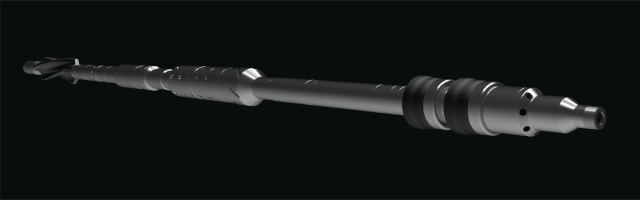

The HydraHemera PWC tool provides an alternative to section milling in P&A operations. (Source: HydraWell)

A wave of oil and gas wells drilled in the last 50 years are reaching the end of their useful life. These wells require attention to be plugged and abandoned in a safe manner to avoid costly liabilities for oil companies. However, plugging and abandonment represent an unwanted but necessary cost to the industry. Any improvements in efficiency and reduction of cost in this activity would deliver significant financial benefits to the oil companies and the tax payers, since in many cases these activities are subsidized through government fiscal regimes.

Since the 1970s section milling has been the preferred method of oil companies for plugging an oil and gas well where the annulus integrity is lacking. However, it is a method that can be time-consuming and difficult to execute safely and effectively.

Briefly explained, section milling incorporates the removal of a section of casing by milling operations enabling the installation of a rock-to-rock plug for hydraulic isolation purposes. After the section of casing is milled, the well needs to be properly cleaned out by removing the swarf cuttings and other debris. After the new formation is exposed, a balanced cement plug is placed in the section.

Section milling challenges

A traditional section milling job is time-consuming. Typically, it takes 10 days to 14 days to perform a 50-m (164-ft) section milling operation using an expensive drilling rig.

Proper hole cleaning is a challenge, and the fluids designed for section milling must have sufficient viscosity to suspend and transport swarf and debris to the surface. In the worst case, poorly transported swarf and debris can build up downhole and result in stuck pipe.

Section milling also presents HSE challenges when the swarf cuttings from the well are brought to surface as these cuttings require specialized material handling and disposal. The cuttings are razor sharp and require protective equipment when handling. On average, milling a 50-m section of an offshore well generates about 4 tonnes of swarf cuttings.

Difficult challenge, new approach

HydraWell worked to create a technology that could improve operational efficiency of plugging through multi-activity tool combinations. From this came the proprietary single-trip perforate, wash, cement (PWC) technology.

The company’s HydraHemera system consists of three parts. Placed at the bottom of the assembly are third-party-supplied perforation guns. Sitting above the perforation guns is a jetting tool and then a cementing tool.

The jetting tool washes and cleans out debris in the annuli behind the perforated casings. The tool features jet nozzles configured at irregular angles and engineered for optimum fluid velocity and annuli cleaning efficiency. The jets penetrate and clean thoroughly behind single or multiple perforated casings. In this process, debris, old mud and cement traces are replaced by clean fluid. The jetting tool ensures clean conditions in the casing annuli prior to placing the plugging material in the cross section.

After jetting is complete, the cementing tool is then activated using a ball drop mechanism. This enables the placement of barrier material in the entire cross section of multiple annuli and establishes a proper rock-to-rock barrier in the well.

As in section milling, the mud weight must be sufficient to maintain the stability of the exposed formation. However, high-viscosity fluids are not required to lift metal debris from the wellbore. In addition, the PWC system creates an abandonment plug that can be verified. After placing barrier material, it is possible to drill out the plug and perform a cement bond log to provide verifi cation of integrity.

Time and cost saving

ConocoPhillips was the first company to use the technology on its Ekofisk Field in the North Sea in 2010. At a presentation during the 2016 Norwegian Plug and Abandonment Forum, ConocoPhillips stated it had achieved a 70% improvement in plug and abandonment (P&A) performance at the Ekofisk Alpha Field based on the number of days saved per well, thereby concluding the P&A campaign almost one year ahead of schedule. This delivered significant cost savings to the operator with the PWC technology playing a major part.

Since introducing the PWC system, 16 operators, including supermajors, national and independent oil companies, have accepted and utilized the technology, installing more than 220 plugs worldwide. The PWC system has repeatedly demonstrated that it is capable of plugging offshore wells in two to three days instead of the 10 to 14 days it takes with traditional plugging methods such as section milling.

BP (now AkerBP) also stated at 2016 forum that it reduced the average days per well P&A process by 45% at the Valhall Field in the North Sea. It also reduced the average cost per well by an average of 35% and plugged and abandoned 13 wells during a rig contract period that was originally planned for six wells. HydraWell supported BP in these operations.

The PWC technology has saved more than 1,500 rig days for oil companies, with the additional benefit of a significantly smaller environmental footprint as no swarf cuttings have been brought to surface for further disposal.

Rigless P&A operations

Plugging offshore wells without removing the production tubing is the next development in the company’s technology portfolio. The new proposed solution, HydraArtemis, enables plugging of wells from the existing infrastructure by use of well intervention equipment such as coiled tubing and wireline.

Typically, thousands of meters of production tubing are brought to surface in the current P&A activity. Today, oil companies often have to upgrade the drilling unit on their platforms or hire a drilling rig to execute P&A operations to retrieve this production tubing to surface. Performing this type of P&A work without a drilling rig will significantly reduce oil companies’ costs.

Avoiding tubing retrieval eliminates costs and risks associated with heavylift vessels, transport of material onshore and disposal of the tubulars recovered from the well.

Have a story idea for Operator Solutions? This feature highlights technologies and techniques that are helping upstream operators overcome their challenges. Submit your story ideas to Group Managing Editor Jo Ann Davy at jdavy@hartenergy.com.

Recommended Reading

Norway's Massive Johan Sverdrup Oilfield Shut by Power Outage

2024-11-18 - Norway's Equinor has halted output from its Johan Sverdrup oilfield, western Europe's largest, due to an onshore power outage, the company said on Nov. 18.

E&P Highlights: Jan. 13, 2025

2025-01-13 - Here’s a roundup of the latest E&P headlines, including Chevron starting production from a platform in the Gulf of Mexico and several new products for pipelines.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

E&P Highlights: Dec. 2, 2024

2024-12-02 - Here’s a roundup of the latest E&P headlines, including production updates and major offshore contracts.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.