Falling oil prices, recession fears and the U.S. election cycle are weighing on U.S. producers, according to the Dallas Fed Energy Survey. (Source: Shutterstock.com)

Are oil prices going up or going down? Is the world still recovering from a recession or entering a new one? Will my company even make money from natural gas production this quarter?

U.S. producers and oilfield services (OFS) providers report that a whirlwind of macroeconomic, political and regulatory uncertainty is sweeping across the sector, according to the third-quarter Dallas Fed Energy Survey published Sept. 25.

The Federal Reserve Bank of Dallas’ quarterly survey is a broad measurement of sentiment across the U.S. oil and gas industry. The third-quarter survey includes responses from 133 oil and gas firms in Texas, southern New Mexico and northern Louisiana. Survey responses were collected between Sept. 11 and Sept. 19.

The Permian Basin was hardest hit by commodity prices, with more than a third of respondents reporting curtailments of oil production because of the deleterious effects of low natural gas prices. Slumping oil prices, along with uncertainties in how the November presidential election will shape up, are also weighing on industry decision makers.

RELATED

‘Too Many’ Players: Oilfield Services Feel Permian M&A Crunch—Dallas Fed

Price check

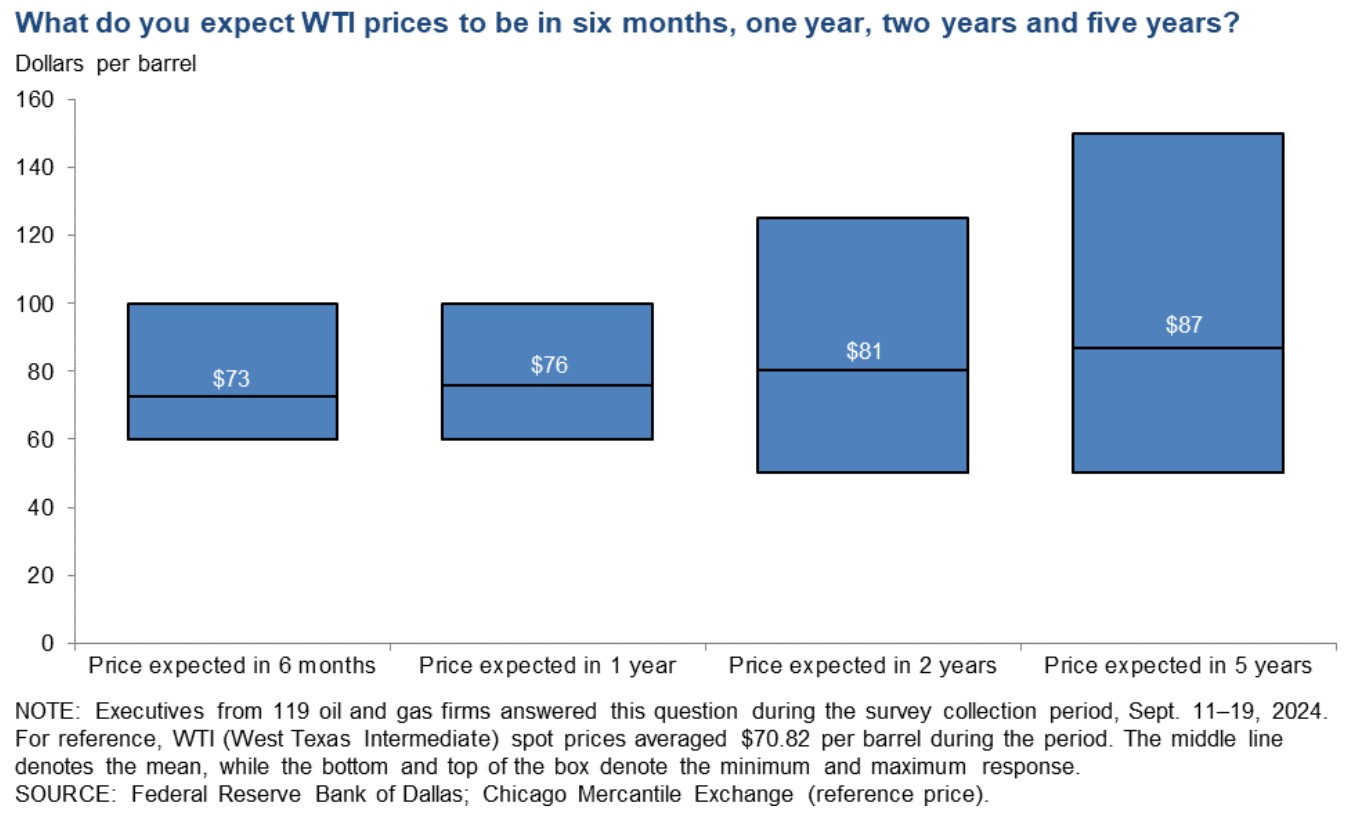

Natural gas producers continue to weather through a prolonged period of low prices. But oil producers are closely watching dipping WTI prices amid elevated storage inventories and shaky global demand.

WTI spot prices averaged $68.82/bbl during the week ended Sept. 13, according to U.S. Energy Information Administration data. WTI prices averaged $76.68/bbl in August and $81.80 in July.

“Recent volatility has started to impact planning discussions for 2025,” one E&P executive wrote in a survey response. “We have not adjusted our plan yet, but we are starting to work on potential drilling plans for a lower commodity environment.”

Some executives see the potential for prices to drop further:

“Future OPEC+ production allotments are uncertain,” another E&P executive told the survey. “Technical analysis of the recent oil-price movements suggests that WTI could drop to around $55 per barrel depending on whether the U.S. is entering a recession.”

Others are more bullish on oil prices in the long term.

“We stand by the hypothesis that the world is swiftly running out of $60 barrels on the way to $100+ barrels within the next five years,” another opined.

Michael Plante, Dallas Fed senior research economist and advisor, said that depressed natural gas prices in the Permian, as well as falling oil prices, “appear to have weighed on survey respondents this quarter.”

“This was especially true for oilfield service firms, many of which reported declining activity levels,” he said.

Out of 23 E&Ps that drilled or completed a horizontal well in the Permian Basin in the past two years, 35% said low Waha Hub natural gas prices caused their firm to curtail Permian production.

Another 26% reported delaying or deferring well drilling in response to low natural gas prices, while 9% noted delaying or deferring well completions.

However, most respondents (~52%) cited no impact on operations or reduced natural gas revenue.

“Several of the past months I have received nothing or a negative adjustment to revenue for natural gas,” an E&P executive wrote. “In June, one operator paid $0.09 per million cubic feet, which is above $0, but accrues little to my revenue.”

Pipeline takeaway constraints are a major reason for the low spot prices in West Texas. Permian Basin operators are focused on crude production; gas is an unwanted byproduct. Egress out of the basin has been full for a year and natural gas has suffered negative pricing for most of the summer.

Producers expect to see higher prices when new projects, particularly WhiteWater Midstream's 2.5 Bcf/d Matterhorn Express, start to come online. In July, WhiteWater announced that a final investment decision (FID) had been reached for the Blackcomb Pipeline, a planned 2.5 Bcf/d pipeline that will run from West Texas to the Gulf Coast.

But Permian E&Ps don’t seem willing to boost output even when natural gas prices are higher—80% of executives said they are not planning to ramp up completion activities in the Permian once the gas pipeline bottleneck clears.

Outside of the Permian, industry players report that low natural gas prices are leading to slacking equipment utilization in gas-focused basins, particularly the Haynesville Shale.

“The Eastern Haynesville drilling rig utilization is dropping off, and drilling rig utilization in the Western Haynesville/Bossier Sands play is increasing due to higher production rates being found there,” an E&P executive wrote.

RELATED

Analyst: Could Permian Gas Pipelines Fall Short of LNG Sweet Spot?

Playing politics

Producers perennially lament commodity prices, whether they’re low or high. They also like to complain about political administrations and elections.

With the U.S. election cycle in full swing, some industry players appear to be waiting to see how the November vote shakes out.

- “The oil community prefers to await the allocation of capital until after the election,” an E&P respondent wrote.

- “We are hearing and seeing a continued reining in of activity from our customers due to the uncertainty regarding the November elections,” an oilfield services respondent wrote. “There is work out there, but it is just being held until there is some certainty regarding energy policy.”

- “Activity levels are up slightly, but the market still feels cautious,” another OFS player wrote. “Whether the caution is driven by the continuous M&A or the election is unclear to us.”

RELATED

Worley CEO: Combative Politics Complicating Regulations, Incentives

Recommended Reading

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

ProPetro Agrees to Provide Electric Fracking Services to Permian Operator

2024-12-19 - ProPetro Holding Corp. now has four electric fleets on contract.

Delivering Dividends Through Digital Technology

2024-12-30 - Increasing automation is creating a step change across the oil and gas life cycle.

Tracking Frac Equipment Conditions to Prevent Failures

2024-12-23 - A novel direct drive system and remote pump monitoring capability boosts efficiencies from inside and out.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.