Under a star-filled West Texas sky, lights from a passing semi streak past El Capitan near WPX Energy's Delaware Basin operations in Loving County, Texas.

Like a scene out of a post-apocalyptic Mad Max movie, oilfield trucks travel in fast, tight convoys in both directions up and down the long miles of the two-lane Texas State Highway 285 between Pecos and the New Mexico border, making it nearly impossible to pass unless you want to gamble on the dusty shoulder. With few paved roadways in this desert Trans-Pecos region of Far West Texas, the trucks are servicing a host of E&P operators scrambling to ramp up drilling activity in the Delaware Basin.

Along the route, the town of Orla at the intersection of 285 and FM 300 is officially a ghost town with a population of two. However, food trucks opportunistically camp at the corner with offerings of chicken, BBQ, Tex-Mex, breakfast and burgers, all relatively expensive at this culinary oasis in the Texas outback, but popular nonetheless. A freelance big rig mechanic has set up shop on a gravel lot with nothing but a truck full of tools and a variety of semis waiting in various stages of repair.

Albeit remote, the southern Delaware Basin is the hottest hub for oil exploration in the Lower 48 today. Still an emerging resource play at the beginning of the oil price downturn in 2015, the Delaware shot to the forefront of must-have assets last year and continuing as early-entrant operators proved in horizon after stacked horizon that EURs could match the best any other play had to offer, and economically so in a soft tape.

“The Delaware Basin is arguably the best real estate in the oil and gas business in the nation, as evidenced by the sheer number of industry transactions over the past 12 months,” said chairman and CEO Rick Muncrief of Tulsa, Okla.-based WPX Energy Inc. in the company’s fourth-quarter conference call.

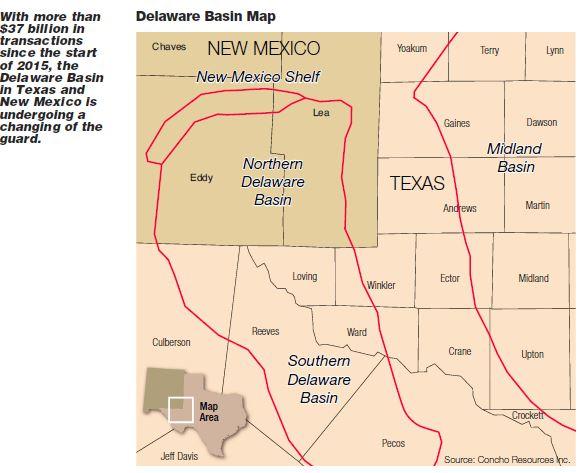

To wit, 57 deals representing some $37 billion in Delaware assets traded hands over the past two years, as mostly public independents rolled up private companies that had built starter acreage positions. Now the majority of the basin is locked up by operators taking a longer-term view on development, and with motivation to deploy capex and rigs into the desolate terrain.

That leaves the hanging question: where to from here for the maturing Delaware Basin?

Supercharged returns

“It starts with the rocks,” said Clay Gaspar, WPX Energy senior vice president and COO, explaining why the company decided to trade out its legacy Piceance Basin position with a new anchor asset in the southern Delaware. “We needed a new crown jewel asset with an oil focus, a deep inventory and strong returns to build the company around.”

Plus, the basin was largely underappreciated by the market at the time. WPX pushed its chips into the southern Delaware Basin in 2015 with a $2.75-billion entry in Loving County at $12,500 an acre for undeveloped locations. Since, it has added to its pot with the purchase of Panther Energy Co. LLC this March for $775 million, or $28,000 per undeveloped acre, illustrating the move in market value and WPX’s confidence in the rock value.

WPX now controls a commanding 120,000 net acres, with a concentration in Loving County south of the New Mexico border. And the serendipity is sweet.

The column of hydrocarbon-charged zones is “incredibly thick,” he said, and highly pressured all the way through. “Full disclosure, we didn’t know there would be this many multiple horizons,” Gaspar said at the time of the original purchase. “If you have that amazing stack of rocks to build a business on, that’s irreplaceable.”

