Crescent Energy has signed a definitive agreement to acquire Eagle Ford assets from Ridgemar Energy for $905 million. (Source: Shutterstock, Crescent Energy)

Crescent Energy has signed a definitive agreement to acquire Eagle Ford assets from Ridgemar Energy for $905 million, plus contingency payments based on future oil prices, the company said Dec. 3.

Upfront consideration consists of up to $100 million of equity issued to the seller with the remainder in cash. Crescent’s future oil-price based consideration could total an additional $170 million.

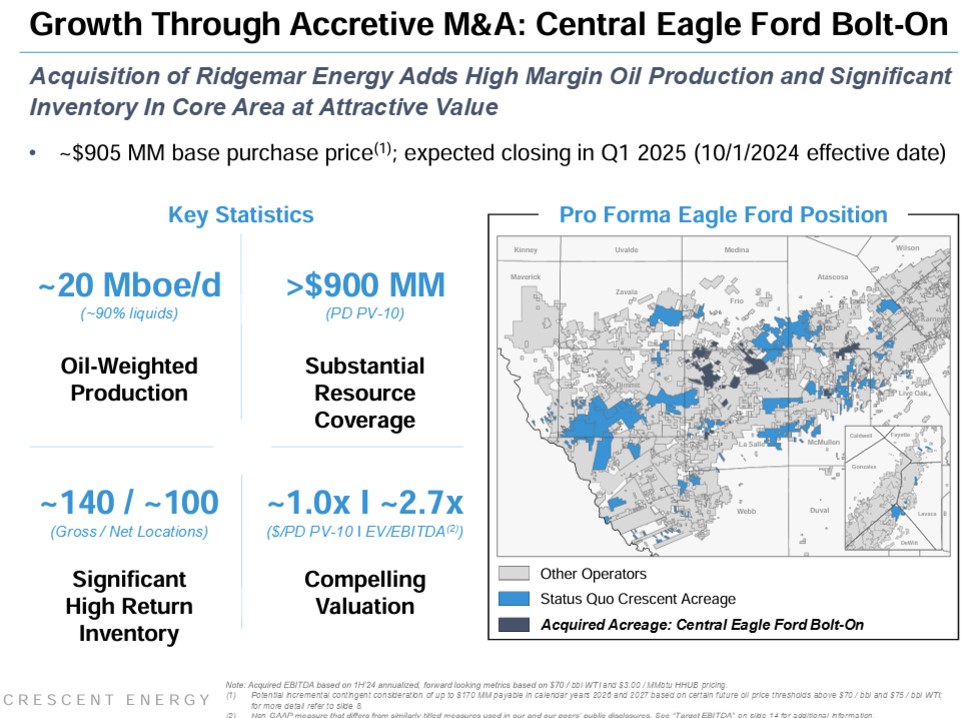

Ridgemar’s assets directly offset Crescent's core central Eagle Ford position. The deal adds significant and contiguous scale in Frio, Atascosa, La Salle and McMullen counties, Texas, with potential for meaningful operating efficiencies, the company said in a press release.

The deal builds on Crescent’s acquisition activity in the Eagle Ford over the past 18 months. Including its $2.1 billion acquisition of SilverBow Resources, Crescent M&A has totaled more than $4 billion during that span.

Crescent said it paid a 2.7x EBITDA multiple for Carnelian Energy Capital Management-backed Ridgemar. Crescent said the deal is accretive to the company’s operating cash flow, levered free cash flow and net asset value “with strong expected cash-on-cash returns,” the company said.

Future oil price contingency payments will be made quarterly by Crescent if certain WTI thresholds are met.

![[Contingent consideration.jpg] (Source: Crescent Energy)](/sites/default/files/inline-images/Contingent%20consideration.jpg)

Ridgemar’s assets add approximately 20,000 boe/d of high-margin, oil-weighted production and about 140 “well understood, high-return locations that immediately compete for capital and extend Crescent's low-risk inventory life,” the company said.

Crescent said the deal maintains its balance sheet and investment grade credit. Crescent's net debt to trailing 12-month adjusted EBITDAX ratio is expected to be at or below the company's publicly stated maximum leverage target of 1.5x.

"With accelerated synergies captured from the integration of SilverBow and our recent bolt-on acquisition, our full team is ready and eager to add the Ridgemar assets to our core operating footprint in the Eagle Ford," said Crescent CEO David Rockecharlie. "These assets contribute meaningful scale, enhance Crescent's cash margins, increase our oil-weighting and extend our low-risk inventory life, all at an attractive and highly accretive valuation."

In conjunction with the transaction, Crescent said it would offer 18 million of its Class A common stock shares, the proceeds of which will fund a portion of the Ridgemar transaction.

The transaction is expected to close in first-quarter 2025, subject to customary closing conditions.

Jefferies LLC served as financial adviser to Crescent in connection with the acquisition and Kirkland & Ellis LLP served as legal counsel. RBC Capital Markets LLC served as financial adviser and Vinson & Elkins LLP served as legal counsel to Ridgemar Energy.

Recommended Reading

AI-Shale Synergy: Experts Detail Transformational Ops Improvements

2025-01-17 - An abundance of data enables automation that saves time, cuts waste, speeds decision-making and sweetens the bottom line. Of course, there are challenges.

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

PrePad Tosses Spreadsheets for Drilling Completions Simulation Models

2025-02-18 - Startup PrePad’s discrete-event simulation model condenses the dozens of variables in a drilling operation to optimize the economics of drilling and completions. Big names such as Devon Energy, Chevron Technology Ventures and Coterra Energy have taken notice.

Halliburton Sees Strong Adoption of New Oilfield Tech Offerings

2025-01-22 - Halliburton Co.’s Zeus e-fracs, Octiv auto-fracs and the Sensori monitoring platform are setting the stage for long-term growth, CEO Jeff Miller says.

Momentum AI’s Neural Networks Find the Signal in All That Drilling Noise

2025-02-11 - Oklahoma-based Momentum AI says its model helps drillers avoid fracture-driven interactions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.