As the onshore rig count climbed in 2014, operators and suppliers pushed for standardization across product lines to optimize inventory and supply chain needs. The development of each shale play resulted in operators using similar well designs for casing and connections. In many cases, this meant operators sacrificed a level of performance to operate within this ad hoc standard well design.

The recent drop in oil price forced distributors to utilize existing stock before ordering new pipe, which gave way to significant drops in standard pipe inventories. For Vallourec this provided the opportunity to work with operators to question conventional wisdom and find ways to achieve higher strength, pressure and production performance with optimized casing designs outside the standard American Petroleum Institute (API) dimensions. Using custom casing led to significant savings for rig time and steel costs in addition to providing increased production.

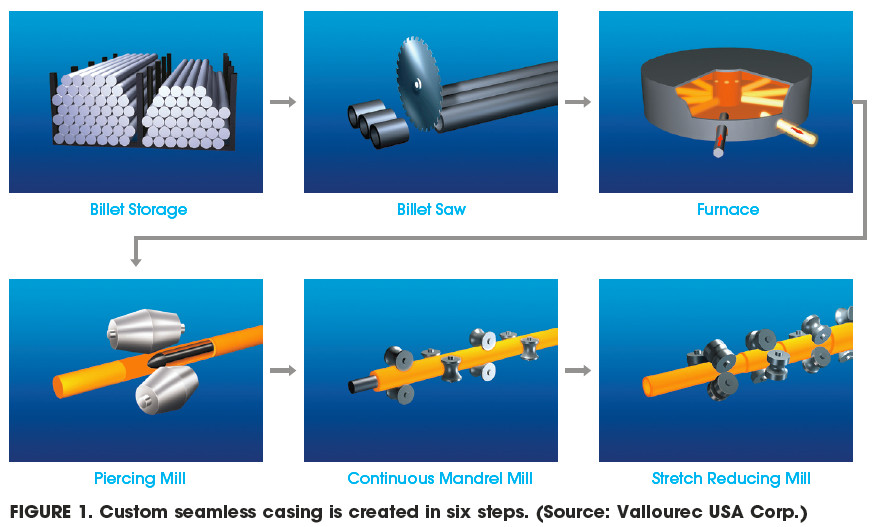

Casing size is not as strict as the API tables list because the adaptability of the manufacturing process gives an infinite number of possibilities for custom casing solutions. There are three main steps that define the geometry of any seamless casing product: Piercing a hot billet into a tube, rolling the tube to the correct wall thickness and sizing the tube for final outer diameter (OD) dimensions (Figure 1). Each step can be expertly manipulated to create almost any size OD or wall thickness.

In the same time line a custom-sized casing solution is produced, a connection needs to be developed to match the needs of each project. The extensive product line of VAM connections gives a wealth of design history, which allows product lines to be extrapolated to new custom sizes. Once a design is on paper, it is evaluated with finite element analysis and/or physical testing according to the International Organization for Standardization’s 13679 standard or the API’s recommended practice 5C5 or customer requirements to assess behavior during critical loading. With the largest testing laboratory of connection suppliers in the world located at VAM USA’s Houston facility, all design and qualification of VAM connections can be performed close to the customers and regions where they will be used.

API allows any OD/wall combination with agreement between mill and purchaser so that the pipe still meets the API standard that operators are used to. There is no need to fit a well design into a standard box if well conditions have room for optimization.

East Texas

An operator drilling in East Texas approached Vallourec with strict criteria on performance numbers needed to complete a new well. The company was using a 7-in.-by-32-lb/ ft (0.453-in. wall) intermediate string. The operator was looking for a significantly higher internal yield rating. Any new product would need to maintain the same inner diameter (ID) as the 7-in.-by-32-lb/ft to use existing liner hangers and drillbits.

To achieve this increased internal rating, Vallourec worked backward to conventional wisdom by using the extreme flexibility of the new Fine Quality Mill rolling mill in Youngstown, Ohio. The customer performance requirements were used to solve for the OD geometry rather than starting with OD geometry to define performance based on the grade and yield strength that could meet those requirements. This project had three main requirements:

- Casing ID had to remain the same to utilize inventory;

- Material had to be capable in a mild sour environment; and

- Internal yield had to be more than 15,000 psi to support the fracture job.

These requirements created an ID-constrained product made from a mild sour material with a restricted yield. Using the ID as the starting point and the restricted yield strength range of 110,000 psi to 125,000 psi, the OD was adjusted accordingly using API formulas until the 15,000- psi internal yield was achieved.