The north end of its holdings in Eddy County, N.M., may have five to six hydrocarbon bearing intervals to chase, as will the southern acreage in central Reeves County, Texas, “but they might be different.” WPX’s state line field, “right in the heart of our play” in northwest Loving County, “probably has more landing zones than anywhere else in the Delaware Basin” with about 13 potential.

Including the recently acquired Panther acreage, Gaspar ballparks the number of identified drilling locations in WPX’s Delaware portfolio to be around 6,400, but “it could just as easily go higher than lower,” he said. “There are just so many landing zones and potential. We are routinely coming up with another opportunity on our existing acreage that just adds to that ultimate development plan.”

WPX completed 28 Delaware wells in 2016. Despite a cornucopia of targets, the company is focusing the majority of its efforts in the Wolfcamp A formation. “The A is our bread and butter zone—it’s going to deliver every day.”

Well economics ultimately are what keep the drillbit turning. WPX bought the original position two years ago based on $7-million well costs and an assumed 670,000 barrels of oil equivalent (boe)-EUR type curve for the Wolfcamp A. Today, those wells are running $5 million with a “comfortable” 1 million barrels of oil equivalent (MMboe) EUR on a 1-mile lateral.

“That combination— costs falling, wells getting significantly better—has allowed us to supercharge the returns and make it very competitive in this $50 to $55 world we seem to be in for the immediate future.” One-mile wells produce a 70% rate of return at that price, he said.

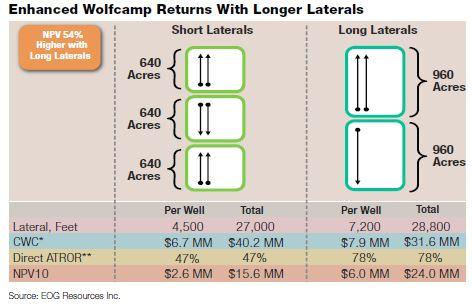

Yet Gaspar ascertains that even longer laterals produce “substantially better” overall returns. Some 40% of its Delaware laterals drilled this year will extend to 1.5 to 2 miles. The only lateral limitation is land issues; the company is working diligently to arrange acreage swaps with other operators to accommodate longer laterals. Well costs for 2-mile lateral wells increase by 1.3x to 1.5x, he said, but EURs jump by 1.7x to 1.8x.

Additionally, to boost recovery, WPX is pumping up to 2,000 to 2,500 pounds of sand standard and has closed its stage spacing from 100 feet to 30 feet between perforation clusters. “More sand, more stages, ultimately stimulating more rock,” he said.

The company recently completed a nine-well density test began in September to explore a second zone in the 350-foot thick WC-A formation, with results expected by the end of the first quarter but after press deadline. If the theory holds, the combination of an Upper and Lower Wolfcamp A flow interval developed in a wine rack pattern of eight wells per zone would validate 16 wells per spacing unit.

Beyond the Wolfcamp A, WPX tested the Wolfcamp XY—which sits above the A—with two wells late in the year. The C-State 16-1H produced 1,812 boe/d (70% oil) in its 24-hour test, and the Pecos State 46-6H flowed 1,780 boe/d (50% oil) over 30 days, both on 1-mile laterals.

In 2017, seven WPX rigs will focus primarily on the Wolfcamp A and the Wolfcamp XY, in which it plans some 100 wells with approximately $500 million in capex, about half of the company total.

Gaspar, though, anticipates a blended development from the top of the Third Bone Spring through the Lower Wolfcamp A that treats the entire column as a 3-D cube without horizon labels. “All of those interact and share resources. By taking the labels off, you instead look at where are the right places to land the wells for optimal development. That’s strategically where we’re headed.”

One zone outside of the near-term development plan that intrigues Gaspar is the Wolfcamp D, with 1,000 feet of column to explore.

“That could be four landing zones right there.”

The WC-D, however, is gassier than the uphole formations, 70% GOR and more the deeper it goes, pushing it out of favor with some local operators. “But it has a lot of pressure and gas in place. With that much rock, it’ll be a very significant development. We’re pretty excited about it internally.”

To date, WPX has tested the D three times, all in the top 150 feet of the flow zone. The latest, Pecos State 46-5H with a 1-mile lateral, came on with an IP30 of 1,600 boe/d and held pressure at 4,000 psi 60 days in. “These are very stout wells,” said Gaspar, “and [they] confirm the prospectivity of the D over our entire state line position.”

