Low levels on a crude tank mean sellers have to overcome a number of problems to get the product to market. If the level drops below the pump level, crude becomes difficult to move. (Source: Shutterstock)

While some analysts forecast an oil supply glut in 2025, the year is starting off with crude storage levels so low they could affect the market.

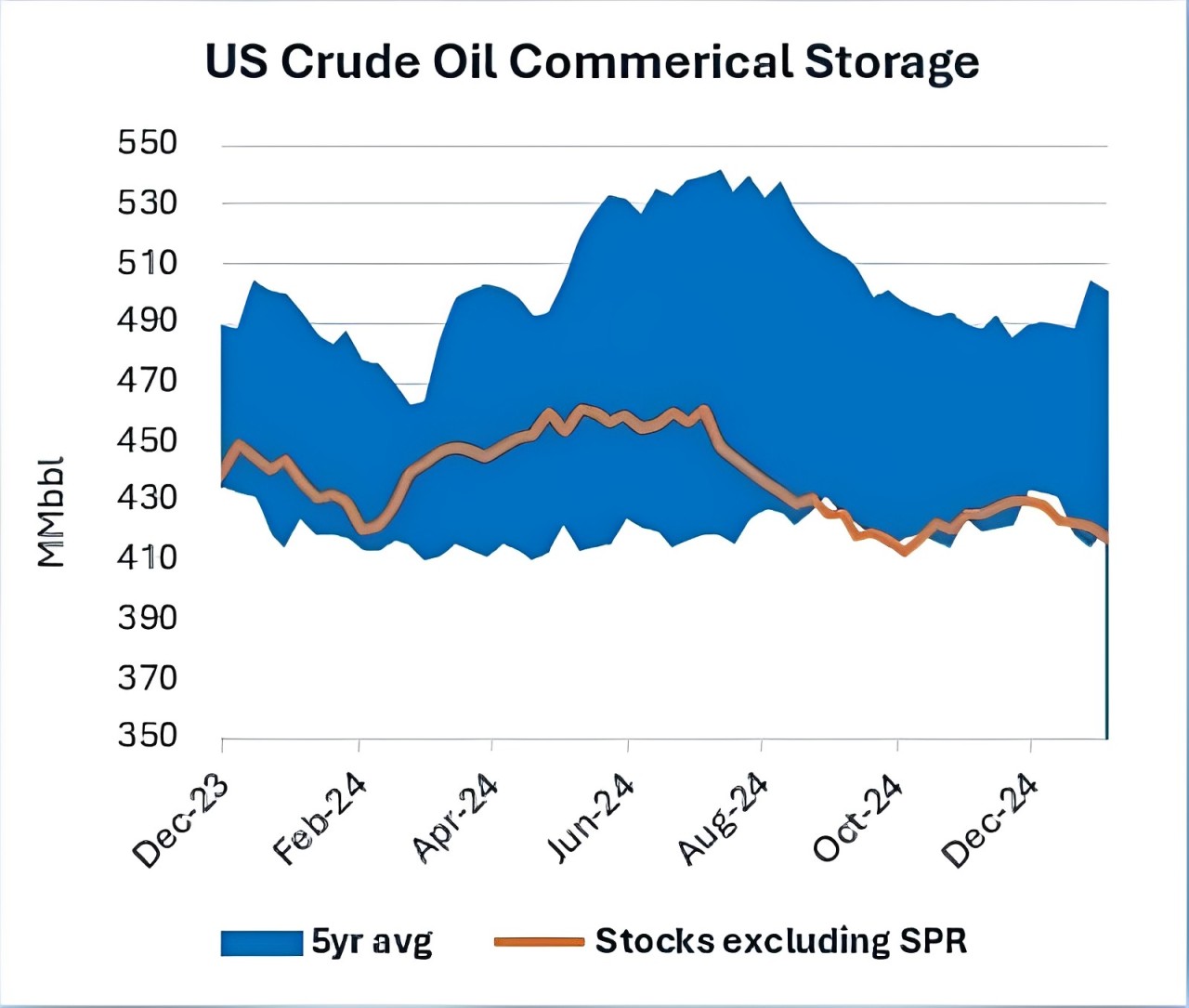

According to the U.S. Energy Information Administration (EIA), overall U.S. crude levels are near five-year record lows. In a report released Jan. 15, the EIA showed crude stocks have continued to fall since July 2024 from about 460 MMbbl to less than 420 MMbbl after the second week of January 2025.

At Cushing, Oklahoma, the country’s primary hub for pipeline crude transport and refining, the situation is worse, said Kristy Oleszek, East Daley Analytics director of energy analytics.

“U.S. crude oil levels continue to border on the five-year average lows,” Oleszek said in an email to Hart Energy. “However, storage in Cushing is at an all-time low.”

The facility received 76,000 bbl of crude oil injections for the week ending Jan. 10, but that’s “a small dent when looking at Cushing’s 91 MMbbl capacity,” she said.

Low levels on a crude tank mean sellers have to overcome a number of problems to get the product to market. If the level drops below the pump level, crude becomes difficult to move.

Draining the tank from the bottom means more water and other impurities are drawn out along with the crude, which otherwise floats on top.

Annually, the owners of crude storage tanks prefer to lower the tank levels at the end of each year to avoid tax charges. However, the situation to start 2025 has been more extreme than usual, the EIA reported.

Technical problems aside, the market may react badly depending on the size of the demand.

“The larger issue is the added volatility to the market when storage levels are abnormally low,” Oleszek said. “The market will not be able to react to current market conditions, resulting in price swings and enhanced volatility.”

Since hitting $69.24/bbl on Dec. 24, the WTI price has increased to $80.52 during trading on Jan. 15. The higher price is bad news for people trying to restock the crude supply, as producers are more likely to sell at that price than put their oil in storage.

Oleszek said East Daley believes that a crude price above $73/bbl will prevent significant injections to storage, meaning the tanks could remain at low levels for a while.

“The crude oil forward strip indicates an average $73/bbl throughout 2025, which will encourage crude sales at today’s prices,” she said.

Recommended Reading

Major Interest: Chevron, Shell Join Vaca Muerta Crude Pipe Project

2025-01-17 - Oil producers are pumping record levels from Argentina’s Vaca Muerta shale. Chevron and Shell have backed a new crude pipeline project that aims to boost takeaway capacity—and exports—of Vaca Muerta oil.

Report: Leak Detection and Repair Work Growing Globally

2025-01-17 - Natural gas trends are boosting the companies that monitor and repair leaks, a consulting firm said in a report.

Oklo Signs MOU with RPower for Phased Power to Data Centers

2025-01-17 - Oklo and power generation company RPower will work together to provide a phased natural gas-to-emissions free approach to power data centers

Colonial’s Line 1 Gasoline Service Restored, Company Says

2025-01-17 - Colonial Pipeline Co. stopped flows on the gasoline transport line following reports of a leak in Georgia.

SLB’s Big Boost from Digital, Offsetting Flat Trends in Oil, E&P

2025-01-17 - SLB’s digital revenue grew 20% in 2024 as customers continue to adopt the company's digital products, artificial intelligence and cloud computing.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.