(Source: Shutterstock.com, Crescent Energy)

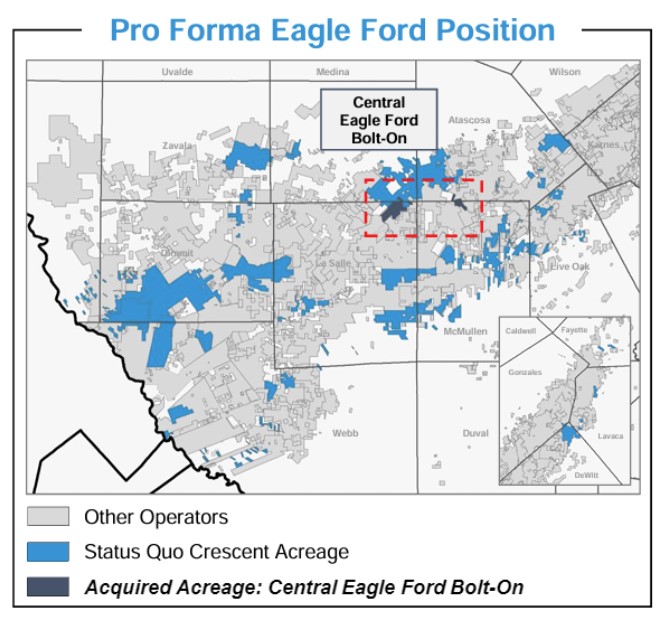

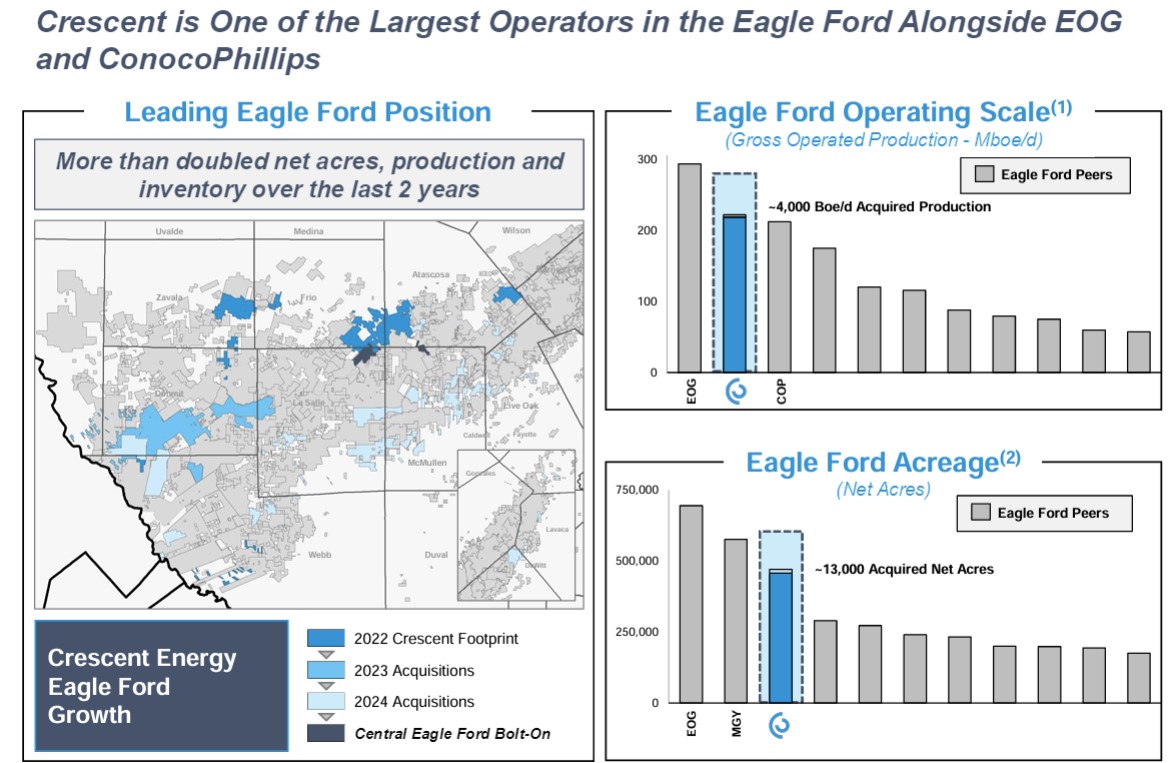

Crescent Energy has agreed to bolt on about 13,000 acres in the central Eagle Ford Shale for $168 million, the company said on Sept. 4.

The deal, Crescent said, builds on the company’s Eagle Ford M&A in the past 18 months, including its recent acquisition of SilverBow Resources. Crescent closed the $2.1 billion merger in July.

The acquisition adds what Crescent called “low-decline oil production” with a decline rate of 23% and includes roughly 23 net (30 gross) oil-weighted, core development locations. The transaction includes 5,300 net royalty acres and production averaging 4,000 boe/d, 85% oil, Crescent said. The seller of the assets wasn't disclosed.

The leasehold directly offsets Crescent’s existing footprint in Frio, Atascosa, La Salle and McMullen counties, Texas, and offers the potential for “meaningful operating efficiencies and extended lateral lengths across Crescent’s existing position,” the company said. The HBP acreage also “unlocks” an additional 30,000 ft of lateral length on Crescent's existing acreage.

“This transaction builds upon our momentum in the Eagle Ford, where we see substantial opportunity for further growth and compelling investment returns,” said Crescent CEO David Rockecharlie. “We are adding low-decline oil production and high-quality acreage adjacent to our existing position, with meaningful opportunity to further increase returns through improved operating efficiency. We are pleased with this attractive acquisition, and we believe in our ability to continue to accretively scale Crescent.”

Crescent has more than doubled its net acreage, production and inventory in the past two years and trails EOG Resources and Magnolia Oil & Gas in total net acreage, according to the company.

In conjunction with the signing of the transaction, Crescent entered into additional hedges in-line with its risk-management strategy.

Crescent said it expects its leverage ratio remain relatively unchanged, with net debt to trailing 12-month adjusted EBITDAX ratio expected to be below the company’s publicly stated maximum leverage target of 1.5x.

Also on Sept. 4, Crescent said that, subject to market conditions, its indirect subsidiary Crescent Energy Finance LLC intends to offer a private placement sale of securities. The total $250 million aggregate principal amount of 7.375% senior notes will be due in 2033.

The notes are being offered as additional notes under the indenture dated as of June 14, 2024, as previously supplemented, pursuant to which the Issuer has previously issued $750 million aggregate principal amount of 7.375% Senior Notes due 2033.

Recommended Reading

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

How DeepSeek Made Jevons Trend Again

2025-03-25 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

TGS to Reprocess Seismic Data in India’s Krishna-Godavari Basin

2025-01-28 - TGS will reprocess 3D seismic data, including 10,900 sq km of open acreage available in India’s upcoming 10th Open Acreage Licensing Policy (OALP) bid round blocks.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.