WPX plans five additional wells into the Wolfcamp D in 2017, as well as tests in other prospective zones.

“We want to put our own completion recipe on these other intervals and home into where they fit in our portfolio. As we find zones that stack up competitively, we’ll high grade those up in development as they compete for capital.”

With $3.5 billion invested in the play, can WPX deliver on its investment?

“We’ve pushed all of our chips in as we revamped the portfolio and made a significant bet. We got in well ahead of the industry excitement, and we are more excited about it now than when we placed that bet,” said Gaspar.

“I look to the Delaware and the opportunity going forward, and it could take the mantle of the best of all time. It’s looking really good so far.”

Going deep and wide

Midland, Texas-based Concho Resources Inc., a venerable stalwart of the Permian with a 360,000 net acre position in the Delaware alone, is a leader in the horizontal transformation of the play. The company stockpiled more acreage through 2016 with a $360-million acquisition from Jetta Operating Co. Inc. in Ward and Reeves counties, Texas, in the spring, and another $430-million acquisition from Endurance Resources in Lea County, N.M., in the fall.

Collectively, the company foresees drilling some 13,300 locations across multiple zones with net resource potential of 5.4 billion barrels of oil equivalent (Bboe).

Amazingly, in its northern Delaware operating area, Concho has not just identified—but delineated—nine distinct landing targets from the Avalon Shale through the Lower Wolfcamp. Over the past year, the Wolfcamp Sands and Wolfcamp A Shale “emerged as prolific zones” in both Lea and Eddy counties, said Concho CEO Tim Leach in the company’s February conference call.

An emerging target for Concho, its first two Wolfcamp Sands wells, the Viking Helmet and Stove Pipe, produced 90-day peak rates of 1,900 barrels per day (bbl/d) average per well. Offsetting these in the deeper Wolfcamp A, the 1.5-mile Skull Cap 22H flowed at an average 24-hour peak rate of approximately 2,800 bbl/d. In addition to its legacy Second Bone Spring drilling program “that’s still a big factor,” the company sees potential in two zones in the Avalon and in the Third Bone Spring.

“With results like these coming in from multiple zones in the northern Delaware Basin, it’s easy to see why we continue to work to increase our acreage footprint across the region,” said Jack Harper, Concho executive vice president and CFO. “In 2017, the focus will be on Avalon, Wolfcamp and Bone Spring.

“By extending our lateral lengths, down spacing and identifying new zones, our total resource in the northern Delaware Basin increased by nearly 40%,” said Harper on the call.

In the southern Delaware in Reeves and Ward counties, Concho is testing the limits of lateral lengths. The Screaming Eagle #3804 was completed with a 12,812-foot lateral, Concho’s longest effort ever. It achieved a 30-day peak rate of 1,890 boe/d (83% oil). Screaming Eagle was the top producer of a six-well recent grouping with 6,350-foot average laterals producing an average 1,252 boe/d (73% oil). Southern Delaware lateral lengths will average 10,000 feet in 2017, said Harper, whereas 7,300 feet will be the norm in the northern acreage.

“If you can put longer laterals together land-wise, you’d want to drill them all that way,” Leach added. “The reserves and recovery are not only linear, but you are leaving less behind because of lease-line constraints.”

For the year, Concho is tackling its massive Delaware position with an average of eight rigs in the northern region, and four in the southern. Sixty percent of its $1.7-billion capex will be directed to the Delaware.

Pushing the limits

Houston-based Noble Energy Inc. made its entry in the Delaware Basin via a $3.9-billion merger with Rosetta Resources Inc. in July 2015, a deal which included an Eagle Ford package as well. But the largely undrilled 46,000-acre Delaware portion of the Rosetta portfolio in southern Reeves County was assumed to contain some 400 MMboe of potential reserves.

Today Noble Energy estimates that same acreage to contain 1 Bboe of reserves, and in January decided to double down with the acquisition of Clayton Williams Energy Inc. for an additional $3.2 billion, still pending at press time. The 71,000 additional net Delaware acres to be contributed by Clayton Williams, adjacent to its existing position, will give Noble Energy almost 120,000 total, making it one of the top acreage holders in the basin.