By challenging the standard casing trend, the operator hoped to optimize the well profile and save money in the process. The typical well design in the area utilized an intermediate 7-in.-by-32-lb/ft casing run from surface to kickoff point. It was then completed with a 4½-in. production string run from surface to total depth. By increasing the rating of the 7-in. casing, the need to have the 4½-in. production string run from surface to a depth of 3,926 m (13,000 ft) would be eliminated, resulting in substantial savings and completion time.

After adjusting for all required parameters, the end result was a product with an OD pushed out to 7¼ in. with 0.578-in. wall thickness (41.50 lb/ft). This new sour service product has an increased internal yield pressure of 15,350 psi, up from 12,460 psi (a 23% increase), and an increased external yield pressure of 16,030 psi from 10,780 psi (a 49% increase) when compared to the standard 7-in.-by-32-lb/ft casing.

These increased ratings allowed the operator to design its wells around an optimized formation fracture pressure, at the same time reducing overall well cost. The ID allows all previously designed equipment to be used (i.e., liner hangers, drillbits, production string, etc.). The oversized OD does not interfere with running the string through the same 8½-in. drilled open hole. The total volume of steel, and therefore cost, to complete this well was significantly lowered. The previous design combined 7-in.-by-32-lb/ft with the 4½-in.-by-15.10-lb/ft casing for a total of 47.10 lb/ ft while the new design is only 41.50 lb/ft. This saved the company 5.60 lb/ft of steel, or about 72,800 lb per well.

To ensure full sealability during the high number of fracture stages this string would see, VAM 21 connection, the company’s next generation threaded and coupled premium connection, was selected to couple the joints together.

South Texas

An operator in the Eagle Ford Shale contacted Vallourec about increasing the size of its existing 5½-in.-by- 23-lb/ft production casing design, opening the door to custom opportunities in that region. The operator’s main reason for enlarging the production casing was to increase the ID to allow a higher volume of fracture fluid flow while maintaining the same fracture pressure as the conventional 5½-in. casing. The added volumetric flow would aid the fracture job with an overall increase in pumped fluid without the same pressure losses associated with the smaller 5½-in. casing.

The company required an overall string OD less than 7 in. to fit inside the 8¾-in. wellbore, leaving enough annular clearance for efficient cementing. At the same time, the company did not want to considerably increase the overall steel cost.

The operator’s initial proposal called for a tapered string design with 65⁄8-in. casing in the vertical and 5½-in. casing in the lateral section of the well. The 65⁄8- in. casing would not be able to make it through the 10-degree to 12-degree dogleg safely. While supplying the 65⁄8-in. casing was not an issue, Vallourec was able to find a better solution.

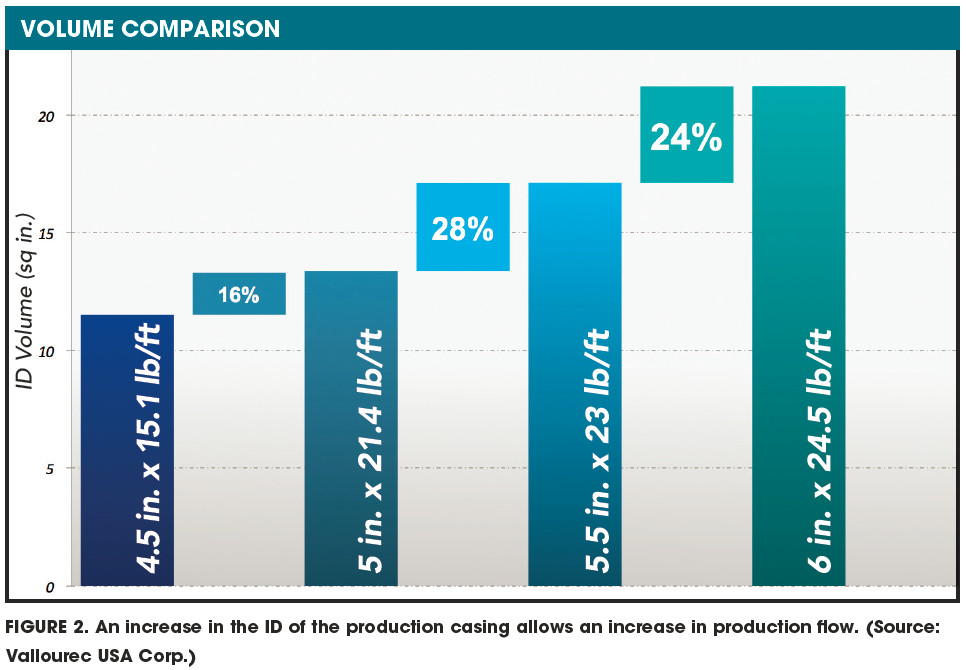

The new design proposed was a 6-in. OD with a slightly reduced wall thickness from 0.415 in. to 0.4 in. to keep a lower weight per foot and increase the ID as much as possible. This meant the ID of this custom product moved from 4.67 in. to 5.20 in., resulting in a 24% increase in ID cross-sectional area (Figure 2). The small geometry adjustment would still be capable of making it through the dogleg while maintaining enough clearance for the connection OD without hindering the cementing process.

