Oil and gas executives remain optimistic, just not as much as they have been, the Dallas Fed’s survey shows. (Source: Hart Energy graphic from Shutterstock)

Oil and gas activity continued to grow and the sector’s executives continued to be optimistic in the fourth quarter, but both activity and optimism were significantly muted compared to the third quarter, the Federal Reserve Bank of Dallas reported Dec. 29 in the release of its quarterly survey of energy companies.

The biggest drag on crude oil and natural gas production growth, cited by 32% of E&P executives, is cost inflation and/or supply chain bottlenecks. A maturing asset base was the second-biggest challenge, cited by 27% of the executives.

Labor market indexes also indicated strong growth in employment, hours and wages, the Dallas Fed said. That prompted anecdotal concerns.

“Labor is an issue that is affecting our firm,” an E&P executive wrote in the comments section. “The government can remove all regulations and timetables, and the amount of increase in activity would not be affected by more than 10%. Automation cannot drill wells, move rigs and build locations.”

That sentiment was echoed in a comment from an executive in the oilfield services sector: “Attracting and retaining labor remains our most significant and intractable challenge. Despite wage and benefit increases, retaining newly hired labor is difficult.”

Activity

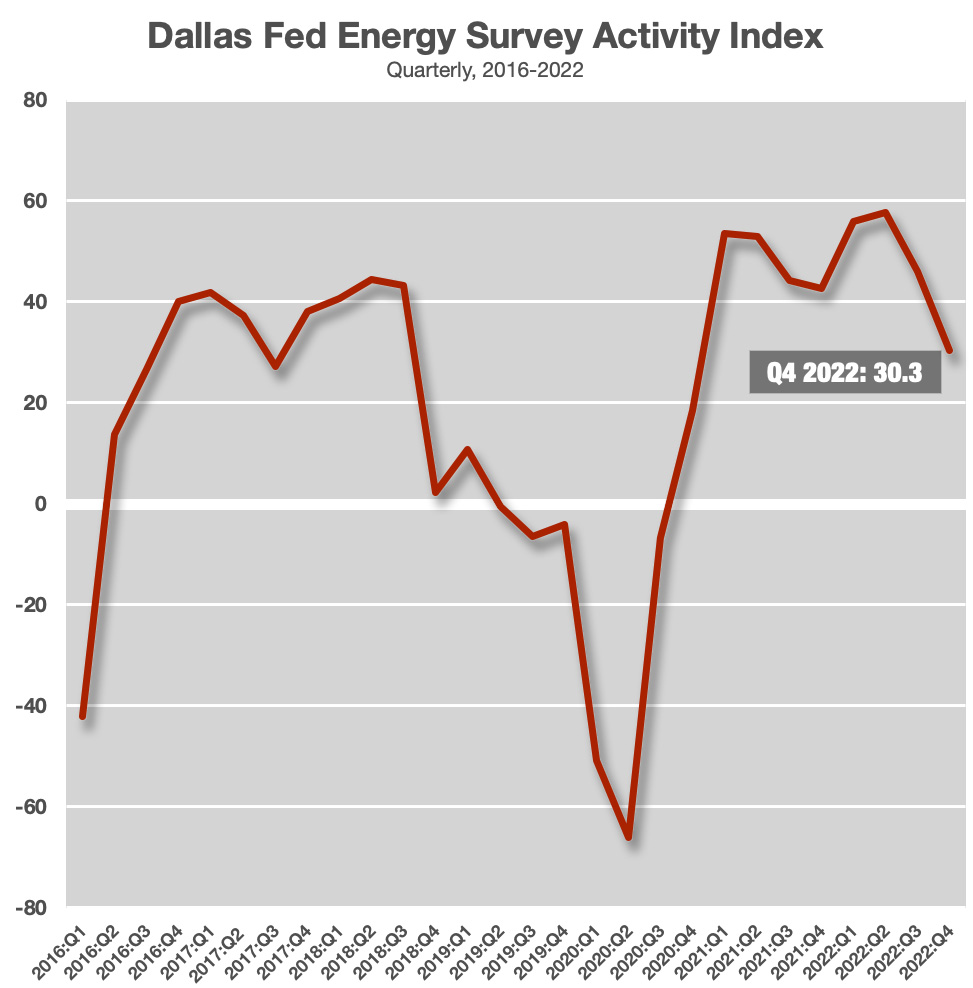

The business activity index, a broad measure of conditions affecting oil and gas firms, fell to 30.3 in the fourth quarter from 46.0 in the third. That suggests a slowing in the pace of expansion, though the index remained above the series average, according to the survey. It was, however, the lowest the index has been since fourth-quarter 2020.

E&P executives reported that oil and gas production grew in the quarter, but slower than in the third quarter. The oil production index slipped to 25.8 from 31.7 in the third quarter. The natural gas production index also declined to 29.4 from 35.6 in the previous quarter.

