Crescent brought four new Uinta wells online in the first quarter and 20 in its other play, the Eagle Ford Shale. (Source: Shutterstock)

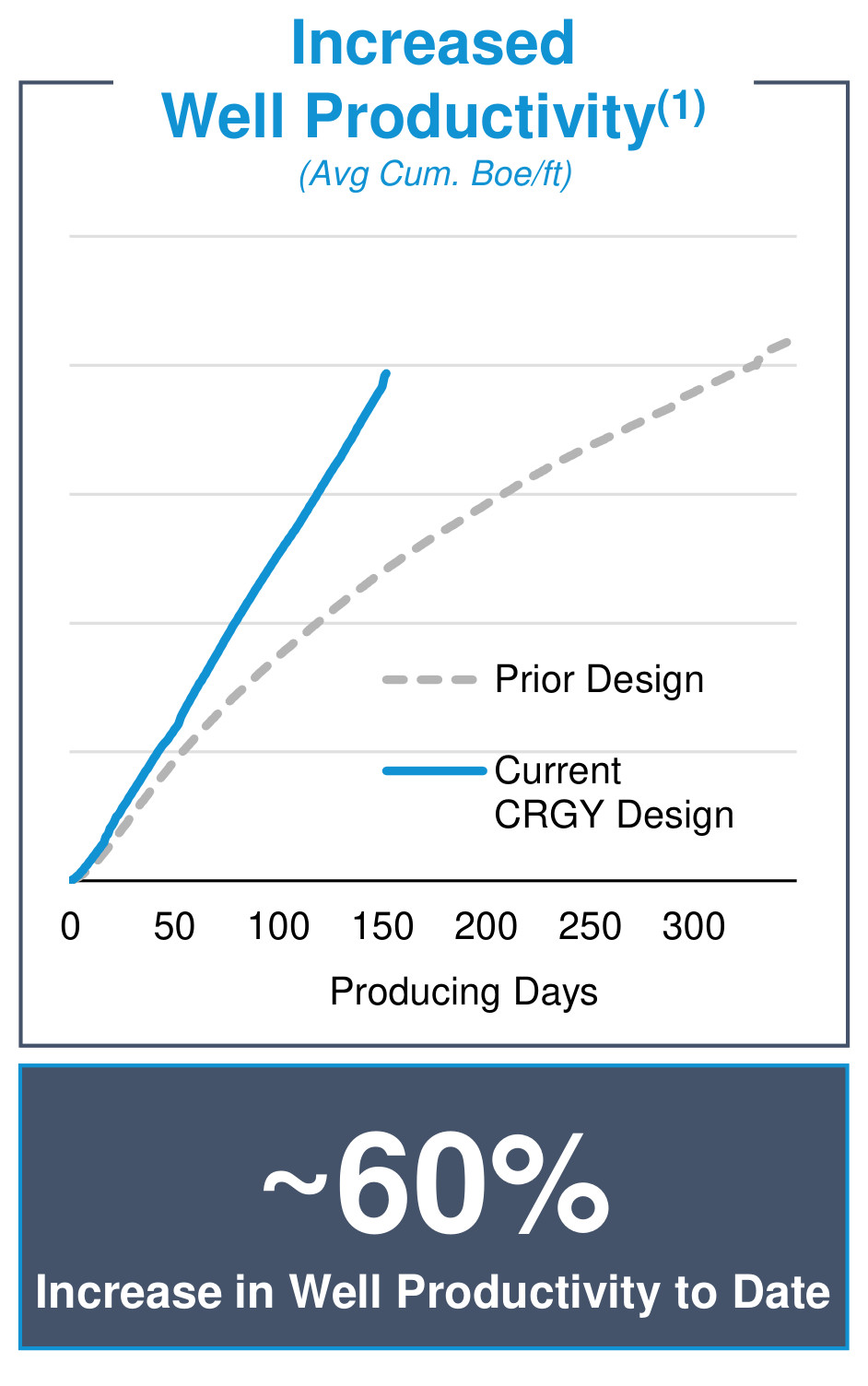

Crescent Energy’s new Uinta Basin completions are showing 60% greater production now that the new-design wells have been online 150 days, the E&P reported May 7.

And the extra oil is “with only minimal increases in our D&C costs,” David Rockecharlie, Crescent CEO, told investors in an earnings call.

A report earlier this year indicated 50% uplift, based on new wells’ output through that time.

“When we acquired this position [in 2022], the only horizontal development on the assets utilized a legacy, smaller completion design with roughly 1,500 pounds of proppant per foot,” Rockecharlie said on May 7.

“As we've implemented our operational approach, we are seeing significantly enhanced returns and improved capital efficiencies through larger completions, which we've doubled to roughly 3,000 pounds per foot.”

Crescent, which operates in Utah’s Uinta as Javelin Energy Partners, was the state’s No. 3 oil producer in January, putting into pipe some 21,000 bbl/d, according to state data.

Crescent brought four new Uinta wells online in the first quarter and 20 in its other play, the Eagle Ford Shale. Its 2024 capex is split 50-50 between the two plays.

Companywide drilling speed has grown 25% from 2022 to 2,000 ft per day, it reported, while completion speed has grown 40% since 2022 to 100,000 bbl/d of fluid pumped.

In full D&C cycle time, the results “save us a couple of days [per] well,” Rockecharlie said. “So a pretty meaningful improvement … over a year ago.”

Meanwhile, well costs have declined 10% to $900/ft per day from 2023, Crescent reported.

‘Supports our optimism’

Based on production growth from both areas, Crescent has increased its 2024 estimated production by 2,500 boe/d to average some 160,000 boe/d this year.

Rockecharlie said of the Uinta Basin results in particular, “Long-term implications for our asset are becoming clearer and clearer over time as productivity remains strong.”

He noted that the findings are still nascent, “but the data supports our optimism about the long-term value creation potential.”

Crescent has one rig drilling in Utah; two rigs, in the Eagle Ford.

It isn’t looking to add rigs or frac spreads, Rockecharlie said, and will return surplus earnings to shareholders instead.

“We would not look to accelerate activity …. I think our basic guidance of a two- to three-rig business today is going to remain intact.”

As for adding more Uinta or Eagle Ford leasehold, Rockecharlie said, “We are constantly in the market and looking for opportunities to invest at attractive risk-adjusted returns.”

Deal-making in the Uinta Basin has been a target of the Federal Trade Commission (FTC) beginning in 2022.

Crescent Energy neighbor XCL Resources has a deal underway to buy fellow operator Altamont Energy, but it is on hold as it awaits FTC approval.

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Liberty Bolsters Mobile Power Business with Acquisition of IMG Energy

2025-03-05 - Liberty Energy Inc. said March 5 it had purchased IMG Energy Solutions as the company expands its mobile power business.

On The Market This Week (Jan. 6, 2025)

2025-01-10 - Here is a roundup of listings marketed by select E&Ps during the week of Jan. 6.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.