The reduced wall thickness did not reduce load ratings. The change in diameter/wall thickness ratio allowed an almost 7% increase in tension, compression and torque. The operator opted to use this new 6-in.-by- 24.5-lb/ft product with a VAM TOP HT connection for the entire 6,096-m (20,000-ft) production string in the final design.

A four-well trial was performed, and the 6-in. casing ran very efficiently. The increased moment of inertia made the pipe stiffer than the original 5½ in., so the operator had less deviation and eccentricity to work against when setting the string in the open wellbore. Cementing pressures were lower than the initial model. The operator also utilized longer spacing between stages, reducing the number of costly perforations. Using the same fracture pressures from the previous well design, the operator gained a 20% increase in production volume.

Timing was crucial in this project. Project time from initial discussion to delivery of the finished threaded product was 90 days. Coordination with VAM Field Services for running tools, original equipment manufacturers and licensees for all accessories was performed to ensure a successful field run. Vallourec is working with this same operator in optimizing the production casing string size in its Permian assets that typically have stricter clearance requirements.

Marcellus and Utica shales

The routine intermediate casing used in the Marcellus and Utica shale plays is 95⁄8 in. Due to collapse concerns, a Vallourec customer utilized a high-strength product that did not permit an 8¾-in. drift. As a result, an 8½-in. hole was planned through the 95⁄8-in. section for the production string. While executing development wells, the operator began to notice the 8½-in. drillbits were going under gauge in the vertical section. When it attempted to trip in with the curve/lateral bottomhole assembly, the rig had to ream significant portions of the well. This caused additional reamer trips to be planned and executed on subsequent wells. In an attempt to eliminate reaming and the cost associated with this process, several casing design alterations were considered. In addition, hole-openers were evaluated, but due to a variety of issues, these were not considered a feasible option. Also considered were 85⁄8-in. drillbits, but the 8¾-in. drillbits were believed to minimize the risk of reaming. Vallourec was contacted to help achieve an 8¾-in. drift, allowing a larger drillbit while still maintaining the high collapse requirement.

To increase the drift 1⁄8 in., it was understood the OD also would need to increase a comparable amount. Also, a similar diameter to wall-thickness ratio would need to be maintained to ensure the final product would have the same yield strength range and maintain the collapse pressure.

The solution was a customized casing string engineered for the optimized wall geometry and performance requirements for ID drift and collapse pressure. Starting with the 95⁄8-in.-by-43.50-lb/ft casing as a base, numerous options were considered to push the drift out to 8.750 in. while maintaining the collapse. Thinner walls and higher yield strengths were considered. However, new OD geometry was the most efficient at meeting the requirements.

The new product at 95⁄8-in.-by-50-lb/ft casing (0.489- in. wall) enlarged the drift to 8.750 in. from 8.625 in. while maintaining a nearly identical collapse pressure (5,770 psi to 5,760 psi). The increased drift allowed the operator to run a larger drillbit, eliminating the reamer trip without sacrificing the required collapse pressure to drill in this region.

Recommended Reading

Coterra Eyes Wolfcamp D, Penn Shale Upside with $3.95B Permian M&A

2024-11-15 - With $3.95 billion in Permian M&A, Coterra is adding new Delaware Basin locations in the Bone Spring, Harkey and Avalon benches—and eyeing upside from deeper zones.

As Permian Targets Grow Scarce, 3Q M&A Drops to $12B—Enverus

2024-10-16 - Upstream M&A activity fell sharply in the third quarter as public consolidation slowed and Permian Basin targets dwindled, according to Enverus Intelligence Research.

Diamondback Swaps Delaware Assets, Pays $238MM For TRP’s Midland Assets

2024-11-04 - After closing a $26 billion acquisition of Endeavor Energy Resources, Diamondback Energy is getting deeper in the Midland Basin through an asset swap with TRP Energy.

Marketed: Providence Energy Partners III LP Permian Non-op Opportunity

2024-10-16 - Providence Energy Partners III LP retained RedOaks Energy Advisors for the sale of certain non-operated working interest properties located in the Permian Basin.

Tailwater Buys Interests Across 5,000 Acres in Permian Core

2024-10-02 - Tailwater E&P's purchase of non-op working interests from Accelerate Resources includes future inventory held by Diamondback, EOG Resources, Devon and several other E&Ps.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.