Inflationary pressure continued to plague the sector, with costs rising for an eighth consecutive quarter. The pace of those increases, however, has slowed. The input cost index for oilfield services firms fell to 61.8 vs. 83.9 last quarter. For E&Ps, the finding and development costs index dropped to 52.5 from 64.7 in the third quarter. The lease operating expenses index also tumbled 22 points to 48.4.

Prices

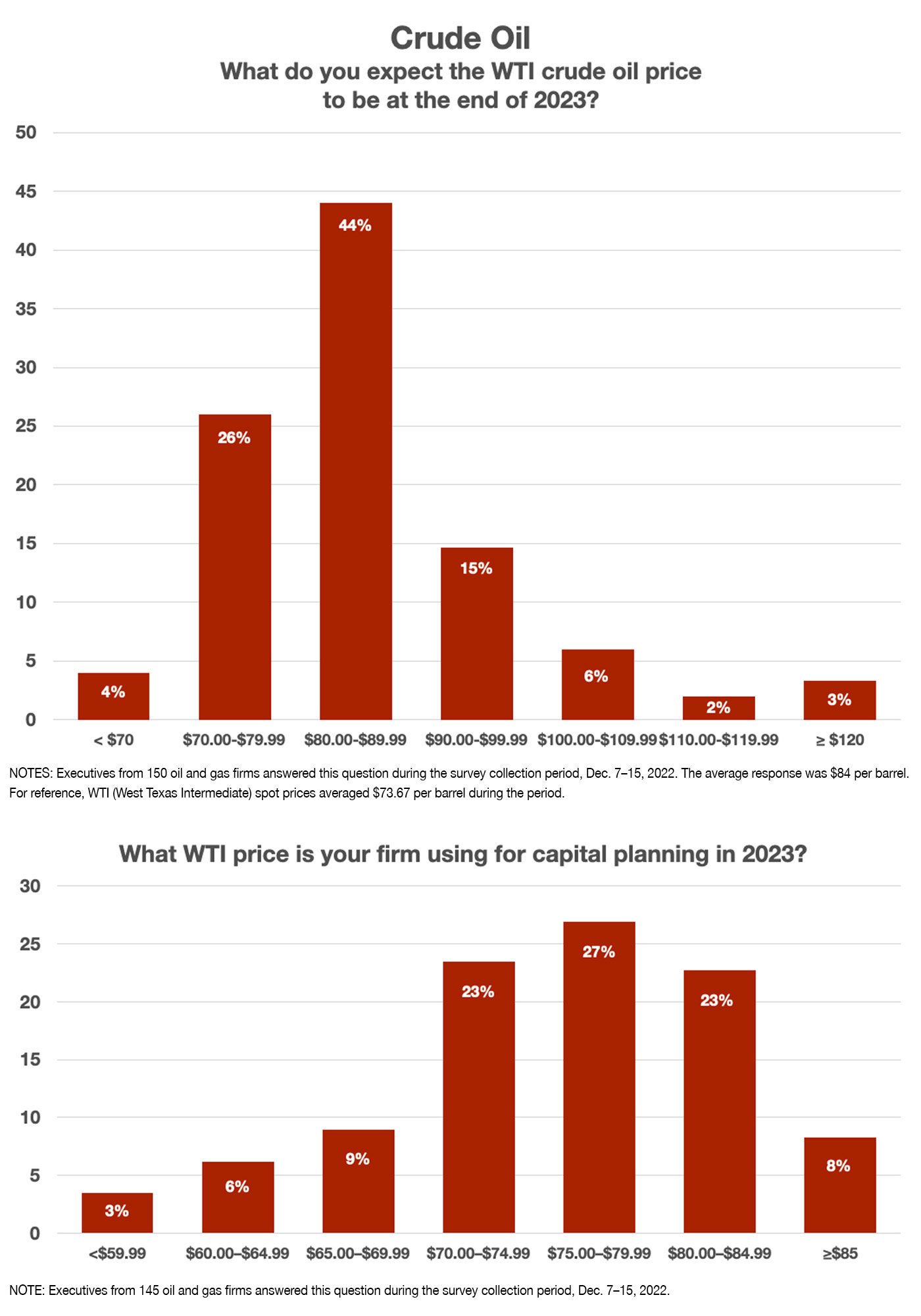

On average, the respondents from 150 oil and gas firms expect a WTI oil price of $84/bbl by year-end 2023; responses ranged from $65 to $160 per barrel. This compares to $92/bbl from Goldman Sachs and $90/bbl from JP Morgan.

For capital planning purposes, the largest segment of respondents estimated WTI’s year-end price at $75-$79.99.

