014 was based on the Harkey.

Davis wrote “Petroleum Geology of the Leonardian Age, Harkey Mills Sandstone: A New Horizontal Target in the Permian Bone Spring Formation, Eddy and Lea Counties, Southeast New Mexico” while studying at the University of Texas at Arlington.

He was working at the Bass family’s Bopco LP at the time and cited its data in his research. Exxon Mobil purchased Bopco for $6.6 billion in cash and stock in 2017, gaining 250,000 Permian acres.

Davis’ analysis of 625 old Harkey verticals found “the best reservoir rock occurs within the apex of turbidite channel deposits proximal to the slope fan.” Net thickness is up to 80 ft; porosity, at

least 8%.

Earthstone Energy put laterals in Harkey in two Lea County wells before selling to Permian Resources in 2023.

The wells averaged some 1,600 boe/d each, 87% oil, in their first 24 days online from 7,500-ft laterals, Earthstone reported. It expected payout within four months from first production.

Randy Nickerson, COO of another Permian operator, Caza Petroleum, told Hart Energy in 2019 that Eddy County’s Harkey “is a little more highly oil saturated than the other [zones].

“I think you’re going to see that’s going to be a new bench out there that people are going to start building. There are some older wells on it that maybe discourage people, but it’s a pretty good zone.”

As to interference, Coterra’s Jorden said that “when it comes to the Wolfcamp and Harkey, we generally see that as one petroleum system.”

Thus, there will be some communication. “But we do not see that as a factor that degrades overall well productivity.”

Findings were that “having the two landing zones does not interrupt or impede your overall recovery out of that drilling spacing unit. So, we don’t see that as a significant issue for the Wolfcamp/Harkey.”

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

TG Natural Resources Boasts 20 Years of Haynesville Inventory

2025-04-09 - TG Natural Resources President and CEO Craig Jarchow said the company’s valuable Haynesville inventory provides a line of sight for investors 20 years down the line.

Queen’s Chess: Changing the Rules

2025-02-28 - There’s a popular response to the inexplicable: “I don’t know. I don’t make the rules.” But what is known with certainty, as shown throughout history, is that we can change them.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.