“We’re very excited about it,” said Gary Willingham, Noble Energy executive vice president of operations. “When we first got into it, we thought it had tremendous potential, and over the past year and a half we’ve demonstrated this truth. That gives us a lot of encouragement on where we’re heading with the Clayton Williams acreage.”

The price plummet early last year slowed Noble Energy’s rig program since the initial acquisition, running half a rig until ramping to three late in 2016. It has drilled just shy of 20 wells coming into 2017. Noble Energy plans to also increase the rig count on the Clayton Williams acreage post-acquisition from one to three by end of year, for six total rigs in the Delaware.

Like the others, the Wolfcamp A horizon garners the lion’s share of Noble Energy’s attention thus far, in which Willingham sees “at least” two horizons to target. The current development plan accounts for six wells per section in each zone for 12 total wells in the Wolfcamp A alone. “We’ll do more vertical spacing tests and see over time whether there’s potential for more lateral positioning,” he said.

Most of the company’s early Delaware wells were completed with laterals less than a mile in length and proppant loading of 2,000 pounds or less per lateral foot, which generated a 1.2 MMboe-type curve. The company is now shifting to enhanced completions with proppant approaching 3,000 pounds per foot or higher. Two such wells, the Jersey Lilly 17-1HB and Black Jack 16-7H, both with 4,600-foot laterals and pumped with 3,000 pounds of sand per foot, flowed IP30 (70% oil) at 1,073 and 1,194 boe/d, respectively.

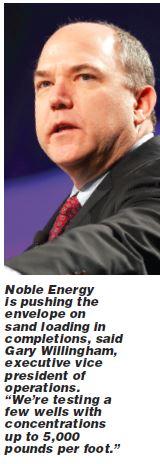

“Most of what we’re doing this year is 3,000 pounds of sand per foot, at least. We’ve got enough data that we feel comfortable transitioning the vast majority of our 2017 program to 3,000 pounds per foot, and we’re testing higher than that in some wells.”

In some cases, a lot higher. Say, 5,000 pounds per foot, the highest any operator in the play has pushed sand loading.

“We’re testing a few wells with concentrations up to 5,000 pounds per foot that we’ll release later this year. We just need to see some longer-term production history.”

One well, Sky King 47-4H, released in Noble Energy’s fourth-quarter results, used the 5,000-pound concentration with a 4,600- foot lateral and flowed 1,252 boe/d (74% oil) over its first 30 days, indicating a boost in productivity.

Going forward, Willingham indicated lateral lengths will average 7,500 to 8,000 feet. Noble is currently testing 10,000-foot laterals on the three-well Monroe pad. “We’re transitioning to longer laterals,” he said. “Like in the D-J Basin and Marcellus, we think longer laterals are the right way to go.” Stage spacing and cluster spacing within those stages are shrinking as well.

Yet longer and bigger wells on multi-well pads create their own logistical challenges, namely lag time until production. How far can you push completions?

“Our focus is on extracting the maximum amount of value from each section, which may be the same as maximizing EUR, but it may not be,” said Willingham. “Mechanically, you can drill longer wells, but it gets trickier to complete and increases cycle times on getting wells online. When you’re drilling multiple wells off of a pad it increases the cycle time of that entire pad.

“From a value standpoint, we’re looking for that sweet spot, but we don’t know where it is yet.”

Beyond the Wolfcamp A, Willingham sees near-term value in the Third Bone Spring above, and the Wolfcamp B and C below. He estimates four wells per section in the Third Bone, and six each in the B and C. The company projects 4,200 total drilling locations, inclusive of Clayton Williams Energy.

Noble Energy brought to production its first Wolfcamp B well in the fourth quarter last year, and it’s “performing in line with expectations.” It is planning its first Third Bone Spring well this quarter. “Based on offset operator data, we expect good things there.” It is leaving the Wolfcamp C for offset operators to delineate for now. “We see a lot of potential there” as well.

But there’s more. “We haven’t scratched the surface yet as to what the potential could be for the Avalon Shale, and the First and Second Bone Spring. The 4,200 locations— that’s just accounting for the Third Bone Spring through Wolfcamp C. Anything beyond that is additive.”

