Crescent Energy’s acquisition of SilverBow Resources will create the second largest Eagle Ford Shale E&P with production of about 250,000 boe/d, the companies said.

Crescent Energy has agreed to buy SilverBow Resources, which has spent much of 2024 embroiled in a squabble with its largest investor, in a largely stock-based transaction valued at $2.1 billion, the companies said May 16.

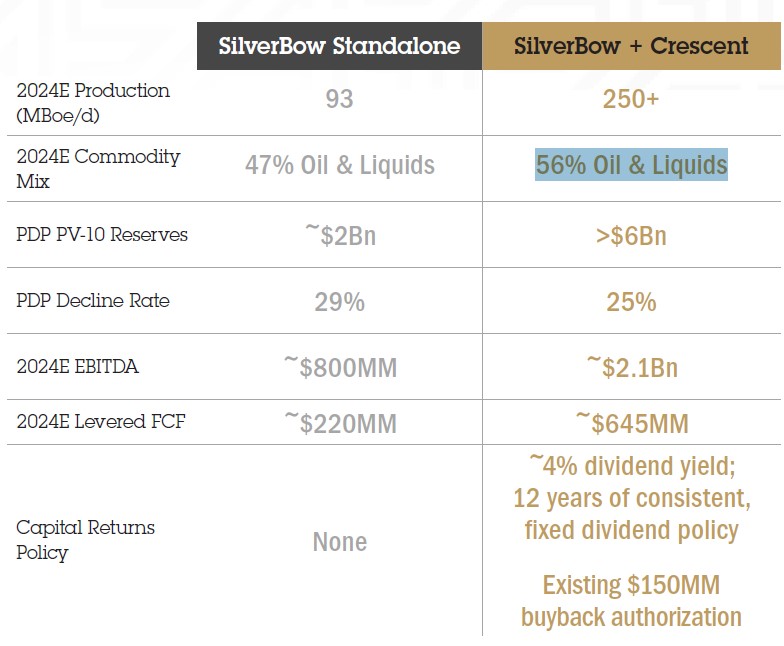

The transaction will create the second largest Eagle Ford Shale operator with pro forma production of roughly 250,000 boe/d, 56% oil and liquids, the companies said.

Under the terms of the transaction, SilverBow shareholders will receive 3.125 shares of Crescent Class A common stock for each share of SilverBow common stock, with the option to elect to receive all or a portion of the proceeds in cash at a value of $38 per share, subject to possible pro ration with a maximum total cash consideration for the transaction of $400 million.

Crescent and SilverBow's ownership stake in the combined company will depend on how much cash is used in the transaction in lieu of receiving stock, Oliver Huang, an analyst at TPH & Co., said in a commentary.

SilverBow has about 220,000 net acres in the Eagle Ford and expected production of 90,000 boe/d – along with 1,000 gross, undeveloped locations.

The combined company will have 2,200 gross locations, Huang said.

The companies said the pro forma Crescent will focus on free cash flow and disciplined capital allocation and an “investor-first” capital allocation that includes a fixed dividend and stock buyback program.

Crescent and SilverBow said the companies’ complementary assets would drive annual synergies of between $65 million and $100 million through “immediate cost of capital savings and operating efficiencies.”

The companies said the deal Creates a "Must-Own" midcap E&P with investing and operating expertise, balance sheet strength and the ability to access capital markets. Those strengths will allow Crescent to continue its strategy of generating free cash flow and “prudent growth through disciplined, returns-driven M&A.”

"This is a compelling transaction for shareholders of both companies, creating a premier growth through acquisition platform," said John Goff, Crescent's board chair. "As Chairman and a major long-term shareholder, it has been exciting to watch this business execute on the strategy management laid out from the very beginning. This combination further positions Crescent as a leading growth business, and we look forward to welcoming the SilverBow team as we continue to build this company."

SilverBow CEO Sean Woolverton said the deal offers a compelling value proposition for shareholders. “The transaction delivers an attractive premium to SilverBow shareholders, with a choice to opt into the significant upside, sustainable value and meaningful synergies that we see in this combination by receiving Crescent shares – or to receive immediate cash liquidity,” he said in a press release.

Woolverton said the transaction is consistent with the company’s commitment of pursuing any pathto maximize shareholder value and is “the result of a review of alternatives conducted with the assistance of our financial and legal advisors.”

“The SilverBow team built an incredible company, and today's exciting announcement is a testament to their hard work and dedication,” Woolverton said. “This combination of two strong companies positions the pro forma business for continued success above and beyond what either company could achieve on its own."

The combination has been unanimously approved by the boards of directors of both companies. A special committee comprised of Crescent independent directors also unanimously approved the transaction. Current Crescent shareholders representing about 43% of total Class A common stock and Class B common stock outstanding have entered into voting agreements in support of the deal.

After close, the Crescent board of directors will increase to 11 members with the addition of two directors to be designated by SilverBow.

SilverBow remains in a proxy fight with investor Kimmeridge after SilverBow spurned the investment firm’s proposal to combine with affiliate Kimmeridge Texas Gas (KTG). Kimmeridge, SilverBow’s largest shareholder holding 12.9% of the company’s outstanding shares, has put forward three candidates consideration at SilverBow’s May 21 annual meeting.

Goff will continue to serve as non-executive chairman and Crescent CEO David Rockecharlie will oversee the combined, Houston-based company.

The transaction, which is subject to customary closing conditions, including approvals by shareholders of each company and regulatory agencies, is targeted to close by the end of the third quarter.

Crescent's financial advisers for the acquisition are Jefferies LLC, as lead adviser, and Wells Fargo. Crescent's counsel is Vinson & Elkins LLP. Wells Fargo Bank NA has also provided $2 billion of committed financing for the transaction.

Crescent’s special committee retained Intrepid Partners, LLC as financial adviser and Richards, Layton & Finger LLP as counsel.

Recommended Reading

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

Exclusive: LNG Takes Control in Meeting Data Center Reliability, Capacity Needs

2025-04-02 - William Seller, solutions architect at DartPoints, shares insight on the impact that data center power demand will have on the natural gas industry, in this Hart Energy Exclusive interview.

Prairie Operating Plans 11-Well Development at Rusch Pad in Colorado

2025-04-02 - Prairie Operating Co. has begun an 11-well development program in Weld County, Colorado, following the closing of its $603 million deal for Bayswater Exploration and Production assets.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

BlackRock’s Fink Calls for Reliable US Power Grid—Now

2025-03-31 - “That starts with fixing the slow, broken permitting processes in the U.S. and Europe,” Larry Fink, the co-founder, chairman and CEO of $12 trillion investment-management firm BlackRock Inc., told shareholders March 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.