Crescent Energy closed a $2.1 billion merger with SilverBow Resources on July 30. (Source: Shutterstock/ Crescent Energy/ SilverBow Resources)

Crescent Energy closed an acquisition of SilverBow Resources on July 30, creating the second-largest operator in the Eagle Ford Shale.

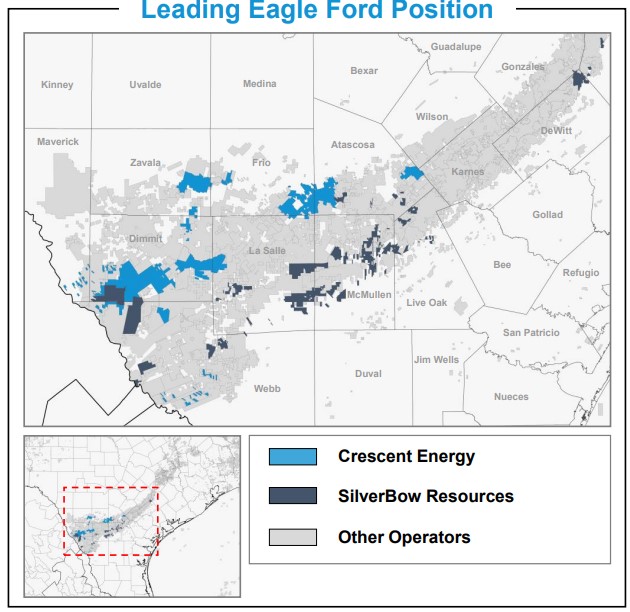

SilverBow had around 220,000 net acres in the western Eagle Ford. The company’s production averaged 91,400 boe/d (46% oil/liquids) during the first quarter.

Crescent had approximately 231,000 net acres across its Eagle Ford portfolio. Net Eagle Ford volumes reached nearly 16.2 MMboe in 2023, or an average of 44,358 boe/d. Crescent also has a footprint of assets in Utah’s Uinta Basin.

When the $2.1 billion transaction was announced in May, Crescent expected production across its broader portfolio to reach roughly 250,000 boe/d.

Crescent plans to provide pro forma guidance for the second half of 2024 when the company reports its second-quarter earnings after markets close on Aug. 5.

The company reports that SilverBow’s integration “is well underway with approximately $35 million of the previously announced [$65 million to $100 million] in annual synergies captured to date through an improved cost of capital resulting in reduced interest expense,” Crescent said.

“Through disciplined investing and operations, we have delivered profitable growth, tripling the size of our business over the last four years,” Crescent CEO David Rockecharlie said. “We have created a premier growth through acquisition platform by executing on our cash flow and returns-oriented strategy. Today, we are focused on rapidly integrating our new assets and personnel and continuing to deliver on the significant synergies we've identified to strengthen returns.”

Under the deal’s terms, SilverBow shareholders elected to receive an aggregate of $358 million in total cash consideration. Crescent issued 52 million shares of Class A common stock as the equity portion of the deal.

SilverBow shareholders own approximately 23% of the combined company on a diluted basis.

Crescent also expanded its board to a total of 11 directors with the appointments of Marc Rowland and Michael Duginski.

Shareholders at both companies voted to approve the combination at their respective stockholders’ meetings held July 29.

Regulators signed off on the deal in early July.

RELATED

Could Crescent, SilverBow Buy More in South Texas After $2.1B Deal?

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.