The task of the three-dimensional Delaware development might seem ominous, but Willingham said the company’s successful experience of developing multiple stacked horizons in the D-J Basin prepared the team well.

“We routinely develop four horizons in the D-J Basin. We’ve got a lot of history developing multiple zones, getting the lateral spacing right, and the vertical spacing and offset patterns. We’ll determine the best plan and the best timing in targeting each zone to maximize recovery from each section while not overbuilding facilities.”

Noble Energy estimates well costs of $8.5 million on 2,000 pound per foot completions. “It’s strong economics.” Once multi-well pad development drilling begins this year, Willingham anticipates that cost to come down. Including the combined acreage, Noble projects drilling approximately 50 Delaware wells this year.

“We haven’t seen anything that’s cause for concern. If anything, the data leads us to believe the Delaware wells are even more conducive to development across the entire acreage position than we thought in the beginning. Everything’s headed in the right direction.”

Can the Delaware live up to its hype?

“It’s not hype,” Willingham declares. “Everything I’ve seen is certainly real. There are probably opportunities even beyond what we’re seeing today. Everything just continues to look better and better.”

EOG bulks up

EOG Resources Inc. made one of the biggest splashes in the Delaware when it acquired family-owned Yates Petroleum Corp. for $2.3 billion in 2016. Yates’ varied portfolio included 186,000 net acres in the Delaware, to which most of the value was ascribed, nearly doubling EOG’s footprint to 416,000. The Houston-based company quickly assimilated the Yates portfolio into its fold, with an aim to drill only “premium” wells, or wells that generate a 30% ROR at $50 oil.

EOG remains vague on the delineation of sub-zones, but generally is working with 11 rigs running in the Wolfcamp, Bone Spring and Leonard (e.g., Avalon) formations, primarily focused in Lea County, N.M.

The company completed 17 Delaware Wolfcamp wells in the fourth quarter with an average lateral length of 4,900 feet and average 30-day initial production rates of 2,405 boe/d. However, it completed the Endurance 36 State Com #705H and #706H with an average lateral length of 7,000 feet per well and average 30-day initial production rates per well of 2,495 bbl/d, 505 bbl/d NGL and 3.7 million cubic feet per day (MMcf/d) of natural gas.

In the Bone Spring in Lea County, EOG completed the Della 29 Fed Com #602H with a lateral of 4,500 feet and 30-day initial production rates of 1,905 bbl/d, 225 bbl/d NGL and 1.7 MMcf/d gas. Also in Lea, targeting Leonard, EOG completed the Leghorn 32 State #201H with a 4,500-foot lateral, resulting in a 30-day initial production rate of 2,550 bbl/d, 480 bbl/dd NGL and 3.6 MMcf/d gas.

The Delaware Basin is “setting up … to be our fastest growing asset in 2017,” said Lloyd Helms Jr., EOG executive vice president, exploration and production, in the company’s fourth-quarter conference call in February. “First, EOG completed some of the industry’s best wells in the Permian Basin through the application of our leading-edge technology, including precision targeting and high-density completions. This technology has proven to deliver a step change in well performance.”

These technical capabilities combined with the Yates transaction resulted in EOG adding 3.7 Bboe of estimated resource potential last year alone, Helms said.

“We’ve already identified almost 3,500 premium oil locations across three targets in the Delaware ... This is almost a mile of stacked pay in this world-class basin, and our exploration efforts are just getting started.”

Out of the gate

“We call the Delaware our unicorn asset,” said Matt Gallagher, Parsley Energy Inc. president and COO. “It’s a rare find.”

A leading operator in the Midland Basin, Parsley stepped out in 2013 “with a hope and a prayer and a lot of engineering guesses” when it took a position in the early horizontal Delaware play on one large ranch in northwest Pecos County in Texas for $450 an acre. The deal was economic on vertical drilling alone. “We’re not an exploration company,” he said. “We like to have a foundational business plan and build upside on top of that.”

The educated experiment appears to be paying off.

Following a period of 3-D seismic gathering and vertical testing through the downturn, Austin, Texas-based Parsley decided to test the horizontal concept. In late 2015, the company’s first operated horizontal well in the southern Delaware Basin, the Trees State 16-1H, posted a 30-day IP rate of more than 1,100 boe/d on a 4,500-foot lateral targeting Upper Wolfcamp. The well tied for Parsley’s second-highest 30-day peak rate ever.

With that knowledge, the company momentarily pressed pause on Delaware drilling with another objective in mind. Parsley liked the Delaware’s prospects so much that it outright bought the ranch it was leasing, owned by the Edith L. Trees Charitable Trust, along with the mineral rights, in March last year. The upside: 30,000 fee and mineral acres, providing nearly 100% working interest and control of the surface rights.

“After that point, with additional wells being placed online and industry results picking up, I think it’s fair to say there was a sea change in Delaware activity and valuations. So we were fortunate to be that small step ahead.”

After adding bolt-on deals from Apache Corp. and Anadarko Petroleum Corp., Parsley currently holds some 48,000 mostly contiguous acres in Reeves and Pecos counties. Through 2016, just one part-time rig worked the play while Parsley cored up acreage, drilling five wells total. But the results impress.

The company’s first drilled well in Reeves County, Lincoln 4-1-4307H, flowed more than 1,900 boe/d IP30 (65% oil) on a 6,900-foot lateral into the Upper Wolfcamp. Its second Reeves well posted a 2,666 boe/d 24-hour IP on a 6,400-foot lateral, and had not been online for 30 days at the time announced. Both wells were completed with 2,600-2,800 pounds per foot of sand. Across the county line in Pecos, a follow-on Trees State well with a 7,800-foot lateral flowed at 1,500 boe/d IP30 (75% oil).

“The rates of return are phenomenal,” said Gallagher. “We’re consistently seeing 30-day IPs of 250 to 350 boe per foot. Depending on the well, they are higher than some of our Midland Basin areas. Productivity is extremely robust, meeting and exceeding our pre-drill estimates.”

Gallagher stated most of its Upper Wolfcamp drilling, equal to Wolfcamp A as described by other operators, is economic above $40/bbl.

EOG Resources reports a 54% gain in net present value with longer laterals in the Delaware’s Wolfcamp Shale.

After 180 days online, the two Reeves Wolfcamp wells were exceeding Parsley’s base 1 MMboe type curve by 55%.

“We feel pretty comfortable with the results in the Delaware, so we’re ramping up as quickly as possible,” he said. Parsley is now running four dedicated rigs in the play, and 40% of its total 2017 capex of approximately $1 billion is directed to the southern Delaware, catching up to the company’s bread-and-butter Midland Basin operations, which scores the remaining 60%. By year-end it anticipates 40 new Delaware wells online.

While Parsley drilled several shorter lateral wells on its acquired acreage to meet lease obligations, most wells going forward will feature 9,000-foot laterals. The company has pushed completions from 1,900 pounds per foot to 2,600 standard, at 65 barrels of water per foot. All results so far are in the Upper Wolfcamp.

“That’s what we’re targeting out of the gate. Through 2017, we’ll test an additional two to three Wolfcamp flow units” in the B and C zones. Here, the total hydrocarbon column is 2,000 feet thick, he said.

Gallagher said he is tracking results from 10 distinct targets being drilled within a 15-mile radius of the company’s acreage, all encouraging, he said. Parsley additionally plans a second and Third Bone Spring delineation well each later this year.

The company currently reports 940 locations in the Wolfcamp and Bone Spring formations at 660-foot spacing. It will eventually test 330-foot spacing before going to full development mode.

Surprisingly, Parsley is standing down on further acquisitions. “We’re in digestion mode. We’ve got a multiyear opportunity, so we won’t be active in any material acquisitions in 2017,” he said. Since that initial $450 per acre purchase, Delaware deals are now trading in the range of $30,000 to $40,000 per acre.

Parsley will not publicly identify a resource potential number, but “it’s pretty staggering,” Gallagher confirmed. “There’s a lot of oil in the ground that’s recoverable. The Permian is home to the best assets in North America, hands down, and we have a tremendous runway of inventory. It’s going to be fun to watch it grow and unfold.”

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.