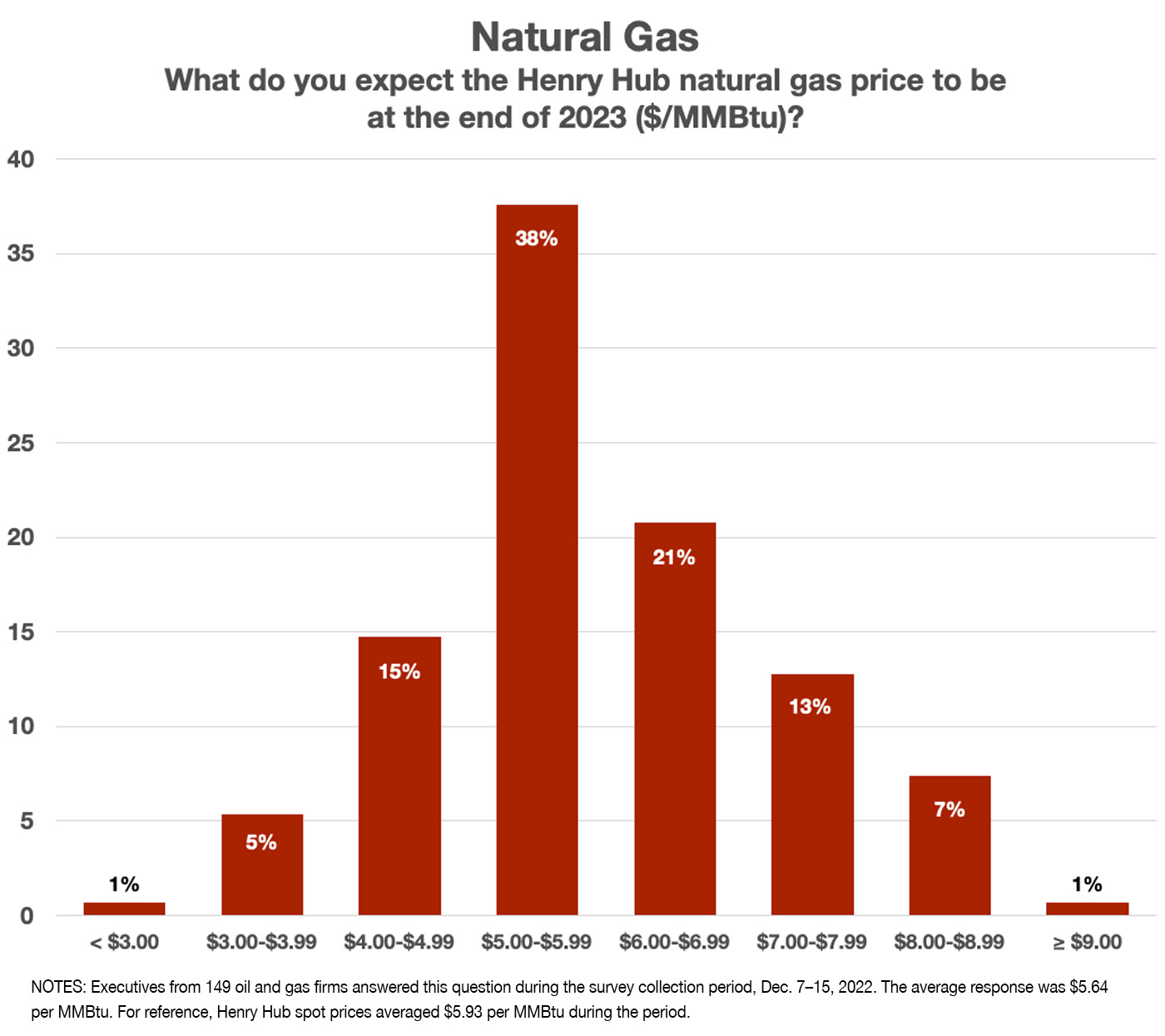

Survey participants expect U.S. benchmark Henry Hub natural gas price to end 2023 at $5.64 MMBtu. S&P Global analysts expect the price to average $5.47/MMBtu for the year, with a high near $7.00/MMBtu in the first quarter and lows of less than $5.00/MMBtu in the second and third quarters. Goldman Sachs forecasts summer 2023 prices at around $4.15/MMBtu.

During the survey period of Dec. 7-15, WTI spot prices averaged $73.67/bbl, and Henry Hub spot prices averaged $5.93/MMBtu.

Recommended Reading

AI Deals Line Up for Energy Transfer’s Gas Supply

2025-02-13 - Midstream company Energy Transfer’s executives say they’re working on more than 100 deals for gas-powered generation projects.

EnCap Portfolio Company to Develop NatGas Hub with DRW Energy

2025-01-21 - EnCap Flatrock Midstream portfolio company Vecino Energy Partners LLC and DRW Energy Trading LLC will be developing an intrastate natural gas storage hub together.

AltaGas, Keyera Come to Mutual Agreements to Leverage Infrastructure

2025-02-07 - Canadian midstream companies AltaGas and Keyera have signed mutually beneficial, long-term contracts for NGLs and fractionation.

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

2025-02-14 - About three-quarters of future U.S. gas demand growth will be fueled by LNG exports, while data centers’ needs will be more muted, according to Expand Energy CFO Mohit Singh.

Diversified Closes Summit Natural Resources Deal for $42MM

2025-02-27 - Diversified Energy Co. Plc closed its deal with Summit Natural Resources to buy operated natural gas assets and midstream infrastructure for approximately $42 million, the company said Feb. 27.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.