With nuclear, fossil fuels and renewables all viable options for power generation, the question is: which will come out on top?

The U.S. is hungry for power as artificial intelligence applications, coupled with the servers and cooling needed for large-scale data centers, drives up demand for electricity.

But large-scale data centers, known as hyperscalers, are not the only ones behind the expected surge.

A widespread movement toward electrification—from EVs to industrial processes to manufacturing—is putting supply center stage.

Energy users, led by technology companies, are racing to secure large amounts of electricity to power and cool data centers. Power providers are positioning themselves to meet the need. Renewables have been a top choice for companies looking to shrink carbon footprints, but the need for reliable access to power is keeping fossil fuels in the picture.

Power companies with nuclear assets are also seeing an opportunity. With three viable options for power generation, the question is: which will come out on top?

The market for the electric generation and transmission and distribution business is probably the hottest it’s been in the past 30 years, Dan Whigham, advisory sector lead for PwC, told Hart Energy.

How much electricity will be needed in the years ahead depends on who is being asked, according to Whigham. But the safe answer is a lot.

“You go from flat demand to now, demand, based on where you are in the country, increasing 10, in some cases 20 times the growth rate what they’ve seen in the last five to ten years,” Whigham said. “In the overall scheme of things, it is now more common to see 30% to 40% more load required on particular systems. In some cases we have seen as much as 50% to 90% of incremental load on certain grids.”

That’s evidenced by plans submitted by electric utilities showing how they expect to meet customers’ electricity needs. Some areas, such as in the South and Southeastern U.S., expect big demand increases, he said, while other parts of the country expect more modest growth of 10% to 20%. Elsewhere, some are anticipating flat demand.

Seeing opportunity

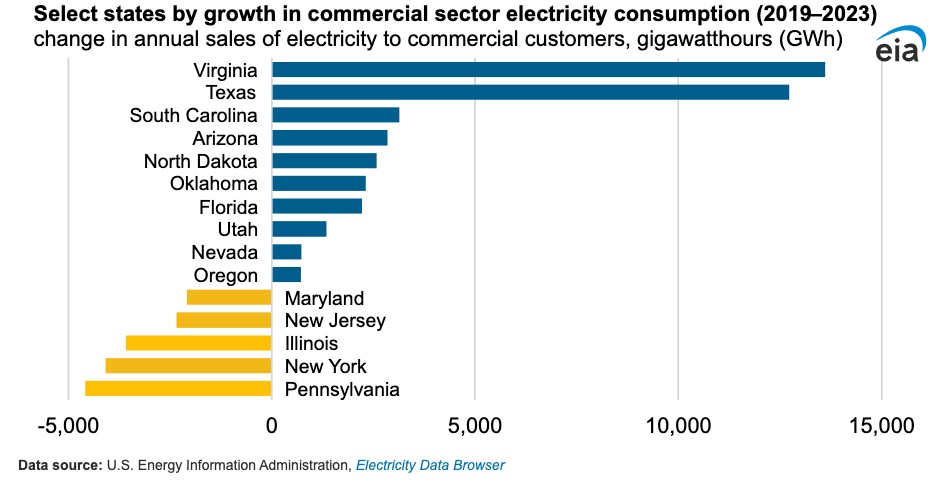

Data from the U.S. Energy Information Administration (EIA) show commercial electricity demand in the 10 states with the most electricity demand growth increased by a combined 42 billion kilowatt hours (BkWh) between 2019 and 2023, representing 10% growth over a four-year period.

Demand was the highest in states that are major hubs for data centers, including Virginia, Texas and North Dakota.

Despite ambitious sustainability goals, tech companies are realizing renewables alone aren’t enough. Whigham said there is more acceptance of natural gas.

“I don’t see an end in sight to that, to be honest … If [energy] storage really got the quantum leap in what they can actually store and not lose during that time period, then maybe we’ll get there,” he said. “But I don’t see any time in the foreseeable future that is solely renewable.”

When it comes to powering data centers, reliability matters.

If Big Tech wants renewables but is willing to settle for reliable, abundant natural gas, could nuclear—a fossil fuel energy source that is recyclable and considered clean due to its minimal greenhouse-gas emissions—be just right?

Nuclear power providers are seeing an entry point, as well.

Positioning data centers near existing nuclear power plants, or co-locating behind-the-meter, is seen as a promising off-the-grid solution for new loads—provided the nuclear plant isn’t facing any economic or environmental challenges that could lead to retirement.

Any type of power plant with any large load could be co-located with a data center; however, existing nuclear plants provide some of the best opportunities for data centers, according to Michael Kormos, former COO at PJM. PJM is the regional transmission organization coordinating wholesale electricity in 13 states and the District of Columbia.

“Nuclear plants are large, often with multiple units, carbon-free and sustainable, and capable of and preferring to run at maximum power for up to 18 to 24 months, which matches perfectly with the data center load profile,” Kormos wrote in his report, The Co-Located Load Solution. “Nuclear units have the highest reliability and availability of any of the existing resources.”

Co-locating nuclear and data centers could be seen as a win-win-win for nuclear, renewables and natural gas.

Co-locating nuclear

Under a co-location configuration, with the data center connected via a substation to a nuclear plant, the data center gets carbon-free electricity, avoids long lead time for grid interconnection and the nuclear plant gets a steady customer, Kormos said in the report.

“And with the nuclear unit now supplying the data center load and not some distant network load, deliverability on the transmission grid is freed up for other existing and newly-interconnecting resources, typically wind and solar projects,” he said.

Independent power producer Talen Energy is trying to do just that. Like other power producers, co-location, data center and power demand talk surfaced on a second-quarter 2024 earnings call.

Talen has struck a deal with Amazon to co-locate a 1-gigawatt AWS data center campus next to Talen’s Susquehanna nuclear plant in Pennsylvania. However, the move—which has raised concerns about the impact on ratepayers—awaits approval by the U.S. Federal Energy Regulatory Commission. The federal agency plans to hold a technical conference in the fall to discuss issues related to co-locating large loads at generating facilities.

“I’ll admit it is one of the most exciting times I’ve seen in my power career. It will drive unprecedented change in our industry, change that will yield great opportunity,” Talen Energy CEO Mac McFarland said on the company’s latest earnings call. “The focus has now turned to the question, how will the value creation get shared across companies?”

He sees it as an opening for all players, if done right.

“This is an opportunity for us as an industry to lead,” McFarland said.

Constellation Energy CEO Joseph Dominguez shared similar thoughts on the company’s second-quarter call with analysts. He said a thorough examination will show nuclear plants are “both the fastest and most cost-effective way to develop critical digital infrastructure without burdening other customers with expensive upgrades.”

He pointed out that co-location is not a new concept.

“Cogen or combined heat and power projects were the first co-locators,” Dominguez said.

Putting data centers near nuclear facilities is a trend Whigham sees continuing.

“We’re not decommissioning a lot of them [nuclear facilities] right now. In fact, everyone’s trying to keep them alive, and if not, bring a few of them back, perhaps.”

Constellation and Talen operate in regions where massive data centers are present.

“Utilities across PJM, and I think you’ve seen this in a bunch of the earnings calls, have been highlighting the growth of data centers in their service territory. In total, … they’ve now identified 50 gigawatts or more that would come in over time,” Dominguez said. “In fairness, I think there’s a bunch of duplication in those numbers, and it’s going to occur over a longish timeline. But the point is, I think it’s powerful that everyone is seeing the same thing: growth in this area.”

Four of the largest hyperscalers have a 2024 capex budget of nearly $250 billion and rising, McFarland said. Those companies are on a pace to spend more than $1 trillion by 2028, he said.

“Our one deal matters because data centers form in multi-site clusters. So, we hope that proving one working model in Pennsylvania is a sign of good things to come for further build-out,” McFarland said.

It will take all types of new models as well as front-of-the-meter and behind-the-meter to meet the growing demand, he added. That includes natural gas as an additional source of backup power.

Natural gas

Like power producers, natural gas producers and infrastructure companies are talking about growing power demand.

Kinder Morgan has talked about 5 Bcf/d of opportunities related to power demand, including 1.6 Bcf/d related to data centers. The growing demand is bigger than AI, according to Kinder Morgan CEO Kim Dang. It’s driven by population migration into states such as Texas, Arizona and Florida; onshoring; factories being built in the U.S.; and natural gas demand in Mexico, she said.

“In Texas, the peak demand in 2018 was 70 gigawatts. This summer, the peak demand was 86 gigawatts. So, you had a 16 gigawatt increase in peak power demand since 2018 in Texas. And I think that’s indicative of what a lot of these states are seeing in the southern states,” Dang said Sept. 5 during the Barclays CEO Energy-Power Conference.

Citing estimates from Wood Mackenzie, Dang said natural gas demand is projected to grow from 108 Bcf/d to 128 Bcf/d by 2030. While forecasts from energy consultancies and others differ on the amount power demand growth, she sees opportunities for natural gas.

But the presence of renewables adds to volatility, including on the storage side.

“I’ll use Texas as an example. In 2023, about 30% of the power stack came from renewables. And so, what happens when the sun doesn’t shine or the wind doesn’t blow is, all of a sudden, gas is really the only power source that you can call on that can make up that difference,” Dang said. “And so now gas has to ramp not only to hit the peak, but it’s also got a ramp to be able to replace the renewables. So that’s creating more volatility in the demand profile.”

Data centers and behind-the-meter talk also surfaced when Chesapeake Energy CEO Nick Dell’Osso Jr. spoke Sept. 4 during the Barclays conference. Depending on where demand is greatest, some basins could have advantages over others.

Three pieces of infrastructure are needed to meet demand, he said.

“You need a piece of fiber from the user of that data back to the data center. The data center needs transmission lines back to a power plant, and a power plant needs a pipeline back to a gas source,” Dell’Osso said. “Two of those three pieces of infrastructure are controversial. You can’t really build pipelines and you can’t build transmission lines easily in this country. You can put fiber anywhere.”

Locating projects near population centers where fiber is a solution and minimizing the distance of transmission lines and pipelines is the right answer, he said.

Demand could also impact in-basin production and pricing dynamics.

“We’d be more than happy to not grow volumes initially and just dedicate some existing production,” Dell’Osso said. “We have at the moment just under 4 Bcf a day of gross production in northeast Pennsylvania. We have plenty of volumes we could dedicate to projects.”

Meeting demand

In the short term, EIA forecasts total electricity consumption to rise to about 4,159 billion kWh in 2025 from about 4,103 billion kilowatt-hours (kWh) in 2024, led by growth in industrial sales, followed by residential sales.

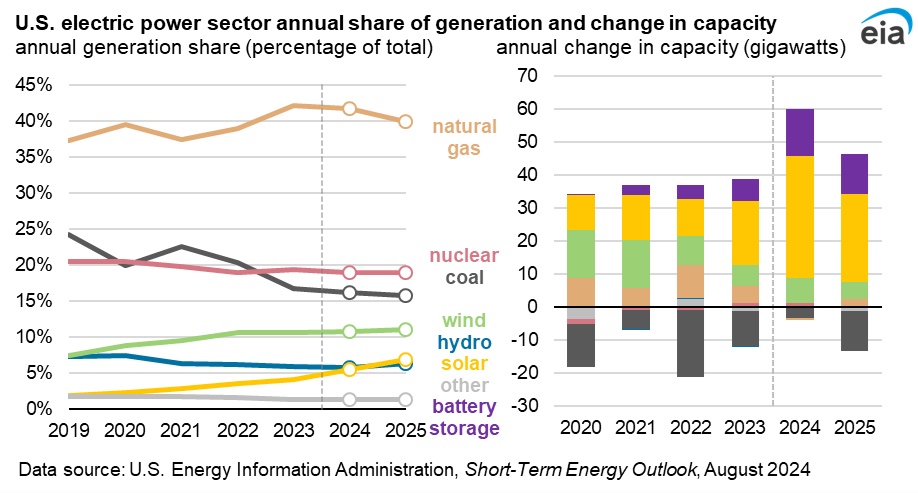

While renewable energy sources—mainly utility-scale solar photovoltaic power plants—are expected to supply most of that growth, natural gas accounts for 42% of electricity generation today in the U.S., followed by renewables at 23% and nuclear at 19%.

Natural gas share is forecast to fall with nuclear unchanged in 2025 as power demand picks up.

It may be tough to say which sector is best positioned today to meet rising energy demand, given renewables, natural gas and nuclear each have their advantages and disadvantages.

Natural gas clearly has the fewest barriers to entry, according to Whigham.

However, it’s neither renewable, nor carbon free. “It’s lesser of the evil but certainly is available. It certainly is at an affordable price point right now. It can solve the reliability concerns or risks around it, provided the pipelines themselves are insulated. My take is it will be a second option,” he said. “I think everyone’s going to go to renewables first.”

But in the race to meet the demand of hyperscalers, it could be a tie.

“At the end of the day, it’s a dead heat between all three, and I think all three will contribute,” Whigham said. “To me, nuclear—where it’s available—will be the first choice, I think, because it’s clean and the ones that are already in play have proven the safety part of it.”

That is if companies are willing to locate their data centers to areas where nuclear plants exist.

“Renewable with a nuclear backup or a nuclear peak feels like the perfect answer,” he added. “But the reality of that is, even when you do that, you’re going to create deficits in energy supply in other places that have to be met with what will probably keep the gas plants alive.”

Recommended Reading

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Japan’s JAPEX Backs Former TreadStone Execs’ New E&P Peoria

2025-03-26 - Japanese firm JAPEX U.S. Corp. made an equity investment in Peoria Resources, led by former executives from TreadStone Energy